|

|

|

About the company: SCL has been in business for 12 years. We are contracted with multiple funding sources which enables us to provide more competitive rates and flexible terms and conditions. |

Friday,

October 29,2004

Headlines---

"Foundation

Celebrates, Welcomes New leadership"

Capital

Leasing Very Popular This Time of the Season

EFG

Enters “Franchise Leasing” Business and More

Chicago’s

Rodney Dixon Found Guilty of Leasing Fraud

Kenesaw

Leasing/J&S Leasing Sold to FSG Bank

Reality

Check: Ensure Your Company's Future

MicroFinancial

Announces 3rd Q 2004 Results: Loss

Universal

Express Sells Capital Subsidiary

Marlin

Business Services 3rd Q 2004 Net Up $3.5M

IKON

Credits GE Commercial Finance for Its Success

######## surrounding the article denotes it is a “press

release”

|

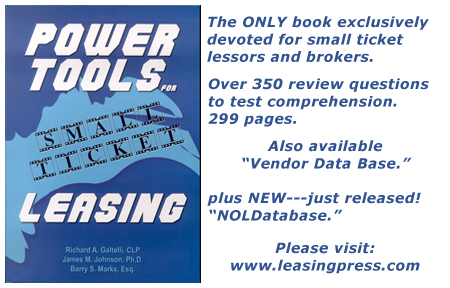

Your One stop solution for training and reference material for the Leasing Professional

|

-------------------------------------------------------------------------------

Classified

Ads---Back Office

Back

Office

Atlanta , GA.

GlobalTech Portfolio Services provides world class lease, loan administration and asset management for equipment and vehicles. Current portfolios $1 billion. Contact Alan Zeppenfeld 678-816-2216

E-mail: azeppenfeld@globaltechfinancial.com

Atlanta, GA.

Let Tax Partners handle your sales and use tax compliance duties w/less risk and cost than in-house. Largest tax compliance firm in US

E-mail: sales@taxpartners.com

Dallas, TX.

Property Tax and

sales and use tax administration services performance is guaranteed

and we will save you time and money or our service is free.

E-mail: info@osgsolutions.com

Indianapolis,

IN

JDR Solutions, LLC specializes in delivering customized back-office lease portfolio admin./ASP services for lessors, banks, manufacturer captives:

other financial institutions.

Paul Henkel (317)

251-5352 ex. 7201

E-mail: paul.henkel@jdrsol.com

Jacksonville,

FL.

CIT's Portfolio Service

Group: providing cost-effective lease/portfolio services: Accounting,

Tax Reporting, Collection svc, End of Lease Solutions, Front End Documentation,

Invoicing, and on-line reporting

E-mail: vincente.dingianni@cit.com

Back Office: Laughlin, NV.

20 years experience

on funder/broker sides. Looking for a relationship where I act as credit

shop for smaller brokers when financial statements are involved.

E-mail: batarista@laughlin.net

New Rochelle,

NY

Proactive management/administration

of commercial/consumer vehicle lease/finance portfolios covering insurance,

titles,

E-mail: Barrett@BarrettCapital.com

Northbrook, IL

Our staff of CPA's and lease professionals can handle any or all portfolio responsibilities incl. portfolio mgmt, invoicing, sales/property/income tax, accounting, etc.

E-mail: ngeary@edwinsigel.com

San Rafael, CA

We can run your back office from origination to final payoff. 30 years experience in commercial equipment lease and loan portfolio management.

E-mail: gmartinez@phxa.com

full listing of all “Outsourcing” ads at:

http://64.125.68.90/LeasingNews/JobPostingsOutsourcing.htm

"Foundation

Celebrates, Welcomes New leadership"

ELTnews

In a lunchtime awards

ceremony on Monday at the Equipment Leasing Association Convention,

The Equipment Leasing and Finance Foundation recognized donors and celebrated

a successful year.

James Renner, Wells Fargo Equipment Finance, outgoing Chairman of

the Foundation, told attendees, "2004 has been a great year for

the Foundation. This year, we set $300,000 as our annual fundraising

goal. I am pleased to announce, here today - the Foundation has reached

and exceeded that goal, and 2004 contributions totaled $332,000.

While recognizing

the generosity of the foundation's many contributors, Renner said "Foundation

research is 100% donor supported. Only your generosity produces the

worthwhile studies and knowledge enhancing reports the Foundation publishes

each year." Renner also announced that GE Commercial Finance has

donated $125,000 over 3 years, earning the designation of Foundation

Fellow.

The ceremony also

saw a changing of the Foundation's leadership, as Renner and James Possehl,

Republic Financial Corp., retired from the Board of Trustees. Both will

remain active in the Foundation.

"I know I leave

the Foundation in very capable hands, with an excellent Board of Trustees

and strong chairman," said Renner, as he introduced his successor

as Chairman, Joe Lane, Bay4 Capital.

In a Monday breakout

session, Charles Wendel, Financial Institutions Consulting, and David

Wiener, GE Commercial Finance-Capital Markets Group, presented results

of the Equipment Leasing & Finance Foundation's newly published

2004 State of the Industry Report.

Some of the results

highlighted include:

*Leasing volume and

penetration declined in 2003 because of low

interest rates, bonus depreciation and a sharp drop in large ticket

activity.

*Industry profitability

improved because of reduced operating costs

and better credit quality.

*Banks are exploiting

their customer relationships and lower cost of

funds.

*Independents are

increasing their emphasis on niche markets

*Captives are narrowing

their focus to their core captive products.

Overall, more lessors

are "plotting paths for growth" by being more selective in

the their niches, but expanding their offerings beyond just financing.

ELT will feature a detailed look at the State of the Industry Report in its January issue. Equipment leasing & Finance Foundation Donors will receive the Report free of charge. Non-donors may purchase a copy of the SOI report for $200. Go to the Foundation website at

http://www.LeaseFoundation.org/

---------------------------------------------------------------------------

Capital

Leasing Very Popular This Time of the Season

The special

depreciation allowance created by Congress in 2002 and expanded in 2003

has been continued in 2004 to stimulate the economy.

http://www.irs.gov/pub/irs-regs/td9091.pdf

|

-------------------------------------------------------------------------------

EFG

Enters “Franchise Leasing” Business and More

by Kit Menkin

No, this is not an

“April 1st” gag, although it may

qualify as a new chapter in a “soap opera” or a New York

Post

“exclusive.” It really

is a Drudge Report item. Perhaps

the

National Inquirer

will buy the rights.

“EQUIPMENT FINANCING

GROUP, INC. OFFERS $150,000 APPLICATION ONLY PROGRAM!

“Equipment Financing

Group, Inc. offers limited franchise offices. EFG is offering 62 satellite

offices in 39 states for a small one time franchise time fee. This fee

will also cover a 5 day training and marketing class.”

The above was the banner advertisement in the Thursday, October 28,

Monitor Daily.

The above is a banner

of the front page of the EFG website. On the company web site. They

also promote plastic credit cards for “lease lines” and “ lease approvals.”

The site also shows

three icons: Better Business Bureau, Equipment Leasing Association,

and United Association of Equipment Leasing.

It does not show the National Association of Equipment Leasing

Brokers (NAELB) icon. Ken Wheeler has had a running feud with the National

Association of Equipment Leasing Brokers.

In fact, he intends to file a “Ricco” action against the association

for damages he claims incurred to his company on the NAELB forum, he

has told Leasing News. The attorney he reportedly retained would not

confirm any information

Leasing News tried

several times to reach Mr. Wheeler for a comment

on the franchise

development advertised in the Monitor Daily and

status of his pending

law suit.

Mr. Wheeler’s son Sean Wheeler was very active as president

of Source One, a company that also set up franchises across the country,

and then got into

trouble. He went to many leasing conferences,

exhibiting for broker

business, also trying to sell “franchises”

to those new in the

business. Along the way he even

became a Certified Leasing Professional ( although that is also a controversy

that will have to

wait until Johnnie Johnson comes back from

Kuwait---he has all

the CLP test scores in his garage at home.)

Sean eventually sold

the leasing operation to the owner of “Wet Pets,” and then traded Source

One for his new enterprise, last heard he was in the tropical fish servicing

and pet sitting business (I am not making this up.)

Leasing News has

written many stories about Source One, Sean Wheeler, and Ken Wheeler

alleged involvement in his son’s business, including the “feud” regarding

the use of his office by his son ( his side) and the ethics involved

(NAELB) which lead to the dispute.

Mr. Wheeler recently

told Leasing News he was “de-emphasizing” the broker side of his business

and thus the reason for the new direct sales office.

August 26,2004, Equipment

Financing Group stated in a press release: "This office will service

over 800 accounts for which EFG currently provides support. The office

will be run by former VP of Election Campaign Marketing Morgan Bennett.

Mr. Bennett started and operated more than 11 political campaign call

centers in the past 12 years in the Washington DC, and Maryland area.

Our call center will house 29 representatives respectively."

For past stories

on Sean Wheeler, please go to:

http://www.leasingnews.org/Conscious-Top%20Stories/

This article explain

the dispute between NAELB and Ken Wheeler:

Sean Wheeler of Fresno,

California Stands Up-----

Kenneth Wheeler Takes

On NAELB Legal Counsel Joe Bonanno

http://two.leasingnews.org/archives/June2002/6-18-2002.htm

Please send to a

colleague and ask them to subscribe.

We are

-----------------------------------------------------------------

Chicago’s

Rodney Dixon Found Guilty of Leasing Fraud

Rodney Dixon admitted

falsely inflating his company Lacrad's net worth to defraud six equipment-leasing

companies of more than $11.4 million and a Texas bank of $2.25 million

for the jet purchase. He

He was convicted

of fraud, pleading guilty in federal court in Chicago to a sophisticated

fraud scheme in which lenders were misled about the success of the business

and bilked out of more than $13 million.

Dixon was able to

mislead many of the lenders into thinking he had as much as $20 million

in Banco Popular by faxing fraudulent confirmations of the deposits

on papers that appeared to be produced by the bank, according to the

Chicago Tribune story.

Dixon also supplied

the lenders a phony phone number for Banco Popular to ensure any calls

would be routed back to his office. He would then pose as the banker

and confirm the huge bank deposits, O'Rourke said.

It turned out that

Lacrad's auditors, Goldblum & Goldblum, never existed. He was able

to fool lenders in part by working out of well-appointed offices in

1 Oakbrook Lane, a DuPage County high-rise, holding meetings around

an $85,000, custom-made conference table, according to O'Rourke.

To give the office

the appearance of a bustling operation, Dixon hired about a dozen temps

to pose as employees, O'Rourke said. He also wore suits costing several

thousand dollars each to have the look of success, he said.

Dixon also had glossy

brochures produced with a photo of his supposed management team -- all

but a couple of them actors hired from a modeling agency, according

to O'Rourke.

http://www.chicagotribune.com/news/local/west/

chi-0410280207oct28,1,2890364.story

--------------------------------------------------------------------

Kenesaw

Leasing/J&S Leasing Sold to FSG Bank

Chattanooga, Tenn.-based

FSG Bank ( formerly known as Frontier Bank) has acquired Knoxville Kenesaw Leasing and J&S Leasing Inc.,

two companies that broke off from previous owner National Bank of Commerce

when it merged with SunTrust Banks in October.

FSG, which has $675 million in assets, also announced yesterday that

the former president of the National Bank of Commerce Knoxville, David

R. Haynes, has been chosen to lead FSG's Knoxville operations.

The $48-million-asset

Kenesaw Leasing provides owner-managed businesses with new and used

equipment, fixtures, and furnishings, while J&S Leasing, with $13.6

million in assets, leases equipment and machinery to construction and

trucking companies.

As wholly owned subsidiaries of FSG, the two Knoxville-based companies

will retain their names and current staffs.

--------------------------------------------------------------------

Classified

Ads---Help Wanted

Account Representative

|

BALTIMORE-BASED

ACCOUNT REPRESENTATIVE

- In this position, you will develop and maintain relationships

with lease brokers, leasing companies, equipment vendors and direct

leases throughout Maryland and Virginia. Must be knowledgeable

in indirect/third party transactions ranging $15K and up. |

|

About

the Company: At Dell

Financial Services, we aspire to fuel your potential with

the kind of challenging opportunities and hands-on support you

need to grow. We're the exclusive provider of leasing and finance

services for Dell technology systems worldwide. |

Brokers

|

About the company: SCL has been in business for 12 years. We are contracted with multiple funding sources which enables us to provide more competitive rates and flexible terms and conditions. |

National Account Manager

|

Trinity Capital, a subsidiary of Bank of the West, is a national leader in the equipment financing industry with a consistent presence and superior reputation. |

Vendor Account Executive

|

About the Company: Lease Corporation of America is a well established, 16 year old, national equipment leasing company. |

Cost of classified

help wanted ads:

$400.00 is minimum

for four lines

For larger ads

$50.00 per line:

the next four lines

$25.00 per line thereafter

This does not include:

Your logo, which

is free.

Also free: the description of your company is free

( not more lines than your ad.)

This is for ten issues

printed ( the ad in the

web site remains

until ten issues are

sent out. The top

of the newsletter is

on a rotation basis,

and not guaranteed

for specific days. Placement is alphabetical

with larger ads first.)

http://64.125.68.90/LeasingNews/PostingFormWanted.asp

-----------------------------------------------------------------

****Announcement******************************

"Reality Check: Ensure Your Company's Future By Attracting

and

Keeping the Best and the Brightest"

ELTnews

An informative, 90-minute

web-based seminar scheduled Tuesday, November 9, 2004 beginning 2:00

pm Eastern Time will discuss the challenges facing leasing companies

today in their efforts to keep their best employees and attract new

talent from a younger and more diverse population. Highlights from the

newly released "2004 Leasing Industry Compensation Survey"

compiled by Semler Brossy Consulting Group will be included. Issues

discussed include:

- How has the tightening

of the job market affected compensation?

- How have regulatory

pressures affected long-term compensation philosophies, such as option

grants?

- What are the trends

in sales force compensation today?

- How has the career

path for a leasing professional changed?

- What kind of talent

is most sought after in today's leasing companies, and what kinds of

pressures are they facing?

- Why is it important

to attract and develop talent from a younger and more diverse population

and what are some companies doing about it?

- How are companies

ensuring they have the top talent needed for their future?

This program is designed

for all executives and managers involved in the hiring of personnel

and human resource professionals working in a leasing environment. Most

companies will want to include a multi-person team in this web seminar

who represent these disciplines. To learn more and to register, both

ELA members and non-members

http://www.elaonline.com/Events/2004/Attract/

***** announcement

***************************

Federal

Reserve Beige Report

Reports from the

twelve Federal Reserve Districts generally indicated that economic activity

continued to expand in September and early October. Boston, Philadelphia,

Chicago, Minneapolis, and Kansas City noted continued expansion in economic

activity. Richmond and Dallas said the pace had quickened, while New

York, Cleveland, and San Francisco suggested that growth had moderated

somewhat. St. Louis received mixed reports on economic activity, and

Atlanta cited widespread hurricane-related disruptions. Many reports

suggested that higher energy costs were constraining consumer and business

spending.

Full Report:

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/FullReport.htm

By Federal Reserve District

Boston

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/1.htm

New York

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/2.htm

Philadelphia

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/3.htm

Cleveland

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/4.htm

Richmond

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/5.htm

Atlanta

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/6.htm

Chicago

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/7.htm

St. Louis

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/8.htm

Minneapolis

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/9.htm

Kansas City

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/10.htm

Dallas

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/11.htm

San Francisco

http://federalreserve.gov/FOMC/BeigeBook/2004/20041027/12.htm

-------------------------------------------------------------------------

#### Press Release

##########################

MicroFinancial

Announces Third Quarter 2004 Results: Loss

WOBURN, Mass.----MicroFinancial

Incorporated (NYSE:MFI), announced its financial results for the third

quarter and the nine months ended September 30, 2004.

MICROFINANCIAL INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except share and per share data)

(Unaudited)

| For the nine months | |||

| ended September 30, | |||

|

|

----------- |

----------- 2004 ----------- |

|

| Revenues: | |||

| Income on financing leases and loans | $25,372 | $9,962 | |

| Rental income | 25,763 | 24,177 | |

| Income on service contracts | 6,653 | 4,671 | |

| Loss and damage waiver fees | 4,271 | 3,127 | |

| Service fees and other | 9,533 | 6,078 | |

| Total revenues | ----------- 71,592 ----------- |

----------- 48,015 ----------- |

|

| Expenses: | |||

| Selling general and administrative | 25,677 | 21,359 | |

| Provision for credit losses | 39,900 | 37,885 | |

| Depreciation and amortization | 12,463 | 11,391 | |

| Interest | 6,364 | 2,016 | |

| Total expenses | ----------- 84,404 ----------- |

----------- 72,651 ----------- |

|

| Loss before benefit for income taxes | (12,812) | (24,636) | |

| Benefit for income taxes | (5,125) | (9,856) | |

| Net loss | ($7,687) | ($14,780) | |

======================

Net loss per common

share - basic and diluted ($0.59) ($1.12)

======================

Weighted-average

shares used to compute:

Basic and diluted net loss per share 12,999,035 13,182,050

-----------------------

For the nine-month

period ended September 30, 2004, revenues decreased 32.9% to $48.0 million

compared to $71.6 million during the same period in 2003. The reduction

in revenues is directly related to the decline in the size of the Company's

leases, rentals, and service contracts.

The net loss year

to date ending September 30, 2004 was $14.8 million or ($1.12) per share

versus a net loss of $7.7 million or ($0.59) per share for the same

period last year. Total operating expenses for the nine months ended

September 30, 2004 were $72.7 million compared to $84.4 million in 2003.

Interest expense declined 68.3% to $2.0 million as a result of average

debt balances being lower by approximately $93.2 million as compared

to the same period last year. Selling, general and administrative expenses

decreased 16.8% to $21.4 million for the first nine months of the year

versus $25.7 million for the same period last year. The decrease was

driven in part by a reduction in personnel related expenses of approximately

$2.1 million, rent expenses of approximately $0.9 million, and legal

expenses of $0.5 million. The Company's headcount at September 30, 2004

was 102; down from 144 at September 30, 2003, while depreciation and

amortization decreased 8.6% to $11.4 million compared to $12.5 million

in 2003. The provision for credit losses decreased 5.1% to $37.9 million

for the nine-month period from $39.9 million for the same period last

year. Year to date net charge-offs increased to $57.2 million for the

nine months ended September 30, 2004 from $52.7 million from the same

period last year. Total cash received from customers year to date decreased

38% to $66.7 million from the same period last year. Total cash received

from customers exceeded year to date revenues by $18.7 million.

Third quarter revenue

for the period ended September 30, 2004, was $14.2 million compared

to $22.1 million for the same period last year. The reduction in revenues

is attributable to the decrease in the size of the Company's portfolio

of leases, rentals and service contracts. The Company was forced to

suspend virtually all originations from October 2002 until June 2004

when the Company was able to secure a limited amount of new financing.

During the third quarter of 2004, the Company focused its efforts on

securing a larger, lower priced line of credit and restarting its origination

business with a few select vendors.

The net loss for

the quarter was $4.2 million, or a loss of $0.32 per share as compared

with a net loss of $3.2 million or a loss of $0.25 per share in the

prior year's third quarter. The net loss is primarily the result of

a 64.3% decline in lease and loan revenues to $2.6 million, a 33.4%

decline in service contracts to $1.4 million, and a 37.8% decrease in

service fees and other to $1.8 million as compared to the same period

last year. Other components of revenue declined by 14.5% to $8.5 million

Total operating expenses

for the quarter declined 22.4% to $21.3 million as compared to the same

period in 2003. Interest expense declined 64.8% to $0.6 million as a

result of lower average debt balances for the quarter. Selling, general

and administrative expenses decreased 7.7% to $7.2 million for the third

quarter ended September 30, 2003, versus $7.8 million for the same period

last year. The provision for credit losses decreased to $10.3 million

for the quarter ended September 30, 2004 from $13.9 million for the

same period last year, while net charge offs increased to $17.8 million

from $16.6 million. Past due balances greater than 31 days delinquent

at September 30, 2004 decreased to $51.5 million from $67.8 million

last quarter. Total cash received from customers for the quarter decreased

15.6% to $19.0 million compared to $22.5 million for the previous quarter.

Cash received from customers exceeded total revenues by $8.3 million

for the quarter.

On September 29,

2004, the Company entered into a $30 million, three year revolving line

of credit with CIT Commercial Services Group. This facility provided

the Company with a lower cost of funds, allowed the Company to pay off

its previous line of credit, and permitted the Company to avoid having

to issue an additional 135,000 warrants at $0.825 to the participants

under the old credit facility. As of September 30, 2004, the total outstanding

debt under the new line of credit was $11.3 million.

Richard Latour, President

and Chief Executive Officer of MicroFinancial stated, "We were

very pleased to have finalized the revolving credit facility with CIT.

This new credit facility was the next step in our process and will now

provide the Company with the opportunity to focus on marketing efforts

and hiring a sales force in order to rebuild vendor relationships in

our efforts to re-establish ourselves as the leader in microticket leasing

and finance."

MicroFinancial Incorporated

continues to operate without the use of gain on sale accounting treatment

and a balance sheet with total liabilities less subordinated debt to

total equity plus subordinated debt of 0.4 to 1.

CONTACT: MicroFinancial Incorporated

Richard F. Latour, 781-994-4800

President and CEO

### Press Release

#############################

Universal

Express Sells Capital Subsidiary

NEW YORK--Universal

Express Inc. (OTCBB:USXP), today sold 75% of Universal Express Capital

Corp. its former subsidiary, to Capitalliance, a $350,000,000 insurance

and funding operation. USXP will retain 10% of the shares of the new

Company and 15% of the shares of the Company will be distributed to

USXP shareholders.

After the new Universal Express Capital is approved as a public entity,

shareholders of USXP will be notified of the distributions of shares

to them.

In addition, the new Universal Express Capital run by Capitalliance

will now serve as a lead funding source for future USXP acquisitions

and investments.

"Most importantly, USXP will receive a preferred lending rate

and Capitalliance is initially capitalizing Universal Express Capital

with $22,500,000 of assets. Capitalliance receives and develops an active

trading company, USXP receives a funding partner and 10% of a $22,500,000

capitalized company with bonding relationships worldwide. Our shareholders

will receive stock distributions of Universal Express Capital and, in

addition we have received from Capitalliance a funding lead commitment

of $22,000,000 for Alpine Airlines financing and $225,000,000 for our

Equipment Trust Certificates Program," said Richard A. Altomare,

Chairman & CEO of Universal Express.

About Universal Express

Universal Express, Inc. owns and operates several subsidiaries including

Universal Express Capital Corp., (including its USXP Cash Express division)

Universal Express Logistics, Inc. (including Virtual Bellhop, LLC and

Luggage Express), and the UniversalPost Network. These subsidiaries

and divisions provide the private postal industry and consumers with

value-added services and products, logistical services, equipment leasing,

and cost-effective delivery of goods worldwide.

### Press Release

#############################

Marlin

Business Services Corp. Reports Third Quarter 2004 Earnings

MOUNT LAUREL, N.J.--(BUSINESS

WIRE)----Marlin Business Services Corp. (NASDAQ:MRLN) today reported

net income of $3.5 million, or $0.30 per diluted share, for the quarter

ended September 30, 2004 compared with a net income attributable to

common shareholders of $371,000 or $0.12 per diluted share in the same

quarter of 2003. For the nine months ended September 30, 2004 net income

was $10.2 million, or $0.87 per diluted share compared with net income

attributable to common shareholders of $136,000 or $0.06 per diluted

share for the nine months ended September 30, 2003.

"Our disciplined operating approach led to another strong quarter

of profit performance," said Dan Dyer, Chairman and CEO of the

company. "We delivered solid asset quality results and attractive

returns on capital. As a leading lender to small business, we are committed

to the delivery of value-added solutions to the customers we serve."

Marlin completed its initial public offering of common stock (IPO)

on November 12, 2003. Certain non-recurring expenses and preferred dividends

were recorded in 2003 and in prior periods which reduced net income

attributable to common shareholders. A reconciliation between net income

attributable to common shareholders in accordance with accounting principles

generally accepted in the United States of America (GAAP) and pro forma

net income for 2003 is provided in a table immediately following the

2003 Supplemental Quarterly Data included with this release. These charges

ended in conjunction with the November IPO and associated corporate

reorganization and therefore will not affect future reporting periods

beginning in 2004. As a result, we believe the pro forma numbers for

2003 present a clearer and more comparable basis to review the company's

fundamental financial performance. On a pro forma basis, net income

for the three and nine-month periods ended September 30, 2003 was $2.3

million and $6.6 million, respectively.

Highlights for the quarter ended September 30, 2004 include:

-- For the quarter ended September 30, 2004, net income was $3.5

million, a 52.6% increase over the pro forma net income of $2.3 million

for the quarter ended September 30, 2003.

-- Diluted earnings per share were $0.30 per diluted share in the third quarter of 2004, compared to $0.28 per diluted share for pro forma earnings in the quarter ended September 30, 2003. Growth in EPS was achieved despite approximately 30% growth in outstanding shares following our November

2003 IPO.

-- Annualized returns on average equity and assets were 16.23% and

2.57%, respectively, for the quarter ended September 30, 2004. For the

first nine months of 2004, annualized returns on average equity and

assets were 16.69% and 2.70%, respectively.

Asset Origination

-- Based on initial equipment cost, lease production was $68.8 million

in the third quarter of 2004 compared with $70.5 million in the second

quarter of 2004 and $65.4 million in the third quarter of 2003. Net

investment in leases grew to $480.1 million at September 30, 2004, an

increase of 21.0% from $396.8 million at September 30, 2003.

-- The weighted average implicit yield on new business was 13.75%

for the quarter ended September 30, 2004 compared to 14.07% for the

second quarter ended June 30, 2004 and 13.80% in the third quarter of

2003.

-- Our end user customer base grew to more than 75,000 at September

30, 2004 compared with 66,000 as of year-end 2003.

Credit Quality

-- Net charge-offs totaled $2.2 million for the third quarter of

2004 compared to $2.1 million for the second quarter of 2004. The provision

for credit losses was $2.7 million for the third quarter of 2004 compared

to $2.4 million for the second quarter of 2004.

-- On an annualized basis, net charge-offs were 1.90% of average

net investment in leases during the third quarter of 2004 compared to

1.93% for the second quarter of 2004.

-- As of September 30, 2004, 0.73% of our total lease portfolio was

60 or more days delinquent, up from 0.66% as of June 30, 2004.

-- Allowance for credit losses was $6.0 million as of September 30,

2004, an approximate $460,000 increase over the prior quarter. Allowance

for credit losses as a percentage of average net investment in leases

was 1.28% at September 30, 2004 compared to 1.23% as of June 30, 2004.

The allowance for credit losses was increased in the third quarter by

an additional $250,000 to reserve for certain accounts 60 or more days

delinquent as of September 30, 2004.

-- In conjunction with this release, static pool loss statistics

have been updated as supplemental information on the investor relations

section of our website at www.marlincorp.com.

Net Interest and Fee Margin and Cost of Funds

-- Based on the average net investment in leases, the net interest

and fee margin was 12.04% for the quarter ended September 30, 2004,

a decrease of 55 basis points compared to a record of 12.59% for the

second quarter ended June 30, 2004. The decrease is attributed in part

to the successful completion of the company's sixth term securitization

transaction on July 22, 2004 which refinanced short-term variable rate

warehouse financing with higher cost fixed rate term financing.

-- Fee income as a percentage of average net investment in leases

was 3.58% for the quarter ended September 30, 2004 compared to 3.57%

for the quarter ended June 30, 2004.

-- Interest expense as a percentage of average net investment in

leases was 3.97% for the quarter ended September 30, 2004. This was

a 69 basis point increase from the 3.28% for the quarter ended June

30, 2004. This increase reflects the higher cost of the fixed rate term

financing including approximately 30 basis points attributed to the

$80.5 million prefunding feature in the July term securitization.

-- Interest expense as a percentage of weighted average borrowings

was 3.81% for the third quarter ended September 30, 2004 compared to

3.63% for the second quarter of 2004 reflecting the higher cost of fixed

rate term financing issued July 22, 2004.

Operating Expenses

-- Salaries and benefits expense was $3.5 million in the third quarter

of 2004 compared to $3.4 million in the second quarter of 2004. Salaries

and benefits expense was 3.1% as an annualized percentage of average

net investment in leases for both the second and third quarters of 2004.

-- Other general and administrative expenses were $2.5 million for

the third quarter of 2004, a decrease of $200,000 from $2.7 million

for the second quarter of 2004. Other general and administrative expenses

as an annualized percentage of average net investment in leases were

2.16% for the third quarter of 2004, a decrease of 32 basis points from

2.48% in the second quarter of 2004. The decrease is primarily attributed

to certain non-recurring items that affected the second quarter.

Insurance and other Income

-- Insurance and other income was $1.2 million for the third quarter

of 2004 compared to $1.0 million for the second quarter of 2004. The

increase is attributed to an 8.7% increase in the average number of

accounts in the insurance program in the third quarter.

Funding and Liquidity

-- On July 22, 2004, we completed our sixth term asset-backed securitization

transaction. This was the company's first securitization rated P-1/A-1+,

AAA/AAA, A2/A-, Baa2/BBB by Moody's and Standard & Poor's. Proceeds

from the transaction were used to repay the company's warehouse credit

facilities and provide an additional $80.5 million for future lease

production.

-- On August 16, 2004 we exercised our call option and paid off our

2001 term securitization at a time when the remaining note balance was

$16.3 million and the coupon was approximately 6.0%.

-- As of September 30, 2004 we have $265 million of committed warehouse

funding capacity and more than $66 million in available cash.

-- Our debt to equity ratio was 5.27:1 at September 30, 2004 compared

to 4.66:1 at June 30, 2004. The increase is principally attributed to

the additional borrowings related to the prefunding feature of the 2004

term securitization.

About Marlin Business Services Corp.

Marlin Business Services Corp. is a nationwide provider of equipment leasing solutions primarily to small businesses. The company's principal operating subsidiary, Marlin Leasing Corporation, finances over 60 equipment categories in a segment of the market generally referred to as "small-ticket" leasing (i.e. leasing transactions less than $250,000). The company was founded in 1997 and completed its initial public offering of common stock on November 12, 2003. In addition to Mount Laurel, NJ, Marlin has regional offices in or near Atlanta, Chicago, Denver and Philadelphia. For more information, visit www.marlincorp.com or

call toll free at

(888) 479-9111.

Marlin Business Services

Corp. Bruce E. Sickel, 888-479-9111 x4108

#### Press Release

#############################

IKON Announces Fourth Quarter and Fiscal 2004 Results;

Earnings In Line With Expectations;

Fiscal Year Closes With Strengthened Balance Sheet,

Success

in Growth Platforms

VALLEY FORGE, Pa.------IKON Office Solutions (NYSE:IKN), the world's largest independent channel for document management systems and services, today reported results for the fourth quarter and fiscal year ended

September 30, 2004.

Net income for the fourth quarter was $25.6 million, or $.17 per

diluted share, on revenues of $1.17 billion. Net income includes certain

unusual charges and benefits recorded during the quarter, representing

approximately $.03 per diluted share, which have been excluded from

GAAP earnings on the attached non-GAAP reconciliation in order to provide

a better view of the Company's operational performance in the fourth

quarter. Excluding these unusual charges and benefits, net income was

$21.5 million, or $.14 per diluted share, in line with the Company's

expectations for the fourth quarter.

Revenues for the fourth quarter of Fiscal 2004 were $1.17 billion

compared to $1.20 billion for the fourth quarter of Fiscal 2003, a decline

of 2.5%. Targeted revenues increased by 3% and represented 96% of the

revenue mix. Targeted revenues exclude finance revenues from the Company's

exit from its captive leasing business in North America in the second

and third quarters of Fiscal 2004, and de-emphasized technology hardware.

Foreign currency translation provided a 1.5% benefit to total revenues.

"Our fourth quarter performance reflects steady progress toward

our long-term objectives, as we continue to shift to a stronger product,

services, and customer mix," stated Matthew J. Espe, IKON's Chairman

and Chief Executive Officer. "We maintained our focus on our strategic

priorities: operational leverage, optimizing our core sales and service

capabilities in areas such as national accounts and color, and expansion

into profitable adjacencies such as Professional Services. Our national

account business continues to be successful with revenues up 40% over

the same period in Fiscal 2003. Color revenues increased by 19% in the

quarter, strengthening our prospects for future service and supply revenues.

Also in the quarter, we launched Enterprise Services' new integrated

solutions portfolio of document management services that will allow

us to address the specific business problems and document challenges

our customers are facing in both office and production environments.

Our new partners in this endeavor are best-in-class providers like EMC

(Documentum), Captaris, Kofax and Equitrac, who, together with our equipment

partners, enable us to offer complete, end-to-end solutions addressing

every phase of the document management lifecycle.

"Two major factors contributed to our performance in the quarter:

the slower summer months, which had a greater impact on the volume experienced

in our off-site Managed Services businesses than we anticipated, and

our aggressive posture in winning new transactions in some of our growth

platforms, which caused some softness in our Net Sales margins. However,

we are exiting the fourth quarter better positioned for growth in Fiscal

2005; in fact, the fourth quarter marked our highest quarter for new

customer wins in both our national account group and our facilities

management business - the largest component of Managed Services. We

are clearly seeing the benefits of our strategic investments in 2004

and look forward to applying that same rigor to other areas of the business

in 2005.

"This year marked a strategic milestone for us as we commenced

the transition out of our lease financing business in North America

as part of a new strategic alliance with GE Commercial Finance ("GE")

and achieved a more attractive business model with a lower risk profile,

a more favorable capital structure, and expanded alternatives for cash

usage. The balance sheet is strong; 44% of our $805 million in corporate

debt matures in 2025/2027; and, we have $473 million in cash on hand,"

Mr. Espe concluded.

During the fourth quarter, the Company repurchased 4.5 million shares of IKON's outstanding common stock for $52.3 million. Year-to-date, the Company has repurchased 6.7 million shares for approximately $78 million, leaving $172 million remaining for share repurchases under the 2004

Board authorization.

The IKON Board of Directors approved the Company's regular quarterly

cash dividend of $.04 per common share. The dividend is payable on December

10, 2004 to shareholders of record at the close of business on November

22, 2004.

Fourth Quarter Analysis

Net Sales of $542.2 million, which includes the sale of copier/printer

equipment, direct supplies and technology hardware, increased by 4.4%

from the fourth quarter of Fiscal 2003. Contributing to this growth

were a 4.7% increase in sales of copier/printer equipment and a 7.8%

increase in supply sales in the quarter, which were offset by a $1.3

million decline in technology hardware sales. Growth in copier/printer

equipment revenues, which represents approximately 90% of Net Sales,

was primarily driven by the new leasing model and growth initiatives.

The new leasing model provides the Company with origination fees for

leases funded in the U.S. and Canada as part of the Company's new strategic

alliance with GE. Gross profit margin on Net Sales increased slightly

to 27.3% from 26.9% in the fourth quarter of Fiscal 2003.

Services of $589.4 million, which includes revenues from the servicing

of copier/printer equipment ("Customer Service"), Managed

Services, Professional Services (collectively, "Enterprise Services"),

rentals and other fees, increased by 2.1% from the fourth quarter of

Fiscal 2003. Overall Services growth was primarily driven by 37% growth

in Professional Services and additional fees received from GE under

the new strategic alliance. Offsetting this growth were declines in

Customer Service and Managed Services of .7% and 2.2%, respectively,

as transaction activity slowed in the summer months. Gross profit margin

on Services improved to 42.3% from 41.0% for the same period a year

ago, primarily due to higher-margin fees received from the Company's

new alliance with GE.

Finance Income of $34.3 million declined by 65.4% from the prior

year due to the Company's previously announced transition out of captive

lease financing in North America. Finance income from the U.S. portfolio

is expected to decline primarily over the next 24 months. Gross profit

margin from finance subsidiaries increased to 74.7% in the fourth quarter,

from 63.7% for the same period a year ago, due to the higher margins

associated with the retained U.S. leasing portfolio and a stronger European

mix.

Selling and Administrative expenses declined by $3.5 million from

the prior year. Excluding $4.7 million in unusual charges in the fourth

quarter, Selling and Administrative expense declined by $8.2 million,

driven mainly by the exit of the captive leasing business in North America.

Interest expense, net, of $13.1 million increased by $1.7 million from

the same period in Fiscal 2003, due to higher corporate debt levels

resulting from IKON's assumption of IOS Capital's public debt, reported

in Finance Interest Expense prior to the third quarter of Fiscal 2004,

offset by cash investments.

Fiscal Year 2004 Results

For the fiscal year ended September 30, 2004, net income was $91.6

million, or $.60 per diluted share, on revenues of $4.65 billion. On

a non-GAAP basis, as described below, earnings were $.72 per diluted

share. On March 31, 2004, certain U.S. assets and liabilities of IOS

Capital were sold to GE, and the Company's Canadian leasing business

was sold to GE on June 30, 2004. As a result, Fiscal 2004 earnings results

only partially reflect the impact of exiting the captive leasing business

in North America.

Non-GAAP adjustments exclude $35.9 million in pretax losses, or $.13

per diluted share, from the early extinguishment of debt; a $11.4 million

net pretax loss, or $.04 per diluted share, from the sale of the Company's

U.S. and Canadian leasing operations; $4.7 million net pretax losses,

or $.02 per diluted share, related to litigation and long-term disability

charges in the fourth quarter of 2004; and tax benefits of $11.8 million,

or $.07 per diluted share, recognized in the second and fourth quarters

of 2004.

Fiscal 2004 revenues of $4.65 billion declined by $61.1 million,

or 1.3%, from the prior year, with modest gains in Net Sales and Services

offsetting the decline in finance revenues. Targeted revenues, which

exclude the impact of U.S. and Canadian leasing and de-emphasized technology

hardware, grew by 2% compared to Fiscal 2003.

Balance Sheet and Liquidity

As of September 30, 2004, the Company had approximately $473 million

in non-restricted cash on its balance sheet. As a result of capital

structure and liquidity-related actions throughout the year, the total

debt to capital ratio decreased to 49.1% from 67.8% at the end of Fiscal

2003.

Cash used in operations for the fiscal year totaled approximately

$377 million, due to income tax payments, higher pension contributions,

and an increase in accounts receivable as a result of the new alliance

with GE. Capital expenditures on operating rentals and property and

equipment, net of proceeds, totaled $74 million. Finance receivable

proceeds and net collections, which provide for a source of cash against

deferred tax liabilities relating to the retained lease portfolio, as

well as lease-related debt repayments, were $365 million.

Outlook

"Fiscal 2004 was a year of strategic repositioning for IKON,

and we are energized by the opportunities we have identified for revenue

growth and improved profitability," commented Mr. Espe. "While

we recognize that fourth quarter operational performance was at the

low end of our expected range, and that market conditions may continue

to be challenging, we are encouraged by the growth potential in areas

such as color, our national account program, and the full range of document

management solutions and services now available through IKON Enterprise

Services.

"Our objectives for Fiscal 2005 assume continued growth and

profitability improvements in our targeted revenue streams, while we

continue to transition out of captive leasing in North America. For

Fiscal 2005, we expect revenues to decline by approximately 2% to 4%,

reflecting 2% to 3% growth in Net Sales and Services, offset by a decline

in finance revenues of approximately 60%. Earnings are expected to be

in the range of $.63 to $.68 per diluted share, reflecting a headwind

of approximately $.15 per diluted share expected from the leasing transition

and double-digit improvement in the remaining business.

"First quarter earnings for Fiscal 2005 are expected to be in

the range of $.12 to $.14 per diluted share.

"Our strong cash position, success in our growth platforms in

2004, and double-digit improvement in our targeted revenue streams in

2005 will give us the momentum we need to deliver substantial improvements

in earnings per share in the years ahead. We remain committed to our

goal of growing earnings per share at an 8% to 12% compound annual growth

rate from 2004 to 2007," Mr. Espe concluded.

First quarter and Fiscal 2005 expectations exclude any additional

potential gain or loss from the early extinguishment of debt that the

Company may incur.

About IKON

IKON Office Solutions (www.ikon.com), the world's largest independent

channel for copier, printer and MFP technologies, delivers enterprise

document management solutions and systems, enabling customers worldwide

to improve document workflow and increase efficiency. IKON integrates

best-in-class systems from leading manufacturers, such as Canon, Ricoh,

Konica-Minolta, EFI and HP, and document management software from companies

like Captaris, EMC (Documentum), Kofax and others, to deliver tailored,

high-value solutions implemented and supported by its global services

organization - IKON Enterprise Services. IKON represents the industry's

broadest portfolio of document management services, including professional

services, a unique blend of on-site and off-site managed services, customized

workflow services, and comprehensive support through its team of 7,000

service professionals worldwide. With Fiscal 2004 revenues of $4.65

billion, IKON has approximately 500 locations throughout North America

and Europe.

#### Press Release

#######################

-------------------------------------------------------------------

News

Briefs----

Mortgage rates fall

again, 30-year lowest since early April

http://www.usatoday.com/money/perfi/housing/

New Checking Law

Takes Effect

http://www.washingtonpost.com/wp-dyn/articles/A7612-2004Oct28.html

Japanese Trust Bank

Sues to Block Merger

http://www.mercurynews.com/mld/mercurynews/business/10038540.htm

--------------------------------------------------------------------

Sports

Briefs----

Sox parade set to

start at 10 a.m. Saturday

http://www.boston.com/news/local/massachusetts/articles/

2004/10/28/menino_sox_parade_most_likely_will_be_saturday/

Curt Schilling, interviewed

on ABC's "Good Morning America," said, "Tell everybody

to vote. And vote Bush next week."

http://news.yahoo.com/news?tmpl=story&cid=694&u=/ap/

20041028/ap_on_el_pr/candidates_red_sox_1&printer=1

The team is out, but the fans aren't down

http://www.stltoday.com/stltoday/news/stories.nsf/stlouiscitycounty/

story/2B2E422819383D3086256F3C0014C098?OpenDocument&Headline

=The+team+is+out,+but+the+fans+aren't+down

Red Sox Erase 86

Years of Futility in 4 Games

http://www.nytimes.com/pages/sports/baseball/index.html?8dpc

NFL closer to picking

place for L.A. franchise

http://www.theredzone.org/news/showarticle.asp?ArticleID=1790

Emmitt Smith Looks

Forward to More Carries

http://www.nytimes.com/aponline/sports/AP-FBN-Cardinals-Smith.html

--------------------------------------------------------------

“Gimme

that Wine”

Robert Mondavi Reports

$57.7 Million Net Loss 1st Q Fiscal Year 2005

http://home.businesswire.com/portal/site/google/index.jsp?ndmViewId=

news_view&newsId=20041027006008&newsLang=en

Some Wine Country

workers believe residents of the past come back to visit, even if they're

no longer living

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2004/10/28/

"North American

Pinot Noir" by John Winthrop Haeger

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2004/10/28/

Wine Events

http://www.wineevents-calendar.com/festivals.Lasso

--------------------------------------------------------------

This

Day in American History

1682

-William Penn lands in what will become Pennsylvania. He originally

called it Sylvania, but the King changed it to Pennsylvania in granted

the charter.

http://xroads.virginia.edu/~CAP/PENN/pnintro.html

http://www.2020site.org/penn/pennsylvania.html

1815-Birthday

of Daniel Emmett DeCatur, creator of words and music for the song “Dixie,”

which became a fighting son for Confederate troops and unofficial “national

anthem” of the South, born Mt. Vernon, OH, and died there June 28, 1904.

1837-Birthday

of African-American folk artist Harriet Powers,

now nationally recognized for her quilts, born in rural Georgia.

http://memory.loc.gov/ammem/today/oct29.html

1863-Battle

of Wauhatchie (Brown's Ferry) concludes: The troops of Union General

Ulysses S. Grant open a supply line into Chattanooga, Tennessee, when

they drive away a Confederate attack by General James Longstreet. Although

the Confederates still held the high ground above Chattanooga, the new

supply line allowed the Union to hold the city and prepare for a major

new offensive the next month. After the Battle of Chickamauga in northern

Georgia on September 19 and 20, the defeated Union army of General William

Rosecrans fled back to nearby Chattanooga. Braxton Bragg's Confederates

took up positions along Lookout Mountain and Missionary Ridge to the

east of the city. The Rebel lines made a semicircle around the city,

and Confederate guns closed traffic on the Tennessee River. As a result,

Union supplies had to come over a rugged mountainous route from the

west. This line was vulnerable to a Confederate attack, and it made

the Union's hold on Chattanooga tenuous at best. On October 23, Grant

arrived as the new commander of all western forces. He immediately ordered

two brigades to attack Brown's Ferry, where the Confederates were blocking

river traffic to Chattanooga. The Yankees captured the ferry on October

27, then held off a counterattack to maintain control. On the night

of October 28, Longstreet mounted a much larger attack to retake the

crossing. The Confederates possessed superior numbers but could not

pry the Union troops from the river. In the dark, the Yankees held and

Longstreet withdrew his forces before dawn. The Union suffered 78 killed,

327 wounded, and 15 missing, while the Confederates suffered 34 killed,

305 wounded, and 69 missing. The Battle of Wauhatchie was one of the

few Civil War engagements that took place at night. As a result of the

battle, the Tennessee River was reopened for the Union and supplies

reached Grant's troops. One month later, Grant drove the Confederates

from the mountains around Chattanooga.

http://www2.cr.nps.gov/abpp/battles/tn021.htm

http://roadsidegeorgia.com/int/1471

http://www.149th-nysv.org/Battles/wauhatchie_cr.htm

1902

-- Fredric Brown, American writer birthday.. One of the most ingenious

American crime, mystery writers, and also wrote science fiction to overcome

— as he said — the too real aspect of detective fiction. He also wrote

television plays for Alfred Hitchcock series. “Martian Go Home” was

one of his best sellers. His other notable novels include Night of the

Jabberwock (1951) and The Deep End (1952)

http://www.kirjasto.sci.fi/fbrown.htm

http://www.hycyber.com/SF/brown_fredric.html

http://members.tripod.com/~gwillick/brown.html

http://www.ebookmall.com/alpha-authors/Fredric-Brown.htm

1917

- The temperature at Denver, CO, dipped to zero, and at Soda Butte,

WY, the mercury plunged to 33 degrees below zero, a U.S. record for

the month of October.

1921

– Birthday of Bill Mauldin (Pulitzer Prize-winning editorial cartoonist:

[1945, 1959], created G.I. Joe and Willie) Killed in action.

http://www.stlouiswalkoffame.org/inductees/bill-mauldin.html

1922-Composer/arranger/trumpet player Neal Hefti Birthday

http://web.mit.edu/klund/www/hefti.html

1923

-- "Runnin' Wild" (introducing the Charleston) opens on Broadway.

http://www.amazon.com/exec/obidos/ASIN/B0000058RB/

avsearch-musicasin-20/002-4023470-8873669#product-details

1925- tenor saxophone player Zoot Sims born, Inglewood, CA.

http://members.aol.com/plabjazz/zootsims.html

1925-

History records “Howard Johnson’s “ as the first franchise chain.

1929-

Major Stock Market Crash as prices on the New York Stock Exchange plummeted

and virtually collapsed four days after President Herbert Hoover had

declared “The fundamental business of the country ... is on a sound

and prosperous basis.” More than 16 million shares were dumped and billions

of dollars were lost. The boom was over and the nation faced nearly

a decade of depression. Some analysts had warned that the buying spree,

with prices 15 to 150 times above earnings, had to stop at some point.

Frightened investors ordered their brokers to sell at whatever price.

The resulting Great Depression, which lasted until about 1939, involved

North America, Europe and other industrialized countries. In 1932 one

out of four US workers was unemployed.

http://www.authentichistory.com/audio/1930s/1930smusic01.html

http://imusic.artistdirect.com/store/artist/album/0,,301462,00.html

1934-Birthday

of alto sax player Jimmy Woods, St. Louis, MO

http://shopping.yahoo.com/shop?d=product&id=1927008906&clink=

http://www.pricegrabber.com/search_getprod.php/masterid=519095601/

http://www.mediawars.ne.jp/~mundo/collect/file/jimmy-woods.html

1936

-- Singer Hank Snow makes his first recordings, "Lonesome Blue

Yodel" & "Prisoned Cowboy."

http://www.harborside.com/~wchope/hanksnow.htm

1953—Top

Hits

You, You, You - The Ames Brothers

No Other Love - Perry Como

Oh - Pee Wee Hunt

I Forgot More Than You’ll Ever Know - The Davis Sisters

1953-The

sale of the St. Louis Browns from Bill Veeck to a group of Baltimore

investors was completed, and the American League’s most hapless team

became the Orioles.

1954- Dizzy Gillespie and Roy Eldridge record “Trumpet Kings”

album, Verve.

1956

- John Cameron Swayze and "The Camel News Caravan" were replaced

by Chet Huntley and David Brinkley on NBC-TV. The "Huntley-Brinkley

Report" clicked so well that the respected newsmen reported nightly

until July of 1970. “Good night Chet. Good night David. And good night

from NBC News.

1960

- Cassius Clay won his first pro bout -- over Tunney Hunsaker -- in

six rounds in his hometown of Louisville, Kentucky.

1961

- The top, pop song on the charts belonged to Dion (DiMucci). "Runaround

Sue" was in its second week at the tiptop of the top-tune tabulation

(it was in the top 40 for three months).

1961—Top

Hits

Runaround Sue - Dion

Bristol Stomp - The Dovells

Big Bad John - Jimmy Dean

Walk on By - Leroy Van Dyke

1962

– John “Buck” O'Neil is the first black coach in major-league baseball,

for the Chicago Cubs.

http://bestofbuck.com/800/bio.htm

http://www.nlbpa.com/o_neil__john_jordan_-_buck.html

http://www.annonline.com/interviews/960715/

1962-Actor

Sydney Poitier testifies before the House Committee on Education and

Labor, condemning the lack of opportunities for black actors in Hollywood.

Poitier was born in 1924 to poor farmers in the Bahamas. He dropped

out of school at age 13 and later joined the U.S. Army. After his army

stint, he became interested in performing and joined the American Negro

Theater. He debuted on Broadway in 1946 and three years later made his

film debut in a U.S. Army documentary. By the late 1950s, he was the

leading African American actor in the country. In 1964, he became the

first African American actor to win the Best Actor Oscar, for his role

as a laborer who helps build a chapel in Lilies of the Field

(1963). Other films include In the Heat of the Night (1967) and

Guess Who's Coming to Dinner (1967). He began directing in 1971

with Buck and the Preacher. In 1992, he won the American Film

Institute's Life Achievement Award, the first black actor and director

to be so honored.

1967-Hair,

An American Tribal Love-Rock Musical, opened at the Public Theater in

New York City. The composer

was Galt MacDermott. The musical,

which appeared during the Vietnam War, carried an antiwar message and

aroused some controversy for its glorification of “hippie” values, including

a nude scene at the end of the first act. The production moved to Broadway’s

Biltmore Theater in April, 1968.

1966-

formation of the National Organization for Women to "bring women

into full participation in the mainstream of American society NOW!"

1969-Historians

consider this the day the Internet was created. The first connection

on what would become the world wide web was made on this day when bits

of data flowed between computers at UCLA and the Stanford Research Institute.

This was the beginning of ARPANET, the precursor to the Internet developed

by the Department of Defense. By the end of 1969, four sites were connected:

UCLA, the Stanford Research Institute, the University of California,

Santa Barbara and the University of Utah. By the next year there were

10 sites and soon there were applications like email and file transfer

utilities. The @ symbol was adopted in 1972 and a year later 75 percent

of ARPANET traffic was e-mail. ARPANET was decommissioned in 1990 and

the National Science Foundation’s NSFnet took over the role of backbone

of the Internet.

1969—Top

Hits

I Can’t Get Next to You - The Temptations

Hot Fun in the Summertime - Sly & The Family Stone

Suspicious Minds - Elvis Presley

The Ways to Love a Man - Tammy Wynette

1970

- Neil Diamond received a nice package: a gold record for the hit, "Cracklin’

Rosie".

1973

- O.J. Simpson set two NFL records this day. The Buffalo Bills’ star

running back ran 39 times for 157 yards -- and he rushed for a total

of over 1,000 yards in only seven games.

1977—Top

Hits

You Light Up My Life - Debby Boone

Nobody Does It Better - Carly Simon

That’s Rock ’n’ Roll - Shaun Cassidy

Heaven’s Just a Sin Away - The Kendalls

1981

- Loretta Lynn received a gold record for her album, "Greatest

Hits, Vol. 2".

1982-

Car maker John DeLorean indicted for drug trafficking in a government

sting operation; later acquitted

http://www.delorean-dmc12.co.uk/john_z_delorean.html

http://www.babbtechnology.com/Collect/index.htm

http://www.who2.com/johndelorean.html

http://ask.yahoo.com/ask/20010927.html

1983

- After four weeks at #1 on the pop music charts, Bonnie Tyler’s "Total

Eclipse of the Heart" slipped to #2 -- replaced by "Islands

in the Stream" by Kenny Rogers and Dolly Parton.

1984

- Golfing great Tom Watson won his sixth PGA Player of the Year title;

the most won by any golfer since the award was first given in 1948.

Jack Nicklaus had accumulated five of those titles.

1985—Top

Hits

Saving All My Love for You - Whitney Houston

Part-Time Lover - Stevie Wonder

Miami Vice Theme - Jan Hammer

Touch a Hand, Make a Friend - The Oak Ridge Boys

1987

- Severe thunderstorms in Arizona produced wind gusts to 86 mph at the

Glendale Airport near Phoenix, baseball size hail and 70 mph winds at

Wickenburg, and up to an inch of rain in fifteen minutes in Yavapai

County and northwest Maricopa County. Arizona Public Service alone reported

2.5 million dollars damage from the storms.

1988

- Wintry weather prevailed in the Upper Midwest. South Bend, IN, equaled

their record for October with a morning low of 23 degrees. International

Falls MN reported a record low of 11 degrees in the morning, then dipped

down to 8 degrees above zero late in the evening.

1989

- Thunderstorms developing along a cold front produced severe weather

in Oklahoma and north central Texas during the late afternoon and evening

hours. Thunderstorms in Oklahoma produced weak tornadoes near Snyder

and Davidson, and produced hail two inches in diameter at Altus. Large

hail damaged 60 to 80 percent of the cotton crop in Tillman County OK.

Nine cities in the northeastern U.S. reported record high temperatures

for the date as readings warmed into the 70s. For Marquette MI it marked

their fifth straight day of record warmth. Arctic cold invaded the western

U.S. Lows of 7 degrees at Alamosa CO and 9 degrees at Elko NV were records

for the date. (My daughter in nearby Lamoille said it

1996-The

National Basketball Association got set to launch its 50th

anniversary of all time, ten of the 50 spent significant portions of

their careers with the Boston Celtics.

http://www.unc.edu/~lbrooks2/50.html

1998

- Hurricane Mitch (Oct 22-Nov 4, 1998), one of the strongest Atlantic

storms ever, made landfall, slamming into Honduras, Nicaragua, Guatemala,

Belize, El Salvador and other Central American countries. The real story

was not the wind but the rain. Slow movement of the storm caused heavy

rain, resulting in widespread flooding and mudslides. Over 10,000 people

were killed, another 10,000 were missing, and some two million people

were affected in some way by the storm.

1998

- The space shuttle Discovery blasted off, returning 77-year-old U.S.

Senator John Glenn to space some 36 years after he became the first

American in orbit. Glenn was part of a crew of seven astronauts shepherding

scientific payloads on the shuttle mission.

2001--

Matt Williams becomes the first player in World Series history to hit

home runs with three different teams. He homered in the Fall Classic

for the Indians in 1997 and the Giants in 1989.

http://worldseries.mlb.com/ws/index.html

http://www.sportingnews.com/archives/worldseries/2001.html

American Football

Poem

WOES OF A BEAR FAN

Standing tall with

the red and gold,

down by the bay,

you’d catch your death of cold.

All come together

to see a football game,

honoring a great,

who’ll be in the Hall of Fame.

Those forty-niners

ran out onto the field,

I bet they couldn’t

next time, wearing high heels.

Da Bears decided

they didn’t need to play,

maybe they ate too

much at da buffet.

Could the reason

for the low Bears tally,

be because they took

a trip to Napa Valley?

Receivers with the

likes of Davis and Rice,

Turned da secondary

into crushed ice.

Neither team is heading

into the post season,

I’m sure there is

no confusion as to the reason.

The wharf, the bay

and gold gate, all sittin pretty,

Huey Lewis is serving

the sounds to the city.

Displaced Chicagoan,

I think not!

A real Illinoian

knows what they got.

We got rough, tough

Bears at Soldier's Field.

They've got cute

uniforms and some appeal.

In 2001, up the ranks

we will slide.

For the red &

the gold...can we say died?

This time we concede

cuz you had Rice,

but next time the

monsters won't be so nice.

It's a chant we are

taught at a tender age

Get's us thru the

cold and holds off road rage.

We shout it loud,

so all can hear,

We're used to saying

it...JUST WAIT TILL NEXT YEAR!!!

LGuzzino & LJMaas

(In San Francisco,

we now say “ At least we scored.”)

|

www.leasingnews.org |