Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe to Leasing News - Free

| Search | All Lists | Site Map

Advertising| Archives | Classified Ads | Columnists

Email the Editor

![]()

Monday, March 11, 2024

Today's Leasing News Headlines

Brian Bjella

Then and Now

New Hires/Promotions in Leasing Business

and Related Industries

Please Fasten Your Seatbelts!

by Randy Haug, LTi Technology

Help Wanted in Finance and Leasing Industry

Ready for Success with Solid Benefits

Top Ten Leasing News Read by Readers

March 4 - March 8

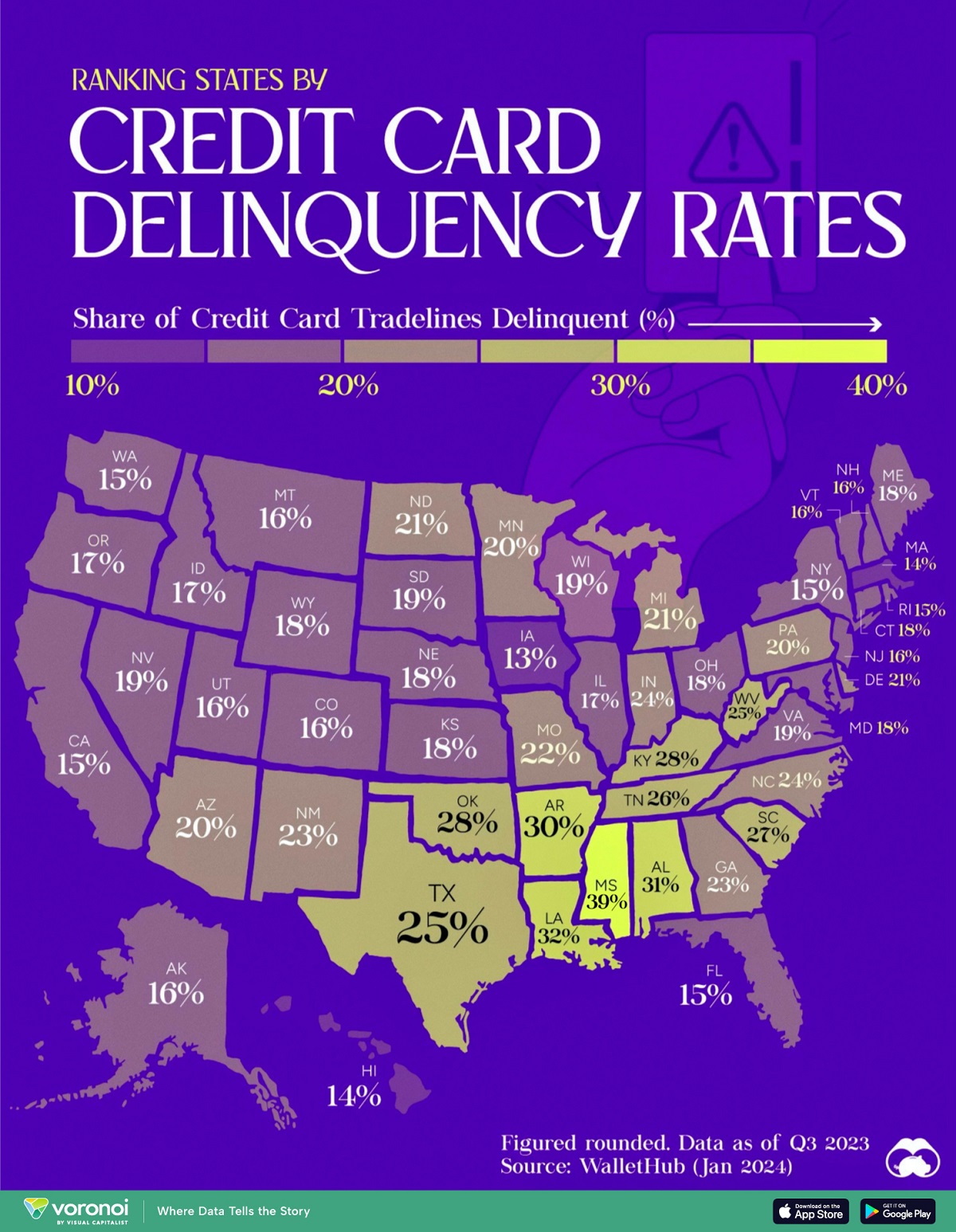

Credit Card Delinquency Rates

Which States Have the Lowest and Highest

Labrador Retriever Mix

Lind (six miles from Marshall), MN

License and Registration

A State-by-State Analysis of Requirements

for Lenders and Brokers - Updated

News Briefs ---

U.S. Employers Add 275,000 Jobs

in Another Strong Month

BMW Is a Surprise Winner in Electric Vehicles

"competes effectively against Tesla"

The sneaky reason supermarkets put fruits

and vegetables at the front of the store revealed

You May Have Missed ---

How Justice Dept. derailed an investigation

of Caterpillar, a major company

Broker/Funder/Industry Lists | Features (wrilter's columns)

Top Ten Stories Chosen by Readers | Top Stories last six months

Sales Make It Happen

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Brian Bjella

Then and Now

Brian Bjella, of Marshall, MN, now serves as Group President, Specialty Markets. Bjella and his company, Grandview Financial, were acquired by GreatAmerica in 2010. Since then, Bjella has helped build the business unit from the ground up into five divisions today: Automotive, Construction & Industrial, Healthcare, Franchise, and Direct Programs Financing.

October 2002 Leasing News

“In April, 2002, Brian Bjella became General Manager of Manifest Funding Services.

"For the past four years, Brian has helped lead the sales efforts of Manifest as the Executive Director of Sales in the eastern half of the United States. Prior to that, Brian was instrumental in the start-up of’ Stellar Financial Services, (currently U.S. Bancorp Portfolio Services) serving as General Manager of that company from 1994 to early 1998."

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Todd Mounts was hired as Senior Portfolio Manager, Ansley Park Capital. He works remote. Previously, he was Senior Portfolio Manager, BciCapital (March, 2017 - February, 2024); Senior Risk Officer, City National Bank of Florida (March, 2017 - present); Executive Vice President of Business Development, Trax Capital (October 2013) - April, 2015). Full Bio: https://www.linkedin.com/in/todd-mounts-5b5b64b1/details/experience/

https://www.linkedin.com/in/todd-mounts-5b5b64b1/

Rafe Rosato was hired as SVP and Managing Director Financial Institutions Group, Auxiliary Capital Partners, Inc., Plymouth Meeting, Pennsylvania. He is located in greater Philadelphia. Previously, he was at DLL, starting 2009 for 10 years, one month, working his way up from Vice President, Global Program Management to Senior Vice President, Strategic Marketing, Office Technology Global Business Unit. Prior, he was Commercial Banking Officer, Chemical Bank of New Jersey, NA (1988 - 1991).

https://www.linkedin.com/in/raferosato/

Sandy Watson was promoted to Loan Service Portfolio Manager, ISB Capital, Friendswood, Texas. She joined ISB September, 2022, Operations Team Member (September, 2022 - March, 2024). Full Bio

https://www.linkedin.com/in/sandywatson2/details/experience/

https://www.linkedin.com/in/sandywatson2

[headlines]

--------------------------------------------------------------

Please Fasten Your Seatbelts!

By Randy Haug, LTi Technology

The resiliency and financial innovation of the Equipment Finance marketplace continues to amaze. The different and diverse funding options available today are changing a bit. In most cases, rates will be higher because the risk and costs of that capital demand it.

Some banks, but not all, have moved the leasing business to be more of a bank product, notably those that have been confronted with capital constraints issues with their banks. Many of those same banks are now focused on much larger project financing opportunities to deploy the limited capital they have and to better credits. Additionally, instead of doing deals for their own balance sheets, they are “sell side” syndicating for fee income and you will see an increase on public securitizations tranches and pools. This will likely continue until capital becomes more widely available.

They are trying to do business within the bank footprint and with larger and more structured finance deal sizes and equipment structure types with bank or potential bank relationship client parameters. Many of these same banks that had multiple origination channels have reduced their focus on some of those channels or completely abandoned them outright.

Many other banks still have dry powder at levels their banks can provide. This is both domestic US banks as well as some well capitalized foreign banks and institutions.

I recently spoke to a few of them and they are seeing more opportunities than ever before. As other larger banks have vacated certain sized deals in the marketplace, they are managing their origination business with very good credits, mainly within their footprints. In some cases, there are many different states on the commercial finance side and are seeing very good growth opportunities in good credits on the vendor side in essential use equipment, especially equipment that holds its value.

Their appetite for buy side is more limited than in years past as they are trying to squeeze out more yield on directly originated equipment finance deals but are still selling off deals for portfolio concentration reasons as well.

Private Equity, Private Credit and Equipment Finance companies backed by large equity players, are also coming into the funding side of the business and filling the funding gaps from which many bank owned leasing companies have retreated. Their rates are, of course, higher but they are also very good at structuring large equipment finance deals and are taking advantage of being able to fund deals at higher than traditional bank rates in the current capital constrained markets.

As they say - "Please fasten your seatbelts as we could encounter some upcoming turbulence. Flight attendants, please take your seats!"

Randy Haug | EVP/ Co-Founder

LTi Technology Solutions | w: 402.493.3445 ext. 1014

Mobile: 402-981-3155

rhaug@ltisolutions.com | www.ltisolutions.com

[headlines]

--------------------------------------------------------------

Leasing and Finance Industry Help Wanted

[headlines]

--------------------------------------------------------------

Top Ten Leasing News Read by Readers

March 4 - March 8

(1) Troubles Continue with Regional Banks

And Funding of Third Party Transactions

https://leasingnews.org/archives/Mar2024/03_04.htm#troubles

(2) Louisiana Introduces Commercial

Financing Disclosure Bill

By Ken Greene, Leasing News Emeritus

https://leasingnews.org/archives/Mar2024/03_06.htm#la

(3) Is the Corporate Transparency Act Unconstitutional?

By Ken Greene, Leasing News Emeritus

https://leasingnews.org/archives/Mar2024/03_08.htm#cta

(4) GreatAmerica Financial Services Appoints

Well-Known Financial Veterans as Group Presidents

https://leasingnews.org/archives/Mar2024/03_06.htm#ga

(5) New York Community Bank Reports $2.4 Billion

More in Losses as C.E.O. Resigns

https://www.nytimes.com/2024/02/29/business/nycb-losses-ceo.html

(6) The Fontainebleau Vegas Hotel had a disastrous start

Is it a $3.7 billion ghost town?

https://www.sfgate.com/travel/article/fontainebleau-vegas-hotel-disastrous-start-18656898.php

(7) Expanding the Types of Entities Requiring

California Licensure Tabled For Now.

By Marshall Goldberg, Leasing News Legal Editor

https://leasingnews.org/archives/Mar2024/03_04.htm#expanding

(8) The Art of Follow-Up: Transforming Leads into

Opportunities By Financial Technology Expert

Alex Vasilakos

https://leasingnews.org/archives/Mar2024/03_06.htm#art

(9) Brean Capital Hosts Specialty Finance

Investor Roundtable

https://newsroom.breancapital.com/brean-capital-hosts-specialty-finance-investor-roundtable

(10) The Two Reasons Why You Get Hired

By Ken Lubin, ZRG Partners, Managing Director

https://leasingnews.org/archives/Mar2024/03_04.htm#two

[headlines]

--------------------------------------------------------------

Mapping Credit Card Delinquency Rates

in the U.S. by State

No state had credit delinquency rates of less than 10% with Iowa coming the closest at 12.9%.

That puts Iowa lower than wealthier states like Massachusetts (13.9%), Washington (14.7%), and New Hampshire (15.5%).

At the bottom end was Mississippi, which had 39% credit delinquency rates to end 2023. That’s well above e the next-lowest states Louisiana (31.7%) and Alabama (30.5%).

It’s notable that the American South had higher rates of delinquency almost across the board. The five states with the highest rates of credit card delinquency are all located in the southeastern region of the country, and Texas had a higher delinquency rate (25%) than other majorly populated states like Florida (14.8%) and New York (14.9%).

By Marcus Lui

--------------------------------------------------------------

Labrador Retriever Mix

Lind (six miles from Marshall,) MN

Amareanth (temporary name)

Female

Puppy

Small

CHARACTERISTICS

Affectionate, Energy level medium, Good with Cats, Good with Dogs, Good with Kids, Likes toys, Not Housetrained, Snuggler

HEALTH

Vaccinations up to date, spayed / neutered.

GOOD IN A HOME WITH

Other dogs, cats, children.

Hi, I am Amaranth but my foster family calls me A! I am much more exuberant than my other only sister. I came to rescue with my 4 siblings. I am your typical puppy and like to play, chew, and snuggle! I get along with other dogs, cats, and kids.

Rescue Network Inc

Lynd, MN

adoptions@rescuenetworkmn.org

(612) 208-2215

[headlines]

--------------------------------------------------------------

License and Registration

A State-by-State Analysis of Requirements

Lenders and Brokers - Update

- Virginia sales-based financing disclosure law – Went into effect July 1, 2022

- California commercial financing disclosures – Went into effect December 9, 2022

- Utah commercial financing disclosures – Went into effect January 1, 2023

- Florida disclosure law and broker law - Went into effect July 1, 2023

- New York commercial financing disclosure law – Went into effect August 1, 2023

- Connecticut commercial financing disclosure laws – Went into effect January 1, 2024

- Georgia commercial financing disclosure laws – Went into effect January 1, 2024

Seven States Reintroduce Commercial Disclosure Financing Bills

- North Carolina – Small Business Truth in Financing Act

- Kansas – The commercial Financing Disclosure Act

- Missouri – Commercial Financing Disclosure Law

- New Jersey – An Act concerning commercial financing

- Illinois – Small Business Truth in Lending Act

- California – Commercial Financing Bill

- New York – An Act to amend the banking law and the administrative code of the city of New York in relation to regulating commercial finance licensing.

Louisiana Introduces Commercial

Financing Disclosure Bill

https://leasingnews.org/archives/Mar2024/03_06.htm#la

Full Report:

https://leasingnews.org/Pages/states_license.html

|

[headlines]

--------------------------------------------------------------

News Briefs

U.S. Employers Add 275,000 Jobs

in Another Strong Month

https://www.nytimes.com/2024/03/08/business/economy/jobs-report-february-2024.html

BMW Is a Surprise Winner in Electric Vehicles

"competes effectively against Tesla"

https://www.nytimes.com/2024/03/09/business/bmw-electric-vehicles.htmlNews Briefs

The sneaky reason supermarkets put fruits

and vegetables at the front of the store revealed

https://nypost.com/2024/03/09/lifestyle/the-secret-ways-grocery-stores-keep-you-shopping-finally-exposed/

[headlines]

--------------------------------------------------------------

How Justice Dept. derailed an investigation

of Caterpillar, a major company

https://www.mercurynews.com/2024/03/09/how-trumps-justice-dept-derailed-an-investigation-of-a-major-company/

[headlines]

--------------------------------------------------------------

Sports Briefs---

Why Super Bowl set 49ers’ defensive line

on path for a big offseason makeover

https://www.sfchronicle.com/sports/49ers/article/super-bowl-set-49ers-defensive-line-path-18709777.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs---

San Francisco Bay Area rebounds with big April

job gains,despite tech losses

https://www.mercurynews.com/2023/05/19/bay-area-job-gain-tech-covid-layoff-google-facebook-april-economy-hotel/

San Franicsoc Bay Area starts 2024 with robust job

gains led by South Bay

https://www.mercurynews.com/2024/03/08/bay-area-job-gain-tech-covid-layoff-january-economy-hotel-store-build/pswing

Less money, less house: How market

are reshaping the American home

https://www.bostonglobe.com/2024/03/10/nation/less-money-less-house-how-market-forces-are-reshaping-american-home/

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Growers scrap vineyards as market dims

" in response to declining wine sales."

https://www.agalert.com/california-ag-news/archives/february-6-2024/growers-scrap-vineyards-as-market-dims/

Ukraine’s Fine Wine Industry Endures

and Grows in Wartime

https://www.winespectator.com/articles/ukraine-wineries-endure-during-war

Napa Valley Film Festival and the Culinary Institute

of America Present, "Salute to Culinary Cinema"

https://www.winebusiness.com/news/article/284342

U.S. Remains Champagne's Largest Export Market,

With More than 26 million Bottles Shipped in 2023

https://www.winebusiness.com/news/article/284320

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Mar2023/03_08.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()