![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

|

|

1 year experience preferred, salary/benefits |

| www.cflbc.com

Commercial Finance & Leasing Bank of Cardiff, Inc, a finance lender licensed pursuant to the California Finance Lenders Law, license #603G469 |

Wednesday, August 14, 2013

![]()

Today's Equipment Leasing Headlines

Ability Capital Solutions, Long Beach, California

Bullentin Board Complaint

Classified Ads---Operations

Over Half of U.S. Adults Bank Online

Making Installment Payments, Paying Bills

ACH Becoming More Popular with Businesses

More and More Leases are being paid by ACH

by Christopher Menkin

Top 10 ACH Providers

by topcreditcardprocessors.com

Classified Ads---Help Wanted

Brican America Case Moves Ahead

by Christopher Menkin

Aggregate Funding Sources--Updated

(Online: connects lessees, lessors, and vendors)

Why I became a CLP

Joe Schmitz. CLP, F.I.T. Leasing

Leasing News Advisory Board Chairman

Robert Teichman, CLP

The QRS 15 Top Franchisor Contenders

Barely Miss the Cut for this year's QRS 50

Element Reports Strong Volume Growth in Q2-2013

---Originations Up 34%

Cocker Spaniel/German Shepherd Mix

Long Beach, California Adopt-a-Dog

Classified ads—Back Office

August 14, 2003--Dedicated to Lawrence Faber

My Very Close Friend who Died at 56

News Briefs---

Audit Reports Could Face Biggest Shake-Up Yet

Oracle's Larry Ellison says Apple's best days are over

Few Clues to Regulatory Goals of Fed Rivals

CEO of AOL Apologizes to Staff for Public Firing of Employee

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send to a colleague. Spread the news.

Also ask them to join

our mailing list or bookmark our site.

We are free

[headlines]

--------------------------------------------------------------

Ability Capital Solutions, Long Beach, California

NAELB, CLP, NEFA Bulletin Board Complaint Status

Brian Acosta, CLP

www.linkedin.com/pub/brian-acosta-clp/9/291/495

As part of the process, Leasing News provides other sources to contact such as BBB, local, state, or federal authorities, if appropriate, as well as associations or groups that also may be of assistance.

This is a follow-up to a complaint from Bryan Kastleman of Kastleman & Associates, Inc., regarding $9,594.36 not returned by Ability Capital Solutions, Long Beach, California founder Brian Acosta, CLP, who's company Blue Star Capital, Inc. Subsidiaries of Blue Start include Matrix Business Capital and Ability Capital Solutions (1).

The National Association of Equipment Leasing (NAELB) Brokers reportedly has received both the complaint from Mr. Kastleman and Mr. Acosta's response as coordinated by their legal counsel, and NAELB board member, Joe Bonanno, Esq., CLP. According to the long time NAELB procedure, the complaint and response are sent to two anonymous brokers and two anonymous NAELB funders for their opinion. The members of the committee do not know each other's identity and the only interact with Mr. Bonanno, CLP, who then will inform both parties of the opinions of the Ethics committee. If the issue is not resolved at this point, it then proceeds to the NAELB Board of Directors for the Board for whatever action it may deem appropriate in the matter.

In the past, members have been expelled and/or when their membership comes up for renewal, they have not been renewed. These actions are considered officially confidential.

Leasing News is aware of several of these actions and can testify the association is very active in keeping members to their code of ethics.

Note: Brian Acosta, CLP, Best Practices Broker, was included in the NAELB Workshop “Marketing Best Practices: Repeat Clients and Vendor Referrals:”

http://leasingnews.org/PDF/naelb_8142013.pdf

In the Certified Leasing Professional Foundation, Leasing News was told Mr. Bonanno, CLP, also a past CLP board member, has been asked for assistance, but due to his involvement in a complaint at NAELB, it was decided it would not be "appropriate," so Rosanne Wilson, CLP, president, asked attorney Tom McCurnin for his assistance in putting together a presentation for the CLP Board to determine if a hearing should be held. Supposedly in addition to documents, there are over 200 emails regarding the complaint as well as recorded telephone voice messages.

In the past, CLP members who do not follow the code of ethics have been asked to leave, as well as not renewed, and action taken to those who continue to use the designation. Such was the case with Rudy Trebels, president of the bankrupt IFC Credit Corporation (2). These actions are considered officially confidential. Leasing News is aware of several of these actions and can testify the CLP code of ethics is considered very important to its members and board of directors.

Mr. Kastleman contacted Gerry Egan, Executive Director, National Equipment Finance Association regarding making a complaint and told Leasing News: "FYI- they don’t have a formal complaint process. They made a note of my complaint and said that they will contact the member only if they receive a few complaints."

Mr. Egan responded to Leasing News:

“NEFA's procedures for lodging complaints against a NEFA member are posted on our website:

nefassociation.org/associations/9928/files/NEFA%20ByLaws%2011-11-08%20Final.pdf

“A careful reading of them will show that my response to Mr. Kastleman's call was exactly in keeping with our policy for handling complaints from non-members.

“I explained to Mr. Kastleman that, in accordance with our policies as spelled out in Section 3, Paragraph (b) on page 11, I would make a note of his complaint. I also explained to Mr. Kastleman that, in accordance with Section 9, Paragraph 9b on page 14, our possible actions can only deal with a Member's membership standing and I explained that our policies and procedures were not intended for, nor do they offer, any avenue of redress to Mr. Kastleman or any other non-member. He said he understood.

“I apologize to Mr. Kastleman if my explanation on the phone wasn't clear and I appreciate this opportunity to clarify it.

“I will be out of the office traveling to one of our regional events for the balance of this week.

“Thanks,”

Gerry E.

(1) Ability Capital Solutions, Long Beach, California

$9,594.36 Bulletin Board Complaint

http://leasingnews.org/archives/Jul2013/7_22.htm#bbc

(2) Rudy Trebels Claiming a CLP

http://www.leasingnews.org/Conscious-Top%20Stories/trebels.html

((Please Click on Bulletin Board to learn more information))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Classified Ads---Operations

(These ads are “free” to those seeking employment

or looking to improve their position)

Want To Work From Home:

Have 10+ years in readying Lease Origination Documentation, Litigation case mgmt., Collection, Repossession, Remarketing, complete Discovery and Interrogatories, attend Trials and Mediation, prepare and submit SAR’s, translate for Spanish speaking customers, clients and employees, monitor high risk accounts for monetary penalties, bankruptcy management. Email: BRFR@ATT.NET

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Over Half of U.S. Adults Bank Online

Making Installment Payments, Paying Bills

Pew Research reports that 51% of adults in the United States do their banking online. According to a Millionaire Corner study, 74% of investors pay most of their bills online. 54% of investors pay some of their bills using a smartphone.

35% reportedly connect using their cell phone or mobile device.

The report states 85% of U.S. adults use the Internet, although it goes down to 56% of U.S. adults over the age of 65. Although there are 61% of Internet users banking online, 67% of U.S. adults between the ages of 18 and 29 bank online.

71% with household income of $50,000 to $75,000 bank online, and 75% of those with $75,000 and above household income bank online. Millionaire Corner reports 74% of investors with net worth of $1 million (not including primary home) pay bills on line.

Reportedly cellphone banking is more popular among African-Americans and Hispanics, up to 41%, while 32% of Caucasian cellphone users report banking on their phones.

[I would urge caution not to intertwine smartphones, online and mobile payments. Since smartphones began to overtake feature phones, simultaneous with tablet adoption, all of which have combined to accelerate mobile financial transactions that include deposits, payments, balances, filing insurance claims, broker transactions and the like. Let me add, the current terminology is not only smartphones, but connected devices, meant to include any device...e-reader, x-box, nook, tablet as well. Ralph Mango, editor.]

[headlines]

--------------------------------------------------------------

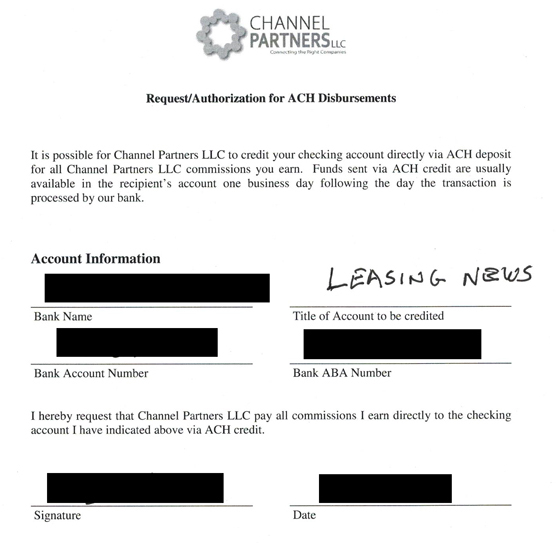

More and More Leases are being paid by ACH

by Christopher Menkin

More businesses are paying their bills with ACH (Automated Clearing House), the nationwide electronic funds transfer (EFT) system that provides for the inter-bank clearing of credit and debit transactions and for the exchange of information among participating financial institutions.

At one time, the ACH system was being required by leasing companies for companies with a slow history of payment, or were subprime credit or marginal but with ACH requirement, the deal went through. Today it is becoming more of a standard feature, as well as businesses also are using ACH themselves to place orders with cash, take discounts, or to pay their bill right before the last day avoid a late charge.

Businesses are finding it not only faster but cheaper than processing paper checks as well as using wire transfers. It takes a very simple form to sign up to receive money into your bank account:

(Form used by Channel Partners to pay for their display advertising

to Leasing News. They pay super-fast. Editor)

It is different than mobile banking as most providers are members of NACHA, the Electronic Payments Association.

The ACH Network processes two types of transactions: Direct Deposits via ACH and Direct Payments via ACH.

Direct Deposit via ACH is the deposit of funds for payroll, employee expense reimbursement, government benefits, tax and other refunds, and annuities and interest payments. It includes any ACH credit payment from a business or government to a consumer.

According to NACHA:

-

In 2012, the ACH Network processed more than 21 billion transactions.

-

In 2012, the total dollar value of ACH Network transactions was $36.9 trillion.

-

In 2012, the ACH Network processed 9.79 billion ACH debit transactions and 6.96 billion ACH credit transactions.

| Working Capital Loans $10,000-$250,000 | |

|

|

[headlines]

--------------------------------------------------------------

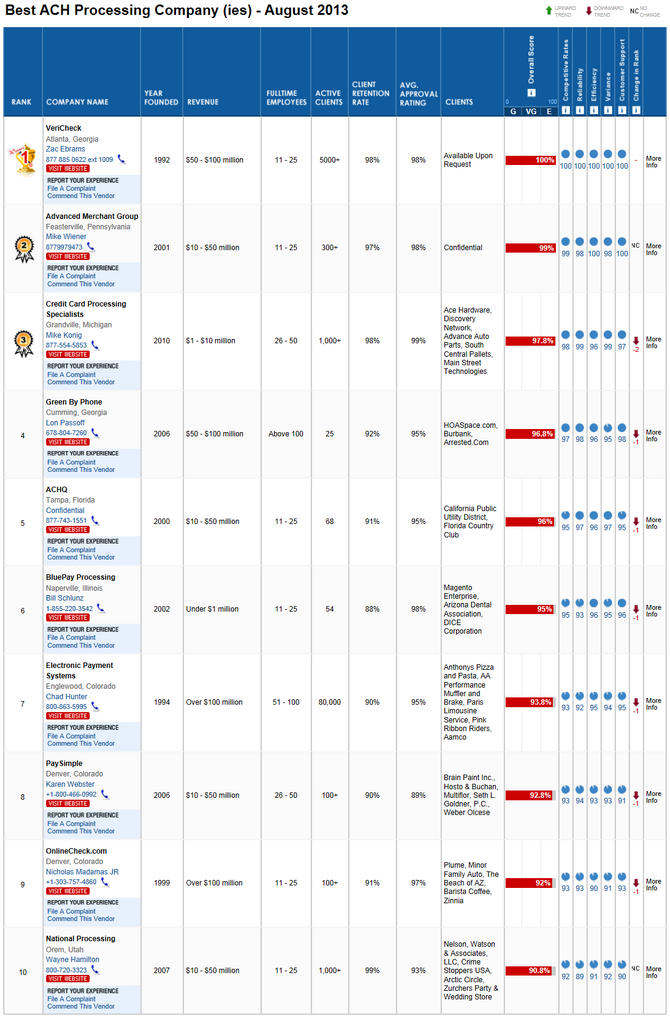

Top 10 ACH Providers

by topcreditcardprocessors.com

topcreditcardprocessors.com, an independent research firm, has revealed the rankings of The 10 best ACH processing services for the month of August 2013, according to topcreditcardprocessors.com:

(click image to view larger)

About topcreditcardprocessors.com: “The main ambition of topcreditcardprocessors.com is to decide and release those individuals or companies offering top payment processing services available. ACH processing companies are put through a systematic examination to ensure the ratings contain the absolute best companies the payment processing industry has to offer.”

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Los Angeles, California www.maximcc.com |

|

|

1 year experience preferred, salary/benefits |

| www.cflbc.com

Commercial Finance & Leasing Bank of Cardiff, Inc, a finance lender licensed pursuant to the California Finance Lenders Law, license #603G469 |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Brican America Case Moves Ahead

by Christopher Menkin

In one of the last scandals still remaining, not settled, this concerned over 4,000 dentists who signed agreements for a large television screen in their waiting office that ran advertisements for products and the dentists services. The advertisements came from a Brican America advertising company and maintenance for the computer and the actual ads were from Brican America who told dentists by running the ads, it would make the payments on the display screen and computer.

The problem is Brican America ran out of advertising and was not providing the money to the dentists for the lease payments. During this time long time leasing executive Chuck Brazier was trying to sell off the Brican America’s portfolios, as the company was having difficulty "laying off the paper."

The difficulty came to Leasing News attention, who quickly learned the founder of the company had done the same before and sent out an alert. It brought a threatening letter from attorney Charles H. Lichtman, who has been involved in such letters with Leasing News (1)

The dentists got involved in their dental associations, created a Yahoo blog and joined together, especially the 1,672 lessees of NCMIC Finance Corporation dba Professional Solutions Financial Services (PSFS), Clive, Iowa, regarding $38 million. Many other dentists were left to hang with other leasing companies as they did not join the class action suit. One just emailed Leasing News they were notified of a lien on their house and wanted to know what they should do.

The case went around and around, then class actions, a consolidation, plus moving from Iowa to Flordia, primarily under the direction of attorney Ronald P. Gossett of Gossett & Gossett, P.A., Hollywood, Flordia (the name may be familiar as he was quite active in the NorVergence scandal. He was the first plaintiff attorney to prove that leasing companies were aware of the telephone service. Simply: the involvement was in the PowerPoint presentation submitted to the leasing companies and banks, as it explained the relationship and separate service. Once the attorneys for the leasing companies saw the PowerPoint, quick settlements with Attorney General offices happened.

Leasing News last reported on July 31, 2013, the plaintiffs were awaiting a ruling on the cross-motions for a summary judgment. The Florida U.S. District Court Judge Patricia A. Seitz, Senior Judge of the United States District Court for the Southern District of Florida, daughter of the late and revered Lt. General Richard J. Seitz, former commanding general of the 82nd Airborne Division and the XVIII Airborne Corps., requested the plaintiffs whether "this is a 'paper case" limited to the alleged misrepresentations in the various versions of the Advertising Agreement, including Plaintiffs' reasoning in support of this position."

The decision on the cross-motions has been made. Gossett states, " Basically, except for legally construing one clause in one contract, everything goes on to trial."

So after an October 5, 2009 alert by Leasing News, almost four years later, the matter may go to trial this year.

Here is a copy from Westlaw:

http://leasingnews.org/PDF/BricanAmericaLitigation_8142013.pdf

(1) Letter from Brican America Attorney Charles H. Lichtman

http://leasingnews.org/archives/December%202009/12-14-09.htm#brican_letter

Brican America/Brican Financial Lawsuits

http://www.leasingnews.org/Conscious-Top%20Stories/brican_america.htm

| John Kenny Receivables Management www.jrkrmdirect.com • End of Lease Negotiations & Enforcement The Solution to Your Credit & Accounts Receivable Needs |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Aggregate Funding Sources

(On Line: connects lessees, lessors, and vendors)

The companies were contacted for additional information, but did not supply them.

Capital Relay states on their web site they have 637 brokers and 115 lenders on their network.

Ecologic states on their web site they were founded in 2000 as "e-leasinghub.com, name changed, then March, 2003 a management team led by Michael Keeler, CEO took over. In 2008, they acquired Captara, a competitor, they note." In 2008, Ecologic renewed agreements with all of Captara's clients and ported their software capabilities, data, and lessor network to Ecologic's software services platform, LeaseAccelerator 5.0...Today, Ecologic has executive offices in metropolitan Washington, DC, Montreal, QC, and San Francisco, CA. However, most of Ecologic's employees work out of their home offices."

They list client testimonials:

http://www.ecologicleasing.com/cts.htm

In-A-Jiffy is a relatively new company, less than two years old, noted as a member of the National Association of Equipment Leasing Brokers. Listed on the web site are many funders such as Allied Funding, Marlin, Direct Capital, United Capital among others. They also appeal to “buyers, vendors, brokers, and funders.”

| www.ecologicleasing.com | ||

Top eLeasing companies as ranked by employees and volume

Rank |

Company Name |

Employees |

CEO |

Additional Services Offered |

Yearly Volume |

Major Clients |

CapitalRelay.com

|

N/R |

N/R |

N/R |

N/R |

N/R |

|

N/R |

N/R |

N/R |

N/R |

N/R |

||

N/R |

N/R |

N/R |

N/R |

N/R |

Bookmark us

[headlines]

--------------------------------------------------------------

Why I became a CLP

Joe Schmitz. CLP

F.I.T. Leasing

Financing Industry & Technology

In 1990 I decided I wanted to work for a bank. I had been working in the transportation industry for a small, slightly crazy, family owned company and I wanted to work for a stable, secure company and thought I wanted to be in finance. I was hired by Ginny Young (Leasing News Advisory Member) at a Thrift & Loan that had been in business for 72 years; however 6 months after hiring me they closed. So much for security. Ginny then helped me get a job at one of the Thrift’s customers, a leasing brokerage named Nova Leasing that was owned by Steve O’Neill. I was a straight commission salesperson. After a rocky start, business started growing and we had a great time until 1998 when Steve passed away.

Upon Steve’s passing, I arranged to buy the company from his family in the beginning of 1999. That’s when I decided to get my CLP. Prior to that I had handled the sales and marketing side; now I owned the company and realized that my knowledge base was way too limited. I believed getting the CLP would help make up for the gaps. Also, I felt it would equip me for the biggest change in my roles, that of working with our lenders. Prior to that we had a classic inside/outside role, I brought the transactions in and Steve dealt with our lender relationships. I did not have his 20 years of history with the principals of these funding sources so it seemed to me that being able to show them that I was serious about the profession of leasing and dedicated to following a professional code of conduct would help them trust our company and the transactions we brought them.

Shortly after I bought the company, a multi-day Master Review class was being held at Pacifica Capital. It was a 3 day intensive class followed by a full day test. While it wasn’t cheap, it took time away from my business and was pretty intimidating; it seemed like the best way to get the process done. Since the class was held at Pacifica Capital, I had a chance to get to know the others taking the test including Bette Kerhoulas, CLP, Amy Spragg, CLP, and Jaime Kaneshina, CLP. It was a great group of people to study with. Johnnie Johnson, CLP, led the class (on his own time) and he was an outstanding teacher.

So for three days, I was stuffed full of leasing information. History, law, pricing, structure, collections; by the end I couldn’t wait to take the test, just so I could be finished. As you might imagine the test was intimidating and pretty exhausting. I was pretty sure I passed, but they didn’t have the results on the spot so you just didn’t know. I was very relieved when they notified me that I passed and pleased that everyone in our group also passed.

So what’s been the benefit? Since I was self-employed, it wasn’t that I got an automatic raise for earning the CLP, but unquestionably it profited me. Of the thousands of people in the equipment leasing industry, less than 1% have achieved this designation. That gives you a level of confidence. I know that if I am interacting with a CFO of a large corporation I can properly address any question or concern he or she might have about leasing as it relates to tax, accounting or legal.

The CLP knowledge base means I can read with understanding some of the in-depth articles on Leasing News written by Terry Winders, CLP, such as how a fair market purchase option may still be considered a “bargain” (and what a “bargain” means!) when the cost to return equipment exceeds its value. Or a post by Tom McCurnin about how amendments in Article 9 of the UCC can affect secured creditors. Lastly having the CLP has been an enormous benefit in developing relationships with funding sources as it lets them know I’m serious about being a professional in this industry.

I highly encourage you to consider getting your Certified Leasing Professional designation. You’ll be glad you did.

“Ignorance is the curse of God; knowledge is the wing wherewith we fly to heaven.”

-

William Shakespeare

CLPs in Good Standing

http://www.clpfoundation.org/members/members.php

Why I Became a CLP series:

http://www.leasingnews.org/CLP/Index.htm

[headlines]

--------------------------------------------------------------

Leasing News Advisory Board Chairman

Robert Teichman, CLP

Bob was appointed by Kit Menkin as chairman May 8, 2005, primarily to recognize him as our number one good will ambassador. Kit has known him for over forty years since the early 1970's when he was President of Dividend Leasing, Santa Clara, and Bob was the champion salesman, just out of Crocker Bank Leasing. Later roles were reversed when Kit sold him deals at various funding companies he represented. He also tutored him to pass the Certified Leasing Professional test, but could never get Kit to run the HP calculator correctly.

Bob joined the Leasing News Advisory Board July 7, 2000. He was actually involved in the "perception" of the newsletter before this date, making many contributions before we went “on line.”

He is the one readers call with the most complaints, or wanting the editor to print a press release or explain what was written. Perhaps he started to get the calls as at one time he wrote about all the leasing conferences for Leasing News, wrote many articles, "pal'd around" with Kit at conferences, where many learned he was a very close friend.

Many don't know Bob is quite a musician, a dancer, and choral singer.

Robert Teichman, CLP

Teichman Financial Training

3030 Bridgeway, Suite 205

Sausalito, CA 94965

Tel: 415 331-6445

Fax: 415 331-6451

e-mail: BoTei@aol.com

Bob Teichman, CLP, was born in New York City. After attending the High School of Music & Art and the New York College of Music, he received his undergraduate degree from Columbia College.

“I studied music for a lot of years. I even played piano professionally while in college (local 802, American Federation of Musicians, James C. Petrillo presiding!), “he added. “I have kept up my interest in music by singing in a local chorus for the past 30 years. There are about 100 of us and we give concerts several times a year, mostly pre-20th century composers like Bach, Haydn, Mozart, Beethoven. But we do get away from the 18th and 19th centuries. At a recent concert we performed 15th and 20th century music.” He pursued his graduate studies in Geneva, Switzerland.

"In 1956, when I was a graduate student in Geneva, I met my wife Patricia," he wrote. "She was working at the UN and she and I were members of a group of expatriates- Americans, British, Russians, Swedes, mid-Easterners- who all hung around the same cafes"

"It was the late 1950's and Switzerland was affordable for students like me. The ski slopes were close and most of the rest of Europe was less than a day’s drive away.

"But sooner or later reality sets in. More than fifty years ago we married in New York and came to California; driving cross-country in a 1957 Bristol sedan my father had picked up on one of his many trips. The car had right-hand drive, so it was a real challenge maneuvering on the two-lane roads (yeah, they were paved; it was the middle of the 20th, not the 19th, century.) Still, it was an adventure when we had car trouble on a couple of occasions.

"Patty is an avid gardener and an excellent watercolorist. The two interests coincide in her botanical paintings. Here is an example of her painting of a flower from our garden:

"We spend our vacations at a small and very primitive cabin in the Sierra backcountry. Summers only; the roads aren't plowed in the winter. Nice country in summer, though. Pines, firs, granite outcrops, streams, meadows. Also coyotes, bears and deer. We don't bother them, they don't bother us. A bear did chew on my neighbor's cabin. Probably liked the taste of the wood stain.

"Thanks for your friendship over all these years. After having been in the leasing business for over 50 years, I really appreciate all the wonderful people I have met, and the lasting friendships I have formed. I still enjoy the business immensely. There is always something new around the corner."

Bob started in automotive leasing in 1963 in sales, then moved into equipment leasing in the late 1960's. For over 20 years he provided funding for leasing companies as an officer of both bank and non-bank lenders. Along the way, he started several successful leasing companies. His company, Teichman Financial Training, located in Sausalito, California, was founded in 1998 and provides lease education and consulting services to lessors, funders, brokers, government and international agencies, and other members of the financial community.

He is active in leasing associations, having served on the Board of Directors of the United Association of Equipment Leasing (UAEL) for four years. For three years he was the Chairman of their Education Committee with responsibility for the Certification Program and Educational Programs. He was also a member of other committees including the Standards Committee.

Bob is a frequent speaker at leasing industry events, and has written articles for UAEL's Newsline and other industry publications. He is a co-author of the Certified Lease Professional's Handbook and a co-author of the World Bank’s Global Leasing Toolkit.

He is currently Chairman of the CLP Foundation Board, as well as has served two years as President, and a number of years as Chairman of the Education Committee. He is also a member of the National Association of Equipment Leasing Brokers and the National Equipment Finance Association.

[headlines]

--------------------------------------------------------------

The QRS 15 Top Franchisor Contenders

Barely Miss the Cut for this year's QRS 50

July 31st the "Top 50 Quick-Service/Fast-Casual Restaurants" were chosen by QSRmagazine.com.(1) Here are the 15 that barely missed the cut:

Full 15 Article:

http://www.qsrmagazine.com/qsr-50/qsr-50-contenders

(1) Top 50 Quick-Service/Fast-Casual Restaurants

http://leasingnews.org/archives/Jul2013/7_31.htm#qsr

|

[headlines]

--------------------------------------------------------------

#### Press Release ############################

Element Reports Strong Volume Growth in Q2-2013

Originations Up 34%

After tax adjusted operating income increases 21% over Q1 to $10.5 million or $0.08 per share

- Origination volumes increased 34% over the previous quarter to $398 million

- Commercial finance volumes (Element Finance) increase 10% in Canada and 88% in the US

- Corporate finance volumes (Element Capital) increase 69% over the previous quarter to $86.6 million

- Fleet management volumes (Element Fleet) increase 36% over the previous quarter to $80.4 million

- After tax adjusted operating income per share was $0.08 versus $0.08 for the previous period

- Total assets increased by 43% over the immediately previous quarter to $2.5 billion from both organic growth and the acquisition of the GE Fleet portfolio

TORONTO, Ontario - Element Financial Corporation (TSX:EFN) (“Element” or “the Company”), one of North America’s leading independent equipment finance companies, today reported financial results for the three and six month periods ending June 30, 2013 showing strong growth in origination volumes across all of the Company’s business verticals. New originations increased 34% to $397.9 million for the three month period versus $296.3 million in the previous period.

Financial revenue increased to $33.96 million versus $31.84 million in the previous period generating net financial income of $24.7 million versus $22.8 million in the previous period. Adjusted operating expenses were $10.3 million for the period versus $10.8 million in the previous period resulting in adjusted operating income of $14.5 million for the current three month period versus $12.0 million for the previous period. After tax adjusted operating income was $10.5 million or $0.08 per share for the current period versus $$8.6 million or $0.08 per share for the previous period. Total assets increased 43% to $2.5 billion at the end of the period versus $1.8 billion at the end of the previous period and book value per share increased to $5.67 versus $4.75 reported at the end of the previous period.

Element Finance accounted for $230.9 million or 58% of the $397.9 million originated during the period. Element Capital accounted for $86.6 million or 22% of the new business volume while Element Fleet originated $80.4 million or 20% of the period’s new business volume. The acquisition of the GE Fleet portfolio also added a further $488.7 million to the Company’s portfolio of finance assets during the period. Finance receivables increased 45.9% to $2.1 billion at the end of the period versus $1.5 billion reported at the end of the previous period. Average finance receivables for the period were $1.5 billion versus $1.4 billion for the previous period. The slight increase resulted from the acquisition of the GE Fleet portfolio on the last day of the quarter.

On June 18th, the Company closed a $300.6 million private placement bought deal equity financing and on June 28th used proceeds from this financing to close the acquisition of GE Capital Canada’s Canadian fleet management business and portfolio (the “GE Fleet portfolio”) of $488.7 finance receivables. During the period the Company also announced that it had commenced funding through the previously announced Element Equipment Finance Fund with the purchase of US$48.5 million of unrated notes by a US-based investment management firm.

Steve Hudson, Chairman/CEO

“We’ve seen strong originations across all our business verticals during the period with a notable increase in our US business which originated $64.2 million of new business volume in Q2,” said Steven Hudson, Element’s Chairman and CEO. “Even after backing out approximately $7 million of volume related to one-time transactions, I’m pleased to see that this business, which we acquired in December of last year, is tracking in line with expectations. We are also on track with our plans for the integration of the Canadian fleet management business that we acquired from GE Capital during the period and continue to expect to deliver on the anticipated earnings accretion from this transaction,” noted Mr. Hudson.

Delinquencies continue to perform as expected and represented 0.15% of total finance receivables as at June 30, 2013 compared to 0.28% as at March 31, 2013. The improvement resulted from the acquisition of the GE Fleet portfolio which had lower delinquency rates than the average portfolio.

Element’s financial leverage ratio increased slightly to 1.75:1 at the end of the second quarter from 1.73:1 at the end of the previous period. Average leverage during the period declined from 2.36:1 in the first quarter to 1.72:1 in the second quarter resulting mainly from the issuance of additional equity in two separate tranches in March and June of this year. “We remain focused on delivering the continued quality growth to our balance sheet that will bring us in line with our target leverage ratio,” said Steven Hudson.

The weighted average number of shares outstanding during the period, including special warrants, increased to 129.4 million from 107.7 million in the previous period. At the end of the period, the company had 155.1 million shares outstanding including special warrants.

Full Eight Page Press Release with Financial Statements:

http://leasingnews.org/PDF/Q2FinancialResults_8142013.pdf

##### Press Release ######################

|

[headlines]

--------------------------------------------------------------

Cocker Spaniel/German Shepherd Mix

Long Beach, California Adopt-a-Dog

Prince

ID #A504446

"I am a female, black and brown Cocker Spaniel and German Shepherd Dog.

"The shelter staff think I am about 1 year old.

"I have been at the shelter since Aug 10, 2013.

For more information about this animal, call:

Long Beach Animal Care Services Bureau at (562) 570-7387

Ask for information about animal ID number A504446

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Leasing Industry Outsourcing

(Providing Services and Products)

| Back Office: Atlanta, GA Let Tax Partners handle your sales and use tax compliance duties w/less risk and cost than in-house. Largest tax compliance firm in US E-mail:sales@taxpartners.com |

Back Office: 58 Calif. counties Property tax, assessment appear representation and consulting, including hearing appearances. www.rpcpropertytax.com Ken Sullivan 800-540-3900 |

| Backoffice: Dallas, TX Property Tax and sales and use tax administration services performance is guaranteed and we will save you time and money or our service is free. E-mail: info@osgsolutions.com |

|

| Back Office: Gig Harbor, WA Orion First Financial provides comprehensive lease/loan account servicing, collection/workout solutions and strategic advisory services. Contact David T. Schaefer 253-857-9610 dtschaefer@orionfirst.com |

Back Office: Laughlin, NV 20 years experience on funder/broker sides. Looking for a relationship where I act as credit shop for smaller brokers when financial statements are involved. E-mail:batarista@laughlin.net |

| Back Office: National Property Tax Compliance Services to the leasing industry. Over 60-years experience and fifty Lessors as clients. References and free quotes available, (216) 658-5618, E-mail gary@avptc.com |

Back Office – National Spending too much time on processing credit applications, preparing lease documents and other administrative tasks and not enough time marketing and growing your business? Call us! 407.964.1232 dee@leasebrokerassistant.com |

| Backoffice: New Rochelle, NY Proactive management/administration of commercial/consumer vehicle lease/finance portfolios covering insurance, titles, registrations, sales/property taxes, tickets, collections, accounting, vehicle disposition. Since 1975 Email: Barrett@BarrettCapital.com |

Back Office: Northbrook, IL Our staff of CPA's and lease professionals can handle any or all portfolio responsibilities incl. portfolio mgmt, invoicing, sales/property/income tax, accounting, etc. 800-826-7070 E-mail: ngeary@ecsfinancial.com |

| Back Office: San Rafael, CA We can run your back office from origination to final payoff. 30 years experience in commercial equipment lease and loan portfolio management. E-mail:gmartinez@phxa.com |

Back Office - Portland, OR Keep more of your hard-earned commissions! Middle-Market, Small-Ticket for brokers, nationwide, 20+years experience, negotiable splits. Contact us for more information at (888)745-9481 or bev@alliedpacific.net |

| Back Office -Portland Portfolio Financial Servicing Company is a leading provider of private label primary and backup servicing for lease and loan contracts. 800-547-4905 sales@pfsc.com |

Portfolio Servicing: Portsmouth, NH |

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

[headlines]

--------------------------------------------------------------

August 14, 2003--Dedicated to Lawrence Faber

My Very Close Friend who Died at 56

Larry is on the left in the picture, and Walt is on the right

(his favorite pick-up truck) from a 1999 Oakland Raider game.

(Walt and I have been close friends since 1963.)

(From 8/15/03 Leasing News)

Larry would have gone to the 49ers-Raiders pre-season game with Walt and I yesterday late afternoon, but it was Cal Camp week. He was a UC Berkeley graduate. He and his family never missed it. He saw his fraternity buddies, and he was a Cal fan, going to all the football games, basketball games, and he would argue with anyone, especially a Stanford alumni.

I started doing business with his company Input/Optics about twenty-five years ago as American Leasing, writing leases for over 500 dentists, and did their up-grades and other equipment after being introduced by Larry.

He turned 56 years old on Sunday. On Wednesday, he said he felt ill, tired, and went to the infirmary. He was not over weight, physically very active, and in generally very good health. They found nothing. He felt a little better, but cold and clammy, so Dr. Budack, a dentist, took him to his tent, where he laid down, and then made a gasp, and was dead. He tried CPR. There was a physician nearby who also tried to revive him. But he had died. It was quick.

I was in shock. I decided to go ahead and go to the game, as I was meeting Walt, his youngest son, and a friend, both had taken the day off from work, and I had the tickets. Larry went to a few 49er games with us. We went to all the Raider games usually with four to six other friends, where we all sat together. We did wine tasting, sometimes blind, in the Oakland Coliseum Parking lot, sometimes across the way in a building parking lot, or whatever was available. Larry and I often went, just the two of us, to afternoon or night games. For years, he was a guest of mine at the Santa Clara Wine Society dinners. He knew his wine.

He and his wife have been to our house many times, in fact, Larry installed the first computer at my house, and originally did all the computers at our office in 1984. I believe. We had lunch at least two to three times a month, often more when we had leases going on, as well as I was involved in his business expansion on his board of directors. We talked on the telephone all the time. His was building up a practice of computers systems for attorneys and we had many leases with attorneys from advertising in the bar association news : "We are not afraid of leasing to attorneys!"

I always enjoyed his wit, his profound intelligence, his different way of looking at things, and spoke his mind. He was very funny, too. He was an avid golfer, won many software trophies at Twin Creeks in his late thirties and forties, then became captain of the team which was composed mostly of San Jose policemen. To say the lease, Larry was in very good physical shape. He was married to Michelle with two teenage children---actually one is at college now. I certainly will miss him. I wanted to share this with readers as leasing has made many friends for me, and Larry was one of the best ones I had.

Kit Menkin

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Audit Reports Could Face Biggest Shake-Up Yet

http://www3.cfo.com/article/2013/8/auditing_auditing-mda-discussion-pcaob-iaasb-caq

Oracle's Larry Ellison says Apple's best days are over

http://www.mercurynews.com/business/ci_23852897/oracles-larry-ellison-says-apples-best-days-are

Few Clues to Regulatory Goals of Fed Rivals

http://www.nytimes.com/2013/08/14/business/economy/careers-of-2-fed-contenders-reveal-little-on-regulatory-approach.html?ref=business

CEO of AOL Apologizes to Staff for the Public Firing of an Employee

http://www.nytimes.com/2013/08/14/business/media/aols-armstrong-apologizes-to-staff-for-firing-of-employee.html?_r=0

[headlines]

--------------------------------------------------------------

--You May Have Missed It

That Time People Sent a Cat Through the Mail Using Pneumatic Tubes

http://www.theatlantic.com/technology/archive/2013/08/that-time-people-sent-a-cat-through-the-mail-using-pneumatic-tubes/278629/

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

10 Excuse-Busting Exercise Truths: SparkPeople Slideshow

(Print out and paste the 10 around your place)

http://www.sparkpeople.com/resource/slideshow.asp?show=88

[headlines]

--------------------------------------------------------------

![]()

Baseball Poem

Frankly Speaking

What makes hot

dogs Taste better

At the ball park

Than anywhere else?

Can't be the

brand Or the

roll Or the

mustard

I think it 's

The process

Of spotting

The vendor

Ordering

over The

noise of The

fans

Passing your bucks

To the right

And

watching

The dog

Move from hand to hand

To the left

Then looking up

And rejoining the

Miracle play

In progress

Becoming again an

active Part of the

hopefuls

Eating quickly

So you can keep

score again And clap

along

With the kids over

there Chanting

WE WANNA HIT!

Written by Gene Carney, “Romancing the Horsehide,” Baseball Poems on Players and the Game, published by McFarland and Company

[headlines]

--------------------------------------------------------------

Sports Briefs----

Lowell Cohn: 49ers ought to cut losses and dump A.J. Jenkins

http://www.pressdemocrat.com/article/20130812/sports/

Jerry Rice finally unloads Atherton chateau

http://blog.sfgate.com/ontheblock/2013/08/13/jerry-rice-finally-unloads-atherton-chateau/

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

Feds say it is OK to open Bay Bridge on Labor Day

http://www.contracostatimes.com/news/ci_23852053/feds-say-it-is-ok-open-bay-bridge

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

New Report Reveals Which States Are Friendliest to Wine Consumers

http://www.winebusiness.com/news/?go=getArticle&dataid=120139

10 Great California Wines Without Homes

http://www.forbes.com/sites/forbeswineclub/2013/08/06/ten-great-california-wines-without-homes/

Russian River Valley AVA turns 30

http://www.mercurynews.com/corkheads/ci_23829544/wine-russian-river-valley-ava-turns-30

How Small Wineries Can Drive Business

http://www.winebusiness.com/news/?go=getArticle&dataid=120377

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1559 - Spanish explorer de Luna entered Pensacola Bay, Florida.

1607 - The Popham expedition reached the Sagadahoc River in the northeastern North America (Maine), and settled there.

1746-Fort Oswego in north central New York was captured by the French under General Joseph de Moncalm de Saint-Veran. General Montcalm surrendered the fort useless for military purposes and returned to Montreal.

1765-- On this morning, the people of Boston awakened to discover two effigies suspended from an elm tree in protest of the hated Stamp Act. From that day forward, that elm became known as the "Liberty Tree". For the next ten years, it stood in silent witness to countless meetings, speeches and celebrations, and often served as the rallying place for the Sons of Liberty. In August of 1775, as a last act of violence prior to their evacuation of Boston, British Soldiers cut it down because it bore the name "Liberty". The American Liberty elm was named after "The Liberty Tree", Our Country's First Symbol of Freedom.

http://www.elmpost.org/

1776- Land grant to deserters from the British Army during the Revolutionary War was authorized by the act of the Continental Congress. The act offered American citizenship to British and Hessian deserters from the British Army and gave each desert or his heirs 50 acres of un-appropriated land in certain states. On August 27, 1776, a similar act was passed to encourage officers in the British forces to desert.

1846-Henry David Thoreau is jailed for tax resistance.

1846-Mormon Elder Sam Brannan preached a sermon in front of Richardson's Casa Grande, San Francisco.

1846--Mormon Elder Sam Brannan preached a sermon in front of Richardson's Casa Grande in San Francisco.

1848-Congress created the Oregon Territory (Idaho, western Montana, Oregon and Washington).

http://memory.loc.gov/ammem/today/aug14.html

1849-Thomas Tennent began San Francisco Bay Area weather observations from roof of the building at the northeast corner of Union and Dupont. He also recorded earthquakes.

1862-Confederate General Edmund Kirby Smith begins an invasion of Kentucky as part of a Confederate plan to draw the Yankee army of General Don Carlos Buell away from Chattanooga, Tennessee, and to raise support for the Southern cause in Kentucky. Smith led 10,000 troops out of Knoxville, Tennessee, on August 14 and moved toward the Cumberland Gap—the first step in the Confederate invasion of Kentucky. After a Federal force evacuated the pass in the face of the invasion, Smith continued north. On August 30, he encountered a more significant force at Richmond, Kentucky. In a decisive battle, the Confederates routed the Yankees and captured most of the 6,000-man army. The Confederates occupied Lexington a few days later.

http://www.civilwarhome.com/ksmithbio.htm

http://www.spartacus.schoolnet.co.uk/USACWkirby.htm

http://www.amazon.com/exec/obidos/ASIN/0807118001/fast-bkasin-20/

103-5362656-4423850

http://www.aoc.gov/cc/art/nsh/smith.htm

http://18.1911encyclopedia.org/S/SM/SMITH_EDMUND_KIRBY.htm

1863-Birthday of Ernest Lawrence Thayer, poet and journalist, born at Lawrence, MA. He wrote a series of comic ballads for the San Francisco Examiner, of which “Casey at the Bat” was the last. It was published and he received $5 in payment for it. Recitations of the ballad by the actor William DeWolf Hopper greatly increased is popularity. It is said that by 1900 there were few Americans who had not heard of “Casey at the Bat.” Died at Santa Barbara, CA, August 21, 1940.

1883-Birthday of African-American Ernest E. Just, American marine biologist, pioneer of cell division, born at Charleston, SC. He was the first recipient of the NAACP's Spingarn Medal and was a professor at Howard University from 1907 to 1941, where he was head of physiology at the medical school(1912-20) and head of zoology(1912-41). He died October 27, 1941, at Washington, DC.

1900-After a siege of nearly two months, troops from the US ( Marines), Great Britain, France, Russia, Germany and Japan reached Peking and put down the Box Rebellion. Bitter antagonism against all foreigners in China broke into open warfare when a nationalist group, the Boxers, occupied Peking on June 20 and besieged members of the diplomatic corps, their families, and others in the British legation. The Boxers wanted to rid China of all foreigners. Under pressure from the U.S., the other powers agreed not to partition China further. On September 7, 1901, China and eleven other nations signed the Boxer Protocol, by which China agreed to pay 4333,000,000 in indemnity. The U.S. Received $24,5000,000 but in 1908 this amount was reduced and the money was used to educate Chinese students in the U.S.

1909 Jazz Violinist Stuff Smith Birthday

http://www.harlem.org/people/smith.html

http://www.musicweb-international.com/encyclopaedia/s/S138.HTM

1926-Birthday of pianist/singer Buddy Greco, Philadelphia, PA.

http://www.candidrecords.com/buddygreco.html

1926-Birthday of 1926, Alice Adams - U.S. writer and novelist. Her major work consisted of the novels Careless Love (1968), Families and Survivors (1975), Listening to Billie (1978), and her best read book Superior Women (1984). She published 25 short stories in the New Yorker magazine.

1929-Birthday of singer Lorez Alexandria, Chicago, IL

1930—Birthday of vibraphonist Eddie Cost, Atlas, PA.

1935-Congress approved the Social Security Act, which contained provisions for the establishment of a Social Security Board to administer federal old-age and survivors' insurance in the US. By signing the bill into law, President Franklin D. Roosevelt was fulfilling a 1932 campaign promise.

As a side note, US Senators/Congressmen do not pay into Social Security, and, therefore they do not collect from it. They felt they should have a special plan. When they retire no matter how long they have been in office, they continue to draw their same pay until they die, except it may be increased from time to time by the cost-of-living.

1936-Kansas City, MO has its hottest ever temperature with 113.1936 - Temperatures across much of eastern Kansas soared above 110 degrees.. It was one of sixteen consecutive days of 100 degree heat for Kansas City. During that summer there were a record 53 days of 100 degree heat, and during the three summer months Kansas City received just 1.12 inches of rain

1940 - Dash Crofts of Seals & Crofts is born in Cisco, Texas. The group has three top 10 hits, all of which reach No. 6: "Summer Breeze" in 1972, "Diamond Girl" in 1973 and "Get Closer" in 1976.

1941 - David Crosby is born David Van Courtland in Los Angeles. He is a member of the Byrds, then teams up with Stephen Stills and Graham Nash to form Crosby, Stills & Nash in 1968. The group wins the best new artist Grammy in 1969. CSN's two top 10 songs are "Just a Song Before I Go" and "Wasted on the Way."

1945- President Truman's announcement in 1945 that Japan had surrendered to the Allies, setting off celebrations across the nation. Official ratification of surrender occurred aboard the USS Missouri at Tokyo Bay, September 2 ( Far Eastern Time ).

1946-Birthday of Susan St. James - U.S. actor who perfected the airhead characterization who had innate common sense in a number of TV series including the hits MacMillan & Wife and Kate & Allie.

1947-Miles Davis record his first session under his own name, New York City ( Half Nelson, Milestones, Little Willie Leaps).

1947--Birthday of Danielle Steel - U.S. novelist with more than 100 million books in print in 42 countries.

http://www.randomhouse.com/features/steel/

1949---Top Hits

Some Enchanted Evening - Perry Como

Bali Ha'i - Perry Como

Again - Doris Day

I'm Throwing Rice (At the Girl that I Love) - Eddy Arnold

1950 -- Birthday of American cartoonist/humorist Gary Larson.

1953 - David N. Mullany and his 13-year-old son, David A. Mullany, while trying to come up with a ball that would curve every time it was thrown, wound up inventing the Wiffle Ball. The ball had oblong holes on the top half, and a solid bottom. The original Wiffle bat was wood, but for many years it has been a skinny glowing yellow shaped plastic bat.

1953-June Christy records “Something Cool,” Los Angeles.

1953-HAMMOND, LESTER, JR. Medal of Honor Rank and organization: Corporal, U.S. Army, Company A, 187th Airborne Regimental Combat Team. Place and date: Near Kumwha, Korea, 14 August 1952. Entered service at: Quincy, Ill. Born: 25 March 1931, Wayland, Mo. G.O. No.: 63, 17 August 1953. Citation: Cpl. Hammond, a radio operator with Company A, distinguished himself by conspicuous gallantry and outstanding courage above and beyond the call of duty in action against the enemy. Cpl. Hammond was a member of a 6 man reconnaissance patrol which had penetrated approximately 3,500 yards into enemy-held territory. Ambushed and partially surrounded by a large hostile force, the small group opened fire, and then quickly withdrew up a narrow ravine in search of protective cover. Despite a wound sustained in the initial exchange of fire and imminent danger of being overrun by the numerically superior foe, he refused to seek shelter and, remaining in an exposed place, called for artillery fire to support a defensive action. Constantly vulnerable to enemy observation and action, he coordinated and directed crippling fire on the assailants, inflicting heavy casualties and repulsing several attempts to overrun friendly positions. Although wounded a second time, he remained steadfast and maintained his stand until mortally wounded. His indomitable fighting spirit set an inspiring example of valor to his comrades and, through his actions, the onslaught was stemmed, enabling a friendly platoon to reach the beleaguered patrol, evacuate the wounded, and affect a safe withdrawal to friendly lines. Cpl. Hammond's unflinching courage and consummate devotion to duty reflect lasting glory on himself and uphold the finest traditions of the military service.

1957---Top Hits

(Let Me Be Your) Teddy Bear - Elvis Presley

Love Letters in the Sand - Pat Boone

Tammy - Debbie Reynolds

Bye Bye Love - The Everly Brothers

1959-The formation of the American Football League was announced at a press conference in Chicago. Play was set to begin in 1960 with at least six and possibly eight franchisees.

1959-Birthday of Earvin “ Magic” Johnson, Jr., former basketball player and coach, born Landsing, MI.

1961-Wanda Jackson's biggest hit, "Right Or Wrong" enters the Billboard Pop chart on its way to #29.

1965- Frank Mitchell, age 15, of Springfield, IL, was appointed by Representative Paul Findley, Republican of Illinois, to become a Congressional page, the first African-American to hold this position in the history of the United States.

1965-The McCoys' "Hang On Sloopy" is released.

1965---Top Hits

I Got You Babe - Sonny & Cher

Save Your Heart for Me - Gary Lewis & The Playboys

Unchained Melody - The Righteous Brothers

The First Thing Ev'ry Morning (And the Last Thing Ev'ry Night) - Jimmy Dean

1965-After several minor hits, Sonny and Cher had the number one song in the US when "I Got You Babe" reached the top.

1967 - No. 1 Billboard Pop Hit: "All You Need Is Love," The Beatles. The group's manager, Brian Epstein, dies of an accidental drug overdose while the song is No. 1.

1969 - The New York Mets were 9-1/2 games behind the league-leading Chicago Cubs. The Amazing Mets began a comeback that launched the phrase, “You Gotta Believe,” as they began a drive that took them to the National League pennant and the World Series Championship (over the Baltimore Orioles). It was the first championship for the Mets franchise which began in 1962.

1969—The Woodstock Music and Art Fair opens for three days on Max Yasgur's farm in Bethel, Sullivan County, New York.

1971-Rod Stewart released "Maggie May."

1973---Top Hits

The Morning After - Maureen McGovern

Live and Let Die - Wings

Brother Louie - Stories

Trip to Heaven - Freddie Hart & The Heartbeats

1974-Paul Anka's "You're Having My Baby," is gold despite its denouncement by feminists. The objection is the use of the word 'my' as in "my baby", not "our baby." It is Number One by the end of the summer.

1976- The longest softball game began at 10am and continued until Saturday, 4pm, when it was called because of rain and fog. The game was played at Summerville Field, Monticello, NY between the Gager's Diner and the Bend n” Elbow Tavern. About 70 players, including 20 women participated. Some $4,000 was raised for the construction of a new softball field and for the Community General Hospital. The Gagers made 832 hits and scored 491 runs; the Elbows made 738 hits, scoring 467 runs. There were 31 home runs. To date, this remains the longest softball game on record.

1976 - Nick Lowe's debut solo single, "So It Goes," is released.

1976-The Steve Miller Band's "Rock 'N Me" is released.

1977---77,691 fans, the largest crowd to that date to watch a soccer match in the US, saw the New York Cosmos, led by Pele, defeat the Fort Lauderdale Strikers, 8-3, in a National American Soccer League quarterfinal playoff game at the Meadowlands in East Rutherford, NJ.

1981---Top Hits

Jessie's Girl - Rick Springfield

Endless Love - Diana Ross & Lionel Richie

Theme from "Greatest American Hero" (Believe It or Not) - Joey Scarbury

Too Many Lovers - Crystal Gayle

1982-The first National Navajo Code Talkers Day. Coded military radio transmissions using a Native American language began in 1942, when the Allied and Axis powers were competing to devise communications codes that could not be deciphered by the enemy. Philip Johnston, a missionary's son who had grown-up on the Navajo reservation, proposed the idea of using the Navajo language, a complicated system in which the meaning of a word is often determined by expression and pronunciation. Marine Major General Clayton B. Vogel approved the plan and recruited 420 Navajo “ code talkers” to handle coded radio communications in the Pacific theater. the codes combined everyday Navajo words with about 400 special terms made up by the code talkers. Members of other tribes were employed as well. The Japanese were aware of the Navajo codes, but never broke them. They were kept top secret until 1968.

1984 - IBM released PC-DOS v3.0 for PC/AT (with network support). A 286 processor, 20-30 megabyte hard drive and 256k/512k RAM for somewhere between $6000 and $9000.

1985-Michael Jackson outbids Paul McCartney for the entire ATV music publishing catalogue, which includes most of the Lennon / McCartney songbook. Jackson paid 47.5 million US dollars for the company, in an act that will permanently sour the friendship between the two stars.

1987 - Mark McGwire set the record for home runs by a rookie, as he connected for his 39th round-tripper of the season. He got the homer off of 317-game winner Don Sutton of the California Angels. McGwire led the Oakland Athletics to a 7-6 win -- in 12 innings.

1987- Slow moving thunderstorms deluged northern and western suburbs of Chicago IL with torrential rains. O'Hare Airport reported 9.35 inches in 18 hours, easily exceeding the previous 24 hour record of 6.24 inches. Flooding over a five day period resulted in 221 million dollars damage. It was Chicago's worst flash flood event, particularly for northern and western sections of the city. Kennedy Expressway became a footpath for thousands of travelers to O'Hare Airport as roads were closed. The heavy rains swelled the Des Plaines River above flood stage, and many persons had to be rescued from stalled vehicles on flooded roads.

1988 - Eighteen cities in the northeastern U.S. reported record high temperatures for the date, and the water temperature at Lake Erie reached a record 80 degrees. Portland ME reported a record fourteen straight days of 80 degree weather. Milwaukee WI reported a record 34 days of 90 degree heat for the year. Afternoon and evening thunderstorms resulted in about fifty reports of severe weather in the northeastern U.S. One person was killed at Stockbridge MI when a tornado knocked a tree onto their camper.

1989---Top Hits

Right Here Waiting - Richard Marx

On Our Own - Bobby Brown

Once Bitten Twice Shy - Great White

Timber, I'm Falling in Love - Patty Loveless

1989-Bon Jovi's "New Jersey" LP becomes the first U.S. album to be released legally in the Soviet Union. The Russian label Melodiya pays the group with a truckload of firewood since rubles can't leave Russia.

1990-Denver votes for a 1% sales tax to pay for a baseball franchise.

1992 - Wayne Newton files for Chapter 11 bankruptcy protection. The singer, a former owner of the Alladin Hotel in Las Vegas, is one of the highest paid performers on the Vegas strip.

1995 - Members of the Grateful Dead meet and decide to cancel their fall tour in the wake of Jerry Garcia's death.

1998 -The A's Rickey Henderson's stolen base in the first-inning against the Tigers makes the thirty-nine year old the oldest player to steal 50 bases in a season.

1999 -With Pudge's 20th stolen base in Chicago, Texas backstop Ivan Rodriguez becomes the first catcher in major league history with 20 homers and 20 stolen bases in the same season.

2003-Largest power outage in US history hits the Northeast. By 11 p.m. in New Jersey, power had been restored to all but 250,000 of the nearly 1 million customers who had been in the dark since just after 4 p.m.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Adopt a Pet

Bank Beat

Career Crossroads-Emily Fitzpatrick/RII

Cartoons

Charlie Chan sayings

Computer Tips

Employment Web Sites

Fernando's Review

From the Desk of Michael Witt, Esq.

Leasing 102

Leasing Cases by Tom McCurnin

Online Newspapers

Placards

Sales Make it Happen

Spark People—Live Healthier and Longer

The Secret of Our Success

To Tell the Truth

View from the Top

Why I Became a CLP

Ten Top Stories each week chosen by readers (click here)

“Complaints” Bulletin Board (click here)

Connect with Leasing News![]()

![]()

![]()

![]()

(chronological order)

- Brican America Alleged Ponzi Scheme--Update

- Top 50 Quick-Service/Fast-Casual Restaurants

- Hey, Let's Hire Ritz Carlton!!!

- Umpqua CEO on Financial Pacific Leasing Purchase

What to Look Forward to

- PacWest-CapitalSource Merger No Surprise;

Leasing Community Saw it Coming

- Leasing News is Not the National Enquirer

- Balboa Capital, Irvine, California

$20,543.22 Bulletin Board Complaint

Alleged “Bait and Switch”

- MB Financial Taylor Cole Merger Good for Leasing Industry

- "Lovely Ladies of Leasing" Visit Temecula Wineries

- Top Five Leasing Web Sites

- BBB Leasing Company Ratings

- Dallin Hawkins Second Arrest within 25 days

Well-known LinkedIn.com Super Broker

- Integrity Financial Groups, Murray, Utah

$50,000 Bulletin Board Complaint

- History of Leasing - Abridged

by Tom McCurnin and Christopher Menkin

- GoBank Goes Live

- "Just What is an "Alternative Dispute Resolution?"

- One Out, Another Getting Out, Not the Third

- Banks and Leasing Regulations

- Luckiest Man in California- Our Tom McCurnin

- On Deck Crosses $500 Million Lending Mark

- Capital One Equipment Finance Terminates Specialty Vehicle

- More on Capital One Raid SunTrust Staff

- Charlie Bancroft Passes Away

- CapitalSource Healthcare Finance No Longer in Business

- Flexpoint Announces the Sale of Financial Pacific Leasing

- Sheldon Player is a Player at the Tables

- Operation Lease Fleece--Sentencing

- Update IFC Credit--Rudy Trebels

- HL Leasing, Fresno, Palm Desert, California

- Element Financial Sued by De Lage Landen

- Sears-Roebuck Joins "Why Not Lease It?"

- Leasing News Search---Archives

- Cobra Capital Back in Business

- Marlin Leasing Officers Exercises Stock Options

- Commonwealth Capital Answers

Finra Charges Misuse Leasing Funds

- Four New CLP's from First American Equipment Finance

- Bentsen-Gregg named to new posts

- FASB/IASB Leasing Accounting Coming Down the Tracks

- Vehicle Leasing Conference Finds Daylight

By Edward P. Kaye, Advantage Funding

- Abbott and Costello Prediction- An Update

- Sterling Financial Purchases Commerce National

- Vegas Conference Biggest Turnout since 2006

by Dwight Galloway, CLP

- Alexa Report---Leasing News Pulls Ahead of Competition

- Steve Jobs---The Best Advice on Success and Failure

- US Hiring Index retreats 8.8% in Q1 2013

- www.leasingcomplaints.com

Leasing News Kicks it up a Notch!

- Twitterverse--Are you a "Tweep" or "Twitterati"?

- Paul Menzel, CLP, Reports on ELFA Funding Conference

- Huntington Bank Hit with $81 Million Judgment

Check Kite Crashes into El Camino Resources

- Leasing Association Membership Echoes Economy

by Christopher Menkin

- Why Networking Doesn't Work

by Eric V. Holtzclaw, www.inc.com

- New York City Investors’ Conference Equipment Finance

By Bruce Kropschot, The Alta Group

- Banks Lending or Not Lending?

Conversation with Deborah Monosson

- Pacific Western Bank Responds to Evergreen Non-Notification

- In-N-Out’s Burger Ranked Top Fast-Food Burger in US

- Media Tips - Learning from the Reporter’s Perspective

- Northern Leasing Systems Says "It isn't so!"

- Los Angeles BBB Expelled from National Association

- Female Lease Finance Association Presidents

- Terry Winders, CLP, Custom Built Poker Tables

---Order One for Father’s Day

- Broker’s Responsibility to Obtain

California Lender’s License

- CLP 2012 Accomplishment Report

Many "fresh faces" Become CLP's

- Most Popular Dog Breeds in America 2012

- Pacific Western Joins “Extra Lease Payment” Group

- The Matrix-Utah Connection

- Current License Regulations and Advice

- The House that Jerry Built

- Loan/Lease Statute Up-Date

- The Day that Albert Einstein Feared May Have Finally Arrived

- Equipment Finance Agreements Explained/Barry S. Marks

- Sheldon Player's E.A.R. Ropes 18 Equipment Lessors

- Chat Acronymns and Keyboard Smilies

- Royal Links "True Lease" Court Ruling

- Element Financials’ Hudson Changing His Image

- Newport Financial Partners, Newport Beach, California

Bulletin Board Complaint

- Reach Potential Customers and Vendors/Find Your Niche

- On Deck reaches $300 Million/1500 distribution partners

- "The Memory Shock" –New Book by Barry Reitman

- Third-IFC Credit Trustee, Northfield, Illinois

Bulletin Board Complaint

- Four Software Solutions

re: Digital device/Laptop Lost or Stolen!

- Excellent Tips by Warren Buffet

- Take Your Banker to Lunch

- Meridian Finance Group Looking Brokers for Europe Biz

- Is Leasing Securitization Dead or Alive?

- Why Leasing News is Different

- Mazuma and Republic Bank Get Snared on PRR Provision

by Tom McCurnin, Esq.

- Companies who utilize Evergreen Clauses for Extra Lease Payments

- Jeff Taylor's Leasing Predictions, Spring, 2006

- Radiance Capital, Tacoma, Washington

Bulletin Board Complaint

Purchase Option on EFA, Won’t Return $5,000 S.D.

- New Case against Mazuma Capital and Republic Bank

---Automatic Evergreen Payment---PPR

-

Eleven Lawyers Against Evergreen Clause Abuse

- Republic Bank out of leasing?

- Ladco Leasing/Elavon Fined $418,601

-

Future of Mobile Devices

- Charles Schwartz and Allied Health

- Why I became a CLP

- Copier Wars---It's more than the lease payment

by Christopher Menkin

- Results Are In---

"Application Only" versus Financial Statements?

- A California Leasing Gypsy Arrested by Costa Mesa Police

- Survey of Evergreen Clauses

-

Responses to Working with a Smaller Bank Question

- Leasing Gypsies

- OneSource Develops Business License Software

- Talk About Chutzpa, Fanghella has more than Trump

- Three Class Action Suits re: Brican America

- Verifying Tax Returns

- Starting a Leasing Company-Four Parts

by Mr. Terry Winders, CLP

- Free Mobile Wine Program

- Special Report: Part I

Could Church Kiosks, Royal Link Carts, NorVergence results been avoided?

The use of “Equipment Finance Agreements”

- Special Report: Part II

Bank of the West

Equipment Lease Agreement (EFA)

- California License Web Addresses

-

Settlement Costs Vs. Litigation Costs