|

|

4-2

Red Sox, But the Score Doesn’t Tell the Whole Story of a very courageous

team and a sullen NY crowd where riot police were on

Restaurants

and other retailers will be feeling it tonight as most

.

Schilling's

ankle showed some wear and tear as the game progressed

Boston

Globe

http://www.boston.com/dailynews/294/sports/

New York Times

http://www.nytimes.com/2004/10/20/sports/baseball/

USA

Flash Photo’s

http://www.usatoday.com/sports/gallery/2004/mlb-lcs/flash.htm

|

Trinity Capital, a subsidiary of Bank of the West, is a national leader in the equipment financing industry with a consistent presence and superior reputation. |

Wednesday,

October 20, 2004

Headlines---

Classified

ads---Places to Advertise/Some for Free

Pictures

from the Past---Schwartz/Dunham/McAfee/Head

Amex,

Matsco, former Rep. Leasing of SC, Depping Buys Bank?

ELA

Survey: Activity Down, But Profits Good

The

30 Year History of UAEL--- Part II

Marc

Baert Joins The Alta Group

Scott

Schauer Joins Key Equipment Finance

CitiCapital’s

Ellen Alemany cited as “Woman to Watch” in Banking

Baseball

Poem--Mickey Mantle's Birthday

######## surrounding the article denotes it is a “press

release”

Editor’s Note: Good News and Bad News. First

the bad news:

Northern California’s

first October winter storm knocked the power off

in our area in Saratoga,

California, where I both write and

send out Leasing

News. In a short period, we received over

three inches of rain,

more than any other city in the Bay Area.

Thus no edition yesterday.

Good News:

Power is back on. The weather is also clearing up for the UAEL Conference

in Monterey, California. Thursday is predicted: Sunny.

-------------------------------------------------------------------------------

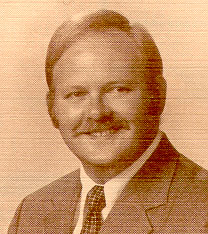

Correction: Here is a current picture of John Torbenson,

more

current than the

1993 printed on Monday.

(and

yes, he still likes to play a lot of golf.)

John Torbenson, President

Odyssey Equipment Financing Company

4130 N. Goldwater Blvd. Ste. 217

Scottsdale, AZ 85251

Toll-Free (888) 607-6800

(480) 607-6800 Fax (480) 607-6868

www.oefc.net

-------------------------------------------------------------------------------

Classified

ads---

www.adams-inc.com

www.affinitysearch.com

www.bajobs.com

www.careerbank.com

www.careerpath.com

www.craigslist.org

(available in many cities now, use scroll feature)

www.elaonline.com

www.goldenparachute.com

www.Headhunter.net

www.hotjobs.com

www.jobs.net

www.lessors.com

www.MarketingJobs.com

www.monitordaily.com

www.Postonce.com

www.RecruiterConnection.com

www.resumeblaster.com

www.vetjobs.com

www.worktree.com

Leasing News is dedicated to helping people find work,

a better job, advance in your career, and the best

time

to start looking for a job is when you don’t need

one.

Interviews are very good practice to hone your skills

in talking about you, your skills, what you have accomplished.

Works at your job the best you can, make friends,

learn

more, become more valuable to your employer, and

your reward will not only be recognized by others,

but will give you the security you can find a paying

job at any age.

Activity leads to activity.

---------------------------------------------------------------------

|

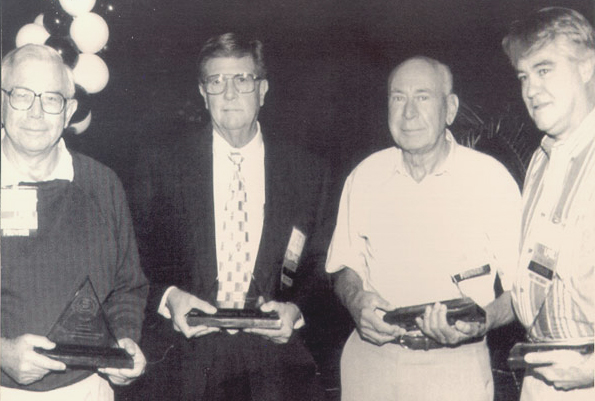

Pictures

from the Past---

November,1999---Schwartz/Dunham/McAfee/Head

Founders Award presentation

in celebration of the Association’s

20th Anniversary

(left to right) Art Schwartz, Steve Dunham, Harold

“Hal” McAfee, and

Steve Head.

November, 1995 UAEL

Regional Reporter

-------------------------------------------------------------------------------

Amex,

Matsco, former Republic Leasing of SC, Depping Buys Bank?

by Kit Menkin

The Wall Street Journal

reports "Insiders say that Greater Bay Bancorp is soliciting potential

buyers, though it is not clear what banks may be interested in the $1.5

billion-plus valued Greater Bay. The bank's assets total $7.6 billion

and it has reported net income of $24.5 million for the second quarter;

it operates under a number of names in the San Francisco area. Sandler

O'Neill & Partners is said to be handling the sales process. Bank

merger activity has slowed since this summer, but the financial industry

is still the most active sector in global mergers and acquisitions,

and 23 of the deals announced this year so far have been bigger than

a Greater Bay deal would be. The California banking market is fairly

consolidated already, observers note."

The Matsco Companies

are part of Greater Bay Bank.

NetBank has been

looking around to spin off various divisions, one of them reportedly

to be the former Republic of South Carolina. Could

it be the many trips

to Houston, Texas, were to see Thomas J.

Depping, as one person

who knew him well said, “He most likely needs to get back in business

because of his spending habits.”

We do have an unconfirmed

report, at this time, the Gazelle finally got his wish: Reportedly he closed on the purchase of Main

St. Bank in Kingwood, TX a suburb of Houston last week. What’s next?

You may have a chance

to ask him as Thomas J. Depping is registered to attend the ELA Conference

in San Diego with his former right hand Bob Quinn. Depping put down

he is CEO/Chairman, Main Street Investment Partners, Inc., 2909 High

Valley Drive, Kingwood, Texas 77345. He is not registered as a member

(when we checked,) but first time attendees are allowed to attend as

non-members. Or as one

observer noted, “he

is up to his old tricks again.”

The mill is getting

more active about American Express wanting to sell it's leasing division,

some say just the portfolio. CIT has allegedly asked to look at their

“book.” American Express has a reputation

for taking care of

their people.

Some very high sources

say the rumor is true. One person, in the know. speculated that Rich

Tambour, General Manager of American Express Business Finance, has put

out feelers. It also could be he may stay for a few years in the sale

and then retire; it depends on the buyer. One thing, he won’t be working

at Main Street Bank in

Kingwood, Texas.

Many American Express

Business Finance employees tell Leasing News they think the buyer is

GE Capital, and ask what do we know? Really, only what readers tell

us, as the major corporations only talk to us via press releases.

Leasing News has

been told by several very high sources that the

word on the street

that the division is up for sale is true; bidders

welcome. No doubt,

GE Capital has the cash.

If you are attending

the ELA Conference in San Diego,

you might find out

what company wants to put in an offer.

Also let me know

if Rob Yohe, who taught Bob Quinn all

about “Private Label”

leasing at Denrich, goes back to

his old time boss,

or better yet, if Oren Hall is coming out of retirement to work for

Tom Depping.

I did hear by e-mail from the former First Sierra/Sierra Cities President Thomas J.

Depping. I did ask him by e-mail for an interview, to talk about what his plans,

his new bank....He responded, "I will be in Monterey over the weekend. I would be happy to buy you a drink."

It will be very interesting as former First Sierra officers, managers, and

competitors will be there. I bet they all will get along, including

Oren Hall, Mark McQuitty...as Tom Depping is that good. He is the

Donald Trump of the Equipment Leasing Industry.

Thomas J. Depping in his Office drinking Diet Coca Cola

------------------------------------------------------------------------------

Classified

Ads---Help Wanted

Brokers

|

About the company: SCL has been in business for 12 years. We are contracted with multiple funding sources which enables us to provide more competitive rates and flexible terms and conditions. |

Funding/Loan Processor

|

Dealer Credit Finance Analyst / Dealer Credit Finance Services Supervisor

|

Dealer Credit Fin. Services Supervisor, Torrance, CA. Click here for full descrip. & to apply. To learn more about us, please visit: www.toyotafinancial.com/careers |

National Account Manager

|

Trinity Capital, a subsidiary of Bank of the West, is a national leader in the equipment financing industry with a consistent presence and superior reputation. |

Vendor Account Executive

|

About the Company: Lease Corporation of America is a well established, 16 year old, national equipment leasing company. |

Our Classified Ads are the most economical

you can buy to reach

25,000 readers in the

leasing industry

in every issue.

$400.00 for four lines

$50.00 per line the next

four lines

$25.00 per line thereafter

The lines do not

include logo area, which is free,

as well as the description about

your company, or

any links to your

site or full job

description. Artwork

is free. Price is for ten newsletter issues

(the ad remains on

the web site and is usage

is not counted if

no newsletter issue.)

Start the ball rolling

by e-mailing: maria@leasingnews.org

--------------------------------------------------------------------------

ELA

Survey: Activity Down, But Profits Good

ELTnews

The Equipment Leasing

Association 2004 Survey of Industry Activity reports volume down, but

higher profitability for the equipment leasing and finance industry

in 2003. Delinquencies and charge-offs dropped, too, indicating improved

portfolio quality.

Another financial

indicator is pre-tax spread. The data shows that 2003 pre-tax spread

declined slightly when compared to the previous year. This decline can

be attributed to a combination of factors: decrease in pre-tax yield

& slight decrease in cost of funds.

The 2004 version

of the annual Survey of Industry Activity reports on the leasing activity

of 135 leasing and finance organizations. It is a ?must-have? for lessors

interested in comparing their operations and performance to their industry

peers, and a critical management tool for any business trying to compete

in today's challenging leasing environment.

The 2004 Survey Report is available at from the ELA Store at http://www.elaonline.com/Store/ProductDetail.cfm?product_code=SIA2004.

Questions can be

emailed to Bill Choi at Bchoi@elamail.com.

-------------------------------------------------------------------------------

Please

send to a colleague, as we are trying to build our

readership. Subscription is free.

-------------------------------------------------------------------------

The

latest books and instruction manuals on leasing

|

Your One stop solution for training and reference material for the Leasing Professional

|

The

30 Year History of UAEL--- Part II

by

Kit Menkin

“Steve Dunham, WAEL’s founder and first president,

fixes his gaze on where we’ve been and where we’re going, both as an

industry and an association.”

Fall 1996 United Association of Equipment Leasing

Newsline

Dunham has 20-20 Vision

By James Veldez Geluz

He is

a 30-year veteran of the equipment leasing industry. He founded its most dynamic association. With these unique credentials,

Steve Dunham has a clear perspective of leasing's past, present,

and the future.

It's

a perspective that offers valuable

insight to everyone in leasing community. Dunham sees the development

of both the industry and the

association as one marked by

a number of distinct, and parallel, stages.

Stage

One:

The Early Years

At WAEL's inception in 1974, the

leasing industry, in the midst of developing standards for procedures

and documentation, was in a

largely formative stage. And, obviously, the association was as well.

The association, which was started to provide a means of exchanging information and building industry relationships,

was an exciting entrepreneurial

undertaking for Dunham. He saw a need and looked to meet it with WAEL.

Dunham, while eagerly taking credit for WAEL's formation, is modest about his

role in making the association run

effectively. "All the credit goes to Art Schwartz," Dunham insists, noting

the contributions of the association's original executive

vice president. "He took a wild idea of mine and made

sense of it.-"

Dunham marks this early stage,

as well as every subsequent stage, by associating it with WAEL's

leaders at that time. The early presidents - Dunham, Harold

"Hal" McAfee, Steve Head, and Fred Shieman

- along with Schwartz, laid the foundation for the association. This

task included determining the activity

of the association, ranging from developing pro-grams to organizing meetings to

attract and aid members, ac-cording to Dunham.

True to his entrepreneurial spirit,

Dunham focused his energies to generating excitement for the then-fledgling organization.

"I had lots to do to get people interested in WAEL,"

Dunham recalls.

In addition to starting the association, Dunham's entrepreneurial skills were tested with the formation of

his present company, Leasing

Associates of Cupertino, CA,

in 1976. The lease brokerage was the latest step for Dunham, who has

worked in the leasing industry since

1963, initially working for

funding sources. But, "in

1967, I wanted

to be a broker, and have been ever since, " Dunham said.

Stage

Two:

A

Coming of Age

The next stage for the association centered around the effort

to build a solid membership base. Continuing his theme, Dunham connects this period

to its leadership of the day. "The

presidents - John Torbenson, Bob Jacobson, III - they were the

go-go guys that tried to get membership

up," Dunham reflects.

Dunham sees the period led by Jim Possehl, CLP, Ronald Wagner,

CLP, and Bill Grohe as the

"coming of age" group, especially

in terms of assuming the management

of WAEL. They were successful in coping with "the difficult

time of moving from the association management organization [that ran

WAEL] to creating a self-running association,"

Dunham said. This included the hiring

of Jon Bednerik.

During this stage, the industry

continued to evolve. Where once few companies wanted to deal with brokers, the leasing and lending companies increasingly turned

to brokers. "Commissions went up; residuals went up,"

according to Dunham. With excitement being generated in leasing

circles, more commercial lenders got

into the act. "They'd do any-thing to fund

deals," Dunham said.

Stage

Three:

Transition

Transition describes the next period, not only for the

association, but for the industry as well. For WAEL and Presidents Hal Horowitz, CLP, Gordon Roberts, and

Peter Eaton, CLP, that meant a deliberate

attempt to fine-tune its member services. Part of this refocusing

included the bringing on board of

Ray Williams, Ph.D., the current Executive Vice President. "Where

Jon [Bednerik] was more of

an administrator, Ray is much more of a front man, more geared to promoting the association," Dunham ascertains.

In relation

to the industry, transition has meant the paramount importance of the

computer and advances such as credit-scoring systems for today's leasing operation. These changes

become vital to keep up in the current economic climate.

Ways of moving ahead include the

development of strategies to cope with downsizing and increased competition,

ac-cording to Dunham. One of the ways to cope is to increase efficiency,

whether through business practice innovation or technological means.

The task remains problematic, however: "The smaller

lessor or broker is pushed hard to make a profit," Dunham

diagnoses.

Dunham has confidence in the association's current leadership in dealing with

the transitional upheaval. "Jim Merrilees (CLP) is a great steadying

force," Dunham notes. "Because of his personality as a bright,

steady guy, he's ideal for man-aging UAEL through the transition."

The

association which was started to provide means

of exchanging information and building industry relationships, was an exciting entrepreneurial undertaking for Dunham. He saw a need and looked to meet

it with WAEL.

The Next Stage

For the future, Dunham again projects

confidence in UAEL's leadership.

"Oren Hall (who is slated to assume

the association presidency in 1996) is ideal for the times, given his

experience in the industry," Dunham

said. "He's the perfect

guy to assimilate the changes in the industry."

But Dunham is careful to recommend

a course of action for the association

that he founded. UAEL should be instrumental in providing the

means of learning - educational programs, regional meetings, and association-wide

conferences - that will help its members deal with the challenges of

the future. With these resources, leasing firms will be "all the

better to prepare for the future of changes" Dunham

said. "UAEL can answer the questions like

`How do we run our business more efficiently?' or `how do

we increase business by maximizing the telephone

or mail?"'

Given his longevity in the industry,

it is obvious that Dunham has enjoyed

a great deal of success. Instrumental in this success is his

wife, Diane. "I couldn't have

got-ten where I am today without her, " he re-calls. "She's certainly

as responsible as any for our prosperity."

Another element includes

association involvement, especially the networking opportunities for

our members. "Networking has always been an important part of the association,

and is cost-effective," Dunham explains.

By attending meetings, it provides an

opportunity to meet people and not have to travel " to their

offices.

"Regional

events supply ideas, especially ones that no one picks up on," Dunham

continues. "90 percent of what people say,

you've heard before, but then, somebody will say, `this is how we do this,' and I'd incorporate

the idea."

Being part of this constant dialog has yielded much

success for Dunham. Looking back

over his career, he pays a consider-able complement: "WAEL has made me a lot of

money."

For his

next stage, Dunham will concentrate on "the fun

stuff," as he calls it - the marketing

of Leasing Associates and generating more "wild ideas." From the

man whose wild ideas have included forming WAEL, it's sure

to be some fun stuff

--------

Today Steve Dunham

oversees the operation from his New England office. The Santa

Clara staff includes Betty Loya, a twenty year employee, as operations

manager and his son Brad Dunham as sales manager. Jay Coles continues

to operate the Pleasant Hill Office.

Brad Dunham

Sales Manager

Leasing Associates

3000 Scott Blvd. Suite 104, Santa Clara, CA 95054

Phone: (800) 544-3981 Ext. 103 Fax: (800) 700-7595

Email: ilease@yahoo.com

“Standing: 1996 United

Association of Equipment Leasing President Elect Oren Hal. Insert: Saturday

keynote speaker Art Schwartz,

( originally a management

service provider, then the first executive secretary of the organization.)”

November, 1995 UAEL

Regional Reporter

A

recent “Whatever Happened to...” found Bob Jacobson:

Bob Jacobson Found Alive and Well!!!

Leasing

News has printed several “Pictures of the Past” regarding former

equipment leasing industry Bob Jacobson. On

February 12

In 1983, Robert S.

Jacobson, III, was the Western Association of Equipment Lessor vice-president. At the time he was vice-president, National

Broker Division, Tri-Continental Leasing Corporation, a division of

Bell Atlantic, a major telephone company.

A WAEL Leasing Conference was not the same without him. He had

served as vice present and member of the Executive Committee. In 1984

he

He was recruited

by Don Smith and Hy Bren of Interlease, San Francisco in 1974, from

Union Bank. Don died of a heart attach while playing tennis in Tiburon,

and his then partner Hy Bren went on to form his own company, finally

joining Matsco, Emeryville, California, where he was a star salesman

and sales personnel recruiter,

Bob learned from

the great advertiser/promoter Don Smith at Perry's on Union Street about

“discounting” to start his own leasing company in 1975, which was sold

to a holding company where he remained president until forming Leasing

Acceptance. where Ben Millerbus was the sales manager. They had a direct

sales force. In the next downturn of the industry,

1978, the company split up: Millerbus left to start Pentek Leasing,

San Jose, California. He later he sold it in 1982 to Alaska Pacific

Bancorporation, which in turn was sold to a large Upstate New York bank.

Millerbus didn't stay retired long, forming Pentech Financial Services

in Campbell, California with the backing of John Otto, plus was co-founder

of Silicon Valley Bank ( he has recently formed a group to start a commercial

bank again ).

Jacobson, well-known

for his late night poker games, set up a broker “private label” operation

called Tri-Continental Leasing, then located in Mountain View, California.

In one of the next economic down turns, the telephone company divested

itself of this division, shutting down their branch operations. Bob

then went to work for Amembal, Deane & Associates doing lease training

across the country. From memory, he was here about a year before he

left the leasing business to join Hewlett-Packard, reformed, reportedly

doesn't gamble, and last heard was involved in managing an engineering

department. He and his family live in the Half Moon Bay area, California,

where he commutes to work (just like John McCue of McCue Systems, Inc.)

Attempts to reach

Jacobson him for a statement of the industry have gone unanswered. He

has been “annoyed” at Kit Menkin for several years for not attending

his birthday party, and that's Bob.

The

Good News ! ! !

Cheryl and Bob Jacobson are Alive and Well in Lake Tahoe

“As you all know,

I had become passionate about technology during my final years in the

leasing industry. After

Bell Atlantic Tricon decided to close the broker division in the early

90's, I devoted about a year to building up a computer BBS (Bulletin

Board System) out of my home. One of my users was a manager at HP Laboratories

in Palo Alto. He made me

a job offer to join HP as a temporary I.T. worker, installing computers

at the labs. That progressed

to a full time engineering job where I eventually became a department

manager in charge of inventing disruptive technologies.

“After about 5 years, my natural core competency of B*S* took over, and I was sent into the field. I ended up being a Business Development Manager for Europe, and then Asia. My job was to negotiate the multi-million dollar alliance and partner relationships for HP overseas. After 300,000 miles of travel per year and 270 nights in hotels every year for a 4 year period, I finally had to get out

in 2002.

“Cheryl and I found

ourselves in Lake Tahoe over a holiday, and fell in love with the area! We sold our home in Half Moon Bay, bought

a house up here, and then tried to figure out what we wanted to do for

work. I thought that maybe being a blackjack

dealer would be a great change of pace!

I was accepted into Harvey's black jack school, but when Cheryl

found out, she told me absolutely not.

She didn't want me in the smoke filled, booze filled, environment. I learned a long time ago that I wear

the pants in the family, but she tells we what color and which leg to

put in first. :-)

“So, Marriott opened

up a timeshare resort in Heavenly about that time.

I called up and they immediately took me on board. I've been selling vacation ownership here

in Tahoe since May '03.

“I'm still sober,

don't gamble anymore, and love living in Paradise!!

Attached is an updated

picture they took at HP a couple of years ago.

“I think about all

my friends in the Leasing Industry many times.

I try to keep up with what's happening to all my old friends

as much as I can. If anyone

wants to email me, my email address is jacobson@overjoyed.com.

And, Kit, you are totally forgiven for standing me up on my birthday

dinner so many years ago. :-)

“Bob Jacobson”

April, 1981 WAEL Newsline

Irene Devine has joined the Western Association of

Equipment Leasing staff as Associate Director. In addition to serving as Editor of Newsline, Irene will work with Executive Director Fran Schwartz and the Associate Director, Arthur Schwartz.

Irene formerly worked with the California Escrow Association, and has a background in publications, public relations and marketing.

February 24,1984,

it was announced Randy Bauler, CAE. would become the full time

executive director.

Randy Bauler, CAE,

formerly Executive Vice President of the Electric League of Arizona,

joined the Western Association of Equipment Leasing executive staff

in February.

“ ‘We are delighted

to have someone of Randy’s experience and enthusiasm join us,’ said

WAEL president Bob Jacobson. “WAEL has grown tremendously in the past

few years and many new programs are planned for this year. Randy will

be a real asset to the WAEL management team.”

“Bauler will work

with the WAEL Board and Long Range Planning Committee in developing

a strategic plan for WAEL’s next five years. Responsibilities for committee

projects and other WAEL programs will be divided between Bauler and

WAEL Executive Director Irene Devine.

“Public Relations,

Member Services, Certification, Membership, Brokers and Federal Legislative

Involvement Committees will be coordinated by Bauler. Devine will work

with Education, Legislative Relations, Accounting, Tax, Legal and Standards

Committees and will continue to edit

“Bauler started his

career as an association executive with the Arizona Electric League

in 1975. He received the Professional Performance award form the American

Society of Association Executives in 1981 and his CAE ( Certified Association

Executive) designation in 1983.”

June, 1985, the new logo was approved:

WAEL NEWS LINE December, 1988

WAEL Selects New Executive

Vice President

After Months of conducting

an extensive nationwide search, the WAEL Management Selection Task Force

recommended a twenty -year association executive, Jon C Bednerik; he

was appointed by the WAEL Board of Directors to the position of Executive

Vice President during a special meeting held in November.

Bednerik assumed

his new post on December 5. That date marks the beginning of the transition

from the long-term relationship with Management/Association Services,

Inc. (MAS), which has been providing administrative support to WAEL

for some fifteen years. WAEL will establish its own association headquarters

staff in the Oakland/San Francisco Bay area. Plans call for the transition

to be completed around mark of 1989.

Chosen from a field

of more than 400 candidates, Bednerik has been Executive Director of

the Western Independent Bankers (WIB) for over five years. WIB is a

regional trade association of 300 independent banks and some 50 associate

member firms in thirteen Western States.

Bednerik's association

career includes serving as Director of Government Affairs for over six

years with the National Association of Drilling Contractors, and five

years with the National Society of Public Accountants, as well as two

years with the National Association of Broadcasters. A registered lobbyist

in Washington, D.C., his prior job experience was a newspaper reporter

and in the advertising and publishing fields.

A graduate of Rollins

College in Winter Park, FL with a bachelor's degree in philosophy and

government, he also completed his course work for an LLB at Vanderbilt

University School of Law in Nashville, TN.

Bednerik noted, "WAEL

is extremely fortunate to have the benefit of outstanding volunteer

member involvement and has enjoyed the services of one of the finest

multi-association management firms in the country. Now WAEL has the

opportunity to develop its own full time team. My goal is to continue

to build on the strong foundation and to provide expanded membership

services, to emphasize high quality seminars at reasonable costs, and

to create higher public profile for professional lessors and the important

role played by the leasing industry."

An avid sailor, he

and his wife Darlene, live in Alameda. Their daughter Lydia attends

the University of California at Santa Cruz.

Management of WAEL

will be in the process of transition throughout the first few months

of 1989, while the new office is being relocated. (See "President's

Perspective" column for details on the Management Transition Task

Force.) Watch your mail and future issues of Newsline for updates and

details on all of the exciting changes currently happening in your association.

|

|

|

|

|

Executive Director |

Meeting Planner |

Administrative Assistant |

|

"The director of the |

"I've got a great idea for our next meeting-if only I could remember

it." |

""Good morning. This is WAEL. |

|

|

|

|

|

|

|

|

|

Artist |

Director of Publications |

Director of Administration |

|

"I paint; therefore, I am." |

"Not now! I'm right in the middle of a great magazine." |

"Let's see... one plus one is two, two plus two is ..."- |

" Jon Bednerik

was a real "people person'. Bednerik had a lot of imagination...

Events and creativity were the best. "

Ron Wagner

" Jon came to

WAEL from the Independent Banker's Association after search committee

interviewed more than 20 candidates and reviewed more than 100 resumes.

Jon's strengths were his written communications and publications. If

you remember the Newsline prior to Jon's tenure it was of much lower

quality. Jon received a crash course in financial management during

his first year at WAEL. To say we had some tough finance meetings before

the BOD met is a gross understatement. The Executive Committee at the

time; Ben Millerbis-Past President, Jim Possehl-President, Ron Wagner-VP

and Bill Grohe-Sec-Tres held weekly conference calls and held Jon's

hand as much as possible. Our Spring Conference at the Camelback was

a success, but not without some significant good fortune. The Fall Seattle

Conference was also successful but the chaos behind the scenes was serious

hand wrenching. We were very fortunate to have hired excellent staff

and the year was a positive one for WAEL but required four or five times

the time and effort by the executive committee and a load of good luck."

Jim Possehl

Western Association

of Equipment Leasing ( WAEL )

Tomorrow---

Part III

On Dr. Ray William’s watch:

WAEL becomes UAEL

----------------------------------------------------------------------

### Press release #########################

Secretary

General of Leaseurope Joins The Alta Group

Marc

Baert

LONDON --In anticipation

of his 2007 retirement from his present role as secretary general of

Leaseurope, Marc Baert has joined The Alta Group as an associate. The

Alta Group, an international consulting firm specializing in the equipment

leasing industry, serves Latin America, North America and Asia Pacific

as well as Europe. Mr. Baert will serve Alta clients throughout Europe

but will focus especially on emerging markets in Central and Eastern

Europe.

Mr. Baert studied

law at Leuven University and was admitted as a Barrister to the Brussels

Bar in 1968. He entered the world of finance in 1972 and until 1984

was the director of sales and marketing at International Factors in

Brussels. During that time he also earned an MBA at the University of

Ghent.

From 1985 until the

present time, Mr Baert has served as the Secretary General of both Leaseurope

and Eurofinas in Brussels. These organisations are the central trade

bodies of both leasing and consumer credit in Europe and are made up

of the national associations. Their main purpose is to represent the

views of the two industries in the European Community and within the

European Commission.

Mr Baert has played

a huge support role to the fledgling markets of the Central and Eastern

European countries, both those who have recently joined the European

Community and those still awaiting membership. He has given considerable

assistance and advice as these countries have formulated their laws

and practices to encourage the development of a leasing industry.

Derek Soper, Principal

in the London Office, said “We are delighted to have Marc Baert join

us, he has made a significant contribution to the development of the

emerging leasing industry in Central and Eastern Europe and his expertise

will help us to keep well ahead of our competitors.”

About The Alta Group

Founded in 1992, The Alta Group (www.thealtagroup.com) is a leading source of corporate consulting and advisory services, education, and training to the global equipment leasing and finance industry. The Alta Group’s European office, based in London since 1998, is now composed of eight members, all with extensive backgrounds in the $500 billion global equipment leasing and finance markets. Globally the Group is composed of former CEOs, company founders, and industry organisation leaders-who collectively have more than 500 years of experience. For more information on The Alta Group and its

European operations,

visit www.thealtagroup.com or

call Derek Soper

at +(44) 1444 891344.

### Press Release

######################

KEY

EQUIPMENT FINANCE NAMES SCOTT SCHAUER

VICE

PRESIDENT, DIRECT LARGE TICKET ASSET MANAGEMENT

SUPERIOR, CO. – – Key Equipment Finance, one of the nation’s

largest bank-affiliated equipment financing companies and an affiliate

of KeyCorp (NYSE: KEY), has announced the appointment of Scott Schauer

as vice president of direct large ticket asset management. His office

is located at Key Equipment Finance’s world headquarters outside Boulder,

Colorado.

“Scott brings a wealth

of knowledge to the CLS-Direct\Large Ticket Asset Management team,”

said Paul Frechette, president and chief operating officer for Key’s

commercial leasing services group. “He is not only experienced in a

bank-owned lessor environment but also has passed all the exams required

to be an ASA Certified Appraiser and has extensive knowledge in the

equipment financing categories relevant to our business.”

Prior to joining

Key, Schauer was senior vice president and director of asset management

for GMAC Commercial Finance in Atlanta, Georgia, where he directed and

developed all aspects of asset management for the Equipment Finance

Division. He has nearly 20 years of equipment financing and asset management

experience gained through positions at SGI Solutions Finance, Mellon

US Leasing, Maryland National Leasing Corporation and G.E. Capital Corporation.

Schauer is a member of the American Society of Appraisers and the National

Aircraft Finance Association.

KeyCorp

affiliate Key Equipment Finance has announced that the company now manages

an equipment portfolio in excess of $10 billion. "Reaching $10

billion in assets is an exciting milestone in our company's history,"

says Key Equipment Finance President and CEO Paul A. Larkins. "The

real accolades go to all of our professionals who are dedicated to providing

best-in-class products and services to our clients around the globe."

Key Equipment Finance

is an affiliate of KeyCorp (NYSE: KEY) and provides business-to-business

equipment financing solutions to businesses of many types and sizes.

The company focuses on four distinct markets:

• businesses of all sizes in the U.S. and Canada (from small

business to large corporate);

• equipment manufacturers, distributors and value-added resellers

worldwide;

• federal, provincial, state and local governments as well as other

public sector organizations; and

• lease advisory services for manufacturers’ captive leasing and

finance companies.

Headquartered outside

Boulder, Colorado, Key Equipment Finance has annual originations of approximately $3.9 billion, and as noted earlier,

manages a $10 billion equipment portfolio. The company has major management

and operations bases in Toronto, Ontario; Albany, New York; London,

England; and Sydney, Australia. The company, which operates in 24 countries

and employs 675 people worldwide, has been in the equipment financing

business for 30 years. Additional information regarding Key Equipment

Finance, its products and services can be obtained online at KEFonline.com.

Cleveland-based KeyCorp

(NYSE: KEY) is one of the nation's largest bank- based financial services

companies, with assets of approximately $85 billion. Key companies provide

investment management, retail and commercial banking, consumer finance,

and investment banking products and services to individuals and companies

throughout the United States and, for certain businesses, internationally.

The company's businesses deliver their products and services through

KeyCenters and offices; a network of nearly 2,200 ATMs; telephone banking

centers (1.800.KEY2YOU); and a Web site, Key.com(R), that provides account

access and financial products 24 hours a day.

### Press Release

#########################

CitiCapital’s

Ellen Alemany cited as “Woman to Watch” in Banking

Ellen Alemany has

been cited by U.S. Banker Magazine as the #8 “Woman to Watch” in banking.

Alemany is President and CEO of CitiCapital, Citigroup’s equipment leasing

and finance business and EVP of Citigroup’s Commercial Business Group,

which offers banking and commercial real estate services for small business

and middle market customers. She is also a member of the Citigroup Management

Committee. Additionally, Alemany serves as Treasurer and Board of Trustee

of the Equipment Leasing & Finance Foundation and is a member-elect

of the ELA Board of Directors.

The annual ranking

was based on U.S. Banker's review of 5,039 women in senior positions,

considering financial performance, job complexity, experience, management

style, ethics, community ties, education, and influence over a specific

market among their criteria.

In its write-up,

U.S. Banker notes, “In the last 21 months, [Alemany] built CitiCapital

into the second largest U.S.-based leasing company, thanks to acquisition

of Associates, Copelco, EAB and Schroeders. With a global portfolio

of $20 billion plus, CitiCapital now boasts more than 575,000 customers

and is a player in construction, material handling, transportation,

healthcare and business technology finance.

Ajay Banga, EVP of

Citigroup’s Global Consumer Group credit’s Alemany’s “strategic vision”

and “tremendous integrity” for her success. “She’s very warm and emotive,”

he says. “And she makes everyone have a voice.”

CONTACT:

Lisa Whitestone

CitiCapital

Phone Number: 914-899-7819

Fax Number: 914-899-7766

E-mail: lisa.t.whitestone@citigroup.com

### Press Release

##########################

|

Your One stop solution for training and reference material for the Leasing Professional

|

News

Briefs---

ABS East notches

record attendance

http://www.absnet.net/include/showfreearticle.asp?file=/headlines/1.htm

First major storm

of season pounds California

http://www.sfgate.com/cgi-bin/article.cgi?f=/news/archive/

2004/10/19/state0112EDT0192.DTL

California's job

growth slow, steady

http://www.signonsandiego.com/news/business/

20041019-9999-1b19jobless.html

Greenspan: Household

Debt Not Serious Threat

http://www.washingtonpost.com/wp-dyn/articles/A44761-2004Oct19.html

FCC Chair to Seek

Net Telephone Oversight

http://news.yahoo.com/news?tmpl=story&cid=562&u=/ap/

20041019/ap_on_hi_te/powell_voice_over_net_2&printer=1

Assuming Someone

Else's Lease: Point, Click, Wait

http://www.nytimes.com/2004/10/18/automobiles/

Google wins tech

growth race

http://www.usatoday.com/money/industries/technology/

Redding, CONN: An

Old Mill Gives Way to a Village

http://www.nytimes.com/2004/10/20/business/20real.html?pagewanted=all

-------------------------------------------------------------------------------

Sports

Briefs---

Cards hope there's

no place like home

http://www.stltoday.com/stltoday/sports/stories.nsf/cardinals/story/

0E6CFD9149FA1EB086256F330018CD71?OpenDocument&Headline=

Cards+hope+there's+no+place+like+home

The Oakland Raiders have traded Jerry Rice to the Seattle Seahawks.

The trade will be final after Rice undergoes a physical and upon League

approval. (from www.raiders.com)

Seattle Seahawks Version of the Trade for Jerry Rice

http://seattletimes.nwsource.com/html/sports/2002066696_hawk19.html

San Francisco Version of Rice Going to Seattle

http://www.sfgate.com/cgi-bin/article.cgi?f=/chronicle/archive/

Chuck Gannon Won’t Be Back This Year/Its Kerry Collins for

the Raiders, while

all the fans yell, “Too-eee” “Too-eee” for

Marques Tuiasosopo,

the third string QB—Looks like Rice

still knows what

he is doing, just as Terrell Owens did

insisting on going

to the Philadelphia Eagles.

http://www.contracostatimes.com/mld/cctimes/sports/football/nfl/

-------------------------------------------------------------------------------

California

Nuts Briefs---

Schwarzenegger cracks

jokes about his wife's politics:

"There was no

sex for 14 days," he says after he endorsed Bush.

Governor bucks Bush

on stem cell research

Schwarzenegger also

supports plan for open primary

http://sfgate.com/cgi-bin/article.cgi?file=/c/a/2004/10/19/MNGVD9C5P01.DTL

---------------------------------------------------------------------------

“Gimme

that Wine”

Mondavi receives

price for entire winery, stock soars after this announcement

http://home.businesswire.com/portal/site/google/index.jsp?ndmViewId=

news_view&newsId=20041018006201&newsLang=en

Update 1: Constellation

Makes Offer to Buy Mondavi

http://www.forbes.com/markets/feeds/ap/2004/10/19/ap1597151.html

Wineries benefit

from tax suspension

http://www.fltimes.com/Main.asp?SectionID=38&SubSectionID=

No more free Russian

River water

Fetzer, Ukiah balk

at paying for first time in 50 years; District contends its a bargain

http://www1.pressdemocrat.com/apps/pbcs.dll/article?AID=/

20041016/NEWS/410160332/1033/NEWS01

Oregon Vintners toast,

roast 2004 weather

http://oregonlive.com/metrosouthwest/oregonian/index.ssf?/base/

metro_southwest_news/1097927708288440.xml

Big and Beautiful:

Lafite for 12/Imperial---Eric Asimov

http://www.nytimes.com/2004/10/20/dining/20POUR.html

---------------------------------------------------------------------------

1803-The

Senate ratified the Louisiana Purchase Treaty by a vote of twenty-four

to seven. Originally concerned that France would develop this territory,

by the time the American delegation reached France, Napoleon was more

concerned about England and to both stop England from gaining this territory,

and to raise money, had offered $15 million for the property. The delegation

accepted it without any authority as too good of an opportunity to turn

down. The ratification was more

a legal formality.

http://memory.loc.gov/ammem/today/oct20.html

1818-A

diplomatic convention signed between Britain and the U.S. gave fishing

rights to American seamen off parts of Newfoundland and the coast of

Labrador. The U.S. renounced such activity within three miles of any

other British Territory. The boundary between Canada and the U.S.

between Lake of the Woods and the crest of the Rocky Mts. was fixed at the

49th parallel. No boundary was decided upon farther west,

and Oregon was declared open territory for ten years.

1827- Emily Howland, received an honorary doctorate

by the University of the State of New York at age 99 for her services

to educating black students which included helping establish or aiding

more than 30 institutions of learning in the youth, and schools in New

York and Virginia.

102-3335791-6093721?v=glance

1847-

Elizabeth Blackwell's application to medical school is accepted. Though

she was refused admittance to 29 medical schools and publicly ridiculed

for her attempts, Elizabeth Blackwell persisted. She studied privately

for three years before being admitted to the Medical Institute of Geneva,

NY, after the director had passed her application on to the students

for approval. Thinking it to

be a joke, they agreed on October 20, 1847, that "...the application

of Elizabeth Blackwell to become a member of our class meets our entire

approval." Her arrival at the school was greeted with shock and

hostility, however. She was cursed, spat upon, refused lodging at first,

and barred from some classroom demonstrations.

1858-Birthday

of James Robert Dewey, American lawyer and legislator, born near Bloomington,

IL, Republican member of Congress from Illinois from 1896 until his

death, Nov 30, 1922, at Washington, DC. Mann was the author and sponsor

of the "White Slave Traffic Act," also known as the "Mann

Act," passed by Congress on June 25, 1910. The act prohibited,

under heavy penalties, the interstate transportation of women for immoral

purposes.

1873

- Showman P.T. Barnum opened the Hippodrome in New York City to accommodate

his "Greatest Show on Earth".

1874

-- Modernist composer Charles Ives lives, Danbury, Ct.

http://www.schirmer.com/composers/ives_bio.html

http://www.ncmutuallife.com/company.html

nc/andrews/menu.html

1901-Birthday

of singer Adelaide Hall, Brooklyn, NY.

http://jacketmagazine.com/11/whalen-writing.html

1924-The

first Negro World Series is played between the Kansas City Monarchs

(Negro National League Champions) and the Hilldale Club (Eastern Colored

League Champions).Kansas City wins the series championship

5 games to 4.

http://www.negroleaguebaseball.com/history101.html

1931-Mickey

Mantle birthday, Baseball Hall of Famer, born at Spavinaw, OK. Mantle

replaced Joe DiMaggio in center field for the New York Yankees

and grew to become the most beloved player of his era.

His battle with liver cancer raised awareness for organ donation

and alcoholism. Inducted into

the Hall of Fame in 1974.

1932

-- Michael McClure born Marysville, Kansas.

http://www.thing.net/~grist/l&d/mcclure/mcclure.htm

http://www.mcclure-manzarek.com/mcclurebio.html

http://www.metroactive.com/papers/sonoma/12.14.00/mcclure-0050.html

1934-Birthday

of tenor sax player Eddie Harris, Chicago, Il.

November 8, 1966.

http://www.cyberstars.com/jazz/les-mccann/eddie.html

http://centerstage.net/chicago/music/whoswho/EddieHarris.html

1944---Top

Hits

Smoke on the Water - Red Foley

1944-

more than 100,000 American soldiers land on Leyte Island, in the Philippines,

as preparation for the major invasion by Gen. Douglas MacArthur. The

ensuing battles of Leyte Island proved among the bloodiest of the war

in the Pacific and signaled the beginning of the end for the Japanese.

The Japanese had held the Philippines since May 1942, when the awful

defeat of American forces led to General MacArthur's departure and General

Wainwright's capture. MacArthur was back, as he promised, but his invasion

of Luzon required a softening up of the enemy. Thus, the amphibious

landing of the American forces at Leyte and the concomitant goal of

destroying the Japanese fleet in the gulf was undertaken. All told,

the Japanese lost more than 55,000 soldiers during the two months of

battle and approximately another 25,000 in mopping up operations in

early 1945. The U.S. forces lost about 3,500-compared with the Japanese

loss of 80,000 total. The sea battle of Leyte Gulf was the same story.

The loss of ships and sailors was horrendous for both sides. The sinking

of the American carrier Princeton resulted in the drowning deaths of

500 men. When the Japanese battleship Musashi was destroyed by a massive

American aerial attack, more than 1,000 sailors died, including the

captain who stood on his bridge and literally went down with his ship.

Three days of sea battle saw the destruction of 36 Japanese warships-compared

with America's three. It also saw the introduction of the Japanese kamikaze-"divine

wind"--suicide bombers. The St. Lo, an American aircraft carrier,

was one of the first casualties, when one kamikaze pilot drove his plane

straight into its flight deck. More than 5,000 kamikaze pilots died

in this gulf battle-taking down 34 ships. But when all was said and

done, the Japanese had not been able to prevent the loss of their biggest

and best warships, signaling the virtual end of the Japanese Imperial

Fleet. The American victory on land and sea opened the door for General

MacArthur's invasion and the recapture of the Philippines. The television

series “Victory at Seas” captures much of this

major battle.

You Belong to Me - Jo Stafford

Wish You Were Here - Eddie

Fisher

I Went to Your Wedding -

Patti Page

Jambalaya (On the Bayou) - Hank Williams

1953

- Science fiction writer Ray Bradbury's chilling futuristic anti-book

novel, “Fahrenheit 451,” was published on this date.

starring Andy Griffith.

1955

- One of Harry Belafonte's hits was recorded for RCA Victor. It took

"Day-O" over a year to hit the pop charts in January of 1957,

after its name was changed to "The Banana Boat Song (Day-O)".

1956-Elvis Presley's "Love Me Tender," is now the first song

to the pop chart at #2. It also makes it to the Country & Western

chart, the R&B chart and the top One Hundred.

1957

- Tonight Walter Cronkite began hosting a weekly documentary. Called

"The 20th Century", the show reported on major events that

shaped modern history. In 1967, the show switched its focus and its

title to "The 21st Century". Until its last show on January

4, 1970. Cronkite was the only narrator of the program.

1961-

The Supreme Court upholds a Florida law which exempts women from jury

duty, unless they volunteer. In all, 18 states allow the jury duty exemption

while three state, Alabama, Mississippi, and South Carolina outright

barred women from jury duty. However, on 02-07-1966, a federal court rules

that such laws should end on June 1, 1967 because such laws "deny

to women the equal protection of the laws in violation of the 14th amendment."

In January of 1975 the Supreme Court says a Louisiana law forbidding

women serving on juries is unconstitutional.

The first woman juror served in the State of New York in 1936.

1962-The

Four Seasons' "Big Girls Don't Cry" is released.

1968---Top

Hits

Fire - The Crazy World of Arthur Brown

Then You Can Tell Me Goodbye - Eddy Arnold

1973-The

Rolling Stones have their first Number One ballad, "Angie,"

a song that sparks rumor that it's a love song from Jagger to David

Bowie's wife, Angela.

servlet/ShowMainServlet/showid-591/The_Six_Million_Dollar_Man/

1976---Top

Hits

1979

- The John F. Kennedy Library in Boston was dedicated.

Hard Habit to Break - Chicago

1988-Top

Hits

Wild, Wild West- The Escape Club

1989

- Forty-nine cities reported record low temperatures for the date as

readings dipped into the 20s and 30s across much of the south central

and southeastern U.S. Lows of 32 degrees at Lake Charles LA and 42 degrees

at Lakeland FL were records for October, and Little Rock AR reported

their earliest freeze of record. Snow blanketed the higher elevations

of Georgia and the Carolinas. Melbourne FL dipped to 47 degrees shortly

before midnight to surpass the record low established that morning.

Showers and thunderstorms brought heavy rain to parts of the northeastern

U.S. Autumn leaves on the ground clogged drains and ditches causing

flooding. Up to 4.10 inches of rain soaked southern Vermont in three

days. Flood waters washed 600 feet of railroad track, resulting in a

train derailment.

http://geo.arc.nasa.gov/sge/jskiles/fliers/all_flier_prose/oaklandfires

_brass/oaklandfires_brass.html

http://www.firewise.org/pubs/theOaklandBerkeleyHillsFire/

http://www.presol.com/~paulkienitz/px/gal-fire.html

October 20

1991- Oakland Hills fire, California

http://geo.arc.nasa.gov/sge/jskiles/fliers/all_flier_prose/

oaklandfires_brass/oaklandfires_brass.html

1993-Top

Hits

Dreamlover- Mariah Carey

Just Kickin It- Xscape

Id Do Anything For Love (But I Won t Do That)- Meat Loaf

1995

- The clever black comedy, Get Shorty, starring John Travolta, Rene

Russo, Gene Hackman, Danny DeVito, and Dennis Farina, opened across

the country. The film did well at the box office, and once again affirmed

Travolta's "come back" to films.

2001—Top

Hits

Silver Side Up-Nickeback

Pain is Love-Ja Rule

Songs in a Minor-Alicia Keys

World Series Champion This

Date

1982---

St. Louis Cardinals

1988—Los

Angeles Dodgers

1990-Cincinnati

Reds

Today is Mickey Mantle’s birthday, so first,

a song made popular by Teresa Brewer, a top hit

in its day, sung along with the famous home run hitter.

I love Mickey

Mickey who? You know who...

The fella with the celebrated swing

I love Mickey

Mickey who? You know who...

The one who drives me batty ev'ry Spring

If I don't make a hit with him my heart will break in two

I wish that I could catch him and pitch a lttle woo oo

I love Mickey

Mickey who? Mickey you. Mickey me?

That's who oo oo oo oo oo oo oo

I love Mickey

Mickey who? You know who...

His muscles are a mighty sight to see

I love Mickey

Mickey who? You know who...

The one I want to steal right home with me

I'd sacrifice most anything to win his many charms

I'd like to be a fly ball and pop into his arms oo

I love Mickey

Mickey who? Mickey Mantle

Mm mm I love you

Who, me?

Mm mm I love you

Not Yogi Berra?

Mm mm I love you

Here are other “baseball hit” songs:

http://www.davesfunstuff.com/funnycity/aaabaseball.htm

|

Lyrics to Roy Clark's Rendition of Performed at Mickey Mantle's Funeral, August 15, 1995 -

Dallas, TX |

|

(When Mickey heard Roy Clark sing the song, "Yesterday

When I Was Young," he felt it summed up his life very

well. He asked Roy if he would sing it at his funeral.)

Yesterday when I was young The taste of life was sweet as rain upon my tongue

I teased at life as if it were a foolish game The way the evening breeze may tease a candle flame

The thousand dreams I dreamed, the splendid things

I planned I always built, alas, on weak and shifting sand I lived by night and shunned the naked light of day

And only now I see how the years ran away Yesterday when I was young So many drinking songs were waiting to be sung So many wayward pleasures lay in store for me And so much pain my dazzled eyes refused to see I ran so fast that time and youth at last ran out

I never stopped to think what life was all about

And every conversation I can now recall Concerned itself with me, and nothing else at all

Yesterday the moon was blue And every crazy day brought something new to do I used my magic age as if it were a wand And never saw the waste and emptiness beyond The game of love I played with arrogance and pride

And every flame I lit too quickly, quickly died The friends I made all seemed somehow to drift away

And only I am left on stage to end the play There are so many songs in me that won't be sung

I feel the bitter taste of tears upon my tongue The time has come for me to pay for yesterday when

I was young "Yesterday

When I Was Young"

Lyrics by Charles Aznavour Translated into English by Herbert Kreutzer Performed by

Roy Clark, August 15, 1995, Dallas, Texas |

|

www.leasingnews.org |