|

|

|

|

|

About the Company: Lease Corporation of America is a well established, 16 year old, national equipment leasing company. |

Tuesday,

September 28,2004

Headlines---

Classified

Ads--- Asset Management

Should

Raeder Reveal the Name or Not?

Goller

Joins Huntington Equipment Finance

AIG

Launches IntelliRisk NetSource-R- 6.0

GE

Rail Services Track Record of Success

Hendershot

Appointed to Lakeland Board

Fitch

Issues Presale CIT Equipment Collateral

Fitch

Upgrades U.S. Bancorp's Ratings; Outlook Stable

######## surrounding the article denotes it is a “press

release”

-------------------------------------------------------------------------------

Classified

Ads--- Asset Management

Austin, TX.

20+ years exper. lease/finance. P & L responsibility, strong credit & collection management, re- marketing& accounting. Computers, construction, auto & transportation. Both commercial/ consumer portfolios.

Email: kmalone@austin.rr.com

Bloomfield Township,

MI.

15+ yrs experience

asset management and credit analyst.

Leadership and training skills. Audited returns, max residual,

lease end

E-mail: cmcozzolino@msn.com

Chicago, IL.

MBA, 15+ years exp. Long history of success in maximizing residual position through outstanding negotiation skills & lease contract management. Third party re-marketing, forecasting etc...

Email: jgambla@aol.com

Oxnard-Hollywood

Beach, CA.

19 Years w/Equity

Analysis/Placement and Residual Forecasting of Computer Assets. Portfolio

Manager for Two Major Lessors and Strong Analyst Background w/Leading

Information Services Firm.

Email: GregoryMLorenz@aol.com

Princeton, NJ.

Asset management/credit/collection

20+ years experience in equipment financing. Last five years in Asset Management including remarketing, end of lease negotiations, equipment and market evaluations

E-mail: bgaffrey@earthlink.net

full listing of all “job wanted” ads at:

http://64.125.68.90/LeasingNews/JobPostings.htm

Post your “free” job wanted ad by going to:

http://64.125.68.90/LeasingNews/PostingForm.asp

------------------------------------------------

Economic

Events This Week

Today

27 September

Consumer Confidence:

September

Thursday

29 September

Personal Income:

August

Weekly Jobless Claims

Friday

30 September

Construction Spending:

August

The

Gazelle Is Back!!!

Thomas

J. Depping Drinking Coca Cola in his Sierra Cities office

Registered for the

October 27th Equipment Leasing Association Conference in

Palm Desert, California:

Mr. Thomas J. Depping MAIN STREET INVESTMENT PARTNERS

Mr. Robert H. Quinn, Jr. MAIN STREET INVESTMENT PARTNERS

Quinn was Depping’s

right hand man as they built up Sierra Cities which was eventually sold

to American Express.

Thomas

J. Depping Looking at Houston from his Sierra Cities office

In the Leasing News

article:

“On the block with

a hoped sale date before October 1, 2000, this company joined Leasing

News "list" due to its Second Quarter loss and the many rumors

from reliable sources that the company is about to be sold. Chairman

Tom Depping has told his employees there will be an announcement before

September 30th.

“Reportedly the man

who originated the First Sierra concept was Bob Quinn, not Tom Depping.

Bob Quinn approached Tom Depping in 1993 after Denrich was purchased

by ATT Capital in December, 1992. Bob did not feel ATT was dedicated

to their Private Label Program so he approached Tom Depping as an old

friend and business acquaintance about forming a new company to do nothing

but Private Label.

(allowing another

to use their name on your contract along with

other “privileges.”)

“From that meeting

in 1993 to April 1994, Tom Depping sold some movers and shakers in Houston to raise the capital to start First Sierra.

When Bob Quinn left ATT in May, 1994, he and Tom along with Fred Van

Etten, Pete Smith and Sandy Ho actually began the operations at First

Sierra.

" ‘SierraCities.com (NASDAQ:BTOB) has harnessed

the power of the Internet to create a totally new way for small business

owners to get the funding they need. The leader in online banking and

financing, we've automated the funding process to offer quick and convenient

access to loans, leases, and a full range of comprehensive banking services.

Since 1994, SierraCities.com has funded over $2.5 billion in small business

loans.’"

The above quote was

from their web site. For the full story about Thomas J. Depping and

Sierra Cities, please go to:

http://www.leasingnews.org/articles.doc/newsletter3.htm

For the full story

of the $20 million law suit against RW Professional

Leasing and their

role with Sierra Cities, the private label debacle,

“Take the Money and

Run,” please go here:

http://www.leasingnews.org/Conscious-Top%20Stories/moneyandrun1.htm

(parts II, III, and the up-date are included )

Thomas

J. Depping at his Sierra Cities office in Houston

Gazelle---that is

the word he used to describe himself in

his letter of resignation

to employees ( that he was going

out like a Gazelle.

He told the parable, which is on several

motivational posters, about the lion and the gazelle both

co-existing in the same jungle, and how each start each

morning running,

either to eat or avoid being eaten.

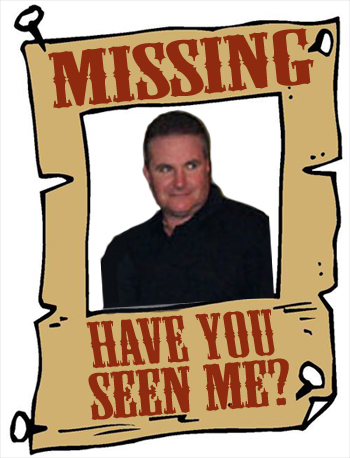

Should Raeder Reveal the Name or Not?

Leasing News asked

readers to give us their opinion as to whether Jim Raeder should reveal

the name of the culprit, and his company, who sent several derogatory

e-mails to CapitalWerks funders , leasing associations, leasing “on

line newspapers,” various print newspapers, and leasing leaders.

Due to technical

difficulties, we are making the questionnaire available

again. You may only vote once, and this form does

not allow a second

vote. Several people did not understand this. Others said they had

trouble with the

form.

Leasing News received

over 400 responses to date, many with comments.

For those that did

not receive the story or are unfamiliar:

http://www.leasingnews.org/#should

Leasing News also

printed Mr. Raeder’s biography:

http://www.leasingnews.org/articles.doc/Raeder_bio.htm

Both Jim Raeder and

Mark McQuitty sold their company

to Sierra Cities,

and their story about what happened

to them is in this

article written by Mr. McQuitty:

http://www.leasingnews.org/articles.doc/newsletterMcQuitty.htm

This image will open

up the Questionnaire form. If

you have voted, it

will not open. It will recognize

your e-mail address.

|

Classified Ads---Help ‘Wanted

Brokers

|

About the company: SCL has been in business for 12 years. We are contracted with multiple funding sources which enables us to provide more competitive rates and flexible terms and conditions. |

Funding/Loan Processor

|

CFO / Leasing Sales Leader

|

Dealer Credit Finance Analyst / Dealer Credit Finance Services Supervisor

|

Dealer Credit Fin. Services Supervisor, Torrance, CA. Click here for full descrip. & to apply. To learn more about us, please visit: www.toyotafinancial.com/careers |

Vendor Account Executive

|

About the Company: Lease Corporation of America is a well established, 16 year old, national equipment leasing company. |

-------------------------------------------------------------------------------

Letters---We get eMail

(Comments that do not include a legitimate

e-mail address or

“The culprit, I'm sure you know who it

is and I know who it is deserves to be exposed. That piece of trash

has ruined my book of business and has allowed other brokers to use

slime ball tactics against me to win deals. I average $30-40K a month

and because of this idiot I have dropped to 60% of those numbers. I

know hate is a strong word, but I have never hated someone so much in

my entire life. I have friends that hate ******** for ripping them off,

but for what this coward did I will have no remorse for him when his

company is out of business. I work 12-14 hours a day Kit and feels almost

useless working at times because of what's gone on. Please do not post

my name because Jim and Mark would probably get mad.”

--

“I hope Jim agrees to making the name public.

I like the cartoon that you made last week. Do you think people can now figure out who it is? If Jim agrees

to announce the culprit, what do you think it will do for this company. The guy is a paranoid freak anyways. I know

a person that works there and the guy is just going nuts right now.”

---

“I wish we as employees could start a class

action lawsuit against the guy and his company.”

--

“I very much enjoy reading your articles.

I've been reading them since I worked at *****.

I can personally tell you that working for Mark and Jim has been

a pleasure. They are the 2 best bosses I have ever had, especially Mark.

They like people who work hard and they reward them for their hard work.

I am probably the #2 guy in the company, but the #1 hardest working

guy in the industry. As you can see I am in here early pounding the

cold calls out hoping that I don't run into those ******** brokers that

are using the past emails as a tool to win deals.”

---------

Nigerian E-mail:

“We just got our 3rd Nigerian Letter today!

We

are having similar problems with the SPAM filters, Anti-Virus and Firewall

Software. I was advised by America On Line that it would be a "good

idea" to have someone spend "several hours a day" updating

the anti-spam, anti-viral, firewall and anti-spyware software!"

“

If it continues, we may have to "do without" and return to

the pre-PC and pre-Internet way of doing business!”

Sincerely,

Joseph leslie

President

FCI Financial Services, Inc.

(We just migrated to our third server,

this time a Unix service,

where they will keep us more up-to-date.

More expensive in

cash, but not in our time in trying to

combat all the e-mail,

spoofing, and hacking problems.editor)

--

“It was interesting to read your leasing

news this morning in which you wrote about all those e-mail scams that

we receive. Here is one that I received from an employee of Great Basin

Bank of Nevada, Elko, NV. When I received it I called the security department

at Great Basin Bank and told them about it. They asked me to forward

the e-mail to them, which I did, claiming that they did not have an

employee by the name mentioned in the message and that they were going

to turn it over to the FBI. I don't know if they did turn it over as

I have not heard from them since. Since all of the previous scam messages

that I have received were supposedly initiated in a foreign country,

I was surprised to see one with a US origination and to actually name

an existing US bank.”

Fred Anderson

-----Original Message-----

Subject: PARTNERSHIP!!!

Fax: 1-800-379-0240 (Direct) Email: treasurydivision@bankofnevada.net

Dear Friend, This letter may come to you as a surprise because we have

not met but was borne out of my sincere desire to establish a business/mutual

relationship with you. I got your contact through the International

Trade and Commerce Chamber (ITCC) in Nevada. I am Mr. Athur F. Price,

the Director of Treasury, Great Basin Bank of Nevada,Elko - Nevada.

We are a highly reputable bank with years of outstanding service.

To be explicit and straight to the point. Sometime in 1997, a customer

of ours deposited the sum of $12,500,000 (Twelve Million, Five Hundred

Thousand US Dollars) in our bank as safe deposit and since then our

customer has failed to come forward to claim his money, which has accumulated

a considerable amount of interest. Consequently, in our bid to contact

this customer to discuss the position of the deposit, we discovered

that the customer was one of the victims of the Pan Carribean Airline

disaster of 2000 in Hawaii.

Since the death of our client who happened

to be an expatriate from France (he worked for Consolidated Oil Inc,

Nevada) none of his benefactors has come forward to claim the money.

This means that none of his relatives or aids had any knowledge of this

money. I also found out from enquiries that our late client siphoned

a lot of money from Consolidated Oil, which led to the liquidation and

eventual sale of the company. It is my conviction that the money in

our bank is part of the money that our customer siphoned, and now that

he is dead there is no trace to it. By the virtue of my office, I stumbled

on this goldmine and decided to keep it for my retirement. I am now

soliciting your unreserved assistance to assist me in transferring this

money into your account anywhere in the world for immediate investment.

In the course of this transaction, you will be required to act as the

benefactor or a relative of the dead depositor. I will furnish you with

all necessary information that will be required from you by our bank.

As a serving senior bank officer, I am not permitted to run a private

business enterprise or maintain a foreign bank account. You will be

entitled to a considerable percentage of the money after transfer and

20% of the investment profit. If you are honest, trustworthy, capable

of investing this huge amount of money and interested in the above proposal,

contact me immediately through the numbers indicated above for more

details.

For my safety, you must maintain absolute

confidentiality to ensure success. Please, indicate your personal Tel./Fax

nos. when replying. Yours Faithfully, Mr. Athur F. Price PLS. NOTE THAT

THIS MESSAGE IS NOT A SCAM. YOU MAY DISREGARD IT IF YOU WISH BUT HELPS

TO ACKNOWLEDGE THE RECEIPT. THANKS FOR YOUR UNDERSTANDING

(The gimmick is when you open a bank account,

you will need to

put sufficient money in it to make the

transfer not so obvious...editor)

--

“Kit, you did a great job collecting the examples listed on your website on Nigerian type e-mail,

but to become a true master of the craft you need

to attend their convention:”

http://j-walk.com/other/conf/index.htm

Larry Sherman

--

“Just wanted to update you on the happenings

of A.E.L.A.

We just started our 2nd year with a successful

mixer held at the Radisson Hotel in Phoenix. It was attended by approx. 20 members and non

member, newbie's and long experienced, funders and brokers. Most in attendance were from AZ, but we did

have attendees from NY, TX and Calif. It allowed us to find out what

is happening in our industry, on the local and national level.

“Thank you for your support!”

Bernice Truszkowski

"your equipment finance specialist"

P.O. Box 985

Scottsdale, AZ 85252-0985

480 949 0710

480 949 7012 FAX

efl1@prodigy.net

480-949-0710

--

“The Hurricanes have come and gone and

I'm thankful and relieved to inform you that my family and my home are

safe and sound. My office however,

was not quite so lucky with Hurricane

Frances. AMSTAT'S roof did not survive and because of it we sustained extensive

water damage. Fortunately we

removed our computers and most of our files (the rest were in water

proof cabinets) before we evacuated, making the job of opening a temporary

office so much easier.

“I am hoping to back at the office sooner

than later but in the mean time here is my contact information:

“Phone:

321-452-4459

Cell: 321-480-9159

Fax: 321-452-7715

email: ljennings@amstatcapital.com

“Thank you for your patience and understanding

and I hope this will not cause you too much of an inconvenience.

“Take care,”

Louise Jennings

AMSTAT Capital

--

“We leased an Elephant

in 1984, it cost $84,000, 20 yrs of inflation

has really raised their prices. We also thought that 3 points then was

a

great commission!”

Leo Timmerman

Timmerman Leasing Inc

--

“In regards to Norvergence, Steve Nardi

of Ramsgate makes the point that our lessees are businesses engaged

in commerce and not subject to consumer protection laws. While this

may be true in fact there is a difference between what is law and what

is justice. In the small ticket arena most of our lessess

are basically consumers who happen to own small businesses. The leases they sign are boilerplate documents

written in favor of the lessors and not subject to negotiation. I'm not saying that's bad, Lessors need protection

from default, fraud, etc., and yet in a situation like Norvergence where

clearly the lessee's have been defrauded (and it appears that all or

most of the lessor's have also been defrauded), if we say to all of

the 11,000 lessee's that it is your fault for signing that lease document

then they and all of their supporters will rise up and impose legislation

on the leasing industry to make sure these small businesses have increased

protection in the future. Is

that what we really want?

“While there will only be pain in the Norvergence

resolution, perhaps the major lease associations might consider involving

themselves in trying to find a negotiated settlement that is fair to

both lessees and lessors. The

alternative is we let the lawyers and the courts dictate events that

could change the landscape for all of us.”

Joe Schmitz, CLP

F.I.T. Leasing

--

“I found out the correct name for the magic

funding source. It is Delphi! Delphi is located in the Chicago suburbs

and the credit application consists of the applicant's name, address

and social security number! There is a 15 minute turn around!”

Sincerely,

( name with held )

( Rockford in the old days would take such

an application on the medical profession and approve deals. In reality, if the consumer credit is very

good, many industrial companies have finance arms that will approve

in such a manner. There is a trend for brokers to set

themselves up as “dealers” in order to

obtain access to these

funding sources.

There is a Delphi automotive company: Delphi Automotive Systems- spun

off by General Motors last February, Delphi

Financial, a Delphi Islamic bank group, a large Swedish company seeming

to specialize in aircraft leasing, plus other European finance, and

Delphi Capital Corp., Chicago, Ill.: (773) 248-8875. editor.)

--

“I have a question - When the truth comes

out about what really went on at Norvergence and Robert Fine is found

not to have known what the owners of the company were doing - Will you

post an apology in your newsletter??????????

“I really don't know where some of your

information comes from but you should do some research because Mr. Fine

was not a Corporate officer or a Boss in any way. He actually did have

a Boss and I find it very funny that his name is never mentioned .”

(name

with held )

(Leasing News made no accusations. We quoted attorneys, other newspapers,

and listserve ex-employees on several

list serves. When we quoted them, we attributed the quote

to the party who

made them.

(April 26,2004 Robert

C. Arnold was named CFO for Norvergence Capital, a wholly owned financial

services subsidiary of Norvergence Inc; Chief Operating Officer Alexander

L. Wolf. Whether Mr. Fine

was the president

or not, he was involved directly with the financing

as per NorVergence

press releases and advertisements, such as:

http://www.elaonline.com/news/MembersOnly/IndNewsWkly/012104.htm

(In an October 16,2003

e-mail, Mr. Fine stated in an e-mail to Leasing News, which we printed:

"“On a personal note, I can assure you

that my twenty-seven years of experience in the equipment leasing industry,

primarily working for commercial banks have impressed upon me the need

to know the people with whom you are conducting business. Norvergence

is an exciting and fast-paced company and I am very happy to be a part

of this organization and look forward to its bright future."

(The Norvergence

web site is no longer up; however, links show he was "president

with full profit and loss responsibility.”http://www.t1matrix.com/rentals.htm

(The Norvergence

press release, printed in Leasing News on June 2,2003:

(“NORVERGENCE is

pleased to announce that Robert J. Fine has been named as Director of

Bank Relations. In his new role Mr. Fine will be responsible for managing

all aspects of the company’s non-recourse, third-party relationships

as well as developing new funding relationships."”

(Perhaps as important,

for the last year and a half, I have personally communicated directly with

him by telephone and by e-mail and through the NorVergence public relations

persons regarding various complaints about service, the equipment, and

what was going on. He denied what readers were saying about the

value of the equipment or the separate service agreements on many occasions.

He had made

Leasing News very

unpopular with his friends and associates because

we were asking questions,

printing what readers were telling us. He was the key point man in the

NorVergence private label program.

(As the bankruptcy

hearing proceeds, perhaps by the first of the year, many of these things

will be further documented in court papers available to the public.

Attorneys have been trying to serve him, but two have told me they have

not located to serve him personally.

They believe he is

also "personally" responsible as well as a "corporate

officer."

(If you have any

information that you could pass along, I will gladly look into it. We look forward to any comment Mr. Fine would

like

to make to Leasing

News or any apology readers may want to

make to him because

he did not know what was going on

at NorVergence or

NorVergence Capital. editor.)

from October 9,2003 Leasing News

Robert J. Fine

#### Press Release ########################

HUNTINGTON EQUIPMENT FINANCE NAMES GOLLER

TO SALES FORCE

Indianapolis, Indiana – Huntington Equipment

Finance, a division of Huntington National Bank that provides both tax

and non-tax financing solutions for company’s purchasing capital equipment,

has appointed Daniel Goller as Vice President of sales for Indiana Region.

In his new capacity, Goller will focus on understanding our client’s

business, structuring the right financial solution to meet their needs

and delivering superior customer service.

“Successful growth in the Equipment Finance

business line at Huntington, combined with the strong and continuing

commitment of Huntington Bank to its local markets, created a need for

local representation across our footprint,” said Rob Allanson, Huntington’s

Equipment Finance Division President. “We are very pleased to have added

such a capable, experienced and talented individual to our team.”

Prior to joining Huntington, Goller served

as a vice-president at Key Equipment Finance of Indianapolis, IN, where

he was responsible for new business development and marketing. Daniel

Goller earned his bachelor’s degree in business administration and finance

from Indiana University.

Huntington Equipment Finance, which began

operation in late 2001, provides a strategic opportunity for Huntington

to add value to its business clients and equipment vendors who have

both large and small financing needs. The team offers financing solutions

for assets that include construction, manufacturing, metal working,

printing and technology equipment as well as railcars, marine transportation

and corporate aircraft.

About Huntington

The Huntington National Bank is the principal

subsidiary of Huntington Bancshares Incorporated (NASDAQ: HBAN), a $30

billion regional bank holding company headquartered in Columbus, Ohio.

Through its affiliated companies, Huntington

has more than 138 years of serving the financial needs of its customers.

Huntington provides innovative retail and commercial financial products

and services through more than 300 regional banking offices in Indiana,

Kentucky, Michigan, Ohio and West Virginia. Huntington also offers retail

and commercial financial services online at www.huntington.com; through

its technologically advanced, 24-hour telephone bank; and through its

network of nearly 700 ATMs. Selected financial service activities are

also conducted in other states including: Dealer Sales offices in Florida,

Georgia, Tennessee, Pennsylvania and Arizona; Private Financial Group

offices in Florida; and Mortgage Banking offices in Florida, Maryland

and New Jersey. International banking services are made available through

the headquarters office in Columbus and additional offices located in

the Cayman Islands and Hong Kong.

Sites of Reference:

http://www.huntington.com/GetHomePageServlet

CONTACT:

Inna Gogoua Marketing Specialist

Huntington National Bank

Phone Number: 2165156601

Fax Number: 2165150689

E-mail: inna.gogoua@huntington.com

#### Press Release ######################

AIG Domestic Claims Announces Launch

of IntelliRisk NetSource-R- 6.0

NEW YORK----The Primary Claims division

of AIG Domestic Claims, a division of the AIG Companies(sm), today announced

the launch of IntelliRisk NetSource(R) 6.0, an enhanced version of the

leading web-based claims analysis and inquiry system. Version 6.0 features

the integration of a new reporting tool that will make it easier to

run standard and custom reports.

Version

6.0 enables users to save customized reports to their library or email

them in either PDF, Microsoft(R) Excel, or HTML format. Improved functionality

provides advanced sort and filter capabilities to help customize reports

by key elements such as location coding, line of business, or state

in which the accident occurred. Further, full "bursting" functionality

allows customers to segment and distribute reports by key elements.

For select reports, users can drill down to access more specific claim

details.

"With

the help of the IntelliRisk Advisory Board, we recognized that this

enhancement was an important step in increasing risk management efficiency,"

said Steve Iler, President, Primary Claims. "IntelliRisk NetSource

6.0 reinforces our commitment to expanding our service capabilities

to meet the diverse and dynamic needs of our clients through cutting-edge

technologies."

The

technology behind the new enhancement is WebFOCUS, a fully integrated

enterprise business intelligence suite. WebFOCUS was provided by Information

Builders, a leader in enterprise business intelligence and real-time

Web reporting, and customized according to the objectives set forth

by the IntelliRisk Advisory Board.

For

more information about IntelliRisk NetSource 6.0, please call 800/767-2524.

AIG

is the world's leading international insurance and financial services

organization, with operations in more than 130 countries and jurisdictions.

AIG member companies serve commercial, institutional and individual

customers through the most extensive worldwide property-casualty and

life insurance networks of any insurer. In the United States, AIG companies

are the largest underwriters of commercial and industrial insurance

and AIG American General is a top-ranked life insurer. AIG's global

businesses also include retirement services, financial services and

asset management. AIG's financial services businesses include aircraft

leasing, financial products, trading and market making. AIG's growing

global consumer finance business is led in the United States by American

General Finance. AIG also has one of the largest U.S. retirement services

businesses through AIG SunAmerica and AIG VALIC, and is a leader in

asset management for the individual and institutional markets, with

specialized investment management capabilities in equities, fixed income,

alternative investments and real estate. AIG's common stock is listed

on the New York Stock Exchange, as well as the stock exchanges in London,

Paris, Switzerland and Tokyo.

CONTACT:AIG, New York Andrew Silver, 212-770-3141

### Press Release ##########################

Rail Services Unit of GE Builds on Track Record of Success

with Customers at Global Railway Tech

2004

CHICAGO-- Announces investment in new capabilities

and expansion of railcar fleet in response to growing demand --

The

Rail Services unit of GE Equipment Services announced it will unveil

new capabilities and fleet management technologies at "Global Railway

Tech 2004," the 43rd Annual Convention of the Railway Supply Institute

(RSI) in Chicago, IL.

Rail

Services is demonstrating how it is building on its solid track record

of over 40 years in providing Class I railroads and shippers with fast,

flexible equipment leasing solutions to meet changing market demands.

Rail Services has made significant capital investments in 2004 to build

on what is already the most diverse fleet in the industry and is targeting

up a significant investment program over the next few years. The company

is also developing new products and service offerings to help streamline

maintenance operations. The result is an even stronger ability to help

customers optimize their productivity.

"Rail

Services is committed to the continued growth and diversification of

our fleet in order to meet our customers' current and future demands,"

says Ted Torbeck, President and CEO, GE Equipment Services, Rail Services.

"We're investing significant capital to continue to deliver the

best service in the industry."

In

addition to actively refurbishing current cars as part of its ongoing

upgrade plan, Rail Services is planning to add several thousand cars

to their fleet over the next several years.

"Being

a leader in the industry starts with having the right product to meet

the customer's needs," says Torbeck. "Rail Services has built

our reputation on providing the right cars, with the right lease at

the right time. Now we're taking steps to build on that reputation and

deliver new products and technologies."

The

new Maintenance Max(SM) service, also announced today, helps shippers

better manage maintenance costs while optimizing their fleet operations.

The unique aspect of Maintenance Max(SM) is that it integrates maintenance

costs into a fixed monthly fee to eliminate the annual guesswork associated

with ongoing maintenance needs.

In

addition to investing in new technologies, Rail Services is contemporizing

its intermodal assets to meet customers' needs. Upgraded chasses give

shippers more room to accommodate larger containers and are a less expensive

alternative to investing in new equipment.

Visit

Rail Services in booth 301 in the southeast hall of the Chicago Hilton

and Towers during Global Railway Tech 2004. Rail Services' equipment

can also be seen on tracks 11, 12 and 13 of Section B at the BNSF/METRA

Railyard, Chicago.

About

GE Equipment Services, Rail Services

A unit of the General Electric Company (NYSE:GE) and GE Equipment Services, Rail Services, headquartered in Chicago, Illinois, leases approximately 180,000 railroad cars--including coal hoppers, grain hoppers, refrigerator cars that carry fresh produce and frozen foods, tank cars for petroleum and chemicals, gondola cars for hauling steel and other industrial products, and intermodal flat cars that carry highway semi-trailers and intermodal containers. Additionally, the company leases 150,000 semi-trailers and containers to shippers and railroads.

For further information, visit www.gerail.com.

CONTACT:GE Rail Services Frank Mantero,

312-853-5557 frank.mantero@ge.com or Gibbs & Soell Inc. Jennifer

Gray, 847-519-9150 Mobile 847-530-5755 jgray@gibbs-soell.com

### Press Release #########################

Janeth C. Hendershot Appointed to Lakeland

Bancorp Board of Directors

OAK RIDGE, N.J., -- John W. Fredericks,

Chairman of Lakeland Bancorp has announced the appointment of Janeth

C. Hendershot to Lakeland Bancorp's Board of Directors.

Ms. Hendershot is a Senior Vice President

at Munich-American Risk Partners, and has held various positions at

numerous insurance organizations. Ms. Hendershot is a Director of Newton

Trust Company, a subsidiary of Lakeland Bancorp and a past Director

of Newton Financial Corporation.

Ms. Hendershot, a resident of Washington

Crossing, Pennsylvania, has a Bachelor of Arts degree, Cum Laude in

Economics from Cornell University.

Lakeland Bancorp, the holding company for Lakeland Bank and Newton Trust Company, has a current asset base of $1.9 billion and forty-eight (48) offices spanning six northwestern New Jersey counties: Bergen, Essex, Morris, Passaic, Sussex and Warren. Lakeland Bank, headquartered at 250 Oak Ridge Road, Oak Ridge, and Newton Trust Company headquartered at 30 Park Place, Newton, offer an extensive array of consumer and commercial products and services, including online banking, localized commercial lending teams, equipment leasing, and 24- hour or less turnaround time on consumer loan applications. For more information about their full line of products and services,

visit their website at http://www.lakelandbank.com or,

SOURCE

Lakeland Bancorp

CO: Lakeland

Bancorp

ST: New

Jersey, New York

SU: PER

Web site: http://www.lakelandbank.com

### Press

Release ########################

Fitch Issues

Presale On CIT Equipment Collateral 2004-DFS

Fitch Ratings-Chicago-

Fitch Ratings has issued a presale report on CIT Equipment Collateral

2004-DFS (CITEC 2004-DFS). The notes will be backed by commercial

lease contracts originated directly or purchased and serviced by Dell

Financial Services L.P. (DFS) through the Dell Inc. (Dell)/ CIT Group

Inc. (CIT) Joint Venture. CITEC DFS represents the first CIT securitization

composed exclusively of DFS contracts.

The presale report is available to all investors on the Fitch Ratings web site,

'www.fitchratings.com'.

For more information about Fitch's comprehensive subscription service

Fitch Research, which includes all presale reports, surveillance,

and credit reports on more than 20 asset classes, contact product

sales at +1-212-908-0800 or at 'webmaster@fitchratings.com'.

Contact: Brigid

E. Keyes +1-312-606-2361 or John Bella +1-312-368-2058, Chicago.

### Press

Release ########################

Fitch Upgrades

U.S. Bancorp's L- & S-Term Ratings; Outlook Stable

Fitch Ratings-New

York- Fitch has upgraded the long- and short-term ratings of U.S.

Bancorp (USB) to 'AA-' and 'F1+', respectively, from 'A+' and 'F1',

respectively. The long-term ratings of subsidiary banks, U.S. Bank,

NA and U.S. Bank NA ND, as well as trust-preferred securities issued

through subsidiary trusts have also been upgraded. These ratings were

placed on Positive Outlook during September 2003. A list of ratings

is provided at the end of this release.

USB continues

to perform well, with its characteristic strong level of earnings

driven by a solid net interest margin, diverse sources of noninterest

income, and disciplined expense management. USB operates one of the

premier banking franchises in the U.S. with a retail banking network

spanning 24 states, which is augmented by strong positions in payment

systems, asset management, and mortgage banking.

USB has not

been immune to challenges on the asset quality front, largely reflecting

the last economic downturn that especially affected the manufacturing

sector prevalent in its footprint. However, asset quality has vastly

improved over the past year, reflecting a slowly improving economy,

as well as previous steps taken to reduce the risk profile of the

organization by exiting some higher risk segments of both the commercial

and consumer portfolios. Nonperforming assets and net charge-offs

are both declining, and the loan portfolio is supported by ample reserve

coverage.

Through earnings

retention and modest balance sheet growth, USB has boosted capital

levels, especially tangible common equity (TCE), which has in the

past been pressured by acquisition activity and stock buybacks. Capital

levels now compare favorably to peer comparisons. USB's strong earnings

momentum adds additional flexibility in its ability to quickly build

capital.

### Press

Release #######################

|

“News Briefs”

Oil Charges to $50.35 on Supply Threats

http://www.washingtonpost.com/wp-dyn/articles/

A55706-2004Sep28.html?nav=headlines

30-year MBS holds steady as Treasury drops

below 4%

http://www.absnet.net/include/showfreearticle.asp?file=/headlines/.htm

Mortgage Giant Agrees to Alter Business

Ways

http://www.nytimes.com/2004/09/28/business/28fannie.html

Fighting off those viruses

20 million copies of free Windows update

downloaded

http://www.sfgate.com/cgi-bin/article.cgi?file=/chronicle/archive

/2004/09/27/BUG4I8TNR01.DTL&type=business

Widening wireless

New WiMax technology allows broadband users

to access Internet from more places

http://www.sfgate.com/cgi-bin/article.cgi?file=/chronicle/archive/

2004/09/27/BUGF68UL091.DTL&type=business

HP Dumps 64-bit Interests

http://www.internetnews.com/bus-news/article.php/3413621

For job seekers, economic gloom persists

Many in middle class struggling despite

employment growth

http://www.boston.com/business/articles/2004/09/27/

for_job_seekers_economic_gloom_persists/

Weekend All But 'Forgotten'; Boxoffice

Hits New Low

http://www.nytimes.com/reuters/arts/entertainment-film-boxoffice.html

O'Brien to Succeed Leno on 'Tonight' Show

http://www.nytimes.com/2004/09/28/business/media/28nbc.html?8hpib

Martha Stewart gets her federal inmate

number

http://www.usatoday.com/money/media/2004-09-27-

-------------------------------------------------------------------------------

“Sports Briefs”

Gardner's 2 TDs Not Enough as Team Loses

13th Of Series' Past 14

http://www.washingtonpost.com/wp-dyn/articles/A55059-2004Sep27.html

http://www.dallasnews.com/sharedcontent/dws/dn/latestnews/stories/

092804dnspocowlede.18bbc1b3.html

Riled Up, Red Sox Clinch Spot in Playoffs

http://www.nytimes.com/2004/09/28/sports/baseball/28sox.html

http://www.boston.com/sports/baseball/redsox/articles/

2004/09/28/berth_announcement/

Report: Bonds tested for steroids

http://www.usatoday.com/sports/baseball/nl/giants/

2004-09-27-bonds-drug-test_x.htm

Monster Park

New Low: 49ers sell rights to name stadium

to Monster Cable

http://sfgate.com/cgi-bin/article.cgi?file=/c/a/2004/09/28/MONSTER.TMP

Hamm Pleads Case as One and Only

http://www.nytimes.com/2004/09/28/sports/othersports/28hamm.html

This Bud's for China

http://www.stltoday.com/stltoday/business/stories.nsf/story/52905C2AC6

D59F0786256F1D001C665B?OpenDocument&Headline=This+Bud's+for+China

-------------------------------------------------------------------------------

“Gimme that Wine”

Joe Montana, Ed Sbragia join forces for

killer cab

http://www.napanews.com/templates/index.cfm?template=

story_full&id=C171C3B8-B908-4930-AF64-D42FC0165E54

No Thanksgiving for Turkeys in California

Wine Country

http://www.winespectator.com/Wine/Daily/News/0,1145,2601,00.html

The red wine revolution: no food

http://www.jancisrobinson.com/winenews/2004/winenews0925.html

Champagne bubbles over with harvest hopes

http://www.detnews.com/2004/business/0409/24/c03-283484.htm

The sipping news: We're in a N.Y. State of vine

http://www.nydailynews.com/city_life/food/story/235078p-201822c.html

This Day in American History

This is a National

Holiday in Taiwan, designated as "Teachers' Day," to celebrate

the birthday of Confucius, the "Latinized " name of Kung-futzu,

born at Shantung province on the 27th day of the tenth moon ( lunar

calendar) in the 22nd year of Kuke Hsiang of Lu (551 BC).

This day is observed annually on September 28, although the 27th day of the 8th lunar month is considered by the Confucian Society

of the Confucius Temple at Causeway Bay.

1542-

California is discovered by Portuguese navigator Juan Rodriguez Cabrillo

who reached San Diego Bay. Cabrillo died at San Miguel Island, CA, Jan

3,1543. His birth date is unknown. The Cabrillo National Monument marks

his landfall and Cabrillo Day is still observed in California (in some

areas on the Saturday nearest Sept 28). Cabrillo left Navidad, Mexico

on June 27, and landed at what is now known as Ballast Point, San Diego,

CA. He continued his explorations and discovered Santa Catalina Island,

San Pedro Bay, the Santa Barbara Channel, San Francisco Bay, and

other West Coast

landmarks. Other Europeans had

encountered the Pacific Ocean previously, including Gasco Nunez de Balboa,

who had laid eyes on the Pacific in 1513, and Ferdinand Magellan, who

had sailed across the Pacific in 152-21 during the first circumnavigation

of the world.

( lower part of:

http://memory.loc.gov/ammem/today/sep28.html

)

1856-Kate

Douglas Wiggin born at Philadelphia, PA. She helped organize the first

free kindergarten on the West Coast in 1878 at San Francisco and in

1880 she and her sister established the California Kindergarten Training

School. After moving back to the east coast she devoted herself to writing,

producing a number of children's books including The Birds' Christmas

Carol, Polly Oliver's Problem and Rebecca of Sunnybrook Farm. She died

at Harrow, England, Aug 24, 1923.

1886-The

Statue of Liberty was dedicated in New York Harbor and women were barred

from the ceremony because it would be too crowded and rough for the

ladies, but a group of women chartered a boat and circled the island

singing and shouting women's rights messages.

1867--

Toronto becomes the capital of Ontario

http://www.lonelyplanet.com/destinations/north_america/

http://www.city.toronto.on.ca/archives/index.htm#more

http://www.blackhole.on.ca/index_history.html

1895-

At a convention in Atlanta, three Baptist groups merged to form the

National Baptist Convention. It is today the largest African-American

denomination in America and the world.

1901-

Birthday of Ed Sullivan, well-known columnist, lived in Port Chester,

New York, and in his day was the “King of TV Variety,” born at New York,

NY. Sullivan started his media career in 1932 as a sportswriter for

the Daily News in New York. His popular variety show, “The Ed Sullivan

Show” (“Toast of the Town”), ran from 1948 until 1971. It included such

sensational first time public

appearances from

such stars as Elvis Presley and the Beatles. He died at New York, NY,

Oct 13,1974.

1912-W.C.Handy’s

“Memphis Blues” is published, changing the course of American popular

music.

http://memory.loc.gov/ammem/today/sep28.html

1920-

Eight members of the 1919 Chicago White Sox were indicted by a grand

jury in Chicago on charges that they conspired to fix the 1919 World

Series and allowed the Cincinnati Reds to win.

White Sox owner Charles Comisky immediately suspended the eight. They were acquitted, but were nevertheless

banned from baseball for life.

1930

-- Lou Gehrig's errorless streak ends at 885 consecutive baseball games.

The winning pitcher is Babe Ruth, beating the Red Sox 9-3.

1934-Birthday

of French sex symbol Brigitte Bardot ( born Camille Javal), Paris, France.

http://www.triviatribute.com/brigittebardot.html

http://www.jon-aristides.com/brigitte.html

http://www.silverscreensirens.com/brigitte.htm

1935-

Pianist/singer Jerry Lee Lewis Birthday

1937—President

Franklin D. Roosevelt dedicates Bonneville Dam on Columbia River (Oregon.)

http://www.ohwy.com/or/b/bonnedam.htm

http://www.cqs.washington.edu/crisp/hydro/bon.html

1941-Ted

Williams of the Boston Red Sox, starting the day with a batting average

of .3995, went six-for-eight in a doubleheader against the Philadelphia

Athletics to finish the season with a batting average of .406.

Williams rejected manager Joe Croni’s suggestion to sit out the

day and have his average rounded up to .400. He went four-for-five in the first game to

raise his average to .4040 and got two hits in three at-bats in the

nightcap.

1945-

Robert Todd Duncan, a baritone of Washington, DC, became the first opera

singer who was African-American to sign a white role with a white cast,

appearing as Tonio in I Pagliacci, and then as Escamillo in Carmen on

September 30 in the New York City Opera Company’s presentation at the

City Center of Music and Drama, New York City.

1954---Top

Hits

Sh-Boom - The Crew

Cuts

Hey There - Rosemary

Clooney

Shake, Rattle and

Roll - Bill Haley & His Comets

I Don’t Hurt Anymore

- Hank Snow

1958-"To

Know Him Is To Love him" by the Teddy Bears, composed and arranged

by 18 year old Phil Spector is released on Dore Records. The title is

taken from the inscription on Spector's father's tombstone. The song

makes it up to Number One by the end of the year.

1961-

“Hazel” premiered on TV, based

on a comic strip of the same name about a maid working for the Baxter

family who gets into everyone’s business. Hazel was played by Shirley

Booth, and the Baxters were played by Don DeFore, Whitney Blake and

Bobby Buntrock. “Hazel” moved from NBC to CBS after the third season

and Hazel switched families from George to younger brother, Steve Baxter.

These Baxters were played by Ray Fulmer, Lynn Borden and Julia Benjamin.

Buntrock and Booth remained. This very successful series also featured

MaIa Powers and Ann Jillian.

1961

- On NBC, Richard Chamberlain sang the top-10 hit song "Theme from

Dr. Kildare (Three Stars Will Shine Tonight)", and played the part

of the handsome, young doctor on NBC. Raymond Massey co-starred in the

medi-drama. A year into the show's run, Chamberlain’s "Theme from

Dr. Kildare" became a hit. On MGM, he also sang "Love Me Tender"

and "All I Have to Do is Dream" in 1962 and 1963.

1962-

US Circuit Court of Appeals orders James Meredith admitted to U of Mississippi.

http://www.olemiss.edu/depts/english/ms-writers/dir/meredith_james/

1962---Top

Hits

Sheila - Tommy Roe

Ramblin’ Rose - Nat

King Cole

Green Onions - Booker

T. & The MG’s

Devil Woman - Marty

Robbins

1963-The

legendary New York disc jockey Murray The K receives a copy of The Beatles'

"She Loves You" and plays it on the radio. It is believed

to be the first Beatles song ever played in the U.S,

1963-The

Beach Boys' "Little Deuce Coupe" peaks at #15 on the singles

chart.

1968-The

Beatles' "Hey Jude" hits #1 on the singles chart, a position

it will hold for 9 weeks. At 7 minutes 11 seconds, it was the longest

song ever to hit the Billboard Hot 100 chart, an honor it held until

Richard Harris' "MacArthur Park" in 1972 clocked in at 7:20.

1970---Top

Hits

Ain’t No Mountain

High Enough - Diana Ross

Lookin’ Out My Back

Door/Long as I Can See the Light - Creedence Clearwater Revival

Julie, Do Ya Love

Me - Bobby Sherman

There Must Be More

to Love Than This - Jerry Lee Lewis

1976

- World heavyweight boxing champion Muhammad Ali won a unanimous 15-round

decision over Ken Norton at Madison Square Gardens in New York City.

1982-Poisoning

of store merchandise, the first of its kind to have resulted in numerous

deaths, took place in and around Chicago, Il,. In a three-day period form September 29 to

October 1,1982, several people died after taking Tylenol, a brand of

acetaminophen, which they had bought at local drugstores and supermarkets.

A murder who was never apprehended had removed the bottles from store

shelves, opened them, added cyanide to the capsules of Tylenol, and

replaced them in the stores. The

poisonings led to the introduction of wraps and seals on all pharmaceutical

products and many other products as well.

1978---Top

Hits

Boogie Oogie Oogie

- A Taste of Honey

Kiss You All Over

- Exile

Hopelessly Devoted

to You - Olivia Newton-John

I’ve Always Been

Crazy - Waylon Jennings

1985-Phil

Collins' "Don't Lose My Number" peaks at #4 on the singles

chart.

1986---Top

Hits

Stuck with You -

Huey Lewis & The News

Friends and Lovers

- Gloria Loring & Carl Anderson

Walk This Way - Run-D.M.C.

In Love - Ronnie

Milsap

1988-The

first American women to ascent Mount Everest was Stacy Allison of the

Northwest American Everest Expedition. Peggy Luce, was who part of the same expedition, completed her ascent

two days later. Both used the

South Col route.

1989-Jimmy

Buffett publishes a book of short stories entitled, "Tales From

Margaritaville."

1989

- Thunderstorms over northeastern Florida drenched Jacksonville with

4.28 inches of rain between midnight and 6 AM EDT. Unseasonably cool

weather prevailed in the northeastern U.S. Five cities reported record

low temperatures for the date, including Binghamton NY with a reading

of 30 degrees. Morning lows were in the 20s in northern New England.

Unseasonably mild weather prevailed in the northwestern U.S., with afternoon

highs in the upper 70s and 80s. In Oregon, Astoria reported a record

high of 83 degrees

1991-R.E.M.'s

"Shiny Happy People" peaks at #10 on the singles chart.

1991-Dire

Straits' "On Every Street" enters the LP chart.

Baseball

Poems

Ballpark Haiku

by Tim Peller

Hot wicked summer

Against the fat man's

belly

Budweiser can sweats

Under the shrubbery

Down by the bullpen mound

Yellow jackets whine

Budweiser!

Budweiser! he calls

between innings, between pitches,

between breaths

God

Protects Fools with Curveballs

Going after her

Was chasing

A bad pitch,

A sharp curve

That tailed off

Into the dirt,

Evaded the end

Of my whirling bat.

Thank goodness

I only looked stupid

On the first strike.

from “ Touching the Bases”

These

come from a soft cover 128 pages

with

index published by www.mcfarlandpub.com

(

they take two weeks to send, but you are helping

this company stay alive, or you can buy from

Amazon, for the same price, but perhaps faster

delivery.

While they are all mostly baseball,

some

are not. He is a unique American poet.

He

lives in Hickory, North Carolina.

|

www.leasingnews.org |