Connect with Leasing News ![]()

![]()

![]()

![]() Add me to mailing list |

Add me to mailing list | ![]() Change email |

Change email | ![]() |

| ![]() Search

Search

Advertising | All Lists | Archives | Classified Ads | This Day In American History

Leasing News is a web site that posts information, news, and

entertainment for the commercial bank, finance and leasing industry

kitmenkin@leasingnews.org

![]()

Monday, July 22, 2013

![]()

Today's Equipment Leasing Headlines

r

Classified Ads---Sales

Umpqua CEO on Financial Pacific Leasing Purchase

What to Look Forward to

Modern History of Leasing---abridged

Written by Tom McCurnin, Leasing News Legal Editor

and Christopher Menkin, Leasing News Editor

Part Four - “Where Do We Go From Here?”

Lease/Asset Finance Market Heating Up

ZRG Partners Second Quarter Up-date

Classified Ads---Help Wanted

Signs of an Immanent Layoff

Career Crossroad---By Emily Fitzpatrick/RII

Leasing 102 by Mr. Terry Winders, CLP

Non-compete contracts

Leasing News Advisor

Andrew Lea

Top Stories July 15--July 19

(You May Have Missed)

SBA Loans Only Increased 3.1%

Compared to Previous Period of 6.9%

Leasing Conferences---Save the Date

Pacific rim/Byzantium

42/Bullet to the Head/Black Sabbath

Film-DVD Reviews by Fernando Croce

Leasing Attorneys

Boxer/Labrador Retriever Mix

Federal Way, Washington Adopt-a-Dog

News Briefs---

Bank in Madoff Case Settles With Some Plaintiffs

---and Gets Favorable Jury Ruling

Restaurants Made Up 75% of Franchise Job Growth in June

Broker/Funder/Industry Lists |

Features (collection)

Top Ten Stories Chosen by Readers |

Top Stories last six months

www.leasingcomplaints.com (Be Careful of Doing Business)

www.evergreenleasingnews.org

You May have Missed---

SparkPeople--Live Healthier and Longer

Sports Briefs---

California Nuts Brief---

"Gimme that Wine"

This Day in American History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

######## surrounding the article denotes it is a “press release” and was not written by Leasing News nor information verified, but from the source noted. When an article is signed by the writer, it is considered a “by line.” It reflects the opinion and research of the writer.

Please send Leasing News to a colleague

and ask them to subscribe

Contact: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

• Contract Negotiations • Fraud Investigations john@jkrmdirect.com | ph 315-866-1167| www.jkrmdirect.com |

(Leasing News provides this ad as a trade for investigations

and background information provided by John Kenny)

[headlines]

--------------------------------------------------------------

Classified Ads---Sales

(These ads are “free” to those seeking employment

or looking to improve their position)

| Montgomery, AL Individual with 10 years advertising sales exp. & 7 years insurance sales exp. Wants independent contractor situation in Alabama. Work with leasing company or broker. 334-590-5133 E-mail: billmcneal2003@yahoo.com |

Free Posting for those seeking employment in Leasing:

http://www.leasingnews.org/Classified/Jwanted/Jwanted-post.htm

All “free” categories “job wanted” ads:

http://www.leasingnews.org/Classified/Jwanted/Jwanted.htm

[headlines]

--------------------------------------------------------------

Umpqua CE0 on Financial Pacific Leasing Purchase

What to Look Forward to

Ray Davis

President/CEO

Ray Davis, President and CEO, Umpqua Holdings Corp. (UMPQ) in his 2nd Quarter Conference Call, gave an idea of what to expect with their purchase of Financial Pacific Leasing, Federal Way, Washington

"This past quarter we, in fact, acted on one such opportunity, the acquisition of one of the premier equipment leasing companies in the country, Financial Pacific Leasing. This transaction announced in June officially closed on July 1st, 2013.

"As we've reported, this transaction comes to Umpqua with many positives, including immediate earnings accretion of at least 14%, an estimated 35 basis point improvement in our total net interest margin, another earning asset channel for Umpqua and a meaningful alternative for Umpqua clients and prospects for significant incremental growth as FinPac moves into more A and B lease paper production.

"We couldn't be more pleased with this new addition, which is led by an extremely knowledgeable team of professionals."

Seeking Alpha Transcript:

http://seekingalpha.com/article/1557102-umpqua-holdings-corp-umpq-ceo-discusses-q2-2013-results-earnings-call-transcript?source=google_news

The Sale of Financial Pacific Leasing

to Umpqua Holdings Corporation

http://leasingnews.org/archives/Jun2013/6_06.htm#flexpoint

[headlines]

--------------------------------------------------------------

Modern History of Leasing---abridged

Written by Tom McCurnin, Leasing News Legal Editor

and Christopher Menkin, Leasing News Editor

Part Four of Four

Where Do We Go From Here?

In the late 1990’s equipment leasing was at its high water mark with thousands of lessor and leasing brokers . (20) The typical leasing company could easily find financing from investment pools, banks, insurance companies, and larger leasing Companies. (21) The industry peaked in 2007, with an estimated volume of $670 billion dollars. (22) Every conceivable type of equipment was being leased and brokers flooded the business. Even retail giants like Dell, Staples and Office Depot offered leasing alternatives made through independent leasing companies, for a fee.

Part of the success of the leasing industry was industry specific procedures for three separate business models. The first business model is internally generated direct sales. Leasing companies may hire a fleet of salesmen, troll for lessees through cold calling and advertising, and once approved present the leases to their funding sources.

The second business model is vendor generated leads under a program agreement with equipment vendors. Leasing companies court equipment vendors and obtain exclusive rights to finance equipment sold by the vendor. (23)

The third business model was to obtain leasing transactions from independent brokers and pay commissions on those leases. The use of a third party broker can present agency problems for the lessor.(24)

Whatever the source of the leases, the leasing company simply tacked on anywhere from 5-10 points to its cost of funds to the lease, and sent the lease to its funding sources.(25) Other well capitalized leasing companies would fund the leases themselves and stockpile the leases in portfolios of buckets of $1-10 million dollars, then securitize the pool with large investment companies, insurance companies or banks.(26) Because the economy was booming, the pools would often be either non-recourse or limited recourse, and the leasing company would be paid the present value of the pool. An important, but often overlooked income stream, would be the residual value of the leases, usually the 10% purchase option at the end of the term, which would be retained by the lessor. (27)

These three business models reaped huge amounts of cash for equipment lessors, so much so that investment pools and funders lined up like lemmings, with a seemingly unlimited appetite for pools of leases with the promise of internal rates of return in excess of 10%.(28)

So great was the institutional appetite for securitized equipment leases, major financial players in the United States agreed to finance pools of equipment leases for equipment which had questionable value, such as tied to advertising or service such as with NorVergence or Royal Links Golf Food Carts (29) never existed, such as happened with Allied Health Care (30) or where the lessor was operating illegally without a license such as Commercial Money Center. (31) While part of the problem was unscrupulous vendors, the lease structure was also to blame.(32)

The Financial Collapse of 2007

and Its Effect on the Leasing Industry

By 2008, the leasing industry was being hit from three sides. As the economy collapsed, there were fewer and fewer qualified lessees with credit scores that justified the sizeable credit risk. (34) In addition, with many businesses abandoning their equipment, there was a flood of machine tools and construction equipment, making resale of the equipment lessor’s collateral very suspect. Finally, with the great credit crunch, Wall Street lost its appetite for investment in local business and their depreciating equipment. As a result, by 2009, the leasing volume had shrunk to $472 billion dollars, a $200 billion haircut . Some lessors and funders vanished and others were merged out of business; brokers on “private label contracts” also closed down. (35)

In short, the leasing industry saw a 30% decrease in financing acquisitions and write offs hovering around 1%. (36). Even if a creditworthy lessee was found, (37) finding a funding source for many independent leasing companies became an impossibility.

The Cycle Goes Full Circle:

Enter the Bank as Equipment Lessor

In the not too distant past, banks were prohibited from leasing equipment on a variety of theories, due mainly to the fact that the lease was often viewed as a sale or conditional sale. It was viewed that sales of equipment were not “incidental” to the bank’s statutory lending powers and thus, not authorized by the National Bank Act. (38)

In 1963, the Office of the Comptroller of the Currency (“OCC”) adopted a rule which allowed direct leasing if substantially similar to the practice of financing personal property acquisition. (39) In 1977, the OCC allowed banks to become the owner of personal property for the use of a banking customer incident to a lease. (40) The OCC ruling was challenged by leasing companies resulting in a court decision which allowed banks to enter into open ended leases and closed end leases where the residual value does not contribute to the bank’s recovery of principal and interest. (41)

Independent non-bank leasing companies challenged the right of the Banks to engage in leasing but lost that case. (42) As a result of this litigation, the OCC adopted new regulations which allowed Banks to enter into full payout leases, essentially, leases without a significant residual value. (43) In 1987, Congress amended the National Banking Act to allow Banks to enter into the leasing business, without regard to the residual value, so long as no more than 10% of its capital was directed toward this endeavor. (44) Approval is not required from the OCC, although if a wholly owned subsidiary engages in leasing activities, approval from the OCC is required.(45) While the OCC limited loans to only those branches approved by the OCC, leases had no such restriction, thus, a Bank in New Jersey may maintain a leasing office in another State. (46) In 1981, the OCC allowed Banks to provide loan servicing and repossession services for other financial institutions. (47) In light of the court decision, the OCC issues specific rules relative to a “net full payout lease.” While this term is not terribly intuitive, the definition seemed to imply either a fully amortized lease (lease intended as security) or a true lease in which the residual is no more than 25% of the original cost of the equipment. (48)

Dissatisfied with the ruling restricting leasing transactions where the residual is less than 25%, the banks sought OCC approval for writing leases with higher residuals. Given the Court’s ruling, the OCC had no power to re-interpret the National Banking Act and denied the bank’s requests. (49) The National Banks then sought Congressional legislation in the form of the Competitive Equality Banking Act (“CEBA”) which authorized banks to enter into any lease of personal property, so long as the total leases do not exceed 10% of the assets of the Bank. (50)

In 1991, the OCC promulgated rules which conformed to CEBA which made it clear that the banks had two specific grants of authority to enter into personal property leases, either “net full payout leases with residuals of less than 25%” (not including vendor recourse) (51) or a CEBA lease, where the total lending is less than 10% of the consolidated assets of the bank.(52) A “net lease” is one where the bank is not required to service, license, register, or insure the equipment, nor may the bank be obligated to provide loaner equipment to the lessee.(53) The OCC further clarified the servicing issue, and allowed a National Bank to service equipment, if done by a third party at the lessee’s expense.(54) Presumably, this would cover service contracts for equipment like copiers. (55)

One regulatory caveat is that under the OCC rules, a bank may not acquire personal property for lease without having a “legally binding written agreement” with the lessee.(56) Leasing companies typically do not have a “legally binding agreement” with the lessee prior to receiving invoices from the vendor. As suggested below, if a bank wants to enter into lease and acquire the property in advance, which is typical, additional paperwork from the Lessee or a specific purchase order vis-à-vis the vendor should be issued. Otherwise, the bank must establish that the practice of acquiring property to be leased, without entering into a binding lease agreement is “consistent with the leasing business” or is less than 15% of the bank’s capital. (57)

Banks enjoy a significant advantage in equipment leasing, if for no other reason, the access to Federal Funds at less than 1%. (58) With “A” credit equipment leases for solid equipment enjoying rates of 5-7%, this translates to an incredible opportunity for profit, and a recent study shows that bank based leasing companies have double the profitability than its competitors. (59) Add to the mix the ability for significant (almost 10%) fee income (late charges and residuals),(60) this now makes bank leasing a very attractive product to be offered to the bank’s customers. Finally, one of the major strategies of mid-sized banks is to increase the number of financial service products it can offer customers, (61) therefore, equipment leasing for banks as returned as a major new business model.

Starting a Leasing Department

At the outset, equipment leasing is not banking, and has little in common with traditional banking. Equipment lessors utilize automated software (62) to drive the entire transaction, including to populate most forms. (63) Notwithstanding the non-CEBA mandate that leases are to be underwritten on the basis of the lessee’s ability to repay the obligation, the underwriting focus in equipment leasing is on the equipment, its value to the business, and the strength of the vendor.

Workflow is Different in a Leasing Company

Unlike traditional Bank loans, where financial statements, tax returns, and loan committees are involved, lease processing is generally handled in three ways, depending on where the originating source of the customer lead comes from, either from the sales department, a vendor program, or from an independent broker. Whatever the source, credit turnarounds are measured in a few days, instead of weeks at banks. (64)

If leads are obtained from direct sales, the usual protocol is that the sales force contacts a prospective customer, or vice versa and a simple one page application is taken. Although paper copies are saved, the entries in the fields are transferred to a leasing software, may have automated credit approval functions. Assuming the vendor is approved, (65) that same software will generate a conditional lease approval and a purchase order. Upon delivery, that same software will populate an equipment inspection request and a certificate of acceptance to be signed by the lessee. Once delivery is confirmed and acknowledged by the lessee, that same software will generate the lease documents and guaranties.

If leads are obtained from a vendor under a program agreement, then the vendor, will supply a completed credit application. No verification of the equipment or vendor is generally required, although site inspections on large dollar equipment is becoming the norm. Because, there may be strong expectations to approve the customer’s financing so long as the customer meets certain objective criteria usually specified in the program agreement. The bank needs to be careful as there are prohibitions against Bank entering into open-ended loan commitments. (66)

Finally, if the leads are obtained from a third party broker, underwriting is handled in two different ways, either as a simple referral, in which case, the lease is handled as a direct lease; or if the broker is handing the underwriting and signatures, in which case, the duties need to be proscribed by a formal broker agreement. It must be noted that there are a myriad of problems in dealing with brokered leases including the failure to be licensed by the States that require licensure, (67) and forgery or fraud in connection with the lease documents. (68) Great caution should be exercised in dealing with any broker, and the broker’s qualifications, license status, and track record should be vetted, as well as putting representations and warranties into a broker agreement.

The Back Office

There has been a growth in the leasing industry known as “The Back Office,” a third party company which provides portfolio services for smaller leasing companies which cannot afford servicing, underwriting, and lease processing for lessors. (69) Most of them have started from a leasing company which processed their own leases and eventually grew into providing service for banks, financial institutions, and other lessors.

Short List of Tasks if a Bank Wants to Enter the Leasing Market

For those banks that want to start up a leasing division, the process probably begins with the hiring of a leasing consultant and the short list of tasks include: determining the business model and the types of leases the bank wants to offer and what industries the bank wants to serve. If the division is a separate company, that company must obviously form and become licensed to conduct business in each State in which it will operate and arrange for personal property tax collection accounts. If the leasing will be done by the bank directly, then regulators need to be informed of this activity. The leasing workflow must set up with appropriate in house software and forms. (70)

Documentation Tips for the Bank Lessor

The Application

Because leasing is equipment and vendor focused, a bank credit application will probably be of little use. The lessor needs to know exactly what equipment will be purchased (so it can determine its value) and the exact vendor (so the lessor can vet the vendor). Finally, the lessor needs to know what kind of business the equipment will be used in and where that location is. The business type is important, as most lessors will not finance certain types of businesses (restaurants and trucking companies are often excluded). The location is important to determine the tax liability, and to run lien searches.

The Lease

Many fine articles have been written about lease terms, and there is no shortage of excellent lease forms available. A complete discussion of every possible term in an equipment lease is beyond the scope of this article. In brief, any lease should have, at the minimum, the following attributes:

▪ Hell and High Water Clause. This clause insures that the lease is non-cancellable and may not be the subject of setoff for non-functioning equipment or other reasons. (71) However, some courts have been reluctant to uphold the clauses where the equipment lacked inherent value, refusing to enforce the clause. (72)

▪ Waiver of Warranties. This clause insures that the lessor does not warrant the equipment, and the lessee has the benefit of whatever manufacturer’s warranties may be available. (73)

▪ Commercial Nature of Lease. This clause insures that the transaction is commercial and is not subject to Regulation Z (74) and although not generally applicable to banks, usury defenses. (75)

▪ Location of Equipment, Non-Assignment. This clause insures that the equipment will be used only at a specific location and that lease may not be assigned nor the equipment sublet. The stated location will have local tax implications (76) and the lessor wants to have documentary assurance that the equipment can be located at the address in the lease, and if the equipment is to be relocated, the lessee’s obligation is to notify the lessor or assignee.

▪ Taxes and Insurance. These clauses insure that the lessee will be responsible for personal property taxes (usually billed by the lessor) and will keep the equipment insured. (77)

▪ End of Lease Options. This clause will describe the end of lease options and will probably determine whether the lease is a “true lease” and entitled to special protections under Bankruptcy law, or is a lease intended as security. (78) While most leases are leases intended as security, riskier transactions should probably be booked as a true lease. The documentary options include making the purchase option of either fair market value, (79) 10% of the invoice price,(80) a $1 option (81) or some combination.(82) This clause will also describe how and when that option is to be exercised. Many lessor provide for automatic renewal of the lease for short periods if proper and timely notification of the intent of the lessee is not accomplished. Called an “evergreen clause,” they are subject to debate, but are generally upheld. (83)

▪ Remedies, Fees and Jurisdiction. These clauses will empower the lessor, in the event of default, to sue for damages, repossess the equipment, and impose various fees for late payments and advances. The agreement should also designate the jurisdiction in which any such controversy is to be litigated with some specificity. (84)

The Purchase Order

Purchase Orders are issued by the leasing company to the vendor. They are important to establish the responsibility of the vendor to deliver the specified equipment to the exact location, and to obligate the lessor to pay the invoice after delivery and acceptance. The lessor should consider including clauses for a material adverse financial change on the part of the lessee, choice of law, and a forum selection. The failure to issue a purchase order might provide the guarantor with additional defenses, so most lessors find the form essential.(85)

The Guaranty

Unlike bank documentation, guaranties in leasing transactions are shorter and usually not over one page. So long as the guaranty covers the basic waivers of various suretyship defenses such as a waiver as to resorting to the principal (86) or the collateral, (87) waiver of notice, as well as the lessor’s ability to compromise or alter the obligation,(88) a simple one page guaranty generally suffices. This is because the leasing company focuses on the equipment and vendor as a primary consideration, not necessarily the creditworthiness of the lessee.

Other Forms

Depending on the transaction, the leasing company will use other forms in its day to day operations, some of which may be adapted from banking forms. These include disbursement requests for used equipment subject to prior liens, upstream and downstream corporate guaranties, corporate resolutions, and subordination agreements.

Conclusion

The current credit crunch has been a disaster for many leasing companies which find obtaining cash to fund transactions scarce and expensive. This problem has forced many of the independent leasing companies out of business. However, one man’s problem is another man’s opportunity, and the problem is easily addressed by banks, which may borrow money from the Federal Reserve at near give away rates.

Because internal rates of return at are at 5% for the best of lease customers, the bank’s ability to borrow funds at near zero interest, makes leasing a very profitable opportunity to banks, now that regulations have been eased to allow banks to enter into this endeavor.

This industry vacuum is easily filled by small to medium sized banks, who may try to differentiate themselves with larger institutions and offer their customers a broader range of financial products. Leasing seems a natural option for those banks wanting to present a new face to their customers.

There are significant laws and regulations being imposed by Congress to redesign Dodd-Frank and the CFPB, both of which portend significant regulations of banks that may inhibit their ability to invest in leases. There are also accounting changes on the way, perhaps three or four years off.

Despite the political overtones, which add to the complexities, the number one consideration is the fact the banking and leasing industries differ greatly in concept and operation. The authors of this series believe the gap may be easily narrowed by banks, with a rudimentary understanding of lease underwriting and leasing operations. Equipment installment loans, equipment finance agreements, “finance” leases, and “operating” leases are an excellent business product when conducted with diligence and intelligence.

Footnotes:

History Part Four

PDF

[headlines]

--------------------------------------------------------------

Leasing Industry Help Wanted

Orange, California 3-5 Year underwriting experience

Underwrite 15 to www.quickbridgefunding.com |

|

Leasing Coordinator

www.dakotafinancial.com |

|

|

Positions Available in Irvine and San Diego

1 year experience preferred, salary/benefits |

| www.cflbc.com

Commercial Finance & Leasing Bank of Cardiff, Inc, a finance lender licensed pursuant to the California Finance Lenders Law, license #603G469 |

For information on placing a help wanted ad, please click here:

http://www.leasingnews.org/Classified/Hwanted/Hwanted-post.htm

Please see our Job Wanted section for possible new employees.

[headlines]

--------------------------------------------------------------

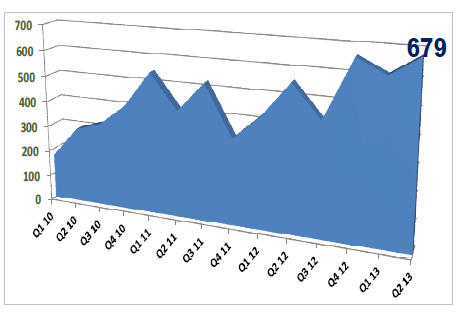

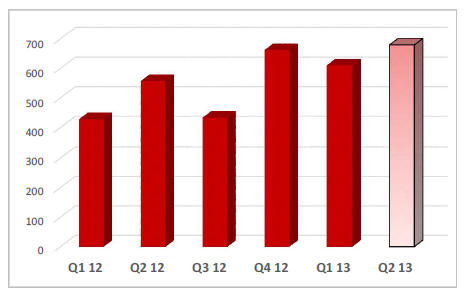

Lease/Asset Finance Market Heating Up

ZRG Partners Second Quarter Up-date

The ZRG Partners, Boston, Massachusetts, reports the hiring index for the second quarter jumped 10% from previous quarters’ numbers and has hit the highest level since 2008. The report echoes from banks, finance, and leasing companies reporting difficulty in recruited experienced employees in their industries.

Recognized as a global authority of talent management issues, ZRG states, "This quarters’ surge is driven by broad 'online' job openings across several tracked sources and includes a wide range of roles, from business development and volume focused opportunities to risk and operational roles.

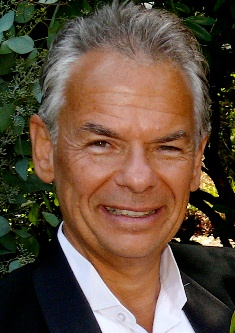

Larry Hartman

Managing Partner

ZRG Partners

West Orange, New Jersey

"The market is heating up in the US in every way it seems for talent and for acquisitions," Larry Hartman, Managing Partner, ZRG Partners told Leasing News.

"Part of the increase could be tracked to the current industry phenomenon of 'musical chairs' that is occurring with a slew of lift outs taking place with new banks entering the space, causing pain and disruption within the headcount of the affected firms." A good example of this was the hiring of 21 "professional" by Capital One Financial, including 11 who came from SunTrust Bank."

http://leasingnews.org/archives/Jun2013/6_13.htm#more

The ZRG Second Quarter report concludes: "Coupling this trend with existing players seeking volume and a continued interest from Wall Street and private equity firms in the space has created a talent shortage to fill the 2013 plans for volume.

ZRG Report:

http://leasingnews.org/PDF/ZRG2ndQ_72013.pdf

| Working Capital Loans $10,000-$250,000 | |

|

|

[headlines]

--------------------------------------------------------------

Signs of an Immanent Layoff

Career Crossroad---By Emily Fitzpatrick/RII

Question: If a layoff is imminent with my current employer, are there signs I should be looking for?

Answer: A lay-off is different from being let go (“fired”) for under performance. If you are performing well and there are rumblings of a merger / acquisition or downsizing, you must be prepared. Number One Rule – “Avoid putting your head in the sand.” For example, (1) when a company merges, the elimination of duplicate employees is a TOP priority (2) If you hear the word “restructuring” that is a pretty good indication that there will be layoffs (3) additionally, an infusion of “new blood’ is typically accompanied by a decision to purge the “old blood!”

Believe me, heads have rolled and not solely because of the recent recession – it is ultra-competitive out there.

It is my experience in today’s environment: continued employment no longer depends on loyalty – any employee can be laid off at any time! Your ability to keep yourself employed will depend upon your ability to see “the writing on the wall”, your ability to accept facts about today’s work environment and an openness / willingness to consider other career opportunities / employers and your ability to deliver results under changing market conditions.

Accept the fact that you will not work for one employer for the bulk of your career – this is no longer viable. Look at the Leasing News Weekly “New Hires--Promotions” and note how many changes a person goes through during their career; many from companies being acquired or merged.

Again, continued employment no longer depends on company loyalty - be prepared and ask yourself where would a layoff leave you?

Make sure you are continuously assessing the health of your employer so you will have the chance to make informed decisions about the kinds of changes you must make. Sometimes looking for another career opportunity (or being open to exploring) before the ax falls is the BEST course of action. Get a hold of a recruiter who can assist you in your potential career move.

Best advice - keep your eyes and ears open - remember to be loyal to yourself and your family first and foremost!

Emily Fitzpatrick

Sr. Recruiter

Recruiters International, Inc.

Phone: 954-885-9241

Cell: 954-612-0567

emily@riirecruit.com

Invite me to Connect on LinkedIn

www.linkedin.com/pub/emily-fitzpatrick/4/671/76

Also follow us on Twitter #RIIINFO

Career Crossroads Previous Columns

http://www.leasingnews.org/Conscious-Top%20Stories/crossroad.html

[headlines]

--------------------------------------------------------------

Leasing 102

by Mr. Terry Winders, CLP

Non-compete contracts

This is a response to a question regarding non-compete contracts from a friend of mine, Cole Sliver, a lease attorney from Moorestown, New Jersey. I thought it would be best to pass it on:

Often employees are required to sign non-compete and non-solicitation agreements as part of their employment.

Often, some think that they really don't amount to much.

But a recent ruling entered in Pennsylvania state court is a stark reminder to employers and employees about the dangers associated with violating post-employment restrictive covenants such as non-compete and non-solicitation provisions.

The case, captioned as B.G. Balmer & Co. Inc. v. Frank Crystal & Co., centered around the question of whether a group of insurance brokers violated the non-solicitation clause in their employment agreements with Balmer. The group of departing employees first began to consider switching insurance brokers from Balmer to Crystal when they individually met with a recruiter in May, 2003.

Only a few months later, in July, 2003, the group of employees all resigned from Balmer on the same day in order to start working for Crystal. Subsequent to their collective departure, approximately twenty clients switched insurance brokers from Balmer to Crystal.

Balmer filed suit alleging the twenty clients switched insurance

brokers as a result of the employees’ breaches of the non-solicitation

clauses in their employment agreements. An injunction was

granted in Balmer’s favor.

At trial, the judge concluded Crystal and the employees should be

held liable. The judge emphasized the record was “replete with instances” where the employees violated their contractual obligations to Balmer including the non-solicitation provision.

Based upon this finding, the judge not only awarded Balmer $2.4 million in compensatory damages, but also $4.5 million in punitive damages.

The $6.9 million award is one commands attention from employers

who hire employees from competitors.

Be careful with these.

Mr. Terry Winders, CLP, has been a teacher, consultant, expert witness for the leasing industry for thirty years and can be reached at terrywinders11@yahoo.com or 502-649-0448.

He invites your questions and queries.

Previous #102 Columns

http://www.leasingnews.org/Conscious-Top%20Stories/Leasing_102/Index.htm

Mr. Terry Winders available as Expert Witness. 35 years as a professional instructor to the top equipment leasing and finance companies in the United States, author of several books, including DVD's, as well as weekly columnist to Leasing News. He also performs audits of leasing companies as an expert on documentation, and has acted as an expert witness on leasing for litigation in legal and tax disputes, including before the IRS. He also has taught the senior bank examiners, how to review a bank leasing department, for the Federal Reserve in Washington D.C. and has trained the examiners for the FDIC on how to prepare a lease portfolio for sale.

Mr. Winders received his Master of Business Administration and his Bachelor of Science degrees from the College of Notre Dame. 502.649.0448/terrywinders11@yahoo.com |

(This ad is a “trade” for the writing of this column. Opinions

contained in the column are those of Mr. Terry Winders, CLP)

[headlines]

--------------------------------------------------------------

Leasing News Advisor

Andrew Lea

![]()

Andrew Lea joined the Leasing News Advisory Board on February 5, 2004. Andrew is a financial services technology marketing pro with extensive experience in the commercial lending and equipment finance sector. He has built a reputation in the industry for designing and executing effective branding and lead generation programs, as well as for attention-grabbing ads and collateral, engaging website design, and innovative editorial content in industry publications.

Marketing Manager

HCL CapitalStream

Pt. Richmond, CA 94801

(510) 236-3766

Andrew.lea@hcl.com

SKYPE: andrew-lea

Andrew serves as Sr. Marketing Manager for Linedata Lending & Leasing, provider of the Linedata Capitalstream leasing and lending front office solution, a straight-through-processing origination and risk management platform. Linedata Lending and Leasing is part of the Linedata Group, a global solutions provider with 700+ clients operating in 50 countries. With more than 1000 employees across the globe, Linedata provides innovative mission-critical solutions and services that help its clients compete and grow, managing 7.1 million credit and financing contracts daily.

Before joining the CapitalStream team, Andrew served as VP for Marketing and Corporate Communications for NetSol Technologies (NTWK) and McCue Systems. Andrew's professional experience includes technical writing and broadcast advertising copywriting and production.

His articles and white papers on equipment finance trends and technology have appeared in many trade publications.

Andrew and his wife Susan live in the San Francisco Bay Area. He holds a Bachelor's Degree from the University of California at Berkeley and a Master's Degree from the New School University in New York City.

He may be reached at andrew.lea@na.linedata.com

[headlines]

--------------------------------------------------------------

Top Stories July 15--July 19

(You May Have Missed)

Here are the top stories opened by readers:

(1) Balboa Capital, Irvine, California

$20,543.22 Bulletin Board Complaint

Alleged “Bait and Switch”

http://leasingnews.org/archives/Jul2013/7_19.htm#bbc

(2) Bulletin Board Complaint

Unnamed Leasing Company

http://leasingnews.org/archives/Jul2013/7_17.htm#bbc

(3) Correction—Top Five Leasing Web Sites—in North America

http://leasingnews.org/archives/Jul2013/7_17.htm#correction

(4) MB Financial Taylor Cole Merger

Good for Leasing Industry

http://leasingnews.org/archives/Jul2013/7_17.htm#merger

(5) Pictures from the Past

1984--Anatomy of a Lease

http://leasingnews.org/archives/Jul2013/7_15.htm#pictures

(Tie) (6) Leasing 102 by Mr. Terry Winders, CLP

Tools for Leasing Sales

http://leasingnews.org/archives/Jul2013/7_15.htm#tools

(Tie) (6) Sales Makes it Happen by Steve Chriest

Anger and the "80% Rule"

http://leasingnews.org/archives/Jul2013/7_17.htm#anger

(8) Top Five Leasing Web Sites—in North America

http://leasingnews.org/archives/Jul2013/7_15.htm#sites

(9) Four Hot Franchises QSRmagazine.com

http://leasingnews.org/archives/Jul2013/7_19.htm#franchise

(10) New Hires—Promotions

http://leasingnews.org/archives/Jul2013/7_19.htm#hires

(11) "Commitment to Lease" Agreements

http://leasingnews.org/archives/Jul2013/7_15.htm#commitment

[headlines]

--------------------------------------------------------------

SBA Loans Only Increased 3.1%

Compared to Previous Period of 6.9%

The number of small business loans increased from 21.3 million to 23.5 million from June, 2012 to June, 2013; the total small business loans outstanding continued to decline by 3.1 percent this year as opposed to 6.9 percent last year, reports the SBA Office of Advocacy in its recent study of depository lending institutions. The study is used by many potential borrowers to identify small business friendly lending institutions in their community, while banks use the information to analyze the competition in their market.

"While overall small business lending continues to decline, we are not seeing the sharp decline we saw in recent years. More importantly, the study shows an increase in the number of small business loans which underscores the positive turn in our country's economic landscape," said Dr. Winslow Sargeant, Chief Counsel for Advocacy.

The report noted, "While large business borrowing increased, total small businesses borrowing from depository lenders remained weak for both commercial real estate and commercial and industrial loans under $1 million. However, C&I lending in amounts under $100,000 was up in both the number and amount of loans for the first time since 2010.

The full report is available with date on all lenders by state. These tables cover small business lending under $1 million and micro-business lending under $100,000:

http://www.sba.gov/advocacy/7540/719311

[headlines]

--------------------------------------------------------------

Fall 2013 Leasing Conferences---Save the Date

Canadian Finance &

Leasing Association

September 18-20

Marriott Halifax

Harbourfront, Halifax

September 27-28, 2013

2013 NAELB Western Regional

Irvine, California

2013 Funding Symposium

October 10-13

Nashville Marriott

at Vanderbilt University

Nashville, Tennessee

October 10-11

2013 Annual Convention

Rome, Italy.

http://www.annual-convention.eu/

October 20-22

ELFA 52nd Annual Convention

JW Marriott Grande Lakes-Orlando, Florida

November 1-2, 2013

2013 Eastern Regional

Nashville, Tennessee

November 6-8, 2013

Boca Raton Resort Club, Boca Raton, FL

Commercial Finance Association

69th Annual Convention

November 13 - 15

JW Marriott Los Angeles at L.A. LIVE

Los Angeles, CA

Schedule of Activities

Link

Early Registration Fees

(Until Friday, August 30, 2013)

Member: $1,195

Non-member: $1,795

Standard Registration Fees

(Saturday, August 31, 2013 – Friday, November 8, 2013)

Member: $1,295

Non-member: $1,895

On-site Registration Fees

(After Friday, November 8, 2013)

Member: $1,395

Non-member: $1,995

Registration

Link

((Please click on ad to learn more))

(Leasing News provides this ad “gratis” as a means

to help support the growth of Lease Police)

[headlines]

--------------------------------------------------------------

Fernando's View

By Fernando F. Croc

Giant robots ("Pacific Rim") and brooding bloodsuckers ("Byzantium") make for a mystical time at the box-office, while DVD releases offer period drama ("42"), rousing action ("Bullet to the Head") and stylish horror ("Black Sabbath").

In Theaters:

Pacific Rim (Warner Bros. Pictures): For audiences who like their gargantuan blockbuster action with smarts as well as thrills will be in heaven with writer-director Guillermo Del Toro's large-scale extravaganza. Set in the future, when a legion of monstrous creatures known as the Kaiju have risen from the sea, the story finds humanity engaged in a fierce battle for its own survival. To fend off this reptilian Armageddon, scientists have designed gigantic, mind-operated robots known as Jaegers to engage in rock 'em sock 'em combat. With a troubled veteran (Charlie Hunnam) and an eager newcomer (Rinko Kikuchi) at the controls, the fate of the planet hangs by a thread. Brimming with eye-popping special effects and Del Toro's breathless sense of humor and wonder, this is a rare summer thrill-ride displaying both brains and brawn to spare.

Byzantium (IFC Films): After the vapid teenage moping of the "Twilight" series, the vampire genre gets a welcome transfusion of new blood in this moody blend of horror and drama. The story centers on Clara (Gemma Arterton) and Eleanor (Saoirse Ronan), a couple of beautiful young women who move to a lonely town off the coast of Ireland as mother and daughter. As they find refuge in an abandoned place known as Byzantium run by Noel (Daniel Mays), they gradually reveal their secret: they are in reality centuries-old vampires who need human blood to survive, a need that becomes something of a problem as they begin falling in love with local men. No stranger to dark fairytales, director Neil Jordan ("The Crying Game," "Interview with the Vampire") crafts an evocative tale of danger, desire and longing that favors poetry over gore.

Netflix Tip: Though only now entering the realm of the blockbuster with "Pacific Rim," Guillermo Del Toro has for years served up fascinating blends of fantasy and horror. Check out Netflix for his earlier successes, which include "Cronos" (1992), "The Devil's Backbone" (2001), "Hellboy" (2004) and "Pan's Labyrinth" (2006). |

On DVD:

42 (Warner Bros.): Jackie Robinson, the legendary baseball player who broke through sports as well as racial barriers, receives an appropriately dignified tribute in this biopic directed by Brian Helgeland. Taking place in the late 1940s when black athletes were barred from most teams, the film follows Robinson (played by Chadwick Boseman) as he's signed as part of the Brooklyn Dodgers by executive Branch Rickey (Harrison Ford in a deliciously peppery performance). The controversial decision is met with hostility from fans and other players alike, which heightens this portrayal of Robinson as a man transcending confrontations and bringing people together at the stadium. Though hardly surprising, this sports drama is guaranteed to be a crowd-pleaser with audiences.

Bullet to the Head (Warner Bros.): Two icons of 1980s action cinema, director Walter Hill and superstar Sylvester Stallone, team up for this brawling, rousing thriller. Stallone plays Jimmy Bonono, a veteran killer-for-hire whose most recent assignment leads him to cross paths with a driven detective named Taylor (Sung Kang). Though the two are mismatched in just about every way, they forge an unlikely alliance when pitted against a corrupt mastermind (Adewale Akinnuoye-Agbaje). The plot may not be original, but, as with fellow aging muscleman Arnold Schwarzenegger in "The Last Stand," there's something almost heroic about Stallone's durable persona. And Hill keeps things moving with his punchy direction, culminating in a showdown between Jimmy and a lethal mercenary (Jason Momoa) that will leave audience gasping.

Black Sabbath (Kino): A master of stylish horror much loved by movie buffs, Italian director Mario Bava serves up a series of delectable frights in this atmospheric tree-part thriller from 1963. In the first segment, "The Telephone," a beautiful young French woman (Michele Mercier) is slowly driven mad by mysterious phone calls which seem to be coming from some other, less human place. In "The Drop of Water," a British nurse learns the real meaning of "scared to death" when she has to prepare the corpse of an elderly fortune teller. Finally, in "The Wurdalak," horror legend Boris Karloff stars in a tale of haunted past catching up with characters in 19th-century Russia. Featuring tons of the director's characteristic voluptuous camerawork and impish sense of humor, this is an underrated gem that confirms Bava's status as a one-of-a-kind stylist.

[headlines]

--------------------------------------------------------------

Leasing Attorneys

Leasing Attorneys

| Birmingham, Alabama The lawyers of Marks & Weinberg, P.C. have over 30 years experience in dealing with virtually every type of equipment financing and are recognized throughout the industry for prompt, practical solutions and exemplary service. They offer cost-conscious, effective lease enforcement and good counsel. Email: Barry@leaselawyer.com Website: www.leaselawyers.com |

California, National: city: Riverside Ellen Stern - get results, reasonable pricing; numerous industry contacts, nearly 30 yrs exp.in SoCal, 20 yrs equip.: CFL license specialist, documentation, work-outs, litigated collections, recoveries; deal-maker. Email: leaselaw@msn.com |

||

|

Connecticut, Southern New England: EVANS, FELDMAN & BOYER, LLC Collections, litigation, documentation, portfolio sales and financing, bankruptcy. We represent many of the national and local leasing companies doing business in this state. Past chairman EAEL legal committee. Competitive rates. email: rcfeldman@snet.net |

||

| Los Angeles, Southern CA Seasoned attorney representing secured creditors in auto finance and truck/equipment lease industry. Bankruptcy and State Court litigation. Vincent V. Frounjian (818) 990-0605 or email: vvf@pacbell.net. |

Encino, California: Statewide “ELFA” |

||

Los Angeles, Statewide: CA. "ELFA" Aggressive creditors rights law firm specializing in equipment leasing handling collection matters on a contingency, fixed fee or hourly cbasis. |

Los Angeles -statewide: CA "ELFA" |

||

Los Angeles- Statewide, CA Lawyer specializing in banking and leasing issues statewide. Documents and litigation. Tom McCurnin, Barton, Klugman & Oetting. Voice: (213) 617-6129 Cell:(213) 268-8291 Email: tmccurnin@bkolaw.com |

|||

Long Beach, CA |

Long Beach CA. |

||

Illinois Website: www.trabaris.com. Blog:trabaris.com/info/blog/ |

Law Firm - Service, Dallas, TX. "ELFA" Mayer regularly practices in leasing, secured financing, project development and finance and corporate finance. email: dmayer@pattonboggs.com Website: www.pattonboggs.com |

||

| National: The OMEGA Network Group-nationwide legal representation of small and mid ticket equipment lessors-flat fee bankruptcy & replevin, contingent collection, billable litigation (704-969-3280) tong_92@yahoo.com |

National: Coston & Rademacher: Business attorneys serving the lease-finance industry since 1980. Transactional, documentation, corporate/finance, workouts, litigation, bankruptcy, portfolio management. Chicago-based national practice. Jim Coston, CLP (Members: ELFA, NEFA). |

||

| St. Louis County , MO. - statewide: Schultz & Associates LLP., collections, negotiation, and litigation. Also register and pursue recovery on foreign judgments. Contingency and reasonable hourly rates. Ronald J. Eisenberg, Esq. (636) 537-4645 x108 reisenberg@sl-lawyers.com www.sl-lawyers.com |

NJ,De,Pa: Specializing in leased equipment/secured transactions. Collections, replevins/workouts reasonable rates. Sergio Scuteri/Capehart & Scratchard, PAsscuteri@capehart.com / www.capehart.com | ||

| New York and New Jersey Peretore & Peretore, P.C. documentation, portfolio purchase & sale, replevin, workouts, litigation, collection, bankruptcy. Aggressive. Over 25 years experience.www.peretore.com |

Thousand Oaks, California: |

[headlines]

--------------------------------------------------------------

Boxer/Labrador Retriever Mix

Federal Way, Washington Adopt-a-Dog

Sweet Pea

Female

Color: Golden/Orange/Chestnut - With White

Age: Two Years

Size: Med. 26-60 lbs. (12-27 kg)

"I am already spayed, housetrained, up to date with shots, good with kids, good with dogs, and good with cats.

Sweet Pea Her Name Says It All's Story...

"Here's adorable Sweet Pea! Her name does say it all! She is easy going and sweet an fun and high energy. But she settles down very nicely in the house and will find a pet bed right away! She's only 2 years old and weighs 45 lbs. but is always up for a walk or a run. She can’t wait for her Northwest summer!

"This amazing girl was rescued out of high kill Georgia shelter at the very last hour and we're very happy about that. Sweet Pea loves car ride and long walks and can’t wait for the beach! She is good on the leash, only somewhat pully and is working on her basic skills, though she will need you to help with her training. Pea is crate trained and housetrained and loves her doggie friends .

"She will be a good playmate and fun adventure partners. calm around kids, Pea is fun and friendly and such a happy girl, We've not cat tested her yet but she is smart and easily motivated to learn. We'd love to have you meet her very soon."

Contact Pam at raincityrescue@gmail.com or go to www.raincityrescue.com for an online application.

Rescue Group: Rescuing Animals In Need (RAIN)

E-mail: rescuinganimals@gmail.com

Let 'em know you saw "Sweet Pea Her Name Says

It All" on Adopt-a-Pet.com!

Website: http://www.raincityrescue.com

Address: Federal Way, WA 98093

Adopt-a-Pet by Leasing Co. State/City

http://www.leasingnews.org/Conscious-Top%20Stories/Adopt_Pet.htm

Adopt a Pet

http://www.adoptapet.com/

[headlines]

--------------------------------------------------------------

Orange, California 3-5 Year underwriting experience

Underwrite 15 to www.quickbridgefunding.com |

![]()

News Briefs----

Bank in Madoff Case Settles With Some Plaintiffs

---and Gets Favorable Jury Ruling

http://dealbook.nytimes.com/2013/07/18/jury-largely-sides-with-bank-in-madoff-related-case/

Restaurants Made Up 75% of Franchise Job Growth in June

http://www.qsrmagazine.com/news/restaurants-made-75-franchise-job-growth-june

[headlines]

--------------------------------------------------------------

---You May Have Missed

A Shuffle of Aluminum, but to Banks, Pure Gold

http://www.nytimes.com/2013/07/21/business/a-shuffle-of-aluminum-but-to-banks-pure-gold.html?ref=business

[headlines]

--------------------------------------------------------------

SparkPeople--Live Healthier and Longer

![]()

What to Eat This Summer

http://www.sparkpeople.com/resource/nutrition_articl

[headlines]

--------------------------------------------------------------

![]()

Baseball Poem

A Baseball Game (Free verse)

The ump showed up early.

Sharply dressed

His pants, meticulously creased.

His gold watch glinting in the 4 o'clock

End of March southern California sun.

He held a sour look

It was his first line of defense.

The manager of the Astros

Was what you might call

An easy going type.

A long-time bachelor, and a slob to boot.

He always had a quick sly grin

Popped his gum unceasingly.

His face like an old first-baseman's glove;

Tanned brown with wear,

The stitching undone,

Staggeringly wrinkled from so much daily use.

He strolled over to home,

Tugging at the bottom of his extra-large shirt

Which barely covered the expanse of his girth,

Slapped the ump on the back

and announced that the teams

were a little behind getting the field ready

and could we start the game at a quarter past?

The ump looked at his watch without saying a word

Held up his right hand for a moment,

Then brought it down like an ax,

"Play Ball!" he shouted

2 inches from the Astros manager's leathery face.

[headlines]

--------------------------------------------------------------

Sports Briefs----

Phil Michelson Talks Final Round 2013 Open Championship

http://www.youtube.com/watch?feature=player_embedded&v=Vjo5z534eTE

Woods flops again on another major stage

http://www.ajc.com/news/ap/top-news/woods-flops-again-on-another-major-stage/nYySy/

49ers enter training camp on renewed Super Bowl quest

http://www.contracostatimes.com/breaking-news/ci_23703520/49ers-enter-training-camp-renewed-super-bowl-quest

http://blogs.sacbee.com/49ers/archives/2013/07/90-niners-every-player-review-of-the-49ers-training-camp-roster.html

NHL schedule reveals 2013-14 San Jose Sharks to be in new Pacific Division

http://www.examiner.com/review/nhl-schedule-reveals-2013-14-san-jose-sharks-to-be-new-pacific-division

[headlines]

--------------------------------------------------------------

![]()

California Nuts Briefs---

Kayaking fastest growing outdoors sport

http://blog.sfgate.com/stienstra/2013/07/18/kayaking-fastest-growing-outdoors-sport/

[headlines]

--------------------------------------------------------------

![]()

“Gimme that Wine”

http://www.youtube.com/watch?v=EJnQoi8DSE8

Final Days to Participate in Second Wine Industry Financial Benchmarking Survey---Closes Today

http://www.winebusiness.com/news/?go=getArticle&dataid=119431

Feds continue search for indicted Napa wine exec

http://napavalleyregister.com/news/local/feds-continue-search-for-indicted-napa-wine-exec/article_0fb6896e-ee79-11e2-b371-001a4bcf887a.html

Sauvignon Blanc Lost at Sea

http://www.winespectator.com/webfeature/show/id/48692

The family business of Wisconsin wine making

http://www.waow.com/story/22869296/2013/07/17/the-family-business-of-wisconsin-wine-making

Free Mobile Wine Program

http://leasingnews.org/archives/Feb2010/2_26.htm#mobile

Wine Prices by vintage

http://www.winezap.com

http://www.wine-searcher.com/

US/International Wine Events

http://www.localwineevents.com/

Winery Atlas

http://www.carterhouse.com/atlas/\

Leasing News Wine & Spirits Page

http://two.leasingnews.org/Recommendations/wnensprts.htm

[headlines]

----------------------------------------------------------------

![]()

This Day in History

1587-The second English colony established on Roanoke Island off North Carolina . The Roanoke Island Colony, sponsored by sir Walter Raleigh, was established on Roanoke Island, off the northeast coast of what is now North Carolina , under the leadership of Sir Richard Grenville and Sir Ralph Lane . the settlers fared badly and returned to England in June of 1586. In 1587, Raleigh sent out another group under John White, consisting of 117 men, women and children, who landed this day. White returned to England for supplies, but was unable to get back to Roanoke until August 17, 1590, three years later. He found all the colonists gone; the only clue to their fate was the word Croton carved on a tree. The meaning of this remains unexplained and no trace was ever found of the settlers. Whether they met their fate by Indians, a cold Winter, lack of food, or disease is not known.http://personal.pitnet.net/primarysources/ronoake.html

1620- A small congregation of English Separatists, led by John Robinson, began their emigration to the New World . Today, this historic group of religious refugees has come to be known as the 'Pilgrims.' Pastor John Robinson was the last face the Pilgrims saw as their ship left for the New World . He never made it to America , but this one man is credited with planting a single word — independencehttp://www.ohioroundtable.org/cfdocs/shows.cfm?

showcode=968&fromhome=YES

http://www.revjohnrobinson.com/art.htm

http://www.mlp.org/sermon.html

http://members.aol.com/calebj/robinson_letter.html

http://www.newnorth.net/~johhnson/~jrobinson.html

1667- New Netherland was ceded to England by the Dutch by the Peace of Breda, which ended the second Anglo-Dutch War (1665-1667). The British had captured Fort Amsterdam and divided the territory into New Jersey and New York . Colonization was slow and the territory was re-organized in 1674.

http://www.infoplease.com/ce6/history/A0816459.html

http://www.infoplease.com/ce6/history/A0857845.html

1724 The Alamo , to become famous as the site of a great battle of the war for Texan independence in 1836, was constructed at about this time as a Franciscan mission.

http://www.thealamo.org/faqs.html#one

http://www.americanwest.com/pages/alamo.htm

1796-Surveyors commissioned by General Moses Cleaveland (sic.) completed the plan for the town of Cleaveland (sic.), Ohio . ( lower half of:

http://memory.loc.gov/ammem/today/jul22.html )

http://www.travelcleveland.com/About_Cleveland/cleveland_history.asp

1860-Birthday of Mother Marie Joseph Butler - Irish-born Roman Catholic American nun. As the Mother General of the Congregation of the Sacred Heat of Mary, she began the Marymount school system. She opened 14 schools in the United States , three of which became colleges.

1861-An intention to issue an Emancipation Proclamation was announced by President Lincoln to his Cabinet. He read the entire proclamation. He wanted to issued it the same day as strictly military effort to cripple Confederate manpower. His Cabinet persuaded him to wait as it was not good political timing, both because the Union was not doing well in the war, and many politicians were questioning the cause. Lincoln argued it needed to be done soon, but was persuaded to wait for a more favorable military situation to avoid the appearance of “desperation.”

1864- The Battle of Atlanta , GA. Young General John Bell Hood attacks General William Tecumseh Sherman, resulting in terrible loses for the Confederate Army; Estimated casualties: 12,140 (3,641 Union , 8,499 Confederate)

http://ngeorgia.com/history/battleofatlanta.html

http://www2.cr.nps.gov/abpp/battles/ga017.htm

http://www.civilwarhome.com/hoodbio.htm

http://ngeorgia.com/people/hood.html

http://home.sprynet.com/~randyyoung/ransom.htm

1886-In San Francisco a brewery workers union formed last month among mostly socialist German workers, to resist the prevailing 16-18 hour workday. Today breweries admitted defeat & gave in to union demands for FREE BEER, the closed shop, freedom to live anywhere for brewery workers (who had, until now, typically lived in the brewery itself), a 10-hour day, six-day week, & a board of arbitration.

1872-birthday of Tom “Boss” Pendergast, St. Joseph , MO

http://www.allaboutjazz.com/jazznew.htm

http://www.energy2001.ee.doe.gov/GoinToKC.htm

http://www.experiencekc.com/truman.html\

http://organizedcrime.about.com/library/weekly/aa102500a.htm

1882-birthday of painter Edward Hopper, Nyack , NY .

http://www.artchive.com/artchive/H/hopper.html

http://sunsite.dk/cgfa/hopper/

http://artcyclopedia.com/artists/hopper_edward.html

http://sheldon.unl.edu/HTML/ARTIST/Hopper_E/AS.html

http://art-posters-art-prints.com/edward-hopper.html

http://www.mcs.csuhayward.edu/~malek/Hopper.htm

1888-brithday detective novelist Raymond Chandler

http://www.america.net/~davdmock/chandler.htm

http://www.hifibliss.com/peter/chandler.htm

http://www.kirjasto.sci.fi/rchandle.htm

http://hometown.aol.com/chandlerla/

http://www.angelfire.com/sd/kreelah/chandler.html

http://www.amazon.com/exec/obidos/search-handle-form/

102-8899986-2380120

1890- Rose Kennedy Birthday. If you travel to Boston , be sure to see the

Italian section and where she grew up. Rose Kennedy became the epitome of a stalwart woman who maintained her dignity while her wealthy husband openly flaunted his many adulteries and somehow maintained her composure when three of her four sons were killed, her other son caused the death of a young woman, and a daughter proved to be mentally limited.

http://www.wic.org/bio/rkennedy.htm

http://www.geocities.com/CapitolHill/Senate/1968/rose.htm

http://www.amazon.com/exec/obidos/ASIN/0791016226/

avsearch-bkasin-20/103-5362656-4423850

1890- the observation “Everybody talks about the weather, but nobody does anything about it” was written by editor Charles Dudley Warner in the Hartford Courant., The remark has wrongly attributed to his Hartford friend Mark Twain.

1893-birthday of Karl Menniger, American psychiatrist, born at Topeka , KS . Along with his father and brother, he founded the Menniger Clinic and Foundation at Topeka in the 1920s. He died July 18, 19990, at Topeka .

1899-birthday of sculptor Alexander Calder.http://memory.loc.gov/ammem/today/jul22.html

1906-Birthday of Writer and pilot Anne Morrow Lindbergh, Englewood , New Jersey . Lindbergh attended Smith College , where her writing won several coveted literary awards. At age 23, she married celebrated aviator Charles Lindbergh, who had made the first transatlantic solo flight in 1927. The couple flew frequently, and she became the first woman to receive a glider pilot's license. She got her airplane pilot's license in 1931 and published several books about her experiences, including North to the Orient (1935), about the couple's flight over Canada and Alaska to Asia. The couple's infant son was kidnapped for ransom in 1932, which led to his death. The tragedy affected the entire nation. In 1934, she became the first woman to win the National Geographic Society Hubbard Gold Medal. Her 1944 book, “Gift from the Sea” became a bestseller and was reissued in a special anniversary edition 25 years after its publication.

1908- Amy Vanderbilt birthday- U.S. author. AV wrote Vanderbilt's Complete Book of Etiquette that took a more modern approach to manners and etiquette than did Emily Post.

http://www.allperson.com/allperson/legend/0000000893.asp

http://www.quotationspage.com/quotes.php3?author=Amy+Vanderbilt

1915-birthday of trumpet player/singer Taps Miller, Indianapolis , IN

http://seattletimes.nwsource.com/html/artsentertainment/

134463975_lawrence17.html

1916-A bombing in San Francisco during a Preparedness Day parade killed 10 persons and wounded 40. In 1917 labor leader Tom Mooney was sentenced to hang and Warren K. Billings was sentenced to life imprisonment for the dead. President Wilson commuted Mooney's sentence to life imprisonment in 118, but because of confessions of perjured testimony at the trial, the case was an international cause celebre for many years. On January 8, 1939, Governor Culbert L. Olson of California pardoned Mooney. Billings was released a later in the year.

1917-July 22, Lou McGarity Birthday http://shopping.yahoo.com/shop?d=product&id=1927006

998&clink=dmmu.artist&a=b

Feast day of Mary Magdalene, who, according to Biblical texts, witnessed both the crucifixion and the resurrection of Jesus. According to Biblical texts, she was the only one of Jesus' followers to do that - and the only one to whom Jesus spoke at the tomb - avoiding Peter and asking her to explain to everyone that he was ascending to heaven. Many feminist religious scholars cite Jesus' orders to Mary Magdalene, asking her to spread the word as surpassing the Pauline (Paul) later philosophy that women were not to speak in church or teach men.

http://elvis.rowan.edu/~kilroy/JEK/07/22.html

http://www.pbs.org/wgbh/pages/frontline/shows/religion/

maps/primary/mary.html

http://www.st-mary-magdalene.org/newpage4.htm

http://www.magdalene.org/biblical.htm

1918 - A single bolt of lightning struck 504 sheep dead in their tracks at the Wasatch National Forest in Utah. Sheep often herd together in storms, and as a result the shock from the lightning bolt was passed from one animal to another.

1924- singer Margaret Whiting was born in Detroit . Her father was the famous songwriter Richard Whiting. She began her career in the early 1940's singing with the bands of Freddie Slack and Billy Butterfield. With trumpeter Butterfield, Whiting recorded the 1944 million-seller "Moonlight in Vermont ." Her 1948 recording of "A Tree in the Meadow" also sold a million, as did her 1949 duet with Jimmy Wakely, "Slippin' Around."

http://www.northwood.edu/dw/1994/whiting.html

1924-birthday of pianist Al Haig, Newark , NJ

http://music.barnesandnoble.com/search/artistbio.asp?

userid=0HNQVIRQ19&ctr=70344

http://www.bobjanuary.com/alhaig.htm

http://jazzinstituteofchicago.org/index.asp?target=/

jazzgram/people/alhaig.asp

http://www.amazon.com/exec/obidos/external-search/102-8899986-2380120?tag=drjohnholleman&keyword=al+haig&mode=music

http://music.zodchiy.com/A/Al_Haig.html

1924-birthday of Tensor tax Bill Perkins.http://music.barnesandnoble.com/search/artistbio.asp?

userid=0HNQVIRQ19&ctr=70886

1930-The Philadelphia Athletics executed a triple steal in the first inning of a game against the Cleveland Indians and another one in the fourth inning. This is the only game in which two triple steals have occurred.

1933-the first Opera prima donna who was African American was Caterina Jarboro (born Katherine Yarborough in Wilmington, North Carolina,) who appeared as Aida, the Ethiopian slave, in Giuseppe Verdi's opera Aida, presented by Alfredo Salmaggi's Chicago Opera Company at the New York Hippodrome, Sixth Avenue and 43 rd Street, New York City. Caterina attended school in Wilmington (where she is noted in their “Walk of Fame” until, at age 13, she journeyed to New York to study music. During her illustrious career, she achieved international fame as a soprano and paved the way for other talented African-Americans in American opera. Caterina performed in many of the world's great opera houses, including Paris , Vienna , Warsaw , Madrid , Moscow and the United States . She also thrilled Wilmington audiences on two occasions by performing at the Academy of Music (Thalian Hall) and the Williston High School auditorium . Died August 23,1986 at the age of 88. Manhattan , NY

http://www.spinnc.org/spinsites/arts/wof_jarboro.htm

1934-birthday of tenor sax player Herman “Junior” Cook, Pensacola , FL

Died February 4,1992. http://members.tripod.com/~hardbop/jrcook.html

http://www.fantasyjazz.com/catalog/cook_j_cat.html

1936-birthday of Don Patterson, organ, Columbus , OH

http://www.amazon.com/exec/obidos/tg/stores/artist/glance/-/49897/ref=m_art_dp/102-8899986-2380120

1937 - Hal Kemp and his orchestra recorded the now-standard, "Got a Date with an Angel", for Victor Records in Hollywood , California . The distinctive vocal on the tune is provided by Skinnay Ennis

1939- the first judge who was an African-American woman was Jane Matilda Bolin, who on this day was appointed judge of the Court of Domestic Relations by Mayor Fiorello La Guardia of New York City . She was also the first African-American woman to graduate from Yale Law School and the first to be admitted to the New York City Bar.http://www.blackseek.com/bh/2001/172_JBolin.htm

1941-Robert “Lefty” Grove of the Boston Red Sox won the 300 th and last game of his major league career, defeating the Cleveland Indians, 10-6.

1942-Harry James with Helen Forrest record “ I Had the Craziest Dream.”

1943-Two weeks after the July 10 Allied invasion of Sicily , the principal northern town of Palermo was captured. Americans had cut off 50,000 Italian troops in the west, but Germans were escaping to the northeastern corner of the island After 39 days, on August 17, 1943, the entire island of Sicily was under the control of Allied forces. The official total of Germans and Italians captured was put at 130,000. The Germans, however, managed to transfer 50,000 of their 90,000 men back to the Italian mainland.

1944 - The Bretton Woods ( New Hampshire ) Conference created the International Monetary Fund on this day. The IMF is “...a cooperative institution that [many] countries have voluntarily joined because they see the advantage of consulting with one another in this forum to maintain a stable system of buying and selling their currencies so that payments in foreign money can take place between countries smoothly and without delay.” The IMF was based on the ideas of the U.S. Treasury Department's Director of Monetary Research, Harry Dexter White, John Maynard Keynes of England and the IBRD (International Bank for Reconstruction & Development). The IMF began operations in Washington , D.C. in May 1946 with 39 member countries.

1944--SKAGGS, LUTHER, JR. Medal of Honor Rank and organization: Private First Class, U.S. Marine Corps Reserve, 3d Battalion, 3d Marines, 3d Marine Division. Place and date: Asan-Adelup beachhead, Guam, Marianas Islands, 21 -22 July 1944. Entered service at: Kentucky. Born: 3 March 1923, Henderson, Ky. Citation: For conspicuous gallantry and intrepidity at the risk of his life above and beyond the call of duty while serving as squad leader with a mortar section of a rifle company in the 3d Battalion, 3d Marines, 3d Marine Division, during action against enemy Japanese forces on the Asan-Adelup beachhead, Guam, Marianas Islands, 21 -22 July 1944. When the section leader became a casualty under a heavy mortar barrage shortly after landing, Pfc. Skaggs promptly assumed command and led the section through intense fire for a distance of 200 yards to a position from which to deliver effective coverage of the assault on a strategic cliff. Valiantly defending this vital position against strong enemy counterattacks during the night, Pfc. Skaggs was critically wounded when a Japanese grenade lodged in his foxhole and exploded, shattering the lower part of one leg. Quick to act, he applied an improvised tourniquet and, while propped up in his foxhole, gallantly returned the enemy's fire with his rifle and hand grenades for a period of 8 hours, later crawling unassisted to the rear to continue the fight until the Japanese had been annihilated. Uncomplaining and calm throughout this critical period, Pfc. Skaggs served as a heroic example of courage and fortitude to other wounded men and, by his courageous leadership and inspiring devotion to duty, upheld the high traditions of the U.S. Naval Service.

1945-birthday of guitarist Al DiMeola, Jersey City , NJ

http://www.aldimeola.com/

http://www.pixelplanet.com/Music/EG.htm

http://www.daddario.com/DADDARIO_ENDORSEES/ALDIMEOL.HTM

http://www.dwponline.com/rock/dimeola.htm

1947---Top Hits

Peg o' My Heart - The Harmonicats

I Wonder, I Wonder, I Wonder - Eddy Howard

Chi-Baba, Chi-Baba - Perry Como

Smoke! Smoke! Smoke! (That Cigarette) - Tex Williams

1948- Peggy Fleming birthday - U.S. figure skater, winner of 1968 Olympic singles gold medal. She became an outstanding business woman who revamped the ailing Ice Capades show into a profitable business. She lives right here in Los Gatos , California , where she is active in the Silicon Valley Community

1949-birthday of film score composer Alan Menken, New Rochelle , NY .

http://disney.go.com/DisneyRecords/Biographies/Menken_Bio.html

http://menken.dyns.net/

1954- In an attempt to put more pop in the lineup, Casey Stengel inserts Mickey Mantle in the infield as the shortstop. The experiment works as the 'Commerce Comet' homers in the tenth inning giving the Yankees a 3-2 victory over the White Sox.

1955---Top Hits

Rock Around the Clock - Bill Haley & His Comets

Honey-Babe - Art Mooney

The House of Blue Lights - Chuck Miller

I Don't Care - Webb Pierce

1962-Gary Player of South Africa became the first nonresident of the US to win the PGA championship. He defeated Bob Goalby by one stroke at Aronimink Golf Club in Newtown Square, PA.

1963---Top Hits

Surf City - Jan & Dean

So Much in Love - The Tymes

Memphis - Lonnie Mack

Act Naturally - Buck Owens

1963- history records the first bank to lease personal property was the Bank of America , San Francisco , CA , which instituted the service this day, under the direction of Robert D'Oyly Syer. James Joseph Saxon comptroller of the currency, advised national banks on March 18, 1963, that they were permitted to lease personal property, buying equipment and leasing it directly to customers.

1963-The Beatles' first US album, "Introducing The Beatles" was pressed by Vee-Jay Records, who thought they had obtained the legal rights from EMI affiliate, Trans-Global Records. When it was finally released in January, 1964, Capitol Records would hit Vee Jay with an injunction against manufacturing, distributing, advertising, or otherwise disposing of records by the Beatles. After a trial, Vee-Jay was allowed to release any Beatles records that they had masters of in any form until October 15th, 1964. After that time, they no longer had the right to issue any Beatles product.

1963 - World Heavyweight Champion Sonny Liston hung on to his boxing title by knocking out challenger Floyd Patterson in the first round of a bout in Las Vegas , NV .

1965 - "Till Death Us Do Part" debuted on England 's BBC-TV. The show was so popular that it became a TV series in Great Britain and was the forerunner of the 1971-92 CBS-TV hit, "All In The Family", starring Carroll O'Connor and Jean Stapleton.

1967- Using five pitchers in same inning, the Braves establish a major league mark for the number hurlers called upon in one inning. Ken Johnson, Ramon Hernandez, Claude Raymond, Dick Kelley and Cecil Upshaw all face the Cardinals in the ninth inning.

1967 - The "Billboard" singles chart showed that "Windy", by The Association, was the most popular record in the U.S. for the fourth straight week. The Los Angeles-based sextet would make way for Jim Morrison and The Doors a week later when "Light My Fire" became the hottest record of the mid-summer.

1968-- Elvis Presley begins filming his twenty-ninth movie, Charro!, on location in Arizona. It is the only Elvis movie where he sports a beard, and the only one in which he does not sing on-camera -- only two songs are recorded for the film, and only the title track, another Mac Davis composition, is used... over the credits only. A "serious" Western, it is nonetheless a critical and commercial failure.

1969- The All-star game is postponed by rain for the first time in major league history.

1971---Top Hits

It's Too Late/I Feel the Earth Move - Carole King

You've Got a Friend - James Taylor

Don't Pull Your Love - Hamilton, Joe Frank & Reynolds

When You're Hot, You're Hot - Jerry Reed

1971- The Doors' "L.A. Woman" is certified gold

1973 -The Reds All-Star shortstop Dave Concepcion will miss the rest of the season due to a broken ankle.

1975 - Confederate General Robert E. Lee had his U.S. citizenship restored by the U.S. Congress.

1977 - Tony Orlando announced his retirement from show business. Orlando was performing in Cohasset , MA when he said that he had finally decided to call it quits. Orlando had two solo hits in 1961 ("Halfway to Paradise " and "Bless You") and 14 hits with his backup singers (known as Dawn) through the mid-1970s. He also hosted a weekly TV variety show with Dawn (Telma Hopkins and Joyce Vincent) from 1974-1976.

http://www.tonyorlandoonline.com/

http://www.friends-of-toad.com/

1979---Top Hits

Bad Girls - Donna Summer

Good Times - Chic

Makin' It - David Naughton

Shadows in the Moonlight - Anne Murray

1979- golfer Sam Snead, age 67, became the first to shoot below his age on a Professional Tour, on the fourth day of the Quad Cities Open Tournament at Coal City, IL. His score was 277 ( 70,67,74, 66 ).

1983 -128ø F (-89ø C) recorded, Vostok, Antarctica (world record

1984- Kathy Whitworth won the Rochester Open to become the all-time winningest professional golfer. Her 85 th victory surpassed the 84 tournament wins of Sam Snead. Her picture made the Wheaties “Breakfast of Champions” box.http://www.golfweb.com/u/ce/feature/pgatour/0,1977,839844,00.html

http://www.golfeurope.com/almanac/players/whitworth.htm

1984- TV Host George Alexander "Alex" Trebek born July 22, 1940 Sudbury, Ontario, Canada, began hosting Jeopardy in 1984.

http://www.imdb.com/name/nm0871618/

1985- Bruce Springsteen's fans disabled the phone system in Washington , D-C by overloading the circuits with requests for tickets to the Boss's show at Robert F. Kennedy Stadium. The concert was sold out within an hour-and-a-half.

1986 - Hurricane Estelle passed 120 miles south of the Hawaiian Islands creating a ten to twenty foot surf. The large swells resulted from a combination of high tides, a full moon, and 50 mph winds. The hurricane also deluged Oahu Island with as much as 6.86 inches of rain on the 24th and 25th of the month.