Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists

Conferences |

Advertising | Archives

Columnists| Site Map

Contact: kitmenkin@leasingnews.org

![]()

Friday, February 27, 2026

Today's Leasing News Headlines

2026 AACFB Annual Conference

Last Chance for Super Save Rates

Save $100, register before March

New Hires/Promotions in the Leasing Business

and Related Industries

Asset Management in Equipment Finance Enters

a New Era of Data, AI, and Telematics

By Edward Castagna, ASA, CEA

New List for Gov't Leasing/Finance

Companies/Brokers who specialize

We’re Hiring

Ameris Bank Equipment Finance

Remote Positions Available

Have Some Fun!

By Ken Lubin, Managing Director, ZRG Partners

Saluting News Advisor

Phil Dushey

The 20 Most Visited Websites

in the World in 2026

News Briefs

Washington Post losses soared past $100M in 2025

prompting mass layoffs: report

EU trade surplus with US hits 5-year low

as tariff truce unravels

Judge denies effort to halt

White House ballroom construction

The IRS broke the law by disclosing confidential information

to ICE 42,695 times, judge says

You May Have Missed ---

Sports Briefs

California News

"Gimme that Wine"

This Day in History

SuDoku

Daily Puzzle

GasBuddy

Weather, USA or specific area

Traffic Live----

Wordle

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Mikki Henkelman , CLFP, was promoted to Senior Vice President, Oakmont Capital Services, Minneapolis, MN, where she is located. She joined Oakmont June, 2018, Credit Manager; promoted

May, 2022, Vice President Credit and Risk. Previously, she was at Steams Bank, N.A., for 10 years, 11 months, starting July, 2007, Senior Credit Analyst/Credit Analyst, promoted Syndication Specialist, 2015, promoted Credit Supervisor (February, 2017 – May, 2016).

https://www.linkedin.com/in/mikki-henkelman-clfp-a33b49163/

Otto Horstmann was promoted to Executive Director, Ready Capital. Previously, he was Vice President, Portfolio Management, starting February, 2025; promoted Senior Associate, Portfolio Management, February 2004; Associate , Portfolio Management, August, 2022; Senior Analyst, Portfolio Management (April, 2021 – August, 2022); Senior Vice President at World Business Lenders, February, 2018; Vice President, (October, 2014 – April, 2021); Chief Financial Officer, Merchant Advance Express (August, 2012 – December, 2013); Operations Manager (2008 – 2012). Full Bio: https://www.linkedin.com/in/otto-horstmann-b8053418/details/experience/

https://www.linkedin.com/in/otto-horstmann-b8053418/

George Krusen, CPA, CLFP, was promoted to Chief Financial Officer and Senior Vice President, Oakmont Capital Services, West Chester, Pennsylvania, where he is located. He joined Oakmont

as CFO, January, 2023. He also is Principal/Consultant The Krusen Group, LLC (January, 2022 – Present); Vice President and CFO, Siemens Financial Services, Commercial Finance, Americas (November, 2011 – November, 2021). Previously, he was at Siemens Healthcare Diagnostics, starting as Director of Finance, May, 2004; promoted Director, Finance (May, 2004 - November, 2007); CFO, LEAF Financial Corporation (2002 – 2004).

https://www.linkedin.com/in/georgekrusen/

Megan Zoba was promoted to Senior Vice President of Docs and Funding at Oakmont Capital Services. Senior Vice President of Docs and Funding. She is located in West Chester, Pennsylvania. She joined Oakmont October, 2010, VP Documentation and Funding. Previously, she was President, Preferred Business Leasing (January, 1997 – October, 2010); Broker Relations Manager, Corporate Capital Leasing ( September, 1991 – December, 1996. https://www.linkedin.com/in/megan-zoba-5b563727

[headlines]

--------------------------------------------------------------

New List for Gov't Leasing/Finance

Companies/Brokers who specialize with government

![]()

This is for companies or brokers who specialize in financing to Federal, States, County, Local Government, school financing or leasing.

It is an overlooked marketplace by many. Several are active in this financial market and a list

with abilities should be sent to kitmenkin@leasingnews.org.

Any suggestions in the list formation is welcome.

[headlines]

--------------------------------------------------------------

Have Some Fun!

By Ken Lubin, Managing Director, ZRG Partners

Somewhere along the way, a lot of high performers forgot how to have fun.

Not the fake kind of fun. Not the “networking happy hour” or the forced smiles at a conference. I’m talking about the kind of fun that actually fills you. The kind that reminds you why you started chasing hard things in the first place.

- We got really good at being serious.

- Serious about goals.

- Serious about outcomes.

- Serious about responsibility.

And don’t get me wrong—discipline matters. Commitment matters. Showing up when it’s hard matters. But when everything becomes a grind, something important gets lost. Joy isn’t a distraction from performance. It’s a fuel source.

- When you’re having fun, you’re present.

- When you’re present, you’re sharper.

- When you’re sharper, you make better decisions.

Think about the moments when you performed at your best—whether it was in sport, business, or life. Chances are, there was an element of play in it. Curiosity. Energy. A sense of ‘I get to do this, not I have to do this.’

- Fun doesn’t mean reckless.

- It doesn’t mean unserious.

- It means alive.

For some people, fun is being ???on snow??? first thing in the morning. For others, it’s a long walk without headphones, a hard workout with friends, cooking a great meal, or working on something creative with no agenda attached. It’s different for everyone—but it’s never accidental. You have to choose it.

Here’s the part most people miss:

If you don’t schedule fun, it disappears.

Life will happily fill every open space with obligation. Work will take everything you give it. And if you’re wired like most driven people, you’ll convince yourself that fun is something you earn later—after the deal closes, after the next milestone, after things calm down.

They rarely do.

- Having some fun isn’t quitting. It’s recalibrating.

- It’s how you stay in the game longer.

- It’s how you reconnect to your edge without burning it out.

So, this is your reminder—not to slack off, but to lighten up just enough to remember why you care. Do something today that has no KPI attached to it. No metric. No audience.

Have some fun.

Your performance will thank you for it.

Ken Lubin

Managing Director

ZRG Partners, LLC

Americas I EMEA I Asia Pacific

C: 508-733-4789

klubin@zrgpartners.com

https://www.linkedin.com/in/klubin/

[headlines]

--------------------------------------------------------------

Help Wanted Ad

Ameris Bank Equipment Finance

--------------------------------------------------------------

Asset Management in Equipment Finance Enters

a New Era of Data, AI, and Telematics

By Edward Castagna, ASA, CEA

These observations are drawn from my takeaways while attending the 2026 ELFA Equipment Management Conference & Exhibition, held at the Omni Amelia Island Resort from February 15–17, 2026, where I was covering the event for Leasing News. The conference brought together over 320 attendees, all focused on gaining up-to-date, actionable insights through dynamic sessions that spanned a wide range of asset classes and current market conditions.

What emerged clearly over the three days is that asset management in equipment finance is undergoing its biggest structural shift since the last credit cycle. What used to be a back-office, end-of-term cleanup function is rapidly becoming a front-of-house profit center, powered by AI, telematics, and tighter coordination between credit, appraisal, and remarketing.

From loss mitigation to profit engine

For many lessors, the mindset around asset management is changing. Instead of treating end‑of‑term activity to minimize losses, leading independents and banks are deliberately designing portfolios so that renewals, extensions, and sales generate incremental margin. That starts at the front end:

- Residual setting, lease tenor, and return conditions are being aligned with the remarketing strategy from day one.

- Asset managers are at the table earlier, helping shape product programs and sector appetite rather than just reacting to problem accounts.

- Realized residuals and recovery ratios are being elevated to primary performance metrics, on par with yield and credit loss.

The message is simple: if the remarketing and extension “backend” isn’t contributing meaningfully to profitability, it’s now seen as an underused lever rather than an unavoidable cost.

AI reshapes residuals and lifecycle decisions

Artificial intelligence is moving from buzzword to workflow. Independent lessors and specialty finance shops are already embedding AI into their underwriting and asset management stacks. The most visible early wins are in:

- Automating underwriting documentation and data extraction.

- Benchmarking individual deals and portfolios against industry data and internal history.

- Building residual and impairment models that go beyond age and generic indices.

On the asset side, the new wave of models ingests usage data, configuration details, and, where available, battery or engine health. For electronic and high-tech assets, battery state of health and duty cycles are emerging as core inputs to residual value setting and remarketing strategy, not just operational concerns.

The longer‑term expectation: AI will help “load balance” fleets, identify optimal sell/extend/upgrade points, and make end‑of‑term decisions more systematic and less subjective.

Telematics and batteries move to the center

Nowhere is this shift more visible than in material handling, transportation, and other fleet-intensive sectors. Telematics has moved from “nice to have” to a central infrastructure for asset management. Lessors are now using:

- Hours, loads, and duty cycles to predict failures and time maintenance.

- Charging behavior and depth‑of‑discharge patterns to assess lithium battery degradation.

- Fault codes and event histories to flag high-risk units before they become charge-offs.

As a result, contract language is changing. Battery warranty terms, testing protocols, and telematics requirements are increasingly written into lease and return provisions. The critical question at the end of term is no longer just “What’s the age and OEM?” but “Can we prove how this asset was used, and how much life is left?”

A growing challenge—and opportunity—is data portability. Asset managers are working out how to package and transfer telematics and battery histories to second buyers to justify better resale prices and shorter selling cycles.

Sector-specific asset management themes

Different verticals are feeling these trends in distinct ways:

- Technology: Shorter refresh cycles and rapid AI infrastructure upgrades are compressing economic lives, forcing more dynamic residual curves and more frequent sets of fair market value. Residual structures increasingly incorporate mid-term upgrade or swap options to manage obsolescence risk.

- Transportation: EV and alternative‑fuel fleets require battery-centric thinking—residual frameworks now hinge on range degradation, charging networks, and duty cycles, not just mileage and model year. Route data and charging profiles are increasingly influencing both underwriting and end-of-term decisions.

- Industrial and material handling: Automation and warehouse robotics are expanding the installed base but also increasing obsolescence risk, making redeployment strategies and flexible end‑of‑term structures essential. Surplus equipment from pandemic-era lease extensions, especially electric lifts, is pressuring values and rewarding lessors who have strong remarketing channels.

Across all of these, the common thread is that asset management is less about “what something is” and more about “how it has actually been used.”

New roles, new playbooks

The asset management function is being rebuilt organizationally. Instead of small teams handling repossessions and odd‑lot sales, forward-looking lessors are investing in:

- Portfolio-level asset managers who steer sector exposure and lifecycle strategy.

- Data and analytics specialists who own telematics ingestion, AI tools, and benchmarking.

- Tighter governance so AI-driven decisions in credit and residuals can pass internal and regulatory scrutiny.

External benchmarks and industry data are being pulled directly into these playbooks. Industry snapshots, economic outlooks, and momentum indicators are now being used to time pullbacks and pushes in specific verticals, linking macro signals directly to day-to-day asset decisions.

The bottom line for lessors

Asset management is no longer a back-office cost center; it is becoming one of the main levers of competitive advantage in equipment finance. Lessors that:

- Integrate asset strategy with credit and remarketing from the start,

- Use AI and telematics to inform residuals and lifecycle calls, and

- Build teams and governance around data-driven asset decisions

will be positioned to turn structural volatility into opportunity. Those that keep treating asset management as end-of-term cleanup risk, leaving real money on the table—right when the tools exist to do better.

A personal perspective

To end on a more personal note, this year’s conference was a milestone for me. It was my 40th year attending the ELFA Equipment Management Conference, and over those four decades I’ve lived through, just about every kind of cycle this industry can throw at us—booms, busts, bubbles, restructurings, and everything in between.

I’ve watched asset classes come in and out of favor, seen risk appetites expand and contract, and learned (sometimes the hard way) how quickly market conditions can turn. What feels different now is the scale and speed of change that AI brings. For the first time, I can clearly see the potential for a new kind of boom—one driven not just by abundant capital or a hot segment, but by powerful technology that enables consistently smarter, faster, data-driven asset decisions.

After forty years of watching this business evolve, I’m convinced that if we apply AI thoughtfully—grounded in sound credit fundamentals, disciplined residual management, and the practical judgment this industry has earned over time—we have a chance to enter one of the most productive eras equipment management has ever seen.

[headlines]--------------------------------------------------------------

Saluting Leasing News Advisor

Phil Dushey

Philip Dushey

Global Financial Services

Email:phil@gbtsinc.com

Phone 212-480-4900

www.globalfinancialtrainingprogram.com

www.globaleasing.com

www.globalchurchfinancing.com

Phil is one of the original founding members of the Leasing News Advisory Board. Phil Dushey has been active in the finance and leasing industry for over 40 years. His first company was Global Financial Services, which is still active and successful today. Global specializes in all types of financing such as equipment leasing, accounts receivable financing, debt restructuring, and establishing lines of credit.

Mr. Dushey feels that to be competitive in today's expanding financial climate a company must be able to service all of his clients’ needs not just equipment leasing.

In 1989, Mr. Dushey saw a need for a company that would serve the needs of churches, synagogues, mosques, and other places of worship throughout the country for equipment leasing. At the time, most financing sources were reticent regarding religious institutions. He then formed Global Church Financing. It continues to be the leading company in providing financing to churches and other religious institutions today.

In 2001, Mr. Dushey fulfilled one of his lifelong dreams and formed Global Financial Training Program.

He believes it is the most comprehensive and successful training school in the country to train people who want to enter the finance and leasing business. The program includes everything they need to enter the business. He says he very much enjoys teaching how to make money in the finance industry based on 39 years of experience.

Mr. Dushey is a founding member of the National Association of Equipment Leasing Brokers, who changed their name to American Association of Commercial Finance Brokers. He has been a member and speaker at many leasing organizations for several years.

He and his wife Laurie have been married for 51 years, with six grandchildren.

[headlines]

--------------------------------------------------------------

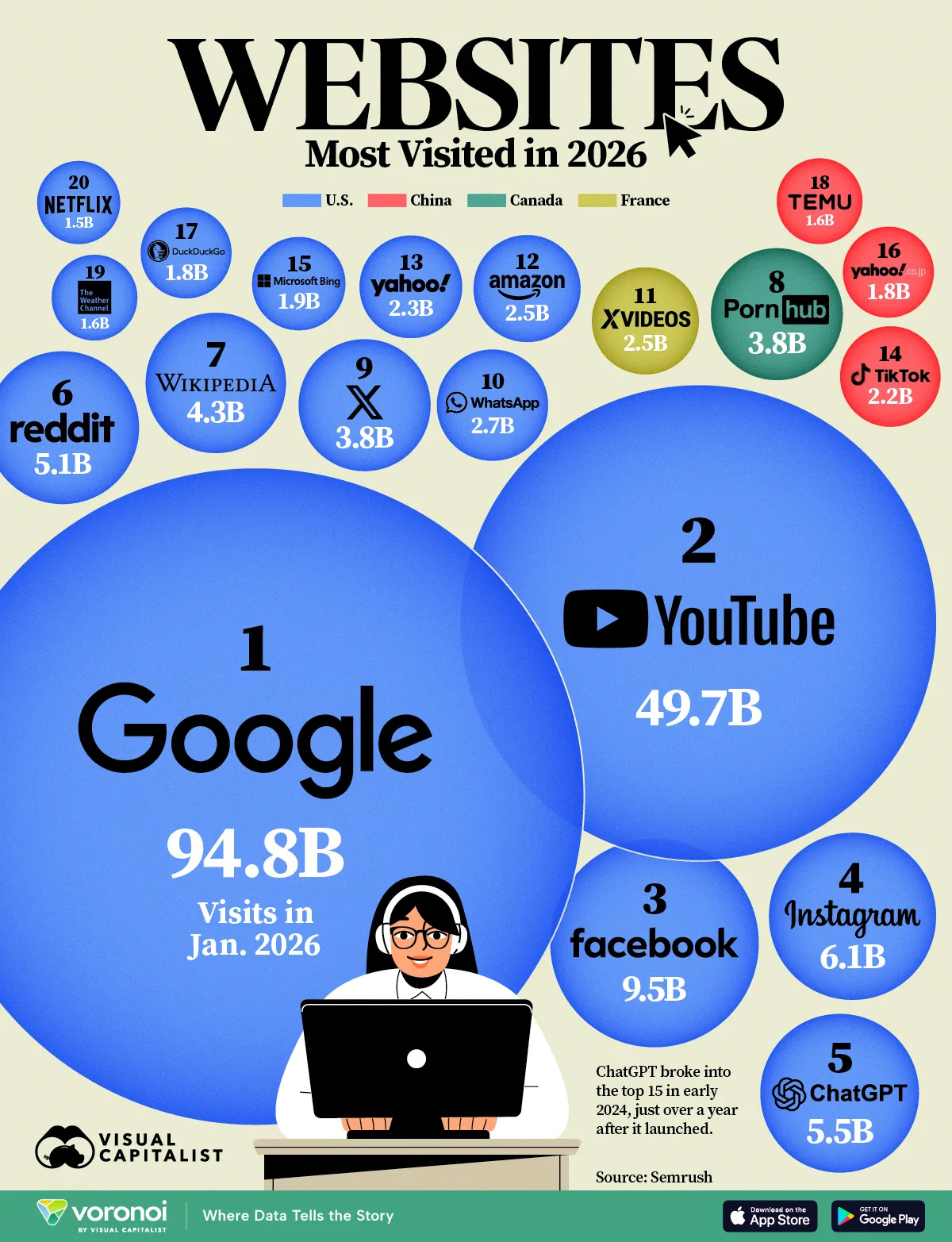

The 20 Most Visited Websites in the World in 2026

Key Takeaways

- Google remains the most visited website in the world in 2026, with nearly 95 billion monthly visits.

- YouTube ranks second, reinforcing Alphabet’s dominance over global internet traffic.

- ChatGPT has climbed into the global top five, ahead of Reddit, Wikipedia, and X.

In 2026, global web traffic is dominated by a small group of platforms that shape how billions of people search, watch, connect, and shop online. Google and YouTube continue to command an outsized share of the internet’s attention, sitting far ahead of every other competitor.

At the same time, the composition of the top rankings is evolving. ChatGPT has emerged as one of the most visited websites in the world, underscoring how quickly AI tools have moved from novelty to everyday utility.

Based on the latest available traffic data from Semrush as of January 2026, this ranking shows which companies dominate the digital landscape.

https://www.visualcapitalist.com/ranked-the-20-most-visited-websites-in-the-world-in-2026/

[headlines]

--------------------------------------------------------------

News Briefs

Washington Post losses soared past $100M in 2025, prompting mass layoffs: report

https://nypost.com/2026/02/26/media/washington-post-losses-soared-past-100m-in-2025-prompting-mass-layoffs-report/

EU trade surplus with US hits 5-year low

as tariff truce unravels

https://www.courthousenews.com/eu-trade-surplus-with-us-hits-5-year-low-as-tariff-truce-unravels/

Judge denies effort to halt White House ballroom construction

https://www.courthousenews.com/judge-denies-effort-to-halt-white-house-ballroom-construction/

The IRS broke the law by disclosing confidential information to ICE 42,695 times, judge says

https://www.bostonglobe.com/2026/02/26/nation/irs-disclosed-confidential-information-to-ice/

[headlines]

--------------------------------------------------------------

Four-Point Field Goals? The Football Laboratory Rethinking the Rules of the Game

https://www.wsj.com/sports/football/tush-push-ufl-rules-nfl-7bab6f0a?st=mLeif2&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

Sports Briefs

In the shadow of the Super Bowl,

Great America slowly dies

https://www.sfgate.com/travel/article/super-bowl-great-america-21316236.php

[headlines]

--------------------------------------------------------------

![]()

California News Briefs

Health care unions to end historic strike

at Kaiser Permanente Health care

https://www.sfgate.com/hawaii/article/best-resort-us-21924486.ph

‘High avalanche danger’ in backcountry Lake Tahoe area

as watch goes into effect

https://www.sacbee.com/news/weather/article314807292.html

After delays, Council expected to vote on

$6.4 million for Old Sacramento boardwalk

https://www.sacbee.com/news/local/article314809411.html

Hawaii and California dominate list of best resorts

in the US

https://www.sfgate.com/hawaii/article/best-resort-us-21924486.php

[headlines]

--------------------------------------------------------------

Gimme that Wine

![]()

http://www.youtube.com/watch?v=EJnQoi8DSE8

Napa Valley pioneer Dan Duckhorn dies aged 87

https://www.sfchronicle.com/bayarea/article/bart-service-oakland-san-francisco-21943150.php

[headlines]

----------------------------------------------------------------

![]()

This Day in History

https://leasingnews.org/archives/Feb2015/2_27.htm#history

-------------------------------------------------------------

SuDoku

The object is to insert the numbers in the boxes to satisfy only one condition: each row, column and 3x3 box must contain the digits 1 through 9 exactly once. What could be simpler?

--------------------------------------------------------------

Daily Puzzle

How to play:

http://www.setgame.com/set/puzzle_frame.htm

Refresh for current date:

http://www.setgame.com/set/puzzle_frame.htm

--------------------------------------------------------------

http://www.gasbuddy.com/

http://www.gasbuddy.com/GB_Map_Gas_Prices.aspx

http://www.gasbuddy.com/GB_Mobile_Instructions.aspx

--------------------------------------------------------------

Weather

See USA map, click to specific area, no commercials

--------------------------------------------------------------

Traffic Live---

Real Time Traffic Information

You can save up to 20 different routes and check them out with one click,

or type in a new route to learn the traffic live

--------------------------------

Wordle

https://www.powerlanguage.co.uk/wordle/

How to Play

https://www.today.com/popculture/popculture/wordle-know-popular-online-word-game-rcna11056

![]()