Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists

Conferences |

Advertising | Archives

Columnists| Site Map

Contact: kitmenkin@leasingnews.org

![]()

Thursday, January 29, 2026

Today's Leasing News Headlines

New Hires/Promotions in Leasing Business

and Related Industries

CapEx Finance Index December 2025:

Equipment Demand in 2025 Reached

Second-Highest Level of All Time

Your Future Starts Now - We're Hiring!

Ameris Bank Equipment Finance

Sustainability

By Scott Wheeler, CLFP

2026 New Story Credit Financing

Leases, Loans, SBA, Working Capital

Mapped: U.S. Cities With the

Most Remote Workers

Rules of Life

Placard

News Briefs

Americans’ confidence in the U.S. economy falls sharply

in January to lowest level since 2014

Amazon cuts 16,000 jobs in

historic wave of layoffs

UPS will slash 30,000 jobs

as company shifts away from Amazon

As grocery prices soar, this German grocery chain

is conquering America

Tesla’s revenue and profit tumble

to cap off rough 2025

Participate in Coleman’s 2026 SBA Lender Department

Compensation Survey and Receive a Free Report

You May Have Missed ---

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Jeni Ford was hired as Recruiter, Channel/Your Partner in Funding, Minnetonka, Minnesota, She is located in Columbus, Ohio. Previously, she was Recruiter, Onset Financial (April, 2024 - January, 2026); Free Lance Columnist (August, 2022 - January, 2026): Captain, Offensive Tackle/Defensive End & Community, Coordinator/Leadership Team, Columbus Chaos (January, 2023 - June, 2025); East Bay Talent, VP, Equipment Leasing/Financing & Working Capital/MCA (Producing Manager) (July, 2022 - February, 2023); Executive Recruiter, Equipment Leasing/Financing & Working Capital, mCA (January, 2021 - February, 2023). Full Bio:

https://www.linkedin.com/in/jeni-ford-35183430/details/experience/

https://www.linkedin.com/in/jeni-ford-35183430/

Lana Goland was hired as Sales Development,, Representative, IRH Capital, Greater Chicago Area. She is located i Buffalo Grove, Illinois. Previously, she was Accounts Receivable Accountant, Les Mill International (May, 2022 - October, 2025).

https://www.linkedin.com/in/lana-goland-0a9b64274/

Tom Haflett was hired as Vice President, Equipment Finance, Broker Relations, First Business Specialty Finance, LLC, Madison, Wisconsin. He is located in Greater Philadelphia, Pennsylvania. Previously, he was Vice President, Broker Relations, Centra (August, 2023 - October, 2025); Vice President, Broker Development Manager, Meridian Equipment Finance (April, 2020 - August - 2023); Outside Sales and Account Manager, Bushwick Metals, LLC (April, 2017 - January, 2020) Inside Sales Account Manager, Secure Components (June, 2016 - April, 2017). Full Bio:

https://www.linkedin.com/in/thomaslhaflett/details/experience/

https://www.linkedin.com/in/thomaslhaflett/

Bob Ragland was promoted Associate District Director, SCORE, Southern California, San Diego, California, where he is located. Previously, he was Chapter Chair (April, 2017 -Present); Managing Partner, Worldfab LLC (September, 2013 - Present); Executive Vice President, AEL Financial (20006 - September, 2013); Senior Vice President, Banc of America Leasing (1993 - 2006); Divisional Vice President, HSBC (1988 -1993). Full Bio:

https://www.linkedin.com/in/bobragland/details/experience/

https://www.linkedin.com/in/bobragland/

[headlines]

--------------------------------------------------------------

##### Press Release #################

CapEx Finance Index December 2025:

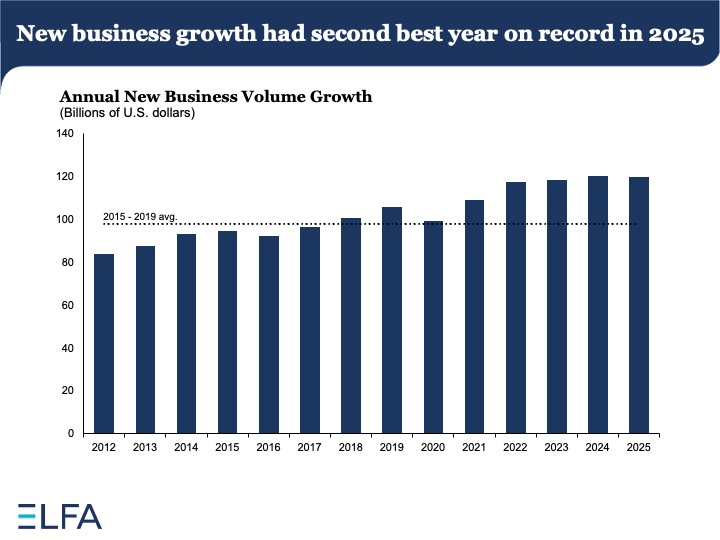

Equipment Demand in 2025 Reached the Second-Highest Level of All Time

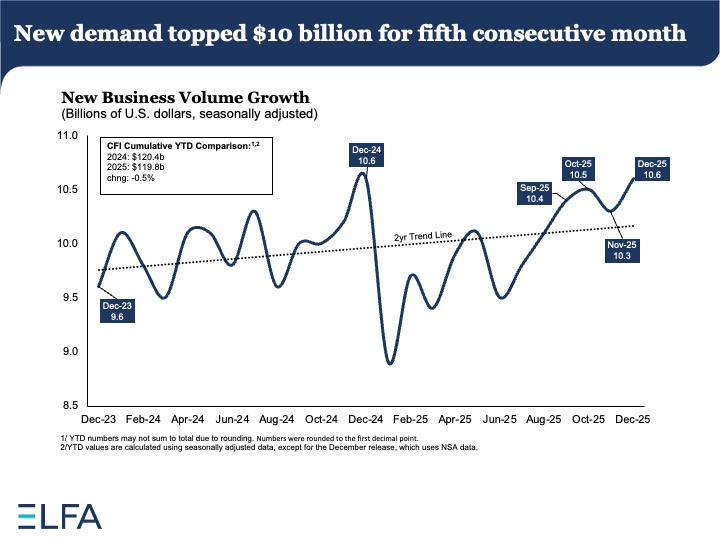

- Total new business volume (NBV) among surveyed ELFA member companies was $10.6 billion on a seasonally adjusted basis, an increase from the prior month.

- Year-to-date NBV contracted by 0.5% relative to the same period in 2024.

- Year-over-year, NBV increased by 5.9% on a non-seasonally adjusted basis.

“December confirmed that 2025 was a year for the record books, with new business volumes closing the year on a tear,” said Leigh Lytle, President and CEO at ELFA. “The data show that the equipment finance industry has not only weathered but thrived amid historic uncertainty. While we expect some volatility in 2026, all signs point to another year of strong demand and stable financial conditions—especially as markets anticipate additional rate cuts later this year.”

Equipment demand had second best year on record. Total NBV grew by $10.6 billion in December, a rise of 3.1% from the previous month, and its longest streak with new activity above $10 billion a month since early 2023. The total new volume series tracks the amount of new activity that banks, independents, and captives added in a given month. Total new activity in 2025 was $119.8 billion, down just 0.5% from its all-time high in 2024. The cumulative growth in business volume over the second half of 2025 was 1.6% higher than in the same period in 2024.

Small ticket volume growth tracks broader economic conditions and is an important barometer of aggregate demand for equipment. Small ticket deals grew by $4.6 billion, up 30% from the previous month.

Activity at banks was down 1.2% from the prior month, but up 16.7% at captives and 29.2% at independents. The gains at captives and independents were fairly widespread across respondents.

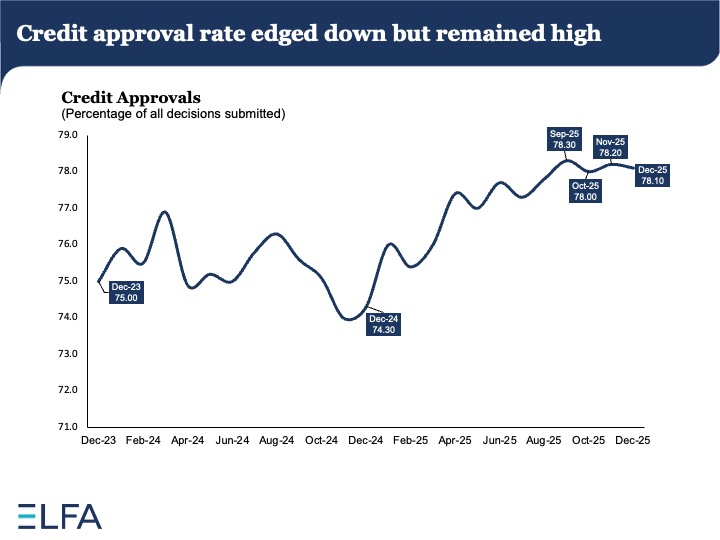

The overall credit approval rate edged down but remained elevated. The industry-wide average dropped slightly to 78.1% in December. It continued to hover around its decade high. The average small ticket approval rate dipped from the prior month to 81.0%, still well above its 2024 average of 75.4%. The rate at banks rose slightly to 80.6%. The rate at captives fell for the fifth time in six months to 79.9%, while the rate at independents dropped to 71.8%.

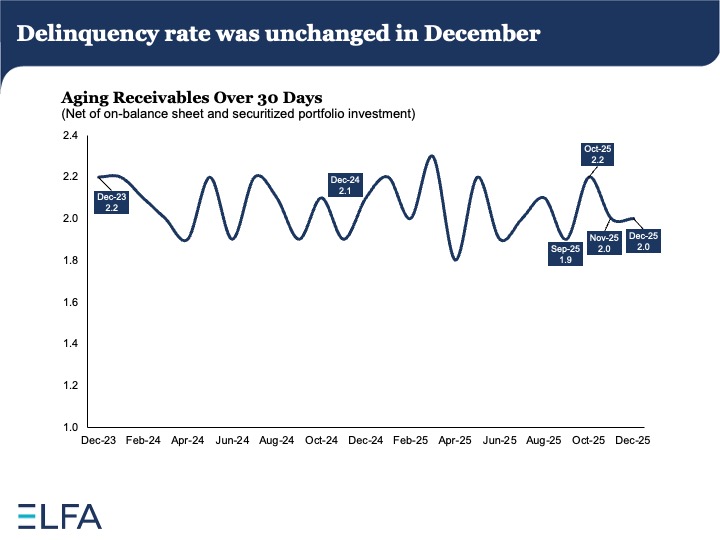

Delinquencies flatlined, while losses rose. The overall delinquency rate was essentially unchanged at 2.0% after rounding. The industry-wide average remained in the middle of its trailing two-year range of 1.9% to 2.2%. The average delinquency rate at banks rose sharply, offsetting a nearly identical percentage point decline in the prior month, while the rates at captives and independents both fell.

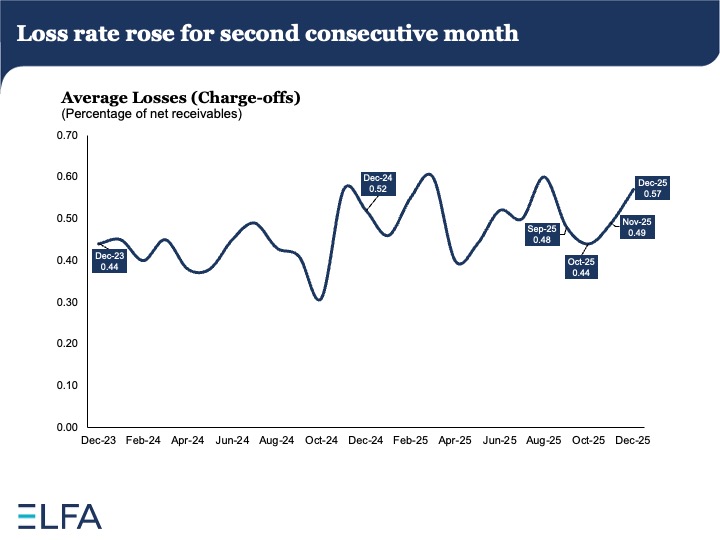

The overall loss rate rose by 0.08 percentage points to 0.57% in December. The average loss rate for small ticket was unchanged at 0.69%, the second-highest reading of 2025. Loss rate for banks was unchanged from November, while the rate for captives ticked up slightly, and rose more sharply at independents.

Commenting on conditions from the equipment finance market, Anthony Perettine, President of Peapack Capital and ELFA member, said, “Peapack Capital finished a record year in 2025 and is poised for significant growth in 2026. The business channels we serve have, without exception, experienced strong growth, and underlying credit quality in our diversified customer base is at an all-time high. Portfolio performance, after some bumps in the Covid years, is now exceptionally strong.”

Perettine added, “Now is an excellent time for strong industry participants, especially bank subsidiaries with strong liquidity and a deep understanding of equipment finance, to grow assets and return excellent value and profits to their parent organization.”

Industry Confidence

The Monthly Confidence Index for the Equipment Finance Industry (MCI) tracks the sentiment of executives in the industry. The index reached an 11-month high of 64.6 in January, up from 58.3 in December.

Technical Note

New business volume data are concurrently seasonally adjusted each month to capture the latest seasonal patterns. Data in previous months and years may change due to updated seasonal factors.

About ELFA’s CFI

The CapEx Finance Index (CFI) is the only real-time dataset that tracks nationwide conditions in the equipment financing industry. The information is compiled from a diversified set of businesses that respond to questions about demand for equipment financing, employment, and changes in financial conditions. The resulting data is organized by institution type, such as banks, captives, and independents, and is classified into overall activity and financing for small ticket equipment and software. The CFI is released on the last Tuesday of the month from Washington, D.C. More detail on the data and methodology can be found at https://www.elfaonline.org/research/capex-finance-index.

About ELFA

The Equipment Leasing & Finance Association (ELFA) represents financial services companies and manufacturers in the $1.3 trillion U.S. equipment finance sector. ELFA’s over 600 member companies provide essential financing that helps businesses acquire the equipment they need to operate and grow. Learn how equipment finance contributes to businesses’ success, U.S. economic growth, manufacturing and jobs at www.elfaonline.org.

##### Press Release #################

[headlines]

--------------------------------------------------------------

Help Wanted Ad

Ameris Bank Equipment Finance

--------------------------------------------------------------

Sustainability

By Scott Wheeler, CLFP

Recently, a group of seasoned originators met with originators who had less than three years of experience. The newer originators were already producing above‑average annual funding numbers. When asked what they believed would help them significantly increase production, the conversation quickly turned toward the usual suspects:

- Lower pricing

- Looser credit criteria

- Cutting corners in process

- Expanding into unfamiliar equipment sectors

Before the discussion could spiral further, one of the seasoned originators stepped forward and reframed the entire conversation. He explained that less experienced originators often believe there are only two levers to pull when trying to grow production:

1) Below-market pricing and

2) Below-market credit requirements.

He emphasized that both are short‑sighted and unsustainable. Both can damage portfolios, reputations, and careers. Both are false paths to long‑term success, Early in his career, he learned that those tactics almost always backfire—and when they do, they reflect poorly on the originator, not just the company.

This originator shared that he had never been the lowest‑priced provider and he always had a strong credit team underwriting his transactions.

For strong originators in the commercial finance and leasing industry, sustainability comes from the most powerful lever - Industry Expertise.

- Industry expertise compounds over time.

- Industry expertise builds trust, reputation, and referrals.

- Industry expertise separates average producers from highly successful professionals.

His core message to younger professionals was: Pricing fades. Low credit exceptions haunt. But expertise endures—and it scales.

The industry rewards those who build sustainably.

Scott A. Wheeler, CLFP

Wheeler Business Consulting

1314 Marquis Ct.

Fallston, Maryland 21047

Phone: 410 877 0428

Fax: 410 877 8161

Email: scott@wheelerbusinessconsulting.com

Web: www.wheelerbusinessconsulting.com

Wheeler Business Consulting is working with individual originators and sales teams throughout the industry to ensure that they are well positioned in the market, capturing their fair share of business, and outperforming the competition. To schedule a one-on-one meeting contact Scott Wheeler at: scott@wheelerbusinessconsulting.com

--------------------------------------------------------------

2026 New Story Credit Financing

Leases, Business Loans, SBA, Working Capital

Those listed are responsible for updating; many have not. This is open to funder and non-funders, as well as the footnotes that explain their capabilities The full listing then will be available on the

main site listing and they are published once a month in Leasing News.

In this edition, the link to the listing and full notes follow. Starting in February, the full listing will only be in the site index. The list will be available that goes to the footnote. The new updates will be listed only by the link to the information in the Leasing News Monthly Edition.

To update your listing, address Rick Jones (rick@leasingnews.org.)

Full listing: https://leasingnews.org/Story_Credit/Story_Credit.htm

[headlines]--------------------------------------------------------------

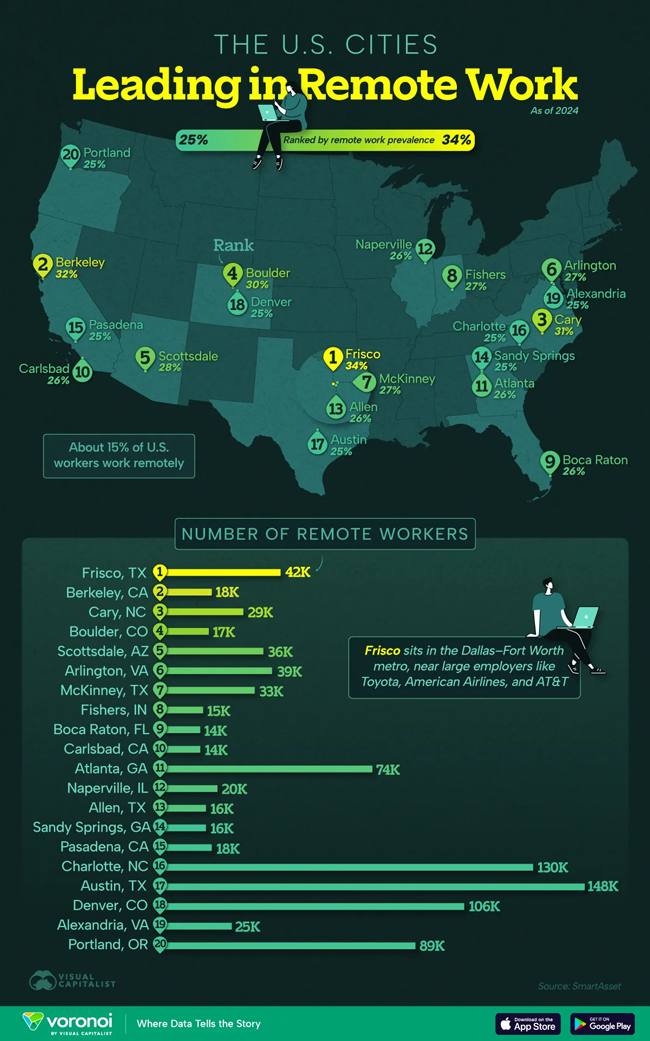

Mapped: U.S. Cities With the Most Remote Workers

Key Takeaways

- Frisco, Texas, has the highest share of remote workers among large U.S. cities, at 34%.

- Many of the top-ranked cities are affluent suburbs or tech hubs well above the U.S. average of 15%.

While the national average share of remote workers sits at 15%, some cities far exceed that level.

This map ranks U.S. cities by the share of workers who work remotely, revealing where work-from-home arrangements are still common. The data for this visualization comes from SmartAsset.

Suburban Texas Cities Top the List

Frisco, Texas ranks first, with 34% of its workforce working remotely. Located in the Dallas–Fort Worth metro area, Frisco benefits from proximity to major corporate employers such as Toyota, American Airlines, and AT&T. Many residents work in high-paying professional and technology roles that are well-suited to remote or hybrid work.

College Towns and Tech Hubs Stand Out

Several college towns and tech-focused cities appear near the top of the ranking. Berkeley, California and Boulder, Colorado both have remote work shares above 30%. These cities have highly educated populations and strong ties to technology, research, and professional services.

Cities like Cary, North Carolina and Naperville, Illinois also stand out as affluent suburbs with large numbers of knowledge workers. In these places, remote work is often an extension of pre-existing white-collar employment patterns.

Big Cities Still Matter

Large metropolitan areas such as Atlanta, Charlotte, Austin, Denver, and Portland also appear in the top 20. While their remote work shares are lower than those of leading smaller cities on the list, they account for far more remote workers in absolute terms. For example, Austin and Charlotte each have well over 100,000 remote workers.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

News Briefs

Americans’ confidence in the U.S. economy falls sharply

in January to lowest level since 2014

https://apnews.com/article/consumer-confidence-economy-spending-inflation-conference-board-f36b997dc46ac9c3577d05db52166846

Amazon cuts 16,000 jobs in

historic wave of layoffs

https://www.seattletimes.com/business/amazon/amazon-cuts-16000-jobs-in-historic-wave-of-layoffs/

UPS will slash 30,000 jobs

as company shifts away from Amazon

https://www.washingtonpost.com/business/2026/01/27/ups-layoffs-amazon/

As grocery prices soar, this German grocery chain

is conquering America

https://www.washingtonpost.com/business/2026/01/24/aldi-us-expansion-inflation/

Tesla’s revenue and profit tumble

to cap off rough 2025

https://www.cnn.com/2026/01/28/business/tesla-q4-2025-earnings

Participate in Coleman’s 2026 SBA Lender Department

Compensation Survey and Receive a Free Report

https://colemanreport.com/colemans-sba-7a-loan-department-compensation-reports/

|

[headlines]

--------------------------------------------------------------

As Trump Promotes Economy in Iowa,

Many Residents Feel Pain

https://www.nytimes.com/2026/01/27/us/politics/trump-iowa-farms-tariffs.html

[headlines]

--------------------------------------------------------------

Sports Briefs

NFL tears up entire 49ers field ahead of Super Bowl

https://www.sfgate.com/centralcalifornia/article/super-bowl-california-grass-21307874.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs

Hollywood has already faced steep job cuts.

The Warner deal could make it worse

https://www.latimes.com/entertainment-arts/business/story/2025-12-10/netflix-paramount-warner-bros-deal-layoffs-what-to-know

San Jose eyes thousands of new homes after

new housing policy, incentive changes

https://www.mercurynews.com/2026/01/28/san-jose-eyes-thousands-of-new-homes-after-new-housing-policy-incentive-changes/

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

What’s Behind One of America’s Favorite Wines?

https://www.winespectator.com/articles/behind-one-of-americas-favorite-wines

Rhône Adventure Makers Announced

The Rhone Rangers New Twist on Wine Education

https://www.winebusiness.com/news/article/313278

Wine venture cofounded by French Laundry’s

Thomas Keller buys historic Napa Valley vineyard

https://www.mercurynews.com/2026/01/27/trubody-ranch-napa-valley-vineyard-purchase/

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Jan2020/01_29.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()