Information, news, and entertainment for the commercial

alternate financing,

bank, finance and leasing industries

Subscribe

| Search | All Lists | Site Map

Conferences/Forums |

Advertising | Archives | Columnists

Don’t take the bait on phishing scams |Top Ten Stories Chosen by Readers

Contact: kitmenkin@leasingnews.org

![]()

Monday, June 2, 2025

Today's Leasing News Headlines

Texas Disclosure Law May Become Law Next Week

By Ken Greene, Leasing News Chief Legal Editor, Emeritus

New Hires/Promotions in the Leasing Business

and Related Industries

Editor's Choice Award

By William Verhelle, Founder of

QuickFi & First American Equipment Finance

Dext Capital Surpasses $2 Billion in Originations

A Milestone for the Company

Leasing and Finance Industry Help Wanted

Excellent Compensation/Many Jobs Open

Top Ten Most Read by Readers

May 27 - May 29

Conferences and Forums – Coverage Updated

Commercial Finance/Leasing Finance

ELFA Members to Urge Congress to Support Small

Businesses and Economic Growth During Capitol

Connections on June 3

######## surrounding the article denotes it is a press release, it was not written by Leasing News nor has the information been verified, but from the source noted. When an article is signed by the writer, it is considered a byline. It reflects the opinion and research of the writer.

[headlines]

--------------------------------------------------------------

Texas Disclosure Law May Become Law Next Week

By Ken Greene, Leasing News Chief Legal Editor, Emeritus

In a recent article, we advised you of legislation proposed in Texas which would mandate that disclosures be provided in commercial sales-based financing transactions (generally, merchant cash advances), and which would also require that sales-based financing brokers register with the state. It now appears that the new law, passed by the House of Representatives but based primarily on the Senate bill, will be signed by the governor as early as this Monday.

Identical bills were being considered by the Senate and the House. Now, the House has adopted the Senate’s version with an important addendum, which provides as follows:

Certain Automatic Debits Prohibited A provider or commercial sales-based financing broker may not establish a mechanism for automatically debiting a recipient's deposit account unless the provider or broker holds a validly perfected security interest in the recipient's account under Chapter 9, Business & Commerce Code, with a first priority against the claims of all other persons.

Senate Bill Sec. 398.056

This makes some sense since having two competing creditors with ACH accounts drawing against the same receivables in one bank account could create some confusion. It is quite possible that this will discourage MCA lenders from providing financing unless they have first position on accounts receivables, but it does not appear from the Senate bill that second position MCA financing would be per se, illegal.

At least one MCA provider has already pulled out of Texas. It is quite possible there will be others as soon as Monday when the Senate bill is poised to become law.

House Bill 700: https://legiscan.com/TX/text/HB700/id/3248235

Ken Greene

Law Office of Kenneth Charles Greene

5743 Corsa Avenue, Suite 208

Westlake Village, California 91362

Tel: 818.575.9095

Fax: 805.435.7464

ken@kengreenelaw.com

www.kengreenelaw.com

[headlines]

--------------------------------------------------------------

New Hires/Promotions in the Leasing Business

and Related Industries

Nicholas Alvarez was hired as Account Executive, Reliant Capital, he will work remote from Las Vegas, Nevada. Previously, he was Senior Account Manager, Smarter Finance, USA (August, 2021 - May, 2025); Security, Allegiant Stadium (August, 2020 - August, 2021); Correctional Deputy II, Riverside County Sheriff's Office (2018 - 2020); Construction Laborer, Jmc Builders Inc. (February, 2018 - August, 2018).

https://www.linkedin.com/in/nickwalvarez

Donna (Babicz) Alexander was hired as Business Sales Professional, Financial Program Management at J&B Capital, LLC, Greater Chicago Area to work remote from Wood Dale, Illinois. Previously, she was Vice President of Sales, SLR Equipment Finance (December, 2004 - March, 2025); Regional Sales Manager, Equify Financial, LLC (January, 2013 - November, 2024). Full Bio:

https://www.linkedin.com/in/donnaalexander/details/experience/

https://www.linkedin.com/in/donnaalexander/

Cory Pedersen was promoted to Funding Analyst, Navitas Credit Corporation, Columbia, South Carolina, where he is also located. He joined Navitas February, 2023 as Customer Service

Representative.

https://www.linkedin.com/in/cory-pedersen-174222368/

[headlines]

--------------------------------------------------------------

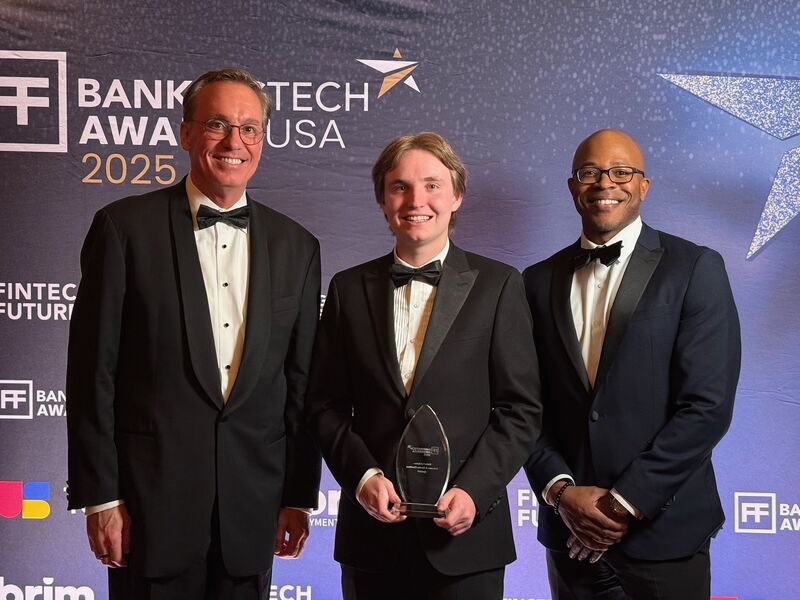

Editor's Choice Award

By William Verhelle, Founder of

QuickFi

& First American Equipment Finance

We were honored to win this “Editor’s Choice Award” last night at the 2025 Banking Tech Awards in NYC. Andy Buckley (David Wallace, from “The Office”) was the master of ceremonies, masterfully facilitating a laugh-filled, fast-paced evening.

This award comes from the organization behind Money 20/20, Finovate, etc., and it’s a huge honor to be selected for this top award by this highly respected organization.

The Editor’s Choice Award is a prestigious FinTech Futures editorial team designation. The team picks three winners of the Editor’s Choice award – a bank/financial institution, a software/services provider, and an individual – for tangible results and perceptible, positive impact.

QuickFi was honored to be designated Editor’s Choice for Software/Service provider last night.

QuickFi helps banks, and global OEMs provide nearly instant, borrower-self-service equipment financing at the point of sale for business equipment.

QuickFi’s rapidly advancing combination of embedded lending plus agentic AI creates an unmatched borrower experience at one-third the cost of the traditional financing model. In five years, we anticipate QuickFi’s price will be 1/10th the cost of the traditional (sales-CRM-based) financing process currently employed by banks and captive finance companies.

https://quickfi.com/bill-verhelle/

Source: Linkedin

[headlines]

--------------------------------------------------------------

Balboa Capital Available Position

Program Manager II- Equipment Broker Sales

[headlines]

--------------------------------------------------------------

#### PRESS RELEASE ##########################

Dext Capital Surpasses $2 Billion in Originations

A Milestone for the Company

Lake Oswego, OR – Dext Capital announced that it has exceeded $2 billion in new business originations since its inception, a significant milestone that reflects the company’s strong growth and reliable access to capital. This achievement highlights continued market demand across its essential-use healthcare, technology, and other business segments, and demonstrates Dext’s commitment to delivering innovative, flexible financing solutions for its vendor partners and middle-market customers.

Kyin Lok, CEO, explains, “This milestone isn’t just about numbers, it’s a reflection of our Dexters’ dedication to delivering value through speed, innovation and a robust suite of industry leading financial solutions. We’ve worked hard to build a differentiated business that can evolve to consistently serve our valued vendor partners and customers in these complex times."

** About Dext Capital **

Dext Capital is a leading provider of equipment financing solutions, committed to supporting businesses across various industries. With a focus on innovation, expertise, and personalized service, Dext Capital empowers its clients to acquire the equipment they need to succeed and grow. As the company expands into new industries, it remains dedicated to its core values of integrity, excellence, and customer satisfaction.

For more information on Dext Capital and its new Dext Wheels Channel, please visit. https://dextcapital.com/

LinkedIn: https://www.linkedin.com/company/dext-capital/posts/?feedView=all

Instagram: https://www.instagram.com/dextcapital/

Tiktok: https://www.tiktok.com/@dextcapital

[headlines]

--------------------------------------------------------------

Top Ten Most Read by Readers

May 27 - May 29

(1) Broker Fair Sets Record Attendance

Up 75% Since Incorparation

By Don Consenza

https://leasingnews.org/archives/May2025/05_27.htm#bf

(2) Kris Roglieri’s Chief Operating Officer Pleads Guilty

to Loan Fraud - Details of Roglieri's Operation Revealed

May Seal January 2026 Trial Outcome

Bob Coleman, Editor Coleman Reports

https://leasingnews.org/archives/May2025/05_29.htm#rog

(3) New Hires/Promotions in the Leasing Business

and Related Industries

https://leasingnews.org/archives/May2025/05_27.htm#hires

(4) Should Everyone Be Taking Ozempic?

Doctors Say More People Could Benefit

https://www.wsj.com/health/pharma/glp-1-drugs-health-benefits-4014d7d5?st=sJqQum&reflink=desktopwebshare_permalink

(5) Kohl's said it planned to close 27 of its more than 1,150 locations by Saturday. The 66 locations Macy's announced are among the 150 it's closing as part of its "Bold New Chapter" initiative "designed to return the company to sustainable, profitable sales growth."

https://www.recordnet.com/story/news/2025/03/28/kohls-and-macys-closing-dozens-of-stores-map-list-show-where/82712691007/

(6) Don't Overlook Community or Regional Banks

They Are Looking for New Relationships

More Than Ever Before

https://leasingnews.org/archives/May2025/05_27.htm#dont

(7) The Sun is Killing of SpaceX's Starlink Satellites

https://www.newscientist.com/article/2481905-the-sun-is-killing-off-spacexs-starlink-satellites/

(8) CLFP Foundation Adds 19 New CLFPs

With Photo’s

https://leasingnews.org/archives/May2025/05_27.htm#clfp

(9) In Case You Missed

Donald Trump Photo on $100 Bill

Introduced April6, 2025 - A Live!

https://leasingnews.org/archives/May2025/05_29.htm#missed

(10 Should Everyone Be Taking Ozempic?

Doctors Say More People Could Benefit

https://www.wsj.com/health/pharma/glp-1-drugs-health-benefits-4014d7d5?st=sJqQum&reflink=desktopwebshare_permalink

[headlines]

--------------------------------------------------------------

Conferences and Forums – Coverage Updated

Commercial Finance/Leasing Finance

September 10-12: AACFB Commercial Financing Expo, Austin, Texas. Please do not get confused with similar event. AACFB Registration Opening soon.

Mel Vinson, CLFP, Vice President of Marketing and Development, CLFP Foundation, will be covering The conferences for Leasing News reads.

September 17: Brokers Expo NYC returns at Center415 on Fifth Avenue in Midtown Register Now:

https://thefundersforumbrokerexpo.com/ny/

Don Cosenza, CLFP, will cover the Expo as he did last year for Leasing News readers.

October 14-16: National Equipment Finance Association Fall Conference, Renaissance Hotel, Minneapolis, Minnesota

Conference Details Coming Soon

Vicki Shimkus, CLFP, Balboa Capital Relationship Manager, will be covering the conference for Leasing News readers.

October 26 - 28: ELFA 64th Annual Convention, Marco Island, Florida

Annual Convention: Call for Presentations Coming Soon!

The 2025 ELFA Annual Convention, Oct. 26-28 in Marco Island, Fla., will open our Call for Presentations SOON! Keep your eyes open for emails, promotion, banners, LinkedIn posts and more. We want YOUR ideas and innovative sessions. Additional details and session topics coming so

Randy Haug, LTi Technology, will be covering the conference for Leasing News. He remembers, "This is going to be back to the same venue and property that the ELFA had previously scheduled but the hurricane came through and the ELFA had to cancel at the last minute, then reschedule up in Orlando a few weeks later." He will also be in Washington DC at the annual ELFA Capitol Connections meeting in early June this year.

To be listed or update: kitmenkin@leasingnews.org

October 28 - 29 DeBanked B2B Finance Expo, Wynn, Las Vegas, Nevada

B2B Finance Expo is back for its highly anticipated second edition at the Wynn Las Vegas! We're thrilled to once again partner with the Small Business Finance Association (SBFA) to deliver an even bigger and better experience, uniting top professionals in the commercial finance industry.

This groundbreaking event will bring together leaders from Small Business Lending, Equipment Finance, Real Estate Lending, Merchant Cash Advance, and beyond. Over the course of this exclusive two-day event, brokers, lenders, funders, and service providers alike can expect networking opportunities, expert panels, and much more.

Join us for an exceptional networking and educational opportunity as we bring together the best in the industry!

Questions? Email us at events@debanked.com

To Update: kitmenkin@leasingnews.org

[headlines]

--------------------------------------------------------------

###### Press Release #######################

ELFA Members to Urge Congress to Support Small Businesses

and Economic Growth During Capitol Connections on June 3

On Tuesday, June 3, 2025, members of the Equipment Leasing and Finance Association (ELFA) will meet with lawmakers on Capitol Hill as part of Capitol Connections 2025—the association’s signature annual advocacy event. The fly-in brings together industry leaders from across the country to advocate for smart policies that support small businesses, capital investment, and American jobs.

This year, ELFA members will urge Congress to:

- Repeal Section 1071 of the Dodd-Frank Act, which imposes costly and burdensome data collection requirements that hinder access to capital for small businesses.

- Restore 100% expensing, allowing businesses to fully and immediately deduct the cost of equipment purchases—an essential driver of investment and productivity.

- Reinstate the full deductibility of business interest, which is critical for financing equipment and infrastructure that keeps the U.S. economy competitive.

Leigh Lytle, ELFA President and CEO, explained, “Our message is simple: Support policies that empower small businesses, not regulations that tie their hands.

“Section 1071’s one-size-fits-all mandates threaten to chill small business lending. Congress can and should fix that. Likewise, restoring 100% expensing and full interest deductibility will strengthen Main Street by encouraging capital formation and growth.”

Approximately 150 ELFA members are expected to participate in over 100 meetings with House and Senate offices to discuss how these policies directly affect jobs and economic development in their communities. ELFA members will share key findings of a new study from the Equipment Leasing & Finance Foundation, “The Effect of the Tax Cuts & Jobs Act on Leasing: Evidence from the Past with Implications for the Future,” that provide data-based analysis of the need for Congress to support the association’s requested actions.

Capitol Connections 2025 highlights the industry’s commitment to responsible financing solutions for U.S. businesses across every sector—from agriculture and construction to health care and technology.

About ELFA

The Equipment Leasing and Finance Association (ELFA) represents financial services companies and manufacturers in the $1 trillion U.S. equipment finance sector. ELFA’s over 600 member companies provide essential financing that helps businesses acquire the equipment they need to operate and grow. Learn how equipment finance contributes to businesses’ success, U.S. economic growth, manufacturing and jobs at.

#### Press Release #########################

![]()