Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Wednesday, July 17, 2013

![]()

Today's Equipment Leasing Headlines

Correction—Top Five Leasing Web Sites—

in North America

MB Financial Taylor Cole Merger

Good for Leasing Industry

Bulletin Board Complaint

Unnamed Leasing Company

Classified Ads---Collections

Modern History of Leasing - (Part Two of Four)

Written by Tom McCurnin, Leasing News Legal Editor

and Christopher Menkin, Leasing News Editor

Brokers Grow in Leasing

Sales Makes it Happen by Steve Chriest

Anger and the "80% Rule"

Leasing News Advisor

Bruce Kropschot

Why I Became a CLP

Krista L. Pressnall, CLP

Financial Pacific Leasing

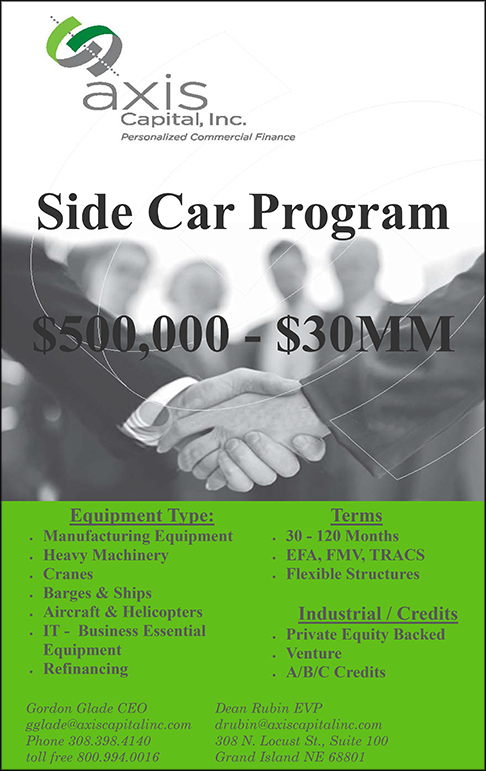

August 16-18 Institute for Leasing Professionals

(Helps Prepare for CLP Exam)

Letters? ---We get Email!

(Mostly chronological order)

ELFA Meets with Lease Accounting Standards Setters

Classified ads—

Operations/Remarketing/Repossessions

Labrador

Chicago, Illinois Adopt-a-Dog

News Briefs---

Restaurant Industry Sales Fell Flat in June

Former Asiana Pilots Say Manual Flying Secondary to Automation

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

| Working Capital Loans $10,000-$250,000 | |

|

|

Please send Leasing News to a colleague

and ask them to subscribe

Contact: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

Correction—Top Five Leasing Web Sites—

in North America

While the story and statistics were correct, the listing of the Top Five companies was not in graphic sequence. It was corrected on line, but for readers who came before the correction:

www.directcapital.com

US Alexa Traffic Rating: 102,508

WWW: 368,562

Sites linking in: 315

http://www.balboacapital.com/home.aspx

US Alexa Traffic Rating: 177,643

WWW: 550,018

Sites Linking in: 259

(Note: Balboa Capital is listed in both:

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org )

www.fivepointcapital.com/

US Alexa Traffic Rating: 198,450

WWW: 1,271,814

Sites Linking in: 65

www.cit.com

US Alexa Traffic Rating 202,071

WWW: 348,692

Sites Linking in: 479

![]()

www.greatamerica.com

US Alexa Traffic Rating: 279,603

WWW: 1,608,501

Sites Linking in: 95

(July 7, 2013)

Top Five Leasing Web Sites—

in North America

http://leasingnews.org/archives/Jul2013/7_15.htm#sites

[headlines]

--------------------------------------------------------------

MB Financial Taylor Cole Merger

Good for Leasing Industry

MB Financial, Inc. (NASDAQ: MBFI), the holding company for MB Financial Bank, N.A., on Monday announced 2013 second quarter net income of $25.3 million. A joint press release also announced MB Financial Taylor Capital Group, Inc. (“Taylor Capital”) (NASDAQ: TAYC) announced the signing of a definitive merger agreement whereby MB Financial will acquire Taylor Capital. Taylor Capital is the holding company of Cole Taylor Bank, a commercial bank headquartered in Chicago with $5.9 billion in assets, $3.3 billion in loans and $3.7 billion in deposits as of June 30, 2013. MB Financial is the $9.4 billion Chicago-based holding company of MB Financial Bank, N.A.

It was noted that the MB Financial increase was driven by the addition of Celtic Leasing Corp. ("Celtic"), a recently acquired leasing subsidiary, which contributed $13 million in leasing revenues during the first six months of 2013. Excluding Celtic, leasing revenues increased 28% in the first six months of 2013 compared to the first six months of 2012.

http://www.thestreet.com/story/11977441/1/mb-financial-inc-reports-second-quarter-net-income-of-253-million-and-return-on-assets-of-109.html

Ed Dahlka

President

Cole Taylor Equipment Finance

Cole Taylor bank got into equipment finance with a team lead by Edward A. Dahlka, Jr., former president and founder of LaSalle National Leasing (now part of Bank of America Leasing). He had been building his team, opening offices throughout the United States with new people, as evidenced in Leasing News "New Hires-Promotions" David M. Drury has joined the company as group senior vice president of sales and capital markets. In this role, Drury will report to CTEF president, Edward A. Dahlka, Jr.

Jill York, CFO

MB Financial

Jill York, CFO, MB Financial told Leasing News it will be "Business as usual. Ed is doing a great job with this business and focuses on a different segment than MB's lease banking group and leasing subsidiaries. Ed does large ticket, while Celtic and LaSalle do mid ticket. All originate direct."

A conference telephone call after the announcement found wide acceptance from the press as the thinking was the strategically attractive combination is expected to nearly double MB Financial’s middle market commercial banking market share in the Chicago area. Reportedly, Taylor Capital’s nine branches complement MB Financial’s existing network of 85 Chicago-area branches. The combined bank is expected to have a top-10 deposit market share ranking in the Chicago MSA and top-5 deposit market share ranking in Cook County.

Mitchell Feiger

President, CEO

MB Financial

“The merger of Taylor Capital and MB Financial is a terrific strategic transaction. Each side brings a strong middle market commercial banking business as well as significant national niche businesses,” stated Mitchell Feiger, President and Chief Executive Officer of MB Financial.

The Chicago Tribune noted in its first sentence: "MB Financial Bank plans to close three to six branches in the Chicago area as part of its newly proposed $680 million purchase of the parent of Cole Taylor Bank," as well as ",,,That will also mean the end a company that has been overseen by three generations of the Taylor family."

Feiger will remain CEO of the combined parent company. Taylor Capital CEO Mark Hoppe will become CEO of MB Financial's subsidiary bank, MB Financial Bank.

The Chicago Tribune noted that Mitchell Feiger said "he has known Hoppe for 30 years. Upon completion of the merger, Jennifer Stearns and C. Bryan Daniels from Taylor Capital's board of directors will join the MB Financial board.

"Feiger said on the call that he also looks forward to working with Bruce Taylor, chairman and a board member of Taylor Capital.(overseen by three generations of the Taylor family.), (however)... Taylor isn't named as a director of the merged company. The Taylor family owns about 30 percent of the company, with the Steans family, who invested in the bank a few years ago and were instrumental in installing Hoppe, owning about 14 percent, the latest proxy statement shows."

Mark A. Hoppe

President/CEO

Cole Taylor Bank

"Hoppe is a former LaSalle Bank lender who left that institution after Bank of America bought it. Cole Taylor and other local banks have grown amid the shakeout of Bank of America's purchase of LaSalle."

http://www.chicagotribune.com/business/breaking/chi-mb-financial-taylor-capital-20130715,0,318500.story

It was Hoppe who convinced Ed Dahlka to form a new equipment finance division in Towson, Maryland.

http://leasingnews.org/archives/Jul2012/7_16.htm#cole_taylor

Taylor Capital President and Chief Executive Officer Mark Hoppe will become President and Chief Executive Officer of MB Financial’s subsidiary bank, MB Financial Bank. Upon completion of the merger, Jennifer W. Steans and C. Bryan Daniels from Taylor Capital’s board of directors will join the MB Financial board. The definitive agreement was unanimously approved by the boards of directors of MB Financial and Taylor Capital.

The merger is subject to regulatory approvals, approval by MB Financial stockholders, approval by Taylor Capital stockholders and certain other customary closing conditions and is expected to close in the first half of 2014. The merger is expected to be immediately accretive to MB Financial’s annual GAAP and cash EPS.

[headlines]

--------------------------------------------------------------

Bulletin Board Complaint

Unnamed Leasing Company

![]()

(Looking for response from readers on

whether leasing company should be named.)

Leasing News would like readers to respond whether the company not named in this complaint should be named. This complaint is considered "open." The back-up data is not included as well as some information is "disguised" in order to disguise names.

XYZ was looking for a "finance lease" of $150,000, primarily software delivered by wire, and decided not to use their bank lines, which were quite available. The two best bids came from East Coast and West Coast lessors. They chose the West Coast 36 month .304 rate. Most of the installation started in March, 2010, almost three months in advance with XYZ making payments to the vendor, accepting the software well before the signing of the lease. $115,000 remaining was remaining not paid and included in a June 22, 2010 contract, now a 12 quarter payment lease at a .063886 factor as the salesman had convinced it was a better deal, requiring $9,582.90 with the face of the contract which stated it would be applied to the "Last Quarterly Rental." There also was a documentation fee of $1,050.00.

The quarterly payment also said "Plus sales/use tax if applicable."

West Coast then required what was assumed the first payment on July 14, 2010 and after conversations, was paid on July 30, 2010. The vendor was paid on July 13th by wire, the vendor states.

There were ten payments made to the bank starting on September 13, 2010. When the bank requested the last payment, XYZ said to apply the security deposit as per the contract. And in looking at this, wondered why the bank was charging use tax on the payment, not noticed until the documents were reviewed by him. There also was a $495 termination fee from their earlier notification they were exercising the $101 purchase option (termination fee not in the lease contract.)

In speaking with the Bank, West Coast had assigned 11 payments, counting the security deposit as perhaps the first payment. As to what XYZ considered the first payment, it was never received by the Bank (the bank states) and appears West Coast treated as "interim rent" and kept the amount. XYZ had decided not to send in payment number 11 to the Bank as they had signed a contract where the security deposit was to be applied for this purpose.

Leasing News was contacted and while West Coast never returned a telephone call or many emails, Leasing News spoke with the Bank, and explained the contract was with XYZ, who kept the 12th payment and did not apply the “first payment” but treated it as profit.

At last conversation, it appears half of the "interim rent" which XYZ thought was to be returned (not confirmed). It is believed the 11th payment was sent to the bank, who also told Leasing News would waive the late fee under the circumstances.

The issue of the use tax on software and maintenance by wire is not resolved, and it is unknown if the $495.00 termination fee not appearing in the lease contract was waived by West Coast.

Leasing News would like to hear opinions on this from readers.

You may opt-out of being named in your opinion, although it is preferred that you do and state it is your personal opinion and not your company's. Please click here (kitmenkin@leasingnews.org). Thank you.

|

[headlines]

--------------------------------------------------------------

Classified Ads---Collections

(These ads are “free” to those seeking employment

or looking to improve their position)

Long Grove, Illinois

Financial services professional with a proven track record of positively impacting corporate finances through effective management of cash flow, collections and financial assets. Strategic thinker capable of analyzing financial issues and processes in order to implement changes that improve efficiency and profit margins. Well-versed in all aspects of corporate financial affairs. roborgaard@aol.com | Resume

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Modern History of Leasing

Written by Tom McCurnin, Leasing News Legal Editor

and Christopher Menkin, Leasing News Editor

(Part Two of Four)

Brokers Grow in Leasing

As the brokers got into the field, many started their own leasingcompanies as originators and some brought in investors or obtain lines of credit via investors or relatives or putting up their house. Private label contracts used by funders for “captive vendor” business became the purview of independents who did the sales while the funder did the approvals and servicing.

At first it was recourse with the banks, then non-recourse as they taught bank officers how the procedure worked and banks become more comfortable. Companies also were obtaining recourse lines of credit from banks with leasing divisions such as Crocker Citizens, Security Pacific, Union Bank, Wells Fargo with its auto center division. Companies such as TRE Financial, Phoenix, Key Lease, and SHW Capital grew to compete with AT&T Capital, Dana, FMC, and Tri-Continental. GE was still the elephant in the room.

Larger banks at this time were getting into middle-market leasing, and for a long time, Bank of America did not consider any leasing below $500,000, even for good existing bank customers.

Leasing commission by leasing companies financed by banks were often capped at 2% to 3%, what the funders were also paying dealers or the dealer sales personnel direct. Copiers were the most popular to be leased, then telephones, security systems, office furniture, and finally computers and even software in the 1980’s. There was very little “franchise leasing,” even McDonald’s and “7- Eleven were financed, not leased--- and Small Business Administration loans prohibited leasing until their loan was paid off. Brokers learned they could not only earn more of a commission in “discounting,” but could earn the residual when the lease paid out, as it was treated as a “balloon payment,” not counted in the “stream of payments.”

This was the start of independent brokers, and a group in California joined together and were up to over 80 members when the then Western Association of Equipment Lessors began to take brokers. In the group were A.J. Batt of Atel Capital, Louis Funkenstein (Funston) of Western States, Mont Gates of Leaserite, Jim Harris of Allco Leasing and Financial, Kit Menkin of American Leasing, Ted Parker of CCLease, just to name a few who began their own leasing companies. (5)

The former Equipment Leasing and Finance Association was slow in accepting third party originators, according to their directories, as well as their membership fees were higher. The newly formed Western Association of Equipment Lessors (WAEL) voted against allowing brokers being a member of their group. In reality, most of the members were “brokers with a staff” acting as a lessor. When it got to the point of competing for broker business, they were allowed to join so they could go to meetings and attract more brokers. Many of them kept direct sales staff, but augmented their business with an “indirect business” representative/processing staff. (6)

As the independent leasing companies grew, they began to have portfolios, warehouse lines to fund leases, and the syndication age began where companies would build up warehouse lines of leases and then discount them in dollar amounts, primarily over $1 million or more. As the marketplace changed, banks got involved and would start to accept portfolios and warehouse lines of credit. In the beginning, it was all recourse to the leasing company.

As competition grew, the 1980's saw the growth of lessors with non-recourse and recourse lines of credit with large banks, then smaller regional banks, and even community banks as it become more acceptable. There were books and manuals published and with brokers joining associations, then other funders, including banks, also wanted to join to vie for their business. The trend was away from direct sales to independent brokers who had access to smaller vendors, manufacturers, distributors, too expensive for the larger companies to service. Fax machines sped up the business, as well as lower price leasing software was becoming available as computers were less expensive and could now not only do accounting, but contain contracts from various companies, which sped up the process. Sending applications, constructs, documents by Federal Express became very popular. Speed became very popular, more than “rate.” Software was catching up with Capital Stream, Lease Team, McCue, and others (even brokers now had software to speed up the typing and processing of documents.)

In 1990, a group of leasing brokers formed an association called the National Association of Equipment Leasing Brokers, where brokers were the only ones who could vote in a general election, as well as had a much lower fee than another group, such as funder or service provider. At first they had a part-time “secretary” and with the help primarily of two attorneys, Joe Bonanno and Barry Marks, Esq. grew into a premier organization which had 1,089 members.

With the roaring economy of the 1990's, everyone became a leasing broker, including the dealers who were demanding higher and higher referral fees for their business. Franchise business was booming, and so was leasing of franchises as well as when they had an SBA loan as the covenant not to lease was changed. Second mortgage made subprime leasing with very high rates acceptable. The trend then turned to "automated credit scoring" and “application only” kept growing up to $150,000 for when once what was standard requirement were a financial statement, tax return, and personal financial statement requirement for small leases especially.

Computerized credit scoring became very popular, not only for marketing purposes, but for approving credit. Often a consumer credit report, time in business, and average bank account was all that was needed. Certain professions such as medical or dental, the limit on “app. only” was higher than others.

Colonial Pacific Leasing developed Pegasus a program for lessors who generated a specific volume and could use the credit scoring system, this may be likened to a franchise operation as the leasing company had a territory and franchise. First Sierra took this a step further by combining many independent lessors into one large company for the volume, making them “corporate partners” and companies such as Republic Leasing of South Carolina began syndicating leases with banks, mortgage companies and others who would underwrite the lease portfolio, enabling them to extend their lines of credit for more leases. (7)

In 1998 and 1999 companies were being merged into large groups, and this trend continued into a downturn in 2000 that saw many companies closed and Leasing News started its well-read “The List”, eventually labeling the list of companies closed as being hit by "The Perfect Storm" after a movie came out starring George Clooney who takes his boat out into weather that the ship no longer can ride. (8)

As the companies merged or went out of business, they rose up again as independents, small lessors who were basically brokers, but instead of using company documents, the thrust was "originators," who began to act as if they were a "funder" as the contracts were theirs, and often the check emanated from them as that was the discounting arrangement with the actual funding source. First Sierra and Colonial grew at terrific rates during this short time period. General Electric was buying leasing companies left and right.

Some of the originators had warehouse lines to fund the leases and then when all the parts were in place, or a group, they were then packaged and discounted. Computers made it simpler. Summit, Lease Team, among others came up with affordable software packages. Companies such as Pioneer Capital gave brokers not only internet access, but software to type and fund documents very simply. (9)

It was the “Age of the Broker” who often was making 15 points on a transaction. Several, such as Balboa Capital, would pay up to 20%, discounting some of the profit in advance from the residual or Evergreen Lease clause. (10)

As of 2005 the National Association of Equipment Brokers (NAELB) had grown to 648 members, where the now Equipment Leasing and Finance Association (ELFA) who had 850 members in 2000 was down to 780 members, and the United Association of Equipment Lessors who was at 589 members in the year 2000 was down to 297 members. It was a “no holds bar the door” and get the deal funded as quickly as you could, “due diligence” out the window, and the race was on who could bring in the most business and earn the most in commissions---take the money and run. Everyone wanted to be an independent broker and earn the generous commissions.

Friday—Part Three of Four

“Hits the Fan”

(5) http://www.leasingnews.org/list_alpha_new.htm#allco

(6) http://www.leasingnews.org/Conscious-Top%20Stories/WAEL_Hist_I.htm

(7) http://www.leasingnews.org/Conscious-Top%20Stories/CLP.htm

(8) http://two.leasingnews.org/archives/November/11-29-00.htm

(9) http://www.leasingnews.org/archives/April%202008/04-02-08.htm#adv

http://two.leasingnews.org/archives/November%202001/11-09-01.htm

(10) http://two.leasingnews.org/archives/May01/5-29-01.htm

http://www.leasingnews.org/archives/September%202004/9-21-04.htm#sales

http://www.leasingnews.org/Conscious-Top%20Stories/Salesman_Survey_update.htm

http://www.leasingnews.org/archives/October%202006/10-18-06.htm#points

[headlines]

--------------------------------------------------------------

Sales Makes it Happen by Steve Chriest

Anger and the 80% Rule

All of us have, at one time or another, encountered a lease customer or a co- worker who became angry as we negotiated with them about business or company matters. The most successful negotiators recognize the basis of anger and what to do when they encounter someone who is angry. I am going to pass on to you the "80% rule."

First, it's important to understand what drives people to anger. According to psychological studies, there are three primary causes of anger:

- fear

- hurt

- frustration

People exhibit anger when they are afraid of something, when they are hurting for some reason, or when they are simply frustrated.

The customer who becomes angry because she cannot obtain the low, implicit interest rate that her boss asked her to secure from your company is not angry because of the higher interest rate. That's just a number. The cause of her anger is most likely the fear she feels when she contemplates telling her boss she failed to secure the low interest rate he wanted.

If for some reason beyond your control you aren't able to provide a service to a long-time customer, he or she may perceive your failure to help as a sign of themself and their company's diminished importance to you and your company. Their feelings may be hurt in this process. These hurt feelings can manifest as anger directed toward you or your company.

Sometimes people express anger simply out of frustration. I've often observed that no one appears upset, irritated or really angry when things are going their way! When a client or co-worker faces one too many obstacles in a day, their increasing frustrations may result in a display of anger directed at anyone within shouting distance.

Although there are three primary drivers of anger, sometimes anger isn't driven by fear, hurt or frustration. In some negotiations, like labor contract talks, anger is used by experienced negotiators as a favorite tactic to coerce, intimidate and threaten the other side. This manufactured anger has become part of the way the labor contract negotiation game is played.

Some leasing applicants use the same ploy to obtain a better deal.

Whatever the source of someone's anger, it's important to remember that your reaction determines, to a large degree, how the negotiation proceeds and ends. According to research done at the Harvard Negotiation Project, there is an 80% chance that you can influence, and even control the atmosphere and tone of a negotiation simply by mirroring the behavior you want from your negotiating partners.

If you find yourself negotiating with someone who is angry, or irritated, and you want to control the tone of the negotiation, don't buy into their anger or frustration. Instead, remain calm, and listen carefully to what your negotiation partner says. At some point, in 80% of all cases, your negotiating partner will calm down and will begin to mirror your behavior. Very few people will argue with themselves or maintain anger when there is no reaction from the other side of the table!

In tough negotiations, remember the 80% rule. By definition, it doesn't always work, but knowing that you have an 80% chance of controlling the tone and atmosphere in any negotiation, simply by mirroring the behavior you want from you negotiating partners, keeps the 80% rule on your side!

About the author: Steve Chriest is the founder of Selling UpTM (www.selling-up.com), a sales consulting firm specializing in sales improvement for organizations of all types and sizes in a variety of industries. He is also the author of Selling The E-Suite, The Proven System for Reaching and Selling Senior Executives and Five Minute Financial Analyst, Basic CREDIT & Analysis Tools for Non-Accountants. He was the CEO of a very successful leasing company and executive at a major company. You can reach Steve at schriest@selling-up.com.

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Orange, California 3-5 Year underwriting experience

Underwrite 15 to www.quickbridgefunding.com |

|

Leasing Coordinator

www.dakotafinancial.com |

|

|

Positions Available in Irvine and San Diego

1 year experience preferred, salary/benefits |

| www.cflbc.com

Commercial Finance & Leasing Bank of Cardiff, Inc, a finance lender licensed pursuant to the California Finance Lenders Law, license #603G469 |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

Leasing News Advisor

Bruce Kropschot

Bruce Kropschot is one of the first asked to join the advisory board and he has been active since September 6, 2000.

Bruce Kropschot

Senior Managing Director and

Merger & Acquisition Advisory Practice Leader –

The Alta Group

2352 Clearwater Run

The Villages, FL 32162

(352) 750-3588

bkropschot@thealtagroup.com

www.thealtagroup.com

Bruce Kropschot has been active in the equipment leasing industry since 1972 and has been a senior executive of three large leasing companies. In 1986 he founded Kropschot Financial Services, a firm he developed into the leading provider of merger and acquisition advisory services for equipment leasing companies. In 2008 Kropschot Financial Services became a part of The Alta Group, the leading worldwide consulting firm for the leasing industry. Bruce heads Alta’s M&A advisory practice, which also arranges debt and equity capital and provides valuation services for leasing companies. He has played a major role representing sellers or buyers in the sale of about 200 equipment leasing and financing companies.

After 41 years in the equipment leasing industry, Bruce shows no signs of slowing down. He says that his business is his favorite hobby. When asked what have been the keys to his success, he stated, “Obviously a thorough knowledge of many types of leasing companies is essential in the M&A advisory business. However, of utmost importance is maintaining the highest level of integrity. The Alta Group’s reputation depends upon always treating as confidential any information we receive in confidence from potential buyers and sellers of leasing companies.”

Bruce has served on the Board of Directors of the Equipment Leasing and Finance Association, the Equipment Leasing and Finance Foundation, Eastern Association of Equipment Lessors, United Association of Equipment Leasing and International Network of Merger & Acquisition Partners. He has served on the Leasing News Advisory Board since 2000, and he also served on the alumni advisory board of the Ross School of Business at the University of Michigan. He has BBA and MBA degrees (with honors) in Accounting and Finance from the University of Michigan and is a CPA.

Bruce’s favorite recreational activity has long been skiing. Now that knee problems have curtailed his ski trips, Bruce and his wife Barbara spend their vacations with international travel.

Leasing News |

|

Chairman, Advisory Board |

|

| Bob Teichman, CLP | Teichman Financial Training, Sausalito, CA. |

Advisory Board |

|

| Ed Castagna | InPlace Auction, Melville, NY |

| Steve Crane, CLP | CLP, Bank of the West, San Ramon, CA |

Endeavor Financial Services, Costa Mesa , CA |

|

| Phil Dushey | Global Financial Services, Manhattan, NY |

| Ken Greene, Esq. | Hamrick & Evans, Universal City, CA |

| Shawn D. Halladay | The Alta Group, Salt Lake City, UT |

| Robert S. Kieve | Empire Broadcasting, San Jose, CA |

| Bruce Kropschot | Kropschot Financial Services, The Villages, FL |

| Bruce Lurie | Douglas-Guardian Services Corporation, Houston, TX |

| Andrew Lea | HCL CapitalStream, Pt. Richmond, CA |

| Allan Levine | Madison Capital, LLC., Owings Mills, MD |

| Ralph Mango | ComScore, Reston, Virginia |

| Don Myerson | BSB Leasing, Colorado, Hawaii |

| Armon L. Mills, CPA | J.H. Cohn, LLP, San Diego, CA |

| Tom McCurnin | Barton, Klugman & Oetting, Los Angeles, CA |

| Hugh Swandel | The Alta Group, Canada |

| Paul Weiss | Panthera Leasing, San Francisco, CA |

| Rosanne Wilson, CLP | 1st Independent Leasing, Beaverton, OR |

| Ginny Young | former Brava Capital, Orange, CA |

[headlines]

--------------------------------------------------------------

Why I Became a CLP

Krista L. Pressnall, CLP

Funding Coordinator II

Financial Pacific Leasing

Back in June 2006, I began my career at Financial Pacific Leasing, starting off as a Booking Coordinator. Within two years, I was promoted to Funding Coordinator Level I, and within two years I was promoted again to Funding Coordinator Level II, which is considered to be a lead position within the department.

The CLP certification was something I had set my sights on when I had first entered the leasing industry. I knew that anybody with this certification had a great and broad knowledge of leasing and were also considered top professionals within the industry.

In 2012, I was asked if I would like to study and sit for the test. I jumped at the opportunity. I’m not going to lie, when I first read the handbook I was a little discouraged. The first thoughts through my head were “What did I get myself into? Am I really ready for this”? I knew from the beginning that this wasn’t going to be easy and that frame of mind wasn’t going to get me very far, so I made the commitment to myself to study as hard as I could. I pushed any negative thoughts out of my head. I attended the 3-day CLP course, studied, took this very seriously, and after almost 2 months felt ready to pass the test.

I knew I did well, as I had studied and really felt I knew much more about leasing and finance before I started. Nevertheless, I was eager to get the results!

All fifteen CLP’s at Financial Pacific Leasing gathered at my desk to tell me the great news: I had passed the test. All of the emotions and experiences that I had gathered over those few months hit me at once and to be honest, it was a great feeling and one of the proudest moments in my life. Knowing that the dedication and determination that I had put into this process had paid off, was priceless.

Anyone who is considering taking the CLP test, I would absolutely encourage it. It is not an easy process, however the experience and knowledge you gain from this certification is tremendous. If you decide to take this journey, remember that it takes hard work, dedication and determination. But in the end, it is fully worth it.

Today’s Top Companies with Employees who are CLP

- Financial Pacific Leasing (17)

- First American Equipment Finance (11)

- Orion First Financial (7)

- Arvest Equipment Finance (5)

- Great American Insurance (5)

- Ascentium (4)

- Bank of the West (4)

- ECS Financial Services (4)

CLPs in Good Standing

http://www.clpfoundation.org/members/members.php

Why I Became a CLP series:

http://www.leasingnews.org/CLP/Index.htm

[headlines]

--------------------------------------------------------------

August 16-18 Institute for Leasing Professionals

(Helps Prepare for CLP Exam)

[headlines]

--------------------------------------------------------------

Letters? ---We get Email!

(Mostly chronological order)

Pictures from the Past

1984--Anatomy of a Lease

http://leasingnews.org/archives/Jul2013/7_15.htm#pictures

Larry Blazek

"Thanks for the pictures of the good old days.

I retired from Pentech two years ago last February. Also my son served his 4 years and got out of the navy last April. I still live in San Jose.

I hope everything is going well with you,"

Regards,

Larry

(Larry was my Barclay's Bank Manager, right down the street, who later got into leasing in an office not far from mine; in his later years joining Pentech (reportedly in a wind down mode. Editor)

------

"I wonder how much of an adverse effect this is having on our industry? Banks get cheap money, they can afford to take unwarranted risks… the tax payer will pay for their mistakes…"

Drew Taggart

Sunbelt Commercial capital

(Leasing News has written about this:

http://leasingnews.org/archives/Jun2013/6_18.htm#snl)

---

Leasing 102 by Mr. Terry Winders, CLP

Captive Lessor Private Label Leasing

http://leasingnews.org/archives/Jul2013/7_09.htm#captive

"Kudos to Terry on the private label program basics.

"As you may recall, this is where I spent a considerable part of my career, and I negotiated several private label agreements, providing the business side of the relationship while the law team kept us whole legally. Three of the more contentious were agreements with StorageTek and Xerox while I was at US Leasing, and the Dell Financial Services agreement while I was at Newcourt. It was almost a given for every agreement when I was with Continental Illinois Leasing in the mid-80s.

"Perhaps the biggest flashpoint is addressing the rights and responsibilities of each party to the other when things do not go as planned….and this is inevitable. Far from being a ‘trust’ issue at the beginning of a relationship, it is a proper business consideration that one of our staff attorneys described as the pre-nup for vendor programs, because none of these protections are needed if everything is going as planned in terms of volume, approvals, portfolio quality, etc. As contentious as the agreement negotiations can be, the real challenge is to implement the controls, processes, and procedures as they were intended, so the flow of applications begins with more than a trickle. This is what set the Dell Financial startup apart as the flow of apps on day one was close to 1000, and passed that volume on day two. As a result is was not unexpected that it took only 17 months to have reached $1B in fundings.

"The monitoring of the manufacturer or dealer from a financial capacity perspective is equally critical, as their ability to perform under the terms of the agreement must be assessed continually. If it is part of the credit origination process that precedes the contract process, it becomes a necessity for ongoing monitoring. No one likes to suspend funding but if the vendor slips into negative trends, the lender must be able to evaluate the vendor’s ability to perform whatever repurchase or repossession/remarketing and other obligations are included in the agreement. All too often, the sales and credit conflict rears its head, thereby interfering with the rapid assessment of the problems, negotiation thereof between the parties, and appropriate resolution to minimize the damage to both sides. It is unpleasant and stressful, but it is all too familiar to those of us who have endured the angst of conflict when the vendor is asked to perform…FPDs, concentrations (SIC, assets, geographic) adjustments, D&A issues…that are inevitable.

"These rights and responsibilities are often attacked in the context of the vendor’s ability to take sale treatment under FASB, and this is not a minor consideration. The challenge for the lender’s business and legal staff is manage a balance so the vendor’s sale treatment is assured while the performance obligations of the vendor to the lender are strong…again no small task.

"(I would like to add these are my private opinions, not my company's.)"

Ralph Mango

(Ralph recently was named to the Leasing News Advisory Board. Editor)

-----

Archives---June 28, 2000

The Good Old Days

http://leasingnews.org/archives/Jun2013/6_28.htm#archives

“I remember that program and actually sent people there. It was a great program at the time and did wonders for cementing the relationship between the funder and the lessor.”

Bob Underwood

Specialty Funding

Business Equipment Finance & Leasing

----

"Kit, Bookfun magazine will become the Official Book Magazine of the DeeperCalling Bookseller platform, and the magazine will be promoted across select web stores online and via email. The Magazine currently goes out to 62,000 and this partnership is a match made in Heaven.”

"The combined efforts of our two organizations will help authors and publishers as well as give our readers access to quality books and other products at competitive prices.” This agreement significantly increases the reach of the magazine and creates a conduit that runs directly from publishers to shoppers – enabling for rapid and effective promotion of new book, gift and music products with audiences publishers most want to reach – shoppers."

Kind Regards,

Fred St Laurent

CEO

The Book Club Network, Inc.

678-455-5700

Fax: 678- 456-5059

Fred@thebookclubnetwork.com

http://www.bookfunmagazine.com

http://www.bookfun.org

http://www.thebookclubnetwork.com

Members of the ACFW, AWSA and the CBA

(Fred is a former Leasing News Advisor when active in the industry. Editor)

---

Integrity Financial Groups, Murray, Utah

$50,000 Bulletin Board Complaint

http://leasingnews.org/archives/Jul2013/7_02.htm#bbc

Dallin Hawkins Second Arrest within 25 days

Well-Known LinkedIn.com Super Broker

http://leasingnews.org/archives/Jul2013/7_02.htm#hawkins

"Great job on the article this morning concerning Dallin!"

BW

Bernard Whitley

Capital Solutions

-

"Here's a simple rule that I've followed for years. If a company uses any of the following words in their company name, avoid doing business with them:

“Fidelity, Integrity, Professional, Expert, Honest.

"It works!"

Steve Brooks

----

"We’ve been called frequently by D&B Credibility. They always leave messages instructing, not asking, us to call in order to avert some kind of credit down-rating or whatever.

"Now we are getting calls from good customers stating that D&B has told them that ***** has reported them as past due when in fact they’ve never been past due and we haven’t been reporting to D&B for years now.

"Is this D&B Credibility or is it a total scam? One customer told us that they could fix her credit for a price. Seems fishy to us."

(Name With Held--a prominent member of the Leasing Industry, well-known)

(Leasing News attempted by telephone, email, and via Dun & Bradstreet Credibility Corp. web site to obtain a comment or statement, but received none. Editor)

• Contract Negotiations • Fraud Investigations john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

### Press Release ############################

ELFA Meets with Lease Accounting Standards Setters

On July 9, ELFA's lease accounting team—members Rod Hurd, John Bober and Bill Bosco and Chief Operating Officer Ralph Petta—met at the offices of the Financial Accounting Standards Board in Norwalk, Conn., to discuss the lease accounting Exposure Draft with several members of the Board and staff, including Chairman Russ Golden and members Larry Smith and Daryl Buck. The purpose of the meeting was to continue the dialogue regarding ELFA’s perspective on a number of critical matters contained in the Exposure Draft. The exchange was productive for both sides and will be especially useful as ELFA drafts its Comment Letter in response to the Exposure Draft.

Separately, Petta and ELFA President and CEO Woody Sutton attended a U.S. Chamber of Commerce-sponsored meeting of the Washington-based lease accounting project coalition. The meeting was attended by FASB Chairman Golden and Board member Larry Smith. The meeting provided another opportunity for the association and its counterparts from other organizations to discuss the project with and provide input to the Board as its conducts its outreach. About 20 different associations and corporations were in attendance or on the phone. It was a productive meeting, and the Board members continued to emphasize the importance of submitting comment letters by the Sept. 13 deadline.

Get the latest on the lease accounting proposal in the cover story in this magazine and on the ELFA website at www.elfaonline.org/Issues/Accounting/

#### Press Release #############################

[headlines]

--------------------------------------------------------------

Classified ads

Operations/Remarketing/Repossessions

Leasing Industry Outsourcing

(Providing Services and Products)

All "Outsourcing" Classified ads (advertisers are both requested and responsible to keep their free ads up to date:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing.htm

How to Post a free "Outsourcing" classified ad:

http://www.leasingnews.org/Classified/Outsourcing/Outsourcing-post.htm

[headlines]

--------------------------------------------------------------

Labrador

Chicago, Illinois Adopt-a-Dog

Rhea

Female

T

wo Years

This form allows you to ask questions:

Link

Adoption Inquiries: adoptions@pawschicago.org

PAWS Chicago Adoption Center

Dog and Cat Adoptions

1997 N. Clybourn Ave. – Map it

Chicago, IL 60614

Telephone: (773) 935-PAWS

Fax: (773) 549-5760

Saturday and Sunday 11 a.m. – 5 p.m.

Monday through Friday 12 noon – 7 p.m.

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

![]()

News Briefs----

Restaurant Industry Sales Fell Flat in June

http://www.qsrmagazine.com/news/restaurant-industry-sales-fell-flat-june

Former Asiana Pilots Say Manual Flying Secondary to Automation

http://www.sfgate.com/business/bloomberg/article/Former-Asiana-Pilots-Say-Manual-Flying-Secondary-4667588.php

[headlines]

--------------------------------------------------------------

---You May Have Missed

Wendy's New Logo Secret (and others)

http://shine.yahoo.com/photos/wendys-logo-secret-slideshow/-photo-2658199-181000665.html

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

8 Things You Always Wanted to Know about Dieting

http://www.sparkpeople.com/resource/nutrition_articles.asp?id=1704

[headlines]

--------------------------------------------------------------

![]()

Baseball Poem

My Last Hit

Late at night

I can still

see the ball

arcing

over the third

base bag, just

inside the line,

hugging

the grass. The

fielder frozen solid,

his mitt a

heavy

stone, resting on

his thick knee.

And that was

it.

Written by Ed Markowski

“Line Drives,” 100 Contemporary Baseball Poems

edited by Brooke Horvath and Tim Wiles

Published by Southern Illinois University Press

[headlines]

--------------------------------------------------------------

Sports Briefs----

Raiders eye NFL's smallest stadium in Oakland

http://www.contracostatimes.com/contra-costa-times/ci_23665661/raiders-want-build-50-000-seat-stadium-oakland?source=most_viewed

Rivera pitches 8th, earns MVP

http://espn.go.com/new-york/mlb/story/_/id/9484189/2013-all-star-game-mariano-rivera-new-york-yankees-pitches-8th-inning

MLB union says suspensions unlikely this season

http://sports.yahoo.com/news/union-says-drug-bans-likely-175616085--mlb.html

((Please click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

Oakland mops up after third day of protests

http://www.contracostatimes.com/breaking-news/ci_23670028/oakland-mops-up-after-third-day-protests

Oakland: Craft beer trend helps rebuild neighborhoods

http://www.contracostatimes.com/business/ci_23671853/oakland-craft-beer-trend-helps-rebuild-neighborhoods

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

U.S. table wine fuels wine industry's growth

http://www.centralvalleybusinesstimes.com/stories/001/?ID=23805

$32 million of wine is going down the drain because the US doesn’t have a taste for it

http://qz.com/104201/32-million-of-wine-is-going-down-the-drain-because-the-us-doesnt-have-a-taste-for-it/

Winemakers Blind Taste Each Other's Trials

http://www.winesandvines.com/template.cfm?section=news&content=11889

Oregon wineries need to retain local authenticity

http://www.oregonlive.com/foodday/index.ssf/2013/07/oregon_winerie

Reclaiming the Earthy Grapes of St.-Joseph

http://www.nytimes.com/pages/dining/index.html

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1763-birthday of John Jacob Astor, Germany , fur trader become banker,

at one time, the richest man in US.

http://www.raken.com/american_wealth/encyclopedia/profile.asp?code=83

1744-Gerry Elbridge, Fifth vice president of the US (1813—14), born at Marblehead , MA . He was a well-known “gadfly” and signer of the Declaration of Independence. His name became part of the language (gerrymander) after he signed a redistricting bill favoring his party while governor of Massachusetts in 1812. http://www.elbridgegerry.com/http://bioguide.congress.gov/scripts/biodisplay.pl?index=G http://odur.let.rug.nl/~usa/B/gerry/gerry.htm 000139

1794- African Church of St Thomas in Philadelphia , dedicatedhttp://www.pbs.org/wgbh/aia/part3/3h471.html

1794- Richard Allen organizes Philadelphia 's Bethel African Methodist Episcopal Church.

http://earlyamerica.com/review/spring97/alle http://www.ame-church.org/amehist.htmln.html

1821 - Spain ceded Florida to the United States.

1821 - Andrew Jackson became the governor of Florida.

1854—King's College opened in New York City . It later changed its name

to Columbia University ( lower half of:

http://memory.loc.gov/ammem/today/jul17.html

http://www.columbia.edu/cu/aboutcolumbia/history.html

1861- Congress authorizes paper money. the notes were $5( Hamilton ), $10 ( Lincoln ), and $20 ( Liberty .) They were called “demand notes” because they were payable on demand at certain designated subtreasuries. There were not legal tender when first issued but were made so by the act of March 17,1862.

1862-Senator Henry Wilson of Massachusetts introduced and Congress passed the military act to authorized military service by African-Americans. President Abraham Lincoln signed it. The act empowered the president to accept “persons of African descent for the purpose of constructing entrenchments or performing camp competent. There was debate on blacks serving in the military, primarily from states who had seceded from the Union . There was a contingency of African-Americans who originally were going to fight on the side of the Confederates, primarily thought to protect their homes, property, and family. The government of the Confederate States refused to accept blacks into the Confederate army, whether “free man” or “slaves”, plus issued declaration of forfeiture to those who joined the Union army.

1863-July 17, Harriet Tubman led Union Army guerillas into Maryland ,

freeing more than 700 slaves

http://www.awm.lee.army.mil/tubman.htm

http://www.digitalhistory.uh.edu/black_voices/voices_display.cfm?id=74

http://www.spartacus.schoolnet.co.uk/USASunderground.htm

http://www.digitalhistory.uh.edu/black_voices/voices_display.cfm?id=74

http://www.nwhp.org/tlp/biographies/tubman/tubman_bio.html

http://www.math.buffalo.edu/~sww/0history/hwny-tubman.html

1863- Battle of Honey Springs, largest battle of war in Indian Territoryhttp://www2.cr.nps.gov/abpp/battles/ok007.htm

http://www.ok-history.mus.ok.us/mus-sites/LHF-bhs.htm

http://www.civilwaralbum.com/indian/honey_springs1.htm

http://www.civilwaralbum.com/indian/honey_springs2.htm

http://www.oklahomaadventureguide.com/greencountry/

places/checotah.html

1864 - Confederate President Jefferson Davis replaces General Joseph Johnston with John Bell Hood as commander of the Army of Tennessee. Davis, impatient with Johnston's defensive strategy in the Atlanta campaign, felt that Hood stood a better chance of saving Atlanta from the forces of Union General William T. Sherman. For nearly three months, Johnston and Sherman had maneuvered around the rugged corridor from Chattanooga to Atlanta. Although there was constant skirmishing, there were few major battles; Sherman kept trying to outflank Johnston, but his advances were blocked. Though this kept losses to a minimum, there was also a limit to how long Johnston could maintain this strategy as each move brought the armies closer to Atlanta. By July 17, 1864, Johnston was backed into the outskirts of Atlanta. Johnston felt his strategy was the only way to preserve the Army of Tennessee, but Davis felt that he had given up too much territory. In a telegram informing Johnston of his decision, Davis wrote, ""you failed to arrest the advance of the enemy to the vicinity of Atlanta, far in the interior of Georgia, and express no confidence that you can defeat or repel him, you are hereby relieved from command of the Army and Department of Tennessee, which you will immediately turn over to General Hood." Davis selected Hood for his reputation as a fighting general, in contrast to Johnston's cautious nature. Hood did what Davis wanted and quickly attacked Sherman at Peachtree Creek on July 20 but with disastrous results. Hood attacked two more times, losing both and destroying his army's offensive capabilities. The next day the city was occupied by Union forces under Gen. William Tecumseh Sherman.

http://www.cviog.uga.edu/Projects/gainfo/johnston.htm http://www.cviog.uga.edu/Projects/gainfo/statues/jejohnston.htm

http://www.ah.dcr.state.nc.us/sections/hs/bentonvi/Main.htm

http://www.tennessee-scv.org/camp28/johnstonbio.html

http://www.moc.org/FlagCollection/Index.html

http://docsouth.unc.edu/gordon/gordon.html

http://www.findarticles.com/cf_dls/m2004/4_45/599619

78/p1/article.jhtml

http://www.gwest.org/46thmsin.htm

http://www.angelfire.com/ga3/confederaterebels/bat2.html

http://ngeorgia.com/history/allapass.html

http://www.netease.net/wayne/Hood.htm

http://www.dnet.net/personal/cwh/

http://www.tsha.utexas.edu/handbook/online/articles

/view/HH/fho49.html

1867 - Harvard School of Dental Medicine was established in Boston , MA . It was the first dental school in America .

1867- Linda Anne Eastman birthday- U.S. librarian. LE developed the children's rooms at the Cleveland Public Library, developed library extensions in hospitals, developed a Braille collection. In 1918 she became the first woman to head a metropolitan library system, that, under her tutelage became one of the largest and most complete library systems in the United States , its collection grew from 57,000 volumes to more than 2,000,000.

http://oasis.harvard.edu/html/sch00186.html#bioghist1

http://www.cpl.org/Locations.asp?FormMode=History

1870 - A drunken brawl turns deadly when "Wild Bill" Hickok shoots two soldiers in self-defense, mortally wounding one of them. William Hickok had earned his reputation as a gunslinger a decade earlier after shooting three men in a gunfight in Nebraska. He parlayed his standing as a sure-shooting gunman into a haphazard career in law enforcement. In 1869, he was elected interim sheriff of Ellis County, Kansas. Hays City, the county seat, was a rough-and-tumble frontier town, and the citizens hoped Hickok could bring order to the chaos. Unfortunately, after Hickok had killed two men in the line of duty after just five weeks, they concluded that he was too wild for their tastes and they elected his deputy to replace him in November. Unemployed, Hickok passed his time gambling, drinking, and occasionally working as a hunting guide. He quickly became bored and was considering taking work at the nearby Fort Hays as an army scout. On this day in 1870, Hickok had been drinking hard at Drum's Saloon in Hays City. Five soldiers from the 7th Cavalry stationed at Fort Hays were also at the bar. They were drunk and began to exchange words with the notoriously prickly "Wild Bill." A brawl broke out, and the soldiers threw Hickok to the floor. One trooper tried to shoot Hickok, but the gun misfired. Hickok quickly pulled his own pistols and opened fire. He wounded one private in the knee and wrist, and another in the torso. The three remaining soldiers backed off, and Hickok exited the saloon and immediately left town. A clear case of self-defense, Hickok was cleared of any wrongdoing. Yet, one of the soldiers, Private John Kile, later died of his wound and Hickok's chances of becoming an army scout evaporated. He spent the next six years working in law enforcement, gambling, and appearing in Wild West shows. He was murdered in a Deadwood, South Dakota, saloon in 1876. 1877 - Riots and violence erupted in several major American cities stemming from strikes against railroads in protest of wage cuts. Strikes started against the Baltimore & Ohio, and quickly spread west, with riots erupting in Baltimore, Pittsburgh, Chicago and St. Louis. Nine were killed when Federal troops were sent into Martinsburg, West Virginia. On July 21, 26 were killed and the Union Depot and machine shops were burned down.

1888- Erle Stanley Gardner ( yes, Erle )American author of detective fiction, born at Maiden, MA. Best remembered for his series about lawyer-detective Perry Mason, Gardner also wrote novels under the pen name A.A. Fair.

1891- Anna Moscowitz Koss birthday - social-minded U.S. judge who devoted much of her private life to working for improving the services for women, juveniles, and children

http://www.huc.edu/aja/kross.htm

1897 - The Steamer Portland arrived into Seattle from Alaska with 68 prospectors carrying more than a ton of gold. The Seattle Post-Intelligencer announced that men with gold from Alaska were landing. This unleashed the Klondike gold rush and tens of thousands headed for the Yukon. The Klondike gold rush gave America and Canada a psychological boost in getting the economy moving again after the terrible depression that followed the 1893 crash.

1898-Birthday of Berenice (sic.) Abbott, born at Springfield , OH , and went on to become a pioneer of American photography. She is best remembered for her black and white photography of New York City in the 1930's, many of which appeared in the book Changing New York. After published his collection, she began photographing scientific experiments that illustrated the laws and processes of physics. She died at Monson , ME , December 11,1991. . Her work was once described by an art critic as "...a chess game between light and shadow." Her portraits are among the most outstanding ever done, although she is best known for her studies of New York city .

http://www.spartacus.schoolnet.co.uk/USAPabbott.htm

http://www.nypl.org/research/chss/spe/art/photo/abbottex/abbott.html

http://www.artsmia.org/picture/print/abbott.shtml

http://www.3wposter.com/abbott.htm http://www.netstoreusa.com/pmbooks/188/1881270173.shtml

http://www.nmwa.org/legacy/bios/babbott.htm

http://women.eb.com/women/articles/Abbott_Berenice.html

http://www.artsmia.org/get-the-picture/abbott/index.html

1920 - Sinclair Lewis finished the now-famous novel, " Main Street ".

http://us.history.wisc.edu/hist102/bios/32.html http://www.selfknowledge.com/mnstr10.htm

1921-birthday of guitarist Mary Osborne, Minot , NDhttp://www.classicjazzguitar.com/artists/artists_page.jsp?artist=21

1925-birthday of singer Jimmy Little Scott, Cleveland, OHhttp://www.fantasyjazz.com/html/scott_j_bio.html

http://www.nytimes.com/library/magazine/home/

20000827mag-jimmyscott.html

1926-birthday of trumpet player Ray Copeland, Norfolk , VA

http://music.barnesandnoble.com/search/results.asp?ctr=93645

1928-birthday of drummer Joe Morello , Springfield MA

http://www.dmprecords.com/JoeMorel.htm

http://www.drummerworld.com/drummers/Joe%20Morello.html

http://community-2.webtv.net/Jem33b/Morello/index.html

1933-birthday of drummer Ben Riley, Savannah , GA

http://www.jazzcorner.com/jokenrecords/riley.html

http://www.drummerworld.com/drummers/Ben%20Riley.html

1934 - One of the worst heat waves in the history of the nation commenced. During the last two weeks of the month extreme heat claimed 679 lives in Michigan, including 300 in Detroit alone.

1934-birthday of trumpet player Bobby Bradford Cleveland MS

http://shopping.yahoo.com/shop?d=product&id=192700

5300&clink=dmmu.artist&a=b

http://www.gallery41.com/JazzArtists/BobbyBradford.htm

1936- General Francisco Franco led an uprising of army troops based in North Africa against the elected government of the Spanish Republic . Spain was quickly divided into a Nationalist and a Republican zone. Franco's Nationalists drew support from Fascist Italy and Nazi Germany. Many saw this as a war to follow in Europe later. The USA had their foreign policy as “Me First.” Ernest Hemingway is best known as a correspondent covering this war and for his short stories and novel, “For Whom the Bell Tolls.” On Apr 1,1939, the Nationalists won a complete victory when they entered Madrid . Franco ruled as dictator in Spain until his death in 1975.http://memory.loc.gov/ammem/today/jul17.html

1933- Dr. Albert Ernest Forsythe of Atlantic City , NJ , became the first African-Americans to make a transcontinental flight ( made by African-American Charles Alfred Anderson of Bryn Mawr , PA. ) He left Atlantic City on July 17 at 2:49am and arrived at Los Angeles , CA , on July 19 at 5:30pm.

http://www.coax.net/people/lwf/chief.htm

http://www.blackseek.com/bh/2001/212_CAnderson.htm

1938-Douglas Grace Corrigan, an unemployed airplane mechanic, left Brooklyn, NY's Floyd Bennet field, ostensibly headed for Los Angeles, CA, in a 1929 Curtis Robin monoplane. He landed 28 hours, 13 minutes later at Dublin , Ireland 's Baldonnel airport, after a 3,150 mill nonstop flight without radio or special navigation equipment and in violation of American and Irish flight regulations. Born at Galveston , Texas , January 22,19-7. Corrigan received a hero's welcome home; he was nicknamed “ Wrong Way ” Corrigan because he claimed he accidentally followed the wrong end of his compass needle. Died at New York , NY December 9, 1995.

1939-Charlie Barnet Band records “Cherokee” ( Bluebird 10373)

1941 - A prolonged heat wave over Washington State finally came to an end. Lightning from untimely thunderstorms was responsible for 598 forest fires.

1941-birthday of Daryle Lamonica Oakland Raider QB (AFL leading passer 1967)

http://www.niashf.org/inductees/lamonica_daryl.html .http://www.cmc.net/~chrisr/Lamonica/ND.html

1943--WAYBUR, DAVID C. Medal of Honor Rank and organization: First Lieutenant, U.S. Army, 3d Reconnaissance Troop, 3d Infantry Division. Place and date: Near Agrigento, Sicily, 17 July 1943. Entered service at: Piedmont, Calif. Birth: Oakland, Calif. G.O. No.: 69, 21 October 1943. Citation: For conspicuous gallantry and intrepidity at the risk of life above and beyond the call of duty in action involving actual conflict with the enemy. Commander of a reconnaissance platoon, 1st Lt. Waybur volunteered to lead a 3-vehicle patrol into enemy-held territory to locate an isolated Ranger unit. Proceeding under cover of darkness, over roads known to be heavily mined, and strongly defended by road blocks and machinegun positions, the patrol's progress was halted at a bridge which had been destroyed by enemy troops and was suddenly cut off from its supporting vehicles by 4 enemy tanks. Although hopelessly outnumbered and out-gunned, and himself and his men completely exposed, he quickly dispersed his vehicles and ordered his gunners to open fire with their .30 and .50 caliber machineguns. Then, with ammunition exhausted, 3 of his men hit and himself seriously wounded, he seized his .45 caliber Thompson submachinegun and standing in the bright moonlight directly in the line of fire, alone engaged the leading tank at 30 yards and succeeded in killing the crewmembers, causing the tank to run onto the bridge and crash into the stream bed. After dispatching 1 of the men for aid he rallied the rest to cover and withstood the continued fire of the tanks till the arrival of aid the following morning.

1944--Two ammunition ships explodes at Port Chicago, California kills 322 - including 202 African-Americans assigned by the Navy to handle explosives. The resulting refusal of 258 African-Americans to return to the dangerous work forms the basis of the trial & conviction of 50 of the men in what is called the Port Chicago Mutiny. The glare of the explosion could be seen in San Francisco, some 35 miles away. It was the worst home-front disaster of World War II. Officially, the world's first atomic test explosion occurred on 16 July 1945 at Alamogordo, New Mexico; but the Port Chicago blast may well have been the world's first atomic detonation.

*PENDLETON, CHARLES F.

Rank and organization: Corporal. U.S. Army, Company D, 15th Infantry Regiment, 3d Infantry Division. Place and date: Near Choo Gung-Dong, Korea, 16 and 17 July 1953. Entered service at: Fort Worth, Tex. Born: 26 September 1931, Camden, Tenn. Citation: Cpl. Pendleton, a machine gunner with Company D, distinguished himself by conspicuous gallantry and indomitable courage above and beyond the call of duty in action against the enemy. After consolidating and establishing a defensive perimeter on a key terrain feature, friendly elements were attacked by a large hostile force. Cpl. Pendleton delivered deadly accurate fire into the approaching troops, killing approximately 15 and disorganizing the remainder with grenades. Unable to protect the flanks because of the narrow confines of the trench, he removed the machine gun from the tripod and, exposed to enemy observation, positioned it on his knee to improve his firing vantage. Observing a hostile infantryman jumping into the position, intent on throwing a grenade at his comrades, he whirled about and killed the attacker, then inflicted such heavy casualties on the enemy force that they retreated to regroup. After reorganizing, a second wave of hostile soldiers moved forward in an attempt to overrun the position and, later, when a hostile grenade landed nearby, Cpl. Pendleton quickly retrieved and hurled it back at the foe. Although he was burned by the hot shells ejecting from his weapon, and he was wounded by a grenade, he refused evacuation and continued to fire on the assaulting force. As enemy action increased in tempo, his machine gun was destroyed by a grenade but, undaunted, he grabbed a carbine and continued his heroic defense until mortally wounded by a mortar burst. Cpl. Pendleton's unflinching courage, gallant self-sacrifice, and consummate devotion to duty reflect lasting glory upon himself and uphold the finest traditions of the military service.

1950---Top Hits

Bewitched - The Gordon Jenkins Orchestra (vocal: Mary Lou Williams)

My Foolish Heart - The Gordon Jenkins Orchestra (vocal: Eileen Wilson)

Mona Lisa - Nat King Cole

Mississippi - Red Foley

1952-Goerge Shearing Quintet records “Lullaby of Birdland” MGM 11354)

1953-The first Navy ace in Korea was Lieutenant Guy Bordelon, who achieved his fifth victory in a World-War-II-vintage propeller-driven F-4U Corsair. He was awarded the Navy Cross

http://m2reviews.cnsi.net/reviews/korean/f4u5n.htm

http://www.people.cornell.edu/pages/dz27/pages/library/bedcheck.html

http://www.history.navy.mil/nan/2000/nov-dec/chosin.htm

1954- the First Newport Jazz Festival. The 1956 movie “High Society” made this become a worldwide event each year.

http://lycos.infoplease.com/ce6/ent/A0835462.html

http://www.pbs.org/jazz/exchange/exchange_festivals.htm

http://www.art4now.com/wepost2.htm

http://news.bbc.co.uk/low/english/special_report/1999/04/99/

1954- With Jim Gilliam (2b), Jackie Robinson (3b), Sandy Amoros (lf), Roy Campanella (c), and Don Newcombe (p) in the starting lineup against the Braves, the Dodgers field the first team which consists of a majority of black players. The historic five helps Brooklyn beat Milwaukee at County Stadium, 2-1.

1954 –The first major league baseball game in which the majority of the players on one team were African-American was played between the Brooklyn Dodgers and the Milwaukee Braves at Milwaukee , WI . the Braves won 6-to-1. The black players on the Brooklyn team were Donald N. Newcombe, pitcher; Roy Campanella, catcher; James William Gilliam, second base; Jackie Robinson, third base, and Edmundo Isasi Amoros, left field.

1955- Disneyland , America 's first theme park, opened at Anaheim . I remember visited it in 1956 and playing Dixieland at the frontier saloon, and watching it grow into an international attraction and destination site. Many did not know that Walt Disney had an apartment there and supervised all during the week. He would stay some weekends, and since the saloon originally did not serve anything alcoholic, he would attend some Dixieland sets with his famous paper cup.

1958---Top Hits

The Purple People Eater - Sheb Wooley

Hard Headed Woman - Elvis Presley

Poor Little Fool - Ricky Nelson

Guess Things Happen that Way - Johnny Cash

1960-birthday of Scott Norwood NFL kicker (Buffalo Bills-Superbowl XXV goat)

http://www.angelfire.com/nv/billsthunder/LEVYSTORY.html

http://www.billsbackers.com/MarvLevy.htm

1961--Motown Records releases The Supremes' second single, "Buttered Popcorn" with "Who's Loving You" on the flip side. The record, featuring Florence Ballard on lead vocal, would be a total flop.

1961- Roger Maris loses a HR (of his 61) due to a rain-out. Ford Frick rules that if anyone breaks Babe Ruth 60 HR record, it must be done in 1st 154 games

1966- Jim Ryun sets mile record (3m51s3)

http://www.ryun.house.gov/biography/

1966--Allen Ginsberg read poetry and Sopwith Camel performed in concert at the San Francisco Fillmore, to Benefit for Artist Reorganization Throughout San Francisco A.R.T.S. Gary Goodrow of The Committee emceed.

Artist: Wes Wilson

1966---Top Hits

Hanky Panky - Tommy James & The Shondells

Wild Thing - The Troggs

You Don't Have to Say You Love Me - Dusty Springfield

Think of Me - Buck Owens

1974-Bob Gibson of the St. Louis Cardinals struck out Cesar Geronimo of the Cincinnati reds to become the second pitcher in baseball history, after Walter Johnson, to strike out 3,000 batters. Gibson pitched in the major leagues from 1959 through 1975 and finished with 3, 117 strikeouts.

1974---Top Hits

Rock Your Baby - George McCrae

Annie's Song - John Denver

On and On - Gladys Knight & The Pips

He Thinks I Still Care - Anne Murray

1978-Pitcher George “Doc” Medich of the Texas Rangers saved the life of a fan suffering a heart attack before a game in Baltimore gains the Orioles. Medich, a medical student, administered cardiac first aid until additional help arrived.

1968-The Beatles' film, Yellow Submarine debuted in theatres this week. The Fab Four weren't originally too keen about the picture, but after seeing elements of the cartoon, liked it enough to make a cameo appearance at the end. The voices in the film were actually actors and not The Beatles themselves, but Ringo Starr said that years later, people were still asking him why he "pushed the button" that created all of the chaos in the animated picture.

1966- Jim Ryun sets mile record (3m51s3)

1980- Ronald Reagan formally accepts Republican nomination for president. George Bush of Texas , former ambassador to the UN and former director of the CIA, was nominated for the vice-presidency. The Democratic National Convention in August then President Jimmy Carter and vice-president Walter Mondale for vice-president. Carter defeated Sen. Edward M. Kennedy of Massachusetts by a margin of nearly two to one. In November, Reagan gets 489 electoral votes to President Carter's 49, carrying 44 states with a popular vote of 42,797,153 to 34,434,100 with John Anderson, an independent candidate picking up 5,533,927. Republicans picked up 12 Senate seats for a 54-46 majority, one independent. In the House, the Democrats lost 33 seats but kept a majority of 242-192, one seat independent.

1982---Top Hits

Don't You Want Me - The Human League

Rosanna - Toto

Hurts So Good - John Cougar

'Till You're Gone - Barbara Mandrell

1985 - The nation's second largest banking company, Bank of America of San Francisco, CA, reported a second-quarter loss of $338 million.

1986 - The largest bankruptcy filing in U.S. history took place as LTV Corporation asked for court protection from more than 20,000 creditors. LTV Corp. had debts in excess of $4 billion.

1987 - Slow moving thunderstorms caused flooding on the Guadalupe River in Texas resulting in tragic loss of life. A bus and van leaving a summer youth camp stalled near the rapidly rising river, just west of the town of Comfort, and a powerful surge of water swept away 43 persons, mostly teenagers. Ten drowned in the floodwaters. Most of the others were rescued from tree tops by helicopter.

1987 - Yankees' first baseman Don Mattingly becomes the first American League player to hit a home run in seven consecutive games.

1988 - A dozen cities in the eastern U.S., and six others in California, reported record high temperatures for the date. Downtown San Francisco, CA, with a high of 103 degrees, obliterated their previous record high of 82 degrees. Philadelphia, PA, reported a record five straight days of 100 degree heat, and Baltimore, MD, reported a record eight days of 100 degree weather for the year. Afternoon and evening thunderstorms produced severe weather along the Middle Atlantic Coast, and over southern New England.

1990-the Minnesota Twins became the first team in major league history to record two triple plays in the same game when they turned the trick against the Boston Red Sox. But the Red Sox won, 1-0.

1990---Top Hits

Step By Step - New Kids on the Block

She ain't Worth It - Glenn Medeiros featuring Bobby Brown

Hold On - En Vogue

The Dance - Garth Brooks

1995-Netscape announced its Secure Sockets Layer (SSL) security product, designed to encourage Internet shopping, on this day in 1995. The company said the technology could conceal customers' credit card numbers from Internet merchants and hackers. At the time, the theft of credit card numbers on the Internet was costing merchants $100 million a year, Netscape officials said. The race to create security standards in the mid-1990s was followed by the explosion of Internet shopping's popularity in 1998 and 1999.

1996 - TWA (Trans World Airlines) flight 800, carrying 230 people, including four cockpit crew members and 14 flight attendants, exploded, falling into the Atlantic Ocean off the coast of Long Island, New York . The Boeing 747 had lifted off from New York 's John F. Kennedy Airport at 8:19 p.m. bound for Paris , France . The explosion happened about 26 minutes later, some 40 miles east of New York , as the plane was climbing through 13,800 feet. The victims included celebrities in sports, entertainment and the arts, business people, and vacationers. Possibly the most poignant were the deaths of sixteen teen-agers, all students from the Montoursville, PA high school French club, and their five chaperones. There are several theories as to the cause of the explosion. Some believe that the airliner was sabotaged and destroyed by a bomb planted on board. Others swore they knew the plane had been struck by a U.S. missile. But, after a 16-month probe, the FBI announced it had found no evidence of a criminal act or stray (or otherwise) missile. It has concluded that the crash was caused by electrical arcing in the plane's center fuel tank igniting fuel vapors.

1997-The Georgia O'Keefe Museum, opened in Santa Fe , NM . It housed major works by O'Keefe, whose paintings of desert scenes and flowers made her the best-known 210 th -century artist of the American Southwest. It was the first art museum of importance devoted to the work of an individual woman. The museum, which contained 116 paints and one sculpture, was housed in a sprawling adobe building renovated and expanded by architect Richard Gluckman. Peter H. Hassrick was the first director.

2005 - Dave Matthews Bandís ìDreamgirlî video premieres on VH1. The band snags one of Hollywood's top actresses for the latest video from its RCA album, "Stand Up." Appearing in her first film role since the birth of her twins last year, Julia Roberts stars in the Dave Meyers-directed clip.

2005 - Kelly Clarkson's concert in Orlando, Fla., is cybercast live via AOLmusic.com. The show is also be available on demand after the conclusion of the performance.

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

http://leasingnews.org/Soduku/soduko-main.htm

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx