Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Wednesday, April 23, 2025

Today's Leasing News Headlines

Recap: 2025 ELFA Funding Conference

By Randy Haug, LTi Technology

Maxim Commercial Capital Exceeds Expectations

in Q1 2025

PNC, Huntington report lease financing uptick

Huntington lease financing grows 8% YoY

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

Top Originators Go Deep

By Scott Wheeler, CLFP

33% of Small Businesses Say Paying Debt

is a Challenge, 51% Concerned about

Uneven Cash Flow

By Bob Coleman, Coleman Report

LTi Dinner after ELFA Funding Conference

By Randy Haug, LTi Co-Founder

Go for It! Make This Year the Year

You Earn Your CLFP

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

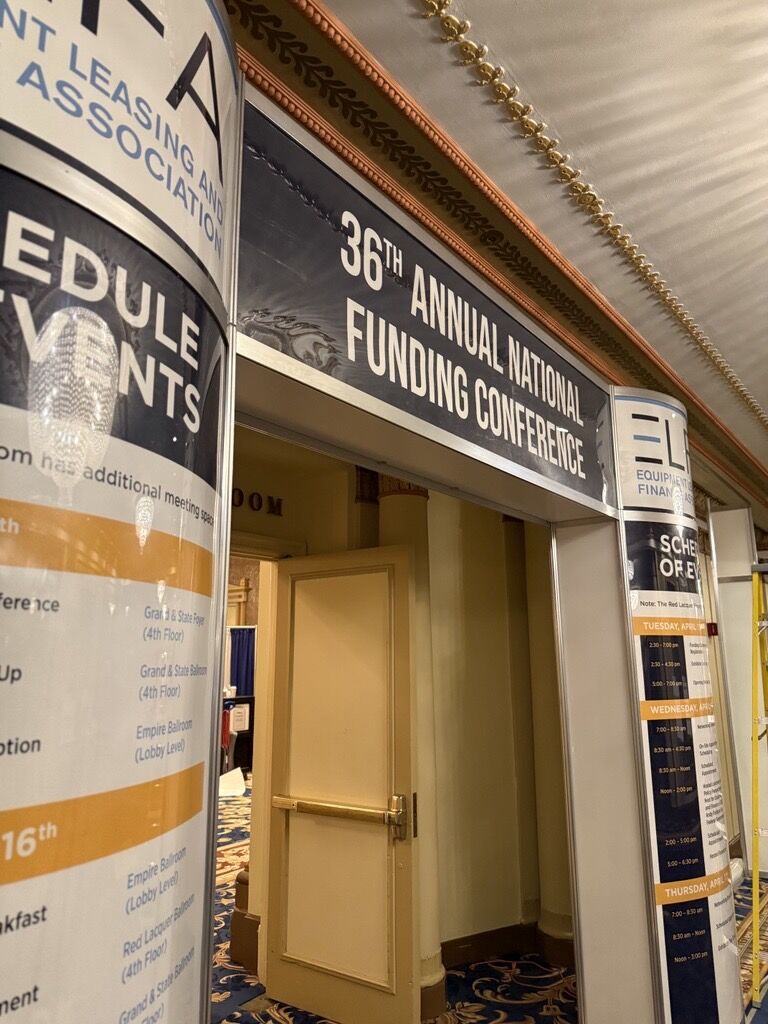

ELFA 36th Annual National Funding Conference Recap

April 15-17 Palmer House Hilton, Chicago, Illinois

By Randy Haug, LTi Technology

When does this meeting really kick off?

While the Equipment Leasing and Finance Association suggests it begins with the opening evening Cocktail reception on Tuesday April 15, those of us who are veterans attendees of this event know that it actually begins long before that. ELFA members made their way to Chicago on Monday April 14th for client meetings and many are already booking meetings with clients and lending partners beginning Monday afternoon, a full day before the official start of the ELFA meeting. If you want to get full and productive use of your time, come early and get started by scheduling your own pre-conference meetings.

Then, of course, be on hand all day Tuesday by scheduling another full day of meetings in advance of the ELFA official cocktail reception kick off Tuesday evening. You can use the very intuitive ELFA scheduling tools to set up short 20-minute meetings with your funding partners who have assigned booths, suites, just meet one-on-one in ELFA assigned meeting rooms, or in the unique main floor set up that is the historic Palmer House Hilton huge lobby and seating area.

The 36th Annual ELFA Funding event was absolutely electric and a packed house.

Julie Benson, ELFA VP of Membership Services, told me that attendance broke through the 750 member threshold with 100 more attendees that last year and an all-time record of registered members attending. I can tell you from personal experience that the event was packed and not only showcased equipment finance members but the suites and booths were sold out. From everyone I spoke to their dance cards / speed dating 20-minute schedules were completely full for the duration of the conference, which ran from Wednesday morning at 8AM until 5 PM, through Thursday at noon.

Many funders / lenders had both booths configured to allow for multiple meetings, as well as double booths and suites. Friends, that equates to more than 40 meetings a day or 60 or more for a day and half. With lenders having 4 or more hard-working skilled members on hand to meet with pre-screened executives from the who’s who of Equipment Finance industry leaders, as well as select service providers from across the country, internationally, Canada, Mexico, South America, Japan and beyond. This is certainly the largest individual funding event held every year and it’s been delivered beautifully for 36 years by the professional staff of the ELFAwho also brought along their “power team”:

Leigh Lytle , CEO of the ELFA

Andy Fishburn, VP Director of Public Policy.

Newly Announced Daryl Millwe, COO of the ELFA, Lisa Ramirez, VP of Business and Professional Development

Julie Benson, VP of Membership Marketing and many additional staff to take care of all members’ needs while we as members were attending. There were additional ELFA breakout and speaking sessions conducted during this packed funding summit.

I spoke to a number of ELFA members during this event and the majority said, “…this National Funding Conference is the most productive and important conference that they attend each year. No one does it quite like the ELFA and it certainly keeps the crowd coming back year after year.”

Chicago is the perfect town, centrally located with 2 large airports offering direct service to and from almost everywhere. Many I spoke to said that if the ELFA did not hold this meeting annually, it would put their membership in doubt; it’s that significant. That is not to say other ELFA events are not well attended but National Funding is core to its membership, which continues to grow, as many member organizations want to be involved with the Equipment Finance Industry’s leading membership services, Funding Services and Advocacy Association.

Attending a meeting like National Funding and that value proposition speaks loud and clear.

If you plan on attending, you know that meeting hours stretch into regular hours and then into after-hours where the power players and significant lenders entertain themselves with cocktail receptions and dinner parties with their client partners and industry associates. That then stretches further into after dinner cocktails and networking back at the historic Palmer House Bar on the Main floor with a few hundred people networking night after night, seeing old friends and meeting new ones as well over a drink or two…or three. When the hotel bar closes, those who want to continue entertaining move over to Millers Pub or a variety of other venues nearby. The electric pulse of this event normally closes shop late at night, and then restarts again early the next morning for a combination of pre-meeting breakfast meetings, a cup of Joe at Starbucks, on the lower floor of the hotel or just some large bottles of water to get yourself re-hydrated for day two or three.

In essence, this is an energized, work hard-play hard funding expo within a historic hotel where the atmosphere is electric with so many industry leaders under one roof, all focused on shaping the future of finance.

What was the vibe of the Conference among attendees and funders?

This year’s vibe was made up of optimism with a healthy dose of caution about the tariff situation unfolding on the political front. There are strong possibilities of higher equipment cost in the future. Everyone had opinions on that subject. Many thought it was a negotiation tactic…which it likely is. Some believe it’s a focus to get more strategic manufacturing brought back into the US. (Which will likely happen, but that also takes time and investment).

Also, many are positive about building and creating more infrastructure to support that build out: Energy, Manufacturing and Construction areas, more focus on Vocational Trucks, and Rental equipment, and a renewed interest in things that will help America build more self-reliant eco systems.

Many members I spoke to were having great first quarters after strong Q4 2024 and strong 2024’s. Some indicated a bit softer Q1 but strong starts to Q2.

The Banks are back!!

I spoke to 15 of the largest banks in the Equipment Finance space throughout the conference, and every single one told me that they are back with the needed liquidity and dry powder. They need to make notable increases in their portfolio of Buy side Capital Markets deals, Direct deals, and third party deal acquisitions.

There is no question that banks have been on the sideline the last couple of years, but they are back on the hunt and were very active in all Equipment sectors. Community Banks are looking for small ticket business, Regional and Commercial Banks are looking for Middle Market and Upper Middle Market and larger Energy deals, as well as participation partners. I do not see many larger banks getting back into the small ticket space, but in all other markets, they are going to be active and are hunting. Their parent banks have seen the resilience of their deals and they like the spreads they can bring to the banks’ overall portfolios.

One large Community Bank Equipment Finance Executive told me that his team and the bank’s specialty finance group are the only really profitable parts of the bank. They are being treated very well by the core bank right now. It’s great to see the banks back in the game.

The Private Equity based institutions are sitting on large amounts of investable capital and they are flexing their financial muscle.

There are some powerful new players in the upper end of the market. I spoke to the leaders of most of the top private equity backed institutions and they are all having very good years and continuing to gain traction in the markets they are serving. All had record years and good backlogs of deals that either are committed or soon will be.

The theme from those I spoke to was, “We are going to focus on closing as much business as we can…as fast as we can…while it’s available.” Many spoke to growth in Q1 that almost equates to what they originated in total of all of last year. If so, that’s incredible traction and growth. They are some of the brightest people that I have had the opportunity to meet and get to know in the last few years.

Many feel these players may be in and out of the market. I have a different perspective. I think the funding industry is pivoting and actually expanding as the US economy continues to expand. I believe they are going to be a bigger part of the industry going forward. They are much more aggressive in deal structures and are more asset oriented than others in the funding side of the industry. These people are not new to the industry but instead have much experience and are powerful teams positioned outside of the complex information and compliance oversight the banks operate in.

In the small ticket and vendor side of the business, these Private Equity backed Equipment Finance companies are growing faster than just about anyone in the industry on a percentage basis. They are the ones leading the current charge in utilizing the ABS funding and securitization marketplace for their banking and funding needs. It’s absolutely happening and it’s absolutely changing how equipment finance companies are funding their business.

The ELFA has noticed this as well and at this year’s National Funding Conference, more than a few new private equity, sovereign-backed funds, and home office leaders as well as many advisors, rating agencies, and bank securities division members were in attendance. Look for this trend to continue as the ELFA looks to add many new members in this new funding supply chain going forward. They are now part of the Equipment Finance marketplace and have a need to connect with the ELFA members.

Final thoughts: What an awesome conference and what a great opportunity to participate, listen and learn. Concerns, sure there are always a few, but this industry is made up of some of the smartest and resilient industry leaders and those who soon will be growing into leadership positions. There is a lot to like about that.

Thanks,

Randy Haug | EVP / Co-Founder

LTi Technology Solutions | w: 402.49.3445

rhaug@ltisolutions.com | www.ltisolutions.com

[headlines]

--------------------------------------------------------------

Maxim Commercial Capital Exceeds Expectations in Q1 2025

Secured Finance Company’s Fundings

Increased 150% Over Prior Year’s Period

LOS ANGELES, CALIF. ) – Maxim Commercial Capital (“Maxim”) announced exceptionally strong results for the first quarter of 2025, reporting a 150% increase in funding volume over the prior year’s period. Maxim is a national provider of loans and leases from $10,000 to $3 million collateralized by class 6 and 8 trucks, trailers, heavy equipment for the construction and agriculture industries, and real estate.

Michael Kianmahd, Maxim’s CEO, said, “As the unprecedented pace of change under the new administration’s economic policies present challenges for our industry, we remain steadfast in our mission to be the preeminent non-prime finance company supporting entrepreneurs, vendors, and finance brokers,” noted.

“Despite market conditions, we approved 80% of financing applications submitted in Q1 2025, funded borrowers in 37 states, and continued to invest in our infrastructure, systems, and team regardless of market conditions.”

Maxim’s dedicated, solutions-oriented approach is particularly impactful when equipment pricing is turbulent. For example, when Class 8 used truck prices increase, Maxim’s team works with buyers to clarify price points and financing structures they can afford and refers them to vendors if needed.

In a recent interaction, Maxim approved financing for a current customer with 2 years’ experience and challenged credit to purchase a $55,000 2020 Peterbilt 579. When the applicant communicated he needed a lower down payment, Maxim proactively revised the approval for a less expensive, higher mileage 2019 Peterbilt 579 and closed the deal.

Contractors nationwide with challenged credit are growing their businesses with heavy equipment financed by Maxim during Q1 2025. Notable examples include an Alabama-based tree service company specializing in disaster relief work that purchased a new, $65,000 2025 Kymron CX10 Crawler Crane for 42% down to fulfill its government contracts and expanding residential business; a South Carolina-based contractor who purchased a $52,000 2014 Caterpillar 308E2 CR Hydraulic Excavator for 34% down to expand his tree-planting business; and, a start up roadside and recovery contractor with a sub-500 FICO who added a second truck by leasing a $6,660 2018 Ram 4500 Wrecker Tow Truck.

Maxim continues to expand and improve its infrastructure to support its growth. The company currently is seeking to hire an accounting manager and senior accountant. Please visit https://www.maximcc.com/our-company/careers/ for job descriptions and to apply.

About Maxim Commercial Capital

Maxim Commercial Capital helps small and mid-sized business owners nationwide by providing loans and leases (“financing”) from $10,000 to $3 million secured by trucks, trailers, heavy equipment, and real estate. It funds equipment purchase financings and leases, working capital, and debt consolidations. Maxim’s more creative financing structures leverage equity in real estate and owned heavy equipment to facilitate growth and preserve customers’ cash.

As a leading provider of transportation equipment financing, Maxim supports startup and experienced owner-operators and non-CDL small fleet owners by funding loans and leases for class 8 and class 6 trucks, trailers, and reefers. Learn more at www.maximcc.com or by calling 877-776-2946.

[headlines]

--------------------------------------------------------------

PNC, Huntington report lease financing uptick

Huntington lease financing grows 8% YoY

Columbus, Ohio-based Huntington Bank’s lease financing portfolio totaled $5.5 billion in Q1, up 1% quarter over quarter and 7.8% year over year, according to last week’s earnings supplement. Huntington’s commercial and institutional loan outstandings landed at $57.6 billion in Q1, up 4.5% QoQ and 13.8% YoY.

PNC lease financing up 2%

Pittsburgh-based PNC Financial Services’ equipment lease financing portfolio reached $6.7 billion in Q1, up 3.5% YoY, according to its April 15 earnings supplement. The company’s total commercial and industrial portfolio totaled $177.3 billion, essentially unchanged YoY.

In addition, PNC’s net charge-offs for equipment lease financing decreased 50% YoY in Q1 to $3 million, while commercial and industrial portfolio charge-offs decreased 4.6% YoY to $68 million, according to the earnings supplement. Nonperforming equipment finance assets increased 53.8% YoY to $20 million to end Q1.

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

[headlines]

--------------------------------------------------------------

Top Originators Go Deep

By Scott Wheeler, CLFP

In today’s volatile market, originators across the board are questioning their next steps. The uncertainty has many feeling cautious—but the top performers aren’t retreating. They’re leaning in, moving forward with clarity and confidence, offering stability and solutions when others are pulling back.

Now is the time to emphasize the true value an originator brings to the table. Vendors, end-users, credit departments, and funders are all watching closely, testing whether originators can truly deliver on what they promise.

Less experienced originators are tempted to treat every transaction the same, often forcing deals that don’t align with their strengths or market realities. In contrast, top originators are highly selective. They don’t chase transactions that come with unmitigated risk. Instead, they seek out deals that fit their expertise and value proposition.

Top originators focus on sectors, equipment types, and niches they know best. They don’t try to be all things to all people—they go deep, not wide.

Top originators Go Deep to:

- Understand the markets they serve inside and out.

- Assess each transaction’s unique needs and nuances.

- Identify emerging trends that could shape future demand.

- Confirm funding capabilities in real time with current market dynamics.

- Position themselves as trusted financial advisors—not commodity-driven salespeople.

- Outperform their competition and gain ground while others fall behind.

In 2025, success won’t be about waiting for the market to improve—it will be about creating and shaping an originator's own success.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

[headlines]

--------------------------------------------------------------

33% of Small Businesses Say Paying Debt is a Challenge

51% Concerned about Uneven Cash Flow

By Bob Coleman, Coleman Report

Our final installment of interesting statistics from the Federal Reserve Bank's small business credit survey:

Rising costs of goods, services, and wages remain the most commonly reported financial challenge. Firms are more likely to identify weak sales and paying operating expenses as challenges in 2024 rather than 2023.

The most important statistic for small business lenders is that 1/3 of businesses state a financial challenge is making their loan payments on time. The cause? In addition to rising costs, half say weak sales and uneven cash flow.

Financial challenges reported

- Rising cost of goods, services, and wages: 75%

- Paying operating expenses: 56%

- Uneven cash flow: 51%

- Weak sales: 48%

- Making payments on debt: 35%

- Credit availability: 28%

Operational challenges include: - Increasing sales: 50%

- Hiring and retaining qualified staff: 51%

- Supply chain issues: 29%

- Technology: 29%

- Government regulations: 29%

Some other interesting stats:

- 29% report being in business for over 20 years

- Geographic location is split at Urban 85% and Rural 15%

- 93% say they are a medium or low credit risk

- An interesting stat for SBA lenders is 23% of businesses

- are owned by individuals age 65 and over

- 20% of small businesses are at least partially owned by an immigrant

- 6% of small businesses are at least partially owned by a veteran

[headlines]

--------------------------------------------------------------

LTi Dinner after ELFA Funding Conference

By Randy Haug, LTi Co-Founder

What an absolutely great evening! We gathered close to 50 of our client partners and industry friends along with our talented LTi Team members and peers, at the wonderful Chicago Prime and Provisions Steakhouse.

For a wonderful social mixer, our clients met each other in a social setting, followed by a great dinner for all of our guests. We have been holding this annually for a number of years at this venue. It did not disappoint. It was a great evening for all attending and continues our foundational aspect of meeting our clients where they are in their business growth while helping them make introductions and grow their business in the most meaningful ways…all a good dose of fun and good cheer!

Our LTi team was feeling incredibly grateful for the conversations, connections, and momentum we have built this week. We held close to 60 meetings with client partners and industry friends and thought leaders. Those conference events flow over to evening events like LTi and many

other companies that are held after hours. These are the moments that make this industry so special.

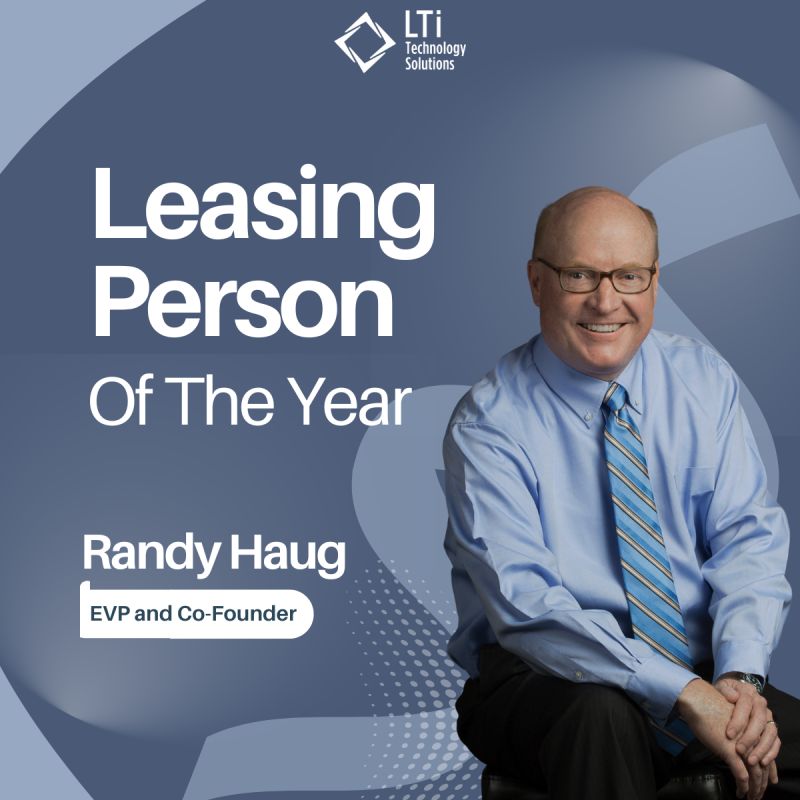

And we cannot forget that right after our social mixer/cocktail reception, and before last night’s dinner, a special industry awards ceremony was held.

To the surprise of almost everyone at event, the 2024 Leasing News “Leasing Person of the Year” was awarded by Shari Lipski, CLFP of ECS Financial Services, to Randy Haug, Co-Founder of LTi Technology Solutions. That made it an extraordinary, yet humbling event , especially for the LTi Team peers and so many client partners in attendance.

A beautiful Commemorative award was given. More importantly, it kicked off the dinner party with great joy and more accolades by everyone attending toward my industry advocacy, accomplishments, and years of giving back to the industry.

I am not one to enjoy the spotlight, but rather more of a good natured servant leader with integrity. I appreciated the outpouring of love by those in attendance.

As that continued through my outreach to each and every guest, I thanked them for attending and acknowledging their great efforts for their companies and our industry. What was really exciting to me is watching and being a part of so many that have been so successful in this industry, especially having a first-hand view of their companies’ growth and success. It is also satisfying to watch so many of them individually become some of the most admired leaders in our industry. I can tell you that the future of the industry is in very good hands judging the talent at all levels in the room as well as those I met with throughout the ELFA National Funding Conference.

It really was an unforgettable evening filled with great food, even better company, meaningful conversations and the Leasing News Person of the Year Award.

Randy

[headlines]

--------------------------------------------------------------

Go for It!

Make This Year the Year

You Earn Your CLFP

![]()