![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

|

Sales Account Executives

Navitas Lease Corp is an innovator in the Small Ticket Leasing |

Monday, October 7, 2013

![]()

Today's Equipment Leasing Headlines

Fresno Broker Ted Anselmo Passes Away

Classified Ads---Legal

Archives---October 7, 2002

UAEL Elects First Female President

Thursday--Sunday, NEFA Conference

---Non-Member Special Offer

Class Action Case against First National Capital

Didn't know she was being recorded

Classified Ads---Help Wanted

“How do you get along with difficult colleagues?”

Career Crossroad---By Emily Fitzpatrick/RII

Placard---No Elevator to Success

Leasing 102 by Mr. Terry Winders, CLP

Proving You Are the Owner

October 6, 2013 Ratings

Alexa top Leasing Web Sites

Top Stories September 30--October 4

(You May Have Missed One)

Bank Branch Cartoon

"Deposits Up, Branches Down'' says SNL Financial

Top 50 Banks Deposits/Branches

Captives Forum Debates Future Relevance of Leasing

by Alan Leesmith, Secretary, Captive Forums

Cairn Terrier-Schnauzer

Orange, California Adopt a Dog

News Briefs---

U.S. Auto Sales Fell 4% Sept., Snapping 27 Month Streak

IBM now employs more workers in India than US

Oregon bartender gets $17,500 tip

Wal-Mart drops price of iPhone 5c to $45

Federal Reserve to Unveil a Redesigned $100 Bill

KeyCorp's Beth Mooney: The Most Powerful Woman in Banking

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release”

and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

| Working Capital Loans $10,000-$250,000 | |

|

|

Please send to a colleague. Spread the news.

Also ask them to join

our mailing list or bookmark our site.

We are free!

[headlines]

--------------------------------------------------------------

Fresno Broker Ted Anselmo Passes Away

Joseph Theodore "Ted" Anselmo, 68, Mana Financial, Fresno, California passed away. He named his company after his son and daughter Mark Anselmo and Nicole Anselmo. His web site states he had been in business for 27 years, specializing in the agricultural community. Steve Crane of Bank of the West Indirect Financing said he was one of their top "ag" brokers with a solid following.

Joseph Theodore Anselmo

October 23, 1944 - September 28, 2013

Joseph Theodore (Ted) Anselmo

Joseph was born on October 23, 1944 in Yuba City, California to Joseph and Gladys Anselmo and passed away on September 28, 2013 in Santa Cruz, California.

In 1966 Ted Married the love of his life Selah Hankins. Upon gaduating Chico State in 1968, he worked for United California Bank in Bakersfield, Ca. He became branch manager in 1970. He was transferred to San Luis Obispo in 1974. In 1978 he left United California Bank and went to work for Calco Leasing in Fresno, Ca. He went to work for Guarantee Leasing as a manager of their leasing division in 1983. In 1987, he went to work for Valley National Bank of Arizona as the manger of their leasing division. Ted started Mana Financial in 1992.

Ted was a wonderful person with a kind heart and had a wonderful sense of humor. He loved classic cars (he rarely missed a car show), planes, his boat and fishing. Everyone he met knew he had a kind heart.

HE WILL BE MISSED BY ALL.

Ted is survived by his wife of 47 years, Selah Anselmo; his son, Mark Anselmo and his wife Stacy; his daughter Nicole Anselmo; grandchildren, Natalie and Nicholas Anselmo.

In Lieu of flowers the family asks for a donation to the Hankins Family Scholarship, Bank of the West, 2110 W. Shaw, Fresno, Ca 93711 or The Fig Garden Rotary, P.O. Box 9234, Fresno, CA 93711

[headlines]

--------------------------------------------------------------

Classified Ads---Legal

(These ads are “free” to those seeking employment

or looking to improve their position)

San Diego , CA |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

John Kenny Receivables Management • Credit Investigations • Asset Searches • Skip-tracing • Third-party Commercial Collections john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

[headlines]

--------------------------------------------------------------

Archives---October 7, 2002

UAEL Elects First Female President

Oren Hall, emeritus member, former president of the United Association of Equipment Leasing (UAEL), made the motion from the floor, and President Bob Fisher, CLP, made the announcement, “ In the first 26 years of our association, we now have a female president, Bette Kerhoulas, CLP. “

Also elected were vice-president Jim Coston, Coston & Lichtman, Secretary/Treasurer, Terey Jennings, CLP, Financial Pacific Leasing , Peter Eaton, CLP, Pentech Financial Services, Bob Baker, CLP, Wildwood Leasing, John Donohue, Direct Capital, Dwight Galloway, CLP, Republic Financial, Brent Hall, CLP, Pinnacle Capital, Victor Harris, Law Offices of Victor Harris, Marci Kimball, ACC Capital, John Kruse, CapitalStream, Jim McCommon CLP, Brad Peterson, Manifest Funding Services, Bob Teichman, CLP, Teichman Financial Training.

Taking the microphone, Bette Kerhoulas, CLP, president of Pacifica- Capital, promised to continue the theme of “ education, networking, and involvement."

“Get together, see what is happening, and be involved,” she said

TODAY

Betty Kerhoulas, CLP

Managing Director

Pacifica Capital

San Juan Capistrano, California

"I started Pacifica in June of 1984. It's been very gratifying to be a part of Pacifica's growth from a two-person business to where we are today. I oversee the day to day operations of the company, handle key in-house accounts and develop and maintain our lender and underwriting relationships. In 2003, I was honored to be selected as the 1st female President of one of our industry's premiere leasing/financing associations, United Association of Equipment Leasing (UAEL). After work hours, I enjoy almost any type of sports - but my favorites are tennis and golf. I also love singing, and spending time with my wonderful husband Dion and family."

http://www.pacifica-capital.com/staff/bette.html

The United Association of Equipment Leasing (UAEL) and Eastern Association of Equipment Leasing (EAEL) announced its merger to form the National Equipment Finance Association (NEFA) effective January 1, 2009.

http://www.leasingnews.org/archives/October%202008/10-27-08a.htm

[headlines]

--------------------------------------------------------------

Thursday--Sunday, NEFA Conference

---Non-Member Special Offer

October 10-13

Nashville Marriott

at Vanderbilt University

Nashville, Tennessee

Gerry Egan

NEFA, Exec. Director

Executive Director Gerry Egan offers a special

Symposium Attendance Promotion Offer

Call: 847-380-5052

Advance Registration Still Open

http://www.nefassociation.org/displaycommon.cfm?an=1&subarticlenbr=270

Conference Pricing

http://www.nefassociation.org/displaycommon.cfm?an=1&subarticlenbr=270

Registration:

http://www.nefassociation.org/frontend/event/registration/login.aspx?EventId=61938

List of Exhibitors On Line:

Allegiant Partners

Bank of the West

Blue Bridge Financial, LLC

Blue Chip Leasing

Boston Financial & Equity

Bryn Mawr Funding

Business Credit Reports

Channel Partners, LLC

CLP Foundation

Collateral Specialists, Inc.

Dakota Financial, LLC

Diversified Lenders, Inc.

ECS Financial Services, Inc.

EquipmentEngine Financial Services

Financial Pacific Leasing, LLC

FORA Financial

Great American Insurance

LeaseTeam, Inc.

Monitor Daily

MRK Leasing, LLP

Nassau Asset Management

Olde City Financial, Inc.

PacTrust Bank Equipment Finance

Pawnee Leasing

Quiktrak, Inc.

RLC Funding

RTR Services

Securcor Financial Group

TAB Bank

United Capital Funding Corp

Varilease Financial, Inc.

[headlines]

--------------------------------------------------------------

Class Action Case against First National Capital

Didn't know she was being recorded

Annette Joncyzyk of Missouri, on behalf of herself and others similarly situated, has filed a class action lawsuit against First National Capital Corporation, Foothill Ranch, California, and its president, Keith Duggan, as an individual. She claims she did not know she was being recorded when she spoke to her husband, Juergen Jonczyk, when he was employed there as a salesman.

The 2011 Monitor Magazine names First National Capital the 4th largest among "Top Private Independents." The company claims "Our team has successfully funded in excess of five (5) billion of capital to meet client objectives."

http://firstncc.com/

A press release states the company "Exceeds $1 billion US in funded volume March 5, 2012." http://www.prweb.com/releases/2013/3/prweb10484323.htm

A press release in Leasing News April 10, 2013 reports the company "posted a record $45.8 million in funded volume for the first quarter of 2013."

http://leasingnews.org/archives/Apr2013/4_10.htm#first_national

Keith Duggan, President and CEO, told Leasing News he could not comment on the case. A former salesman did tell Leasing News that the employees sign a statement regarding telephone call recordings, particularly salesmen where the sales manager can monitor calls to provide improvement in sales techniques and to insure sales personnel were following company policy in presenting full disclosure. He was connected with Triple K Capital, DFLT Capital, and Capital Stream under the direction of Kevin Riegelsberger. State of California records show First National Capital Corporation was incorporated

1/25/2005 (C2719391)

Mr. Duggan previously worked for Amplicon as regional manager and testified in the January, 1995, famous case (at the time) of McFetters v. Amplicon and the alleged matter of termination of J. Scott McFetters by its president Patrick Paddon . (Amplicon reorganized into California First National Bancorp, May 23, 2001 (CalFirst Bank—Paddon to this day remains as President/CEO/Founder/Chairman ).

http://caselaw.findlaw.com/ca-court-of-appeal/1402769.html

Plaintiff Attorney Christopher W. Arledge, Newport Beach, California did not have a public statement for Leasing News. Telephone calls to Annette Joncyzyk at her residence during the day and evening were not returned.

The class action case calls for $5,000 for each occurrence (1).

In a response by Ana Tagvoryan, attorney for the defendant, she argued basically: "Defendant Keith Duggan, acting within the scope of his employment for Defendant First National Capital Corporation, cannot be separately held liable under California’s Invasion of Privacy Act (“CIPA”).

3. The application of CIPA to the interstate calls between Plaintiff and Defendants is preempted by federal law.

4. The statutory text in Penal Code section 637.2 makes clear that statutory damages for violations of CIPA are $5,000 per action, not per occurrence.

Defendants’ Motion for More Definite Statement asks the Court to require Plaintiff to identify the particular sections of CIPA that she alleges Defendants have happened." (2)

The Honorable Josephine L. Staton, U.S. District Court Judge, entered a (Proposed) Order grading defendants' motion to dismiss plaintiff's class action complaint to be heard November 15, 2013, 2:30pm, Courtroom 10A, Central District of California (3)

-

First National Class Action Case (11 pages)

http://leasingnews.org/PDF/FirstNationalClassAction_102013.pdf

-

(a) Plaintiff Response (2 pages)

(b) Plaintiff Memorandum (30 pages)

http://leasingnews.org/PDF/PlaintiffResponse_102013.pdf

http://leasingnews.org/PDF/DefendantMemorandum_102013.pdf

-

Judge Proposal to Dismiss

http://leasingnews.org/PDF/JudgeProposalDismiss_102013.pdf

---Related Legal Story on Company Telephone Calls---

E-Discovery Catches Up with Mobile Devices

By Tom McCurnin

Leasing News Legal News Editor

http://leasingnews.org/archives/Apr2013/4_12.htm#ediscovery

|

[headlines]

--------------------------------------------------------------

Classified Ads---Help Wanted

|

Sales Account Executives

Navitas Lease Corp is an innovator in the Small Ticket Leasing |

Software Programmer www.pawneeleasing.com |

|

5 positions available in our Calabasas office: |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

“How do you get along with difficult colleagues?”

Career Crossroad---By Emily Fitzpatrick/RII

Question: I am back in the market and setting up interviews. I interviewed, about five years ago, and there was a question that I was unsure how to answer - - -

“How do you get along with difficult colleagues?” I remember being uncomfortable and not knowing the “correct” response.

For reference, how should I handle this type of question?

Answer: This line of questioning would make anyone uncomfortable – these types of questions are “stress questions” for a reason!

There are truly three parts to this question:

1. What kinds of people do you like to work with?

2. What kinds of people do you find it difficult to work with?

3. How do you work with difficult people?

-

The first part is rather simple: like most people, you like to work with people who are honest and are dedicated to their career/job

-

The second question can be handled by underscoring the types of colleagues you LIKE to work with e.g., I like working with colleagues dedicated to their job--- but employees who don’t follow procedures or lack interest in the company I find difficult to work with

-

The third portion is more difficult: You may want to present an example of working with a difficult co-worker and how you were able to maintain a cordial professional relationship. Be careful in this response. Be positive, not negative.

Prepare for your interview in advance by developing answers / rebuttals for such stressful questions / scenarios.

I recommend role playing with a friend or colleague. A rehearsal may help you feel more at ease in a job interview.

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Proving You Are the Owner

The word “personal” always confused lessors and lessees because it appears the transaction is a consumer one. However, the Uniform Commercial Code (UCC) uses personal property to define commercial transactions.

Equipment leasing is a financial product that deals with asset ownership in many different ways. When you say that you own something, what does that really mean? We purchase many things during our lives---but the way we approach each purchase varies with the purchase. A car, truck, or transportation equipment requires a certificate of ownership, i.e., a title. This is also true for airplanes, boats, railcars and mobile homes. These assets are called titled personal property. However, if we purchase a sofa, desk, computer, or office equipment there is no certificate of ownership. This type of asset is called untitled personal property or tangible property.

Tangible property is not supported by any title so the owner obtains control and ownership with a “bill of sale” and “possession”. Many professionals define ownership in personal property, as having “title” even though there is no actual title instrument.

We protect our ownership in the leased equipment by filing a UCC-1 within 20 days after the lessee take possession in the State the lessee has filed its business papers. It is not required that we file a UCC-1 if the lease is a true legal lease ( Article 2A,) but we do need to file it if the transaction is a disguised security agreement (Article 9).

From a lessor’s viewpoint, when our equipment is in the possession of the lessee, how is the general public to know it is our equipment with no title? By filing a UCC-1. This document notifies the public that the lessee is in possession of our equipment and it cannot be sold by the lessee legally as they are not the owner.

The problem exist that a lot of small equipment is sold, lost or made useless over the term of the lease regardless of our safeguards. In addition very few people other than financial people understand what the UCC filings are about, so protecting our equipment requires inspections, identification tags or stickers. This may help in personal property inspections or in identifying equipment in a repossession or court case.

In addition, some equipment can be attached to real estate and become the property of the landlord unless a fixture filing is properly handled in some States. In some States you must notify the property owner before it is attached. Occasionally some lessees will change the status of the property by making it permanent at its location requiring you to get a land lease to make it a legal lease.

Some equipment can be attached to a vehicle and requires a vehicle notification of ownership, which varies from state to state; otherwise the owner of the vehicle may claim it is their property.

Protecting your asset is important; proper documentation can not only save time wasted in disputes, but the cost in the process of proving you are the owner.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at terrywinders11@yahoo.com or 502-649-0448.

He invites your questions and queries.

Previous #102 Columns:

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

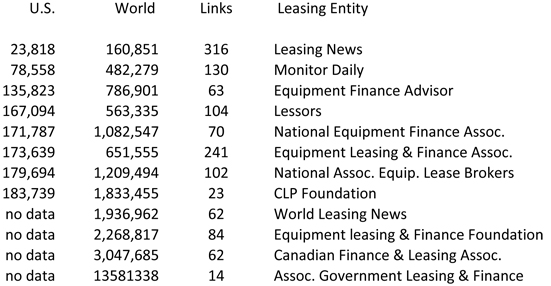

October 6, 2013 Ratings

Alexa top Leasing Web Sites

(lower the number shows position on worldwide list with #1 Google , #2 Facebook, #3 YouTube.)

The positions basically stayed the same from September 15, 2013 with both Leasing News and the Monitor improving (lower on the list) along with the National Association of Equipment Lease Brokers and National Equipment Finance Association (both having conferences) and a move up for the CLPFoundation.org, which Leasing News featured their new web site in last week's edition.

It should be noted association web sites publish to their members or mailing lists notices and announcements which often link to their web sites and are counted as well as direct visits to their web site, as well as the on line media publish five days a week (except for Leasing News.)

More about Alexa Internet:

http://en.wikipedia.org/wiki/Alexa_Internet

[headlines]

--------------------------------------------------------------

Top Stories September 30--October 4

(You May Have Missed One)

Here are the top stories opened by readers:

(1) October Court Wrap-Up: Balboa, De Lage Landen/Element Financial, IFC Credit-Rudy Trebels,NorVergence, Sheldon Player

http://leasingnews.org/archives/Oct2013/10_02.htm#legal

(Tie) (2) "Banks No Long Can Consider Loans under $250,000"

Leasing Group Enters Marketplace with Windset Capital

http://leasingnews.org/archives/Oct2013/10_04.htm#windset

(Tie)(2) Correction: NAELB Western Regional Conference Report

by Brian Huey, LeaseSource

http://leasingnews.org/archives/Oct2013/10_02.htm#correction

(4) NAELB Western Regional Conference Report

by Brian Huey, Leasource

http://leasingnews.org/archives/Sep2013/9_30.htm#naelb

(5) Jeff Menzel, son of Paul Menzel, CLP,

Brings Home the Gold

http://leasingnews.org/archives/Sep2013/9_30.htm#gold

(6) Archives: October 4, 2000

US Bancorp Merges with Firstar

http://leasingnews.org/archives/Oct2013/10_04.htm#archives

(7) Wants to Go After Lessors and Their Attorneys

Re: Evergreen Clause Abuses

http://leasingnews.org/archives/Oct2013/10_02.htm#wants

(8) More than 50 People Indicted in Massive Fraud Ring

http://www.leasingnews.org/PDF/Fraud_ring_92013.pdf

(9) The Growth of Business Loans by Private Lenders

by Christopher Menkin

http://leasingnews.org/archives/Sep2013/9_30.htm#growth

(10) New Hires—Promotions

http://leasingnews.org/archives/Oct2013/10_04.htm#hires

(11) Letters from Readers?---We get Email!

(Mostly in chronological order)

http://leasingnews.org/archives/Oct2013/10_02.htm#letters

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

"Deposits Up, Branches Down," says SNL Financial

Top 50 Banks Deposits/Branches

SNL Financial reports, "BofA's "express branches" will have tellers onsite during regular business hours as well as during early morning and evening hours — as well as on weekends…But, importantly, these offices will be much smaller — the first such branch, which recently opened in New York City, is about 2,200 square feet — than typical bank branches, which often range in size from 3,000 square feet to 6,000 square feet. As such, fewer people will be needed to staff the express offices, and BofA will save money"

B of A plans to open five more in Boston, Charlotte and the New York City area by the end of the year, they report.

The express branches feature ATMs with "Teller Assist," which lets customers speak with an off-site representative through the ATM. Onsite B of A employees will be available to help customers during normal working hours, and Teller Assist will make offsite employees available during nights and weekends, B of A said.

"We are working to make the customer experience with Bank of America reflect how people live their lives every day," said Katy Knox, retail banking and distribution executive, in the BofA news release. "With the addition of express centers, our retail business offers customers more flexibility and convenience."

SNL Financial reports, "Banks of varying sizes are studying ways to make similar moves, analysts say…”

"Wells Fargo & Co., for example, earlier this year launched its own version of express branches, beginning with a store in April in Washington, D.C. Wells said its smaller branches are designed to be about 1,000 square feet, roughly a fourth of what many of the bank's existing traditional branches encompass."

"Mark Fitzgibbon, head of research at Sandler O'Neill & Partners LP, told SNL Financial that a decade ago many banks tried to push for increased use of online banking only to face some pushback from customers. But today, in a smartphone-driven world, increasingly more Americans are eager to do more of their business, including banking transactions, via new technology.

" As such, it makes sense that banks are powering forward on this front in order to deliver what customers want. And it happens to feed a trend at a time when banks desperately need technology to help them become more efficient, he said. Loan demand is soft, he noted, making organic revenue growth a constant challenge. And, in the wake of the last financial crisis, regulations are tougher and greater in number, forcing banks to spend more on compliance. Banks therefore need ways to trim expenses elsewhere, he said.

"'Banks are grappling with weaker-than-they'd-like profitability, while their cost structures are under constant pressure from the regulatory burden,' Fitzgibbon said. 'So they are working hard to take advantage of technology to reduce branches, shrink the size of others and to scale back on staffing. … Almost every bank we talk to is doing this or at least looking to do it.'

"At the same time, he and other analysts note, with both businesses and consumers sitting on greater levels of cash and saving more in the aftermath of the last recession, most banks are flush with deposits and do not need more branches to bolster their liquidity positions."

[headlines]

--------------------------------------------------------------

#### Press Release #############################

Captives Forum Debates Future Relevance of Leasing

by Alan Leesmith, Secretary

The Trade Association of Manufacturers' Finance Company

In a world where Captives offer far more than just leasing, the relevance that the word “leasing” will have to manufacturers in the future was enthusiastically debated by members of the Captives Forum, at their Autumn quarterly meeting. Are Captives “Lessors” or far more than just that and do they believe that the word “leasing” wrongly categorises them and underplays their role?

The Autumn meeting of the Captives Forum, the equipment manufacturers’ European trade association, was hosted by John Deere Bank at its Luxembourg headquarters. The meeting attracted a record attendance. As is normal practice, the Forum’s day consisted of a mix of external speakers and member presentations, all of which led to considerable discussion and participation among the members. Those discussions just further emphasised that leasing is just one of many facilities offered by members in support of their parent company “sales”.

Derek Soper

Chairman of the Foundation

One of the key topics discussed by members centred around the Leasing Foundation research project “Redefining the Leasing Industry”. Derek Soper, Chairman of the Foundation, explained that there is a view among some that the word “leasing” no longer covers the diverse and complex nature of current products. Although banks’ definition may be narrowing - and leasing becoming just yet another finance product offered to the bank’s customer base - it is a different story for manufacturers whose definitions and offerings are expanding. The rental/leasing market goes well beyond what is normally considered leasing. Is the market size therefore being significantly underestimated?

The presentation started a debate on what the future shape of a Captive’s business might be. This centred on: the growing extent to which services and support often exceeded equipment costs, the increasing trend for end users to outsource to managed services facilities and the trend for the finance arm to managed account administration and collection for other parts of the business.

Members were far from sure that they wished to see the discredited word “leasing” expanded to include wider services at a time when many were moving further and further away from what is generally understood by that terminology. Concerns were expressed that it could bring large parts of a captives business into a definition that may not be favourable to their business. There was a view that to wrap the wide range of services offered under the term “lease” may be detrimental, with the risk of services agreements being designated something that they are not.

Members agreed that this would be the start of a series of discussion in future meetings as to how the long term future of captive offerings would evolve. Particular focus would be on how a captive can continue to provide increased added value to a parent, thus making themselves increasingly relevant and essential. This entails reviewing and being conscious of what factors are, or should be, really important to the parent as time changes them. In addition future discussions could include considering different ways in which that value may be demonstrated to parent companies.

The day had commenced with Stephen Bodmann, Director of Wholesale Credit at John Deere Bank, presenting on the role they play and challenges they face in supporting John Deere sales through the distributor and dealer channels, while at the same time maintaining banking industry standards and practices.

Bodmann explained the range of facilities that they are able to offer, alternative contractual structures, the various tools and intelligence that they use for underwriting purposes and collateral monitoring. The demand for such financial products had increased significantly since the banking crisis as the banks cut lines of credit.

Annette Jung presented on Philips Healthcare Global Customer Finance, explaining that Philips was no longer mainly consumer focused, but that healthcare and lighting were now significant parts of the group business. Members were interested to hear the extent to which long term service contracts were wrapped into the finance agreements, the imaginative way in which contracts were now “usage” based in both sectors and the significant role of managed services agreements. Jung then led a discussion about the balance between retaining risk and obtaining external wholesale finance.

The external speaker was Dr. Peter Zemcik, Director of European Economics at Moody’s Analytics. Dr. Zemick had originally planned to present on “Is there light at the end of the tunnel”, but in view of the more positive outlook over recent weeks moved to “Europe seeks sustained growth”. His presentation started with the current Global Business Cycle Status and then the European one in greater detail, the latest GDP figures and the outlook from the latest PMI.

The debate then moved on to an analysis of private sector and total debt, savings and fiscal tightening and their impact on various countries’ economies, in particular the troubled countries. The adverse impact of high debt on unemployment and house prices. The problems facing the banks, higher borrowing costs and declining investment. On monetary policy, the outlook for yield spreads and short term interest rates, and the relationship between inflation and unemployment.

An analysis of structural adjustments that have taken place in some countries, such as declining labour costs, and why not in other ones that need such adjustments. The need for increased competitiveness in many countries and the general loss of industrial production capability. Dr. Zemick concluded with an outlook for Europe and for the Euro in a global context and the risks faced from other economic zones, including the US and emerging markets. As may be expected, members asked Dr. Zemcik many challenging questions throughout his presentation.

As is usual practice when the Captives meet, the members met for dinner the evening before, on this occasion hosted by Nils Jaeger and John Deere. An excellent evening was enjoyed by all in a charming basement restaurant full of atmosphere, having the rugged walls of the ancient city on two sides and being a UNESCO world heritage site.

The Trade Association of Manufacturers' Finance Companies is a not-for-profit company limited by guarantee. It was created to run the Captives Forum. The Captives Forum community is a coming together of Manufacturer owned finance companies whose main activity is to finance the acquisition of equipment, services or software for customers of the manufacturer. The ‘asset finance’ products range from equipment leasing to various types of ‘purchase/use over time’ products such as Hire purchase, Conditional Sale, operating leasing and rental. The Members are subsidiaries of a variety of global equipment manufacturers, whose aim is to assist those manufacturers in the financing of their products and to help sell more equipment.

The management of the Captives Forum is undertaken by IAA-Advisory. Alan Leesmith, IAA’s International Director, is the Captives Forum’s Secretary and Derek Soper is Advisor to the Captives Forum Board.

Contact at the Captives Forum:-

Alan Leesmith

alan.leesmith@captivesforum.org

Tel: +44 1444 417688

#### Press Release ##############################

[headlines]

--------------------------------------------------------------

CAIRN TERRIER - SCHNAUZER

Orange, California Adopt a Dog

RIPPLE

Pet ID: A1278932

Sex: M

Age: 1 Year

Color: GRAY - TAN

Breed: CAIRN TERRIER - SCHNAUZER MIN

Kennel: 205

Intake: 9/25/2013

Steps to Adoption

http://media.ocgov.com/gov/occr/animal/adopt/steps.asp

OC Animal Care

561 The City Drive South

Orange, CA. 92868

714-935-6848

Open Daily - 10:00 AM to 5:00 PM

Wednesday (Extended Hours) - 10:00 AM to 7:00 PM

Closed Holidays

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

U.S. Auto Sales Fell 4% Sept., Snapping 27 Month Streak

http://www.autonews.com/article/20131001/RETAIL01/131009972/stability-trumps-growth-in-sales-payback-month?goback=%2Egde_2542813_member_5791968796273033219#

IBM now employs more workers in India than US

http://nypost.com/2013/10/05/ibm-now-employs-more-workers-in-india-than-us/

Oregon bartender gets $17,500 tip

http://news.yahoo.com/oregon-bartender-gets-17-500-tip-190817724.html

Wal-Mart drops price of iPhone 5c to $45

http://www.upi.com/Business_News/2013/10/05/Walmart-drops-price-of-iPhone-5c-to-45/UPI-85101381005625/

Federal Reserve to Unveil a Redesigned $100 Bill

http://www.nytimes.com/2013/10/07/business/us-to-unveil-redesigned-100-bill.html?ref=business

KeyCorp's Beth Mooney: The Most Powerful Woman in Banking

http://www.americanbanker.com//magazine/123_10/keycorps-beth-mooney-the-most-powerful-woman-in-banking-1062072-1.html

[headlines]

--------------------------------------------------------------

--You May Have Missed It

10 Tricks to Avoid the Halloween Treats

How to Enjoy the Holiday without Overindulging in Sweets

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=1389

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

Moderation in All Things

How to Avoid the Diet Blues

http://www.sparkpeople.com/resource/motivation_articles.asp?id=729

[headlines]

--------------------------------------------------------------

Baseball Poem

Baseball Poem

The Machine

by Stephen Porter ©

Published: Baseball Almanac (03-20-2001)

T'was the greatest group of men, ever to play,

On a diamond, with a ball, every dayThere was Joe, there was Johnny, and then there was Pete,

The whole team was sturdy, as two ton concreteDown at first there was Tony, always catching them square,

And at second was Joe, who could run like a mareDave held up short, never missing a beat,

And fielding at third, no one else, but PeteThe outfield was anchored, by three all their own,

Foster, Griffey, and Geronimo, no better were knownIndividually the best, well maybe not quite,

But together they put up one hell of a fightAll who watched, those 8 play the game,

Knew something was up, they were destined for fameAnd sure enough, two years back to back,

The Machine won the title, for they had the knack.Were they truly the best group, ever to play,

On a diamond, with a ball, every dayIt isn't for sure, no one can agree,

For many teams have put it on the line, in this land of the freeBut one thing I feel, as other Reds fans do,

Those 8 played the best, as a team, as a crew.

[headlines]

--------------------------------------------------------------

Sports Briefs----

49ers stomp Texans

http://blog.sfgate.com/49ers/2013/10/06/brocks-two-ints-lead-49ers-to-34-3-romp-over-texans/

Chiefs storm back in 26-17 win over Titans, remain unbeaten

http://www.kansascity.com/2013/10/06/4535977/chiefs-storm-back-in-26-17-win.html

Tom Brady’s touchdown streak ends as Patriots offense struggles in 13-6 loss to Bengals

http://www.boston.com/sports/football/patriots/2013/10/06/tom-brady-touchdown-streak-ends-patriots-offense-struggles-loss-bengals/wDNd6msYRqFNCZIYLVWWSN/story.html

Seahawks fall to Colts, 34-28

http://seattletimes.com/html/seahawks/2021982321_seahawks07xml.html

Giants Fall to Eagles, Manning's Struggles Leave Giants 0-5

http://www.nytimes.com/reuters/2013/10/06/sports/football/06reuters-nfl-giants.html?hp&_r=0

Bears fall to Saints 26-18 for second straight loss

http://www.chicagotribune.com/sports/football/bears/ct-spt-1007-bears-saints-chicago-20131007,0,678180.story

Rams run past Jaguars 34-20

http://www.stltoday.com/sports/football/professional/rams-report/rams-run-past-jaguars/article_b6753c5a-aa75-5996-8ca4-039ba482c0f8.html

Cowboys thoughts: Same story, Tony Romo with costly mistake late, but Dallas wouldn’t have had a shot without him

http://cowboysblog.dallasnews.com/2013/10/cowboys-thoughts-same-story-tony-romo-with-costly-mistake-late-but-dallas-wouldnt-have-had-a-shot-without-him.html/

College Football: Stanford Cardinal holds No. 5 ranking

http://www.contracostatimes.com/news/ci_24253126/college-football-stanford-cardinal-holds-no-5-ranking

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

California Nuts Briefs---

Jerry Brown Now state's longest-serving governor

http://www.mercurynews.com/ci_24226861/jerry-brown-poised-become-states-longest-serving-governor?IADID=Search-www.mercurynews.com-www.mercurynews.com

Trust Act Signed In California To Limit Deportation Program

http://www.huffingtonpost.com/2013/10/05/trust-act-signed_n_4050168.html

Ships, planes and trains in Baja's future

http://www.utsandiego.com/news/2013/oct/04/baja-california-governor-elect-rail-line/

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

The Man Behind Whole Foods' Wine Department

http://www.winespectator.com/webfeature/show/id/48978

Chile frost hits fruit and wine, emergency declared

http://www.reuters.com/article/2013/10/03/chile-frost-idUSL1N0HT16M20131003

What Do Americans Really Think Of Aussie Wines?

http://www.wine-searcher.com/m/2013/10/what-do-americans-really-think-of-aussie-wines-

Vineyards take action as climate change threatens wines and livelihoods

http://www.theguardian.com/sustainable-business/blog/vineyards-climate-change-threat

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1728-Birthday of Rodney Caesar, singer of the Declaration of Independence, most famous for his midnight ride. Rodney's ride ended up at the doorstep of Independence Hall where he cast the decisive Delaware vote for Independence.. Born near Dover, DE, he died June 26, 1794. Rodney is on a quarter issued by the US Mint in 1999, the first in a series of quarters that will commemorate each of the 50 states.

http://www.ushistory.org/march/bio/rodney.htm

http://www.colonialhall.com/rodney/rodney.asp

http://www.state.de.us/facts/history/rodnbio.htm

1777-In the second Battle of Bemis Heights, near Saratoga, NY, the Americans routed a force of some 1500 British. Benedict Arnold was wounded while attempting to force an entrance into the Hessian camp, and British Gen. Simon Fraser was killed.

1780-British and Tory forces were defeated at King's Mountain, South Carolina, by Americans under Col. William Campbell, Col. Isaac Shelby, and Col. Benjamin Cleveland. The British commander, Maj. Patrick Ferguson, and 160 others, were killed. Nearly 800 prisoners were taken.

1821-Birthday of William Still, chronicler of “The Underground Railroad Records,” born near Medford, in Burlington County, N.J

http://www.undergroundrr.com/stillbiofr.html

http://www.undergroundrr.com/firstfamily.html

1832- Birthday of Charles Converse, American lawyer and sacred composer. Converse penned the hymn tune CONVERSE, to which we sing today "What a Friend We Have in Jesus."

http://www.cyberhymnal.org/bio/c/o/converse_cc.htm

1833- Margaret Fox - U.S. spiritualist birthday. Along with her younger sister Catherine (1839) , they are both said to have invented the field of spiritualism. At least they were among the most popular and much sought-after spiritualists of the era of table tapping and sounds from the dead. Later in life Margaret turned to religion and sister Catherine recanted spiritualism and then recanted her recanting. As teen-agers they appeared to have attracted poltergeist-like manifestations. The primary divination method used by the Fox sisters in séances was table tapping - a method in which those in the spiritual (after death) realm used tapping sounds on the table, the walls and the floor to communicate. According to tradition, one of the sisters was able to snap her big toe on the floor to create the tapping sound. Horace Greeley was convinced the sisters were authentic and they got the backing of his New York Tribune. Later in life Margaret Fox revealed it started out as a game and turned into outright charlatan.

http://psychicinvestigator.com/demo/Foxtxt.htm

1849 - Birthday of American Poet James Whitcomb Riley; died July 22, 1916.

http://www.jameswhitcombriley.com/

1864- Naval Engagement at Bahia Harbor Brazil-CSS Florida vs USS Wachusett The Union warship Wachusett captures the famed Confederate raider Florida while the Rebel ship is in port at Bahia, Brazil. After the Yankee crew sailed the Florida out to sea, the Brazilian government protested the invasion of its neutrality. The Union returned the ship and crew to the Confederate government, but the Florida sunk six weeks later off Hampton Roads, Virginia.

http://www.csa-dixie.com/Liverpool_Dixie/exhib.htm

1864 - Battle of Darbytown Road, Virginia

In the summer of 1864, the campaign between Lee and Union General Ulysses S. Grant ground to a halt at Petersburg, 25 miles south of Richmond. Seeking to halt the march to Richmond, Lee sent two divisions under Generals Charles Field and Robert Hoke to move around the end of the Union line and attacked 1,700 cavalrymen. The assault sent the Yankees into a quick retreat. The Confederates captured eight cannons and drove the Union troopers into the breastworks of General Alfred Terry. Alerted to the advancing Confederates, Terry summoned reinforcements to his position. By the time the Confederates worked their way through the thick foliage, they faced a strong Union force. Lee ordered an attack anyway. Brigades advanced one at a time, and the Yankee artillery tore the lines apart. By the afternoon, the Confederates withdrew to their original position. They lost 700 men while the Yankees lost only 400, and no ground was gained. Lee did not make another attempt to regain the ground and focused instead on setting up defenses closer to Richmond. (there seems to have been several skirmishes around Darbytown Road, but here is from the writing on a solider of the Fourth Oneida Regiment, New York, who was at the scene: “Efforts by the rebel forces to retake Fort Harrison on the 30th were not successful. General Grant decided not to renew the attack on the 30th, ordering the Army of the James to maintain its defensive position in preparation for General Lee's subsequent unsuccessful counterattack,” that followed.

http://www.117nyvi.org/reghist.htm

http://www2.cr.nps.gov/abpp/battles/va077.htm

1884-Oct 7

Another point of fact, the first black major league baseball player was Moses Fleetwood Walker, who played for Toledo in the American Association.

http://www.oberlin.edu/external/EOG/OYTT-images/MFWalker.html

http://www.nlbpa.com/walker__moses_fleetwood.html

History

1868-Cornell University welcomes its first student.

(lower half of:

http://memory.loc.gov/ammem/today/oct07.html

1887-Birthday of African-American sculptor Sargent Johnson.

http://www.ijele.com/ijele/vol1.2/montgomery.html

http://www.ijele.com/ijele/vol1.2/images1.2/mont/index.htm

http://www.artcyclopedia.com/artists/johnson_sargent_claude.html

1896---Down Jones began reporting an average of the prices of 13 industrial stocks in the wall Street Journal. In the early years, these were largely railroad stocks. In 1928, Mr. Dow expanded the number of stocks to 30, where it remains today. Today, the large, frequently-traded stocks in the Down Jones Industrial Average represent about a fifth of the market values of all US stocks.

1905 -- Meyer Levin born Chicago, Illinois. His 1956 novel, Compulsion, based on the Leopold and Loeb murder trail, earned him enough money to devote nearly the rest of his life to an epic saga of modern Israel. It took him 15 years and resulted in two big novels, The Settlers and The Harvest.

http://www.geocities.com/meyerdotcom/

http://us.imdb.com/name/nm0505670/

1916-Georgia Tech University defeated Cumberland 222-0, in the most lopsided college football game of all time.

1924-Louis Armstrong's first session with the Fletcher Henderson Orchestra.

1925-Birthday of drummer Alvin Stoller, New York City

1940 - Artie Shaw's orchestra recorded Hoagy Carmichael's standard, "Stardust" -- for Victor Records.

1942 - "TIME" magazine described "Command Performance", which debuted this day, as “...the best wartime program in radio.” The show was originally produced by the U.S. War Department in cooperation with Armed Forces Radio Services specifically for those in the military overseas. It continued until 1949 and was reprised for more than three decades in syndication. "Command Performance" was hosted by Bob Hope, Bing Crosby, Don Wilson and Harry Von Zell and featured just about every major Hollywood and Broadway star.

1947-Top Hits

I Wish I Didn't Love You So - Vaughn Monroe

Feudin' and Fightin' - Dorothy Shay

I Wonder Who's Kissing Her Now - Perry Como

Smoke! Smoke! Smoke! (That Cigarette) - Tex Williams

1950-U.S. forces invaded North Korea across the 38th parallel. The first tank crew to cross was a patrol of the 1st Cavalry Division that crossed into the Kaesong Area, about 85 miles south of the Communist capital of Pyonsang, at 3:14pm. The crew members were Sergeant Homer Lee of Evansville, IN, Private First Class James Emerich of Sutton,WV, Sergeant Walter Hill of Fairmont,ND, Sergeant Charles Gissendanner of Autaughville,AL, and Corporal Clarence Johnson of Taylorsville, NC. the 38th parallel was the line of latitude that had divided North Korea form South Korea since the end of World War II.

1950-“The Frank Sinatra Show” premiered on TV. Singer Frank Sinatra's first series was a musical variety show featuring regulars Erin O'Brien and comic Ben Blue. However, during the last season this show was cut from an hour to 30 minutes at it could not compete with “The Texaco Start Theater” with Milton Bearle, the most popular TV show of the time.

1955- The religious drama 'Crossroads' first aired over ABC television. An anthology which dramatized true experiences of clergymen of all denominations, the program ran for two years.

http://www.tvtome.com/tvtome/servlet/EpisodeGuideSummary/showid-7969/season-all

1955-Top Hits

Love is a Many-Splendored Thing - The Four Aces

Autumn Leaves - Roger Williams

Moments to Remember - The Four Lads

The Cattle Call - Eddy Arnold

1956 - A U.S. House subcommittee began investigations of allegedly rigged TV quiz shows.

1960- "Route 66" premieres. Each week from 1960 through 1964, the “Route 66” television show came into the living rooms and dens of American homes. The series, written by Stirling Silliphant, tracked the adventures of two young men traveling down Route 66. The two drove from town to town along the route in a 1960 Chevrolet Corvette. The series, which lasted four seasons, shot a total of 116 episodes, 36 per year at 36 different locations every year. Before the “route 66” show became history in 1964, the show compiled an incredible 20.1 average rating, making it one of the highest rated shows of that time. Originally starring George Maharis as Buz Murdock and Martin Milner as Tod Stiles. Maharis left the show in midseason to be replaced by Glenn Corbett as Linc Case. The stories centered around their travels on Route 66 in their corvette convertible, working at odd jobs and helping people, searching for adventure. Jazz was played predominately as background music. The theme was written by Bobby Troupe and became a hit song again.

http://www.tvtome.com/Route66/

http://www.route66products.com/home.html

http://www.autobahn.mb.ca/~gardners/BobbyTroup.htm

1963-Top Hits

Blue Velvet - Bobby Vinton

Be My Baby - The Ronettes

Sugar Shack - Jimmy Gilmer & The Fireballs

Abilene - George Hamilton IV

1968-The movie industry adopts a film ratings system for the first time. The initial ratings were G (for general audiences), M (for mature audiences), R (no one under 16 admitted without an adult), and X (no one under 16 admitted). 1990, the Motion Picture Association of America replaced the X rating with NC-17, after its Code and Ratings System Administration gave 10 mainstream films the X rating. NC-17 was designed to indicate a non-pornographic film with sexual content that might be inappropriate for viewers under 17.

1973 - 40,000 football fans failed to use their pro-football tickets, opting instead to watch games on TV since legislation was signed lifting blackout rules of games. It was not soon after that the league re-introduced the “black out” rule if a game did not sell a certain percentage of tickets.

1975-Military service academies' enrollment of women was authored by an act of Congress,” to insure that female individuals shall be eligible for appointment and admission to the service academies beginning with appointments to such academy for class being inning in calendar year 1976.”

1979-The the final day of the fall round up and trail drive for the Ninety-Six Ranch. The Ninety-Six lies along Martin Creek, a tributary of the Little Humboldt River in the upper section of Paradise Valley, Humboldt County, Nevada. Know it very well as my late wife was from this area and we would visit her mother who ran a restaurant near here, and owned land adjacent to Martin Creek in Paradise Valley, where she wanted to retire. (She lives today at 94 in Lamoille, Nevada and still has plans of moving her trailer to Paradise Valley.)

http://memory.loc.gov/ammem/today/oct07.html

1982-Cats opened n Broadway—The longest-running production in Broadway history. Cats was based on a book of poetry by T.S. Eliot and had a score by Andrew Lloyd Webber. More than 10 million theatergoers saw the New York City production, which closed September 10,2000, after 7,485 performances. Cats was also produced in 30 other countries.

1984-Running back Walter Payton of the Chicago Bears broke two records held by Jim Brown in the same game. He passed the mark of 12,312 career rushing yards and rushed for 100 yards or more for the 58th time in his career as the Bears beat the New Orleans Saints, 20-7.

1985-Lynette Woodland, captain of the gold-medal-winning US basketball team of the 1984 Olympics was selected to be the first woman to play for the Harlem Globetrotters.

http://www.harlemglobetrotters.com/history/tl_1985.html

1987-Top Hits

Didn't We Almost Have It All - Whitney Houston

Here I Go Again - Whitesnake

Lost in Emotion - Lisa Lisa & Cult Jam

You Again - The Forester Sisters

1988 -Dallas Green replaces Lou Pinella as NY Yankee manager

1988- Robin Givens files for divorce after 8-month marriage to Mike Tyson

1993 - Toni Morrison was awarded the Nobel Prize in literature. She was the first black woman to received the award and one of America's most significant novelists of the twentieth century. She is the Author of six major Novels, "The Bluest Eye", "Sula", "Song of Solomon", "Tar Baby", "Beloved" and "Jazz". "Song of Solomon" won the National Book Critics Circle Award in 1977 and "Beloved" won the Pulitzer Prize in 1988.

World Series Champions This Date

1933 New York Giants

1935 Detroit Tigers

1950-New York Yankees

1952-New York Yankees

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Adopt a Pet

Bank Beat

Career Crossroads-Emily Fitzpatrick/RII

Cartoons

Charlie Chan sayings

Computer Tips

Employment Web Sites

Fernando's Review

From the Desk of Michael Witt, Esq.

Leasing 102

Leasing Cases by Tom McCurnin

Online Newspapers

Placards

Sales Make it Happen

Spark People—Live Healthier and Longer

The Secret of Our Success

To Tell the Truth

View from the Top

Why I Became a CLP

Ten Top Stories each week chosen by readers (click here)

“Complaints” Bulletin Board (click here)

Connect with Leasing News![]()

![]()

![]()

![]()

(chronological order)

- The Best Economies in the World

- NorVergence Head Finally Tagged a Felon But Sentence is a Joke

- Record Number 15 Pass CLP Test

- Loan/Leasing Regulation --- Update

-

Small Business Left Out of Prime Credit Marketplace

- Scottrade Bank Equipment Finance

Begins Lease and Loan Origination

- Sample of Usury Laws in United States

- Sheldon Player—

E.A.R. Looks Like Sheldon will Walk

- Operation Lease Fleece

Last One Sentenced

- Norvergence Update - No End

- IFC Credit--Rudy Trebels BK End May be Near

- Balboa Capital Class Action Case Settled--$5 million?

- HL Leasing - Delayed to October

- Old Cowboy On His Horse

- Leasing Brokers: When May You Collect a Commission?

- Is Long Term Leasing Dead?

- Brican America Case Moves Ahead

- Depping and Team hit $1 Billion Credit Applications

- TimePayment On-Line Credit Decisions in Five Seconds!

- Congress Considering Eliminating "Interest" Write-Off

---What You Can Do!

- ACH Becoming More Popular with Businesses

More and More Leases are being paid by ACH

- Top 10 ACH Providers

- 5 Ways Women Are Better Bosses Than Men

- Inside Marlin's 2nd Quarter 10Q

(What was not in detail in the Press Release)

- Pepperdine Private Capital Survey

"Alarming Low" Application-to-Loan Ratio

- Top 50 Quick-Service/Fast-Casual Restaurants

- Hey, Let's Hire Ritz Carlton!!!

- Umpqua CEO on Financial Pacific Leasing Purchase

What to Look Forward to

- PacWest-CapitalSource Merger No Surprise;

Leasing Community Saw it Coming

- Leasing News is Not the National Enquirer

- Balboa Capital, Irvine, California

$20,543.22 Bulletin Board Complaint

Alleged “Bait and Switch”

- MB Financial Taylor Cole Merger Good for Leasing Industry

- "Lovely Ladies of Leasing" Visit Temecula Wineries

- Top Five Leasing Web Sites

- BBB Leasing Company Ratings

- Dallin Hawkins Second Arrest within 25 days

Well-known LinkedIn.com Super Broker

- Integrity Financial Groups, Murray, Utah

$50,000 Bulletin Board Complaint

- History of Leasing - Abridged

by Tom McCurnin and Christopher Menkin

- GoBank Goes Live

- "Just What is an "Alternative Dispute Resolution?"

- One Out, Another Getting Out, Not the Third

- Banks and Leasing Regulations

- Luckiest Man in California- Our Tom McCurnin

- Element Financial Sued by De Lage Landen

- Abbott and Costello Prediction- An Update

- Sterling Financial Purchases Commerce National

- Twitterverse--Are you a "Tweep" or "Twitterati"?

- Female Lease Finance Association Presidents

- Terry Winders, CLP, Custom Built Poker Tables

---Order One for Father’s Day

- Broker’s Responsibility to Obtain

California Lender’s License

- CLP 2012 Accomplishment Report

Many "fresh faces" Become CLP's

- Most Popular Dog Breeds in America 2012

- Pacific Western Joins “Extra Lease Payment” Group

- The Matrix-Utah Connection

- Current License Regulations and Advice

- The House that Jerry Built

- The Day that Albert Einstein Feared May Have Finally Arrived

- Equipment Finance Agreements Explained/Barry S. Marks

- Sheldon Player's E.A.R. Ropes 18 Equipment Lessors

- Chat Acronymns and Keyboard Smilies

- Royal Links "True Lease" Court Ruling

- "The Memory Shock" –New Book by Barry Reitman

- Third-IFC Credit Trustee, Northfield, Illinois

Bulletin Board Complaint

- Four Software Solutions

re: Digital device/Laptop Lost or Stolen!

- Excellent Tips by Warren Buffet

- Take Your Banker to Lunch

- Meridian Finance Group Looking Brokers for Europe Biz

- Is Leasing Securitization Dead or Alive?

- Why Leasing News is Different

- Mazuma and Republic Bank Get Snared on PRR Provision

by Tom McCurnin, Esq.

- Companies who utilize Evergreen Clauses for Extra Lease Payments

- Jeff Taylor's Leasing Predictions, Spring, 2006

- Radiance Capital, Tacoma, Washington

Bulletin Board Complaint

Purchase Option on EFA, Won’t Return $5,000 S.D.

- New Case against Mazuma Capital and Republic Bank

---Automatic Evergreen Payment---PPR

-

Eleven Lawyers Against Evergreen Clause Abuse

- Republic Bank out of leasing?

- Ladco Leasing/Elavon Fined $418,601

-

Future of Mobile Devices

- Charles Schwartz and Allied Health

- Why I became a CLP

- Copier Wars---It's more than the lease payment

by Christopher Menkin

- Results Are In---

"Application Only" versus Financial Statements?

- A California Leasing Gypsy Arrested by Costa Mesa Police

- Survey of Evergreen Clauses

-

Responses to Working with a Smaller Bank Question

- Leasing Gypsies

- OneSource Develops Business License Software

- Talk About Chutzpa, Fanghella has more than Trump

- Three Class Action Suits re: Brican America

- Verifying Tax Returns

- Starting a Leasing Company-Four Parts

by Mr. Terry Winders, CLP

- Free Mobile Wine Program

- Special Report: Part I

Could Church Kiosks, Royal Link Carts, NorVergence results been avoided?

The use of “Equipment Finance Agreements”

- Special Report: Part II

Bank of the West

Equipment Lease Agreement (EFA)

- California License Web Addresses

-

Settlement Costs Vs. Litigation Costs